How to get URL link on X (Twitter) App

https://twitter.com/rohitchauhan/status/1592296693285937154Investor perfectionists tend to feel upset when things don't work out the way they thought. They attribute all bad outcomes to bad processes which they then try to "fix".

https://twitter.com/deepakshenoy/status/1567019755919515649"If any obligation of an enterprise deserves to qualify as a fixed-value investment, then all its obligations must do so. Stated conversely, if a company's junior bonds are not safe, its first-mortgage bonds are not a desirable fixed-value investment."

https://twitter.com/conorsvan1/status/1560372918223134721Also an example of one of the iron laws of economics: you can either control the price of something or its supply. But you cannot control both.

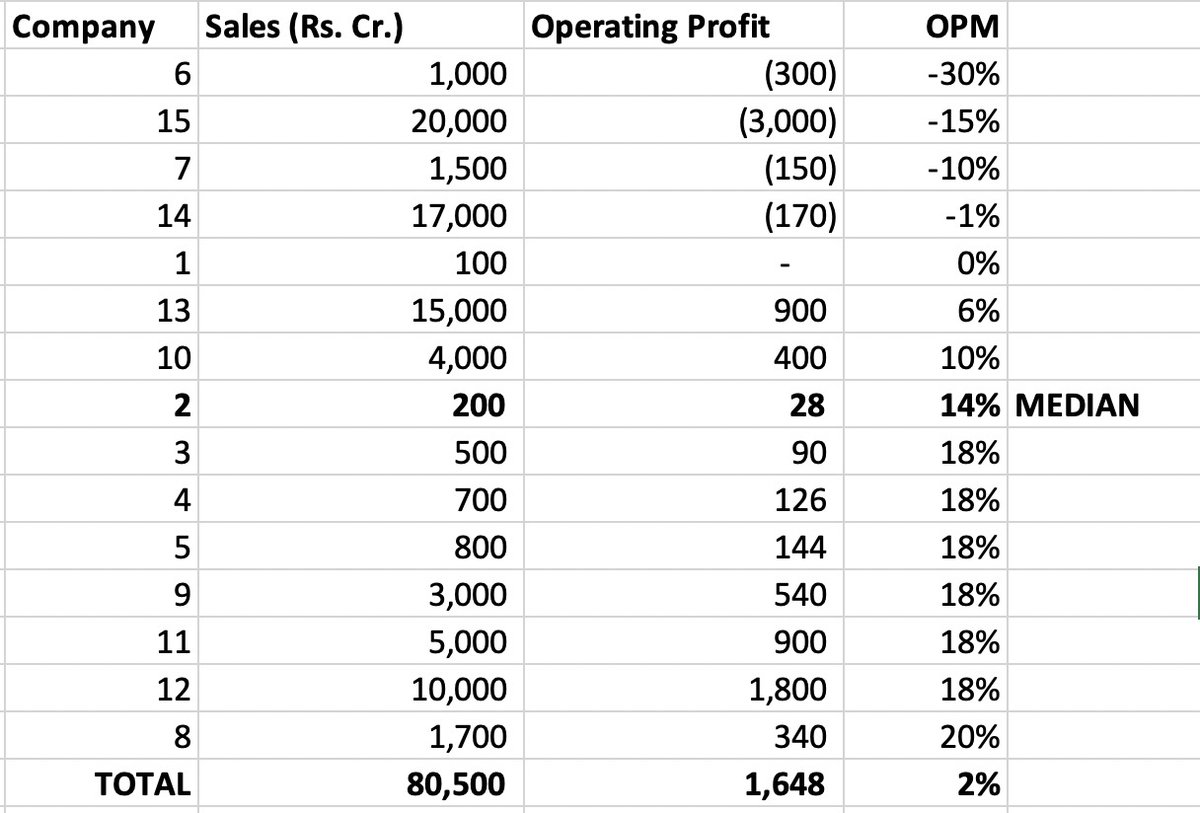

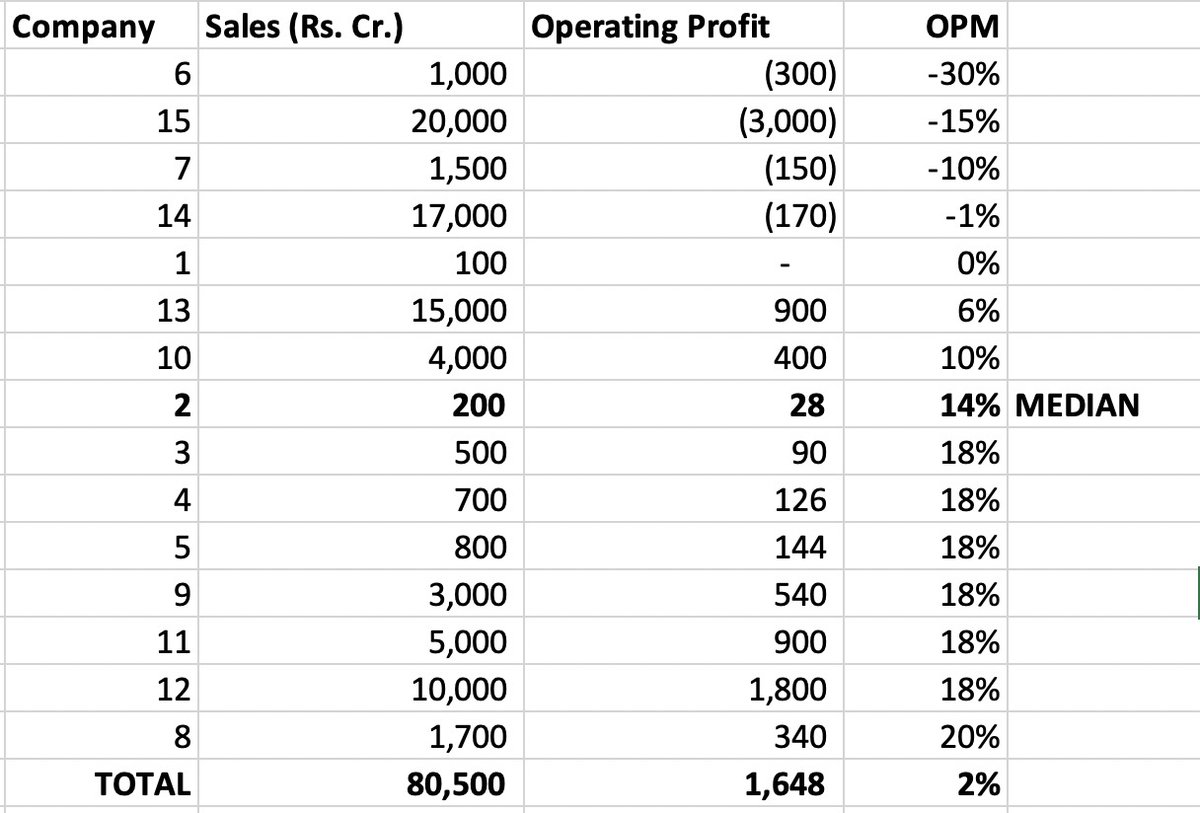

https://twitter.com/Falak_Kalyani/status/1554736438612267008Weighted average misleads because of outliers. You can eliminate outliers by using MEDIAN. That's 14%. See below.

https://twitter.com/shayanghosh123/status/1547061419170238464

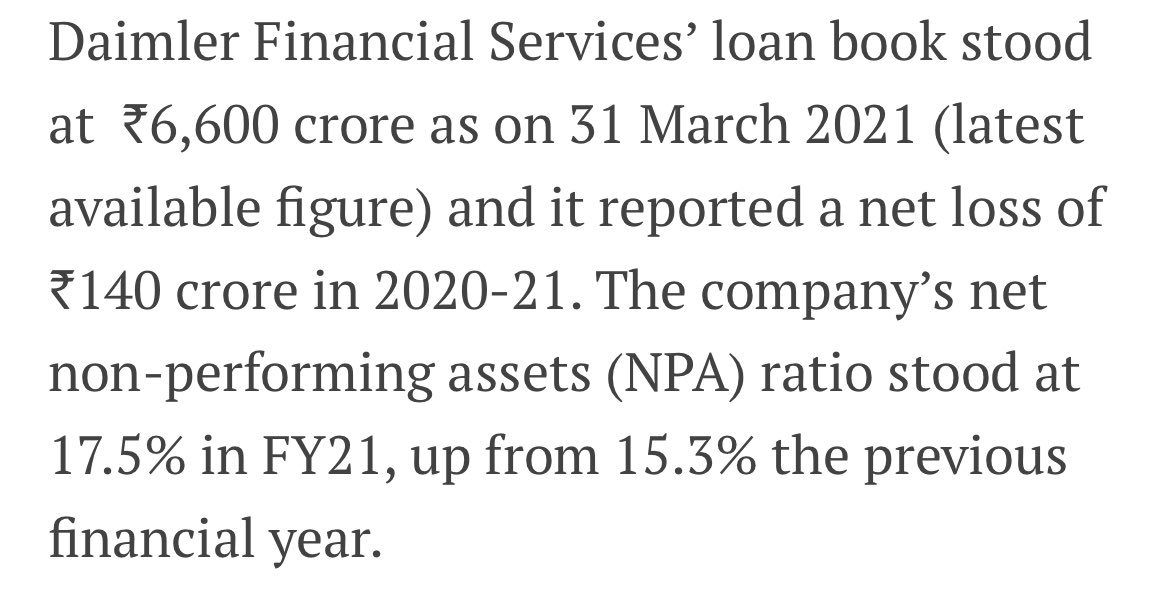

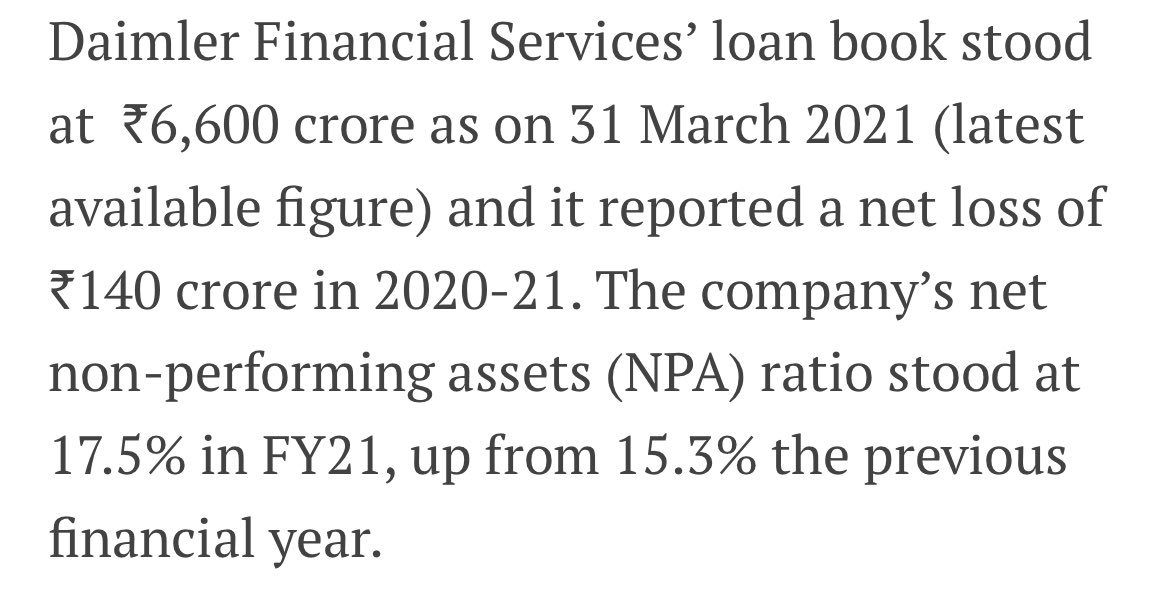

There are many ways in which the finance company can make the auto company’s P&L and balance sheet look pristine. One way is that all the loans (including bad ones) given to customers for creating the demand reside on the finance company’s balance sheet.

There are many ways in which the finance company can make the auto company’s P&L and balance sheet look pristine. One way is that all the loans (including bad ones) given to customers for creating the demand reside on the finance company’s balance sheet.

https://twitter.com/menakadoshi/status/1485632021947101185Why should public market investors buy stock in a listed company at 150 bucks when they can buy it from the market at 100 bucks?

https://twitter.com/Sanjay__Bakshi/status/1482207990375915521The first one is the "Peloton template." This is an example of a business that didn't make any money - not even in a boom year. google.com/finance/quote/…. And yet, in December 2020, during covid times, its market cap exceeded USD 50 billion.

https://twitter.com/TheKenWeb/status/1463045120098398211Trying to disrupt a model (local butcher shop) which has been around hundreds of years (think Lindy effect) requires u too not only sell at a price not too different from local butcher price but also to spend a bomb on logistics, packaging, and customer acquisition (advertising)

Whenever shortages appear, the typical manager simply can’t wait to expand capacity and thereby plug the hole through which money is showering upon him." - Buffett

Whenever shortages appear, the typical manager simply can’t wait to expand capacity and thereby plug the hole through which money is showering upon him." - Buffett

https://twitter.com/safalniveshak/status/1437060044579737605Our moms and grandmoms multi tasked seemingly effortlessly. Just think of a typical day in their lives when they were married, had kids, and had a home to run.

https://twitter.com/contrarianeps/status/1408855920235323393And it’s not easy to develop a conviction to hold on to things that should be held. There are these “demons” that will enter the mind of the investor, which will prevent them from holding on to what will turn out to be an outstanding stock.

https://twitter.com/iradhikagupta/status/1404456227875131395Are HDFC Bank and Kotak Mahindra Bank quality companies? If so, then did they become so without taking credit risk? Answer: No.

https://twitter.com/dinesh_sairam/status/1401139884719476740But the taint of tobacco is removed from non tobacco assets if they are separated from the tobacco operations with ITC tobacco having no stake in them.