78th Secretary of the Treasury. Former Fed Chair. Always an economist.

2 subscribers

How to get URL link on X (Twitter) App

In the year since this launch, the Pandemic Fund has raised nearly $2 billion, including $700 million from the United States.

In the year since this launch, the Pandemic Fund has raised nearly $2 billion, including $700 million from the United States.

In these meetings, I have been reminded that even among the world’s most advanced economies, it is still far too uncommon for women to rise to the top—both in public service and the private sector. Barriers persist in the U.S., Korea, and globally.

In these meetings, I have been reminded that even among the world’s most advanced economies, it is still far too uncommon for women to rise to the top—both in public service and the private sector. Barriers persist in the U.S., Korea, and globally.

I had productive meetings with many of my counterparts on how a price cap on Russian oil can help us achieve our goals of denying Putin revenue for his war machine, while dampening energy costs at a moment when inflation is a major concern globally.

I had productive meetings with many of my counterparts on how a price cap on Russian oil can help us achieve our goals of denying Putin revenue for his war machine, while dampening energy costs at a moment when inflation is a major concern globally.

https://twitter.com/VP/status/1404907557651501056Currently, some forms of investment are heavily concentrated within just a handful of cities. Last year, for instance, 71% of all venture funding went to just 4 metropolitan areas.

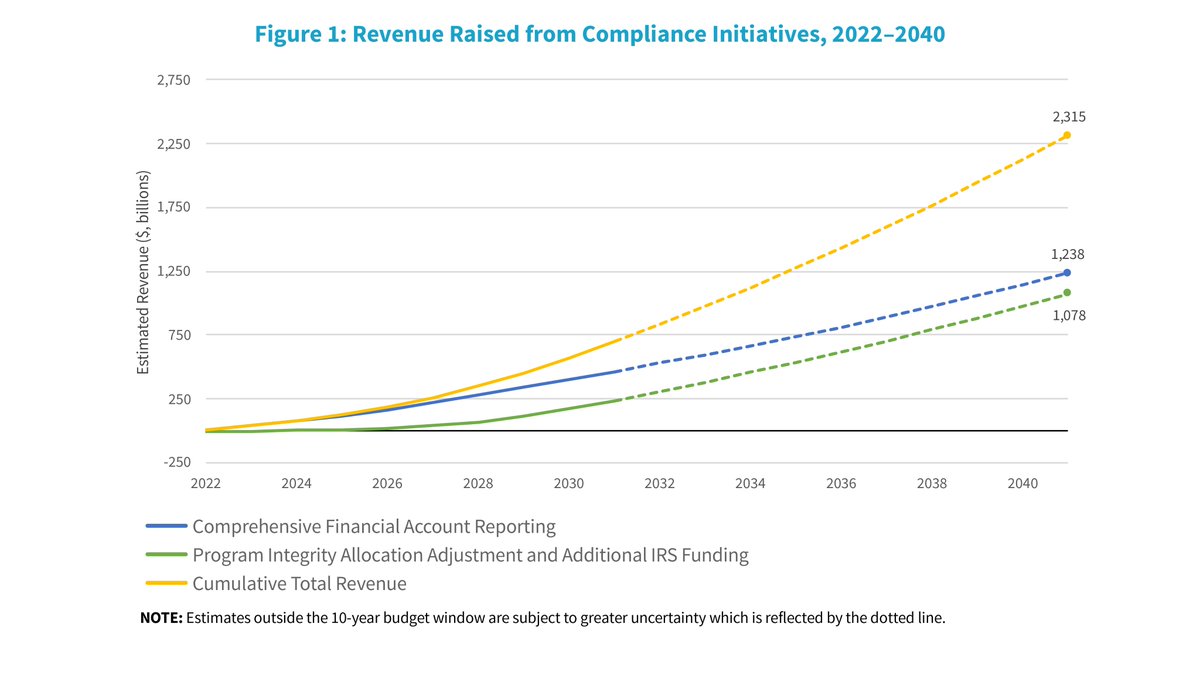

https://twitter.com/USTreasury/status/1395471577022664709How should we address the gap? We build up the IRS, revitalize taxpayer services, modernize technology, focus on high-end evasion, & streamline info gathering. There are no new requirements for taxpayers & most Americans won’t be impacted at all. In fact, almost all will benefit.

https://twitter.com/USTreasury/status/1390306154308247566The IRS went through a great transformation, adapting during the pandemic. An agency that mainly manages the nation's tax filings and returns once a year, IRS has marshaled its resources to send nearly $800 billion to Americans & implement several rounds of relief programs.