World's largest tokenization platform.

$4B+ in assets across BUIDL, USDtb, VBILL + more.

Backed by: @BlackRock @MorganStanley

How to get URL link on X (Twitter) App

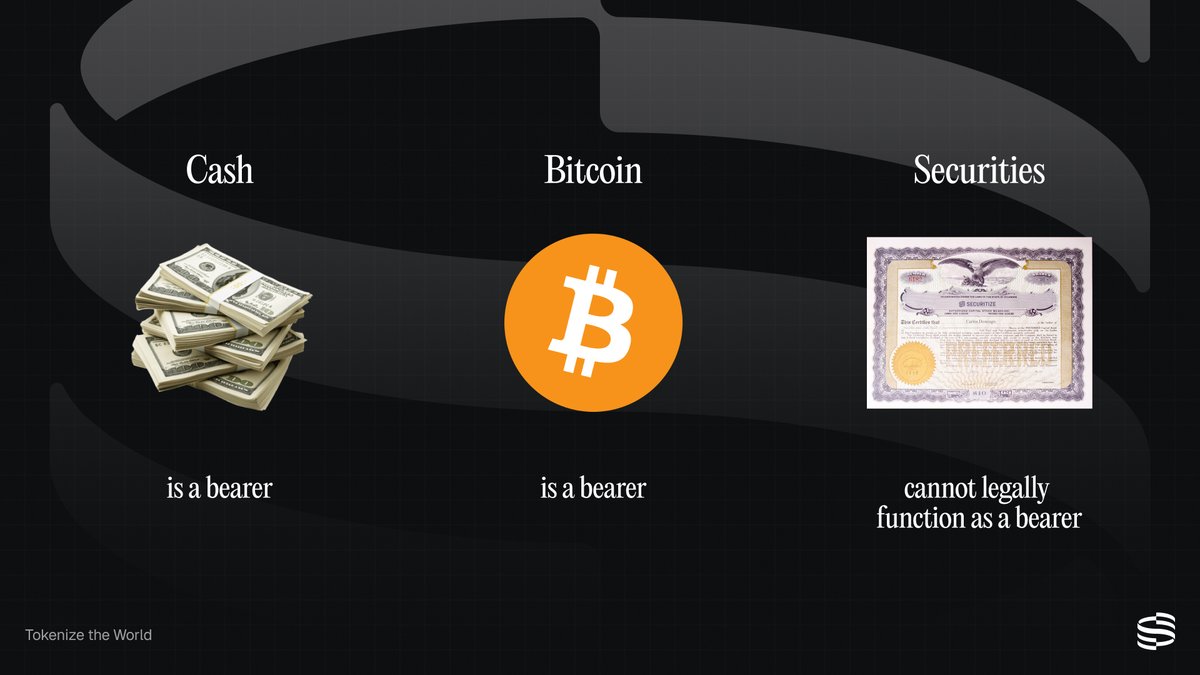

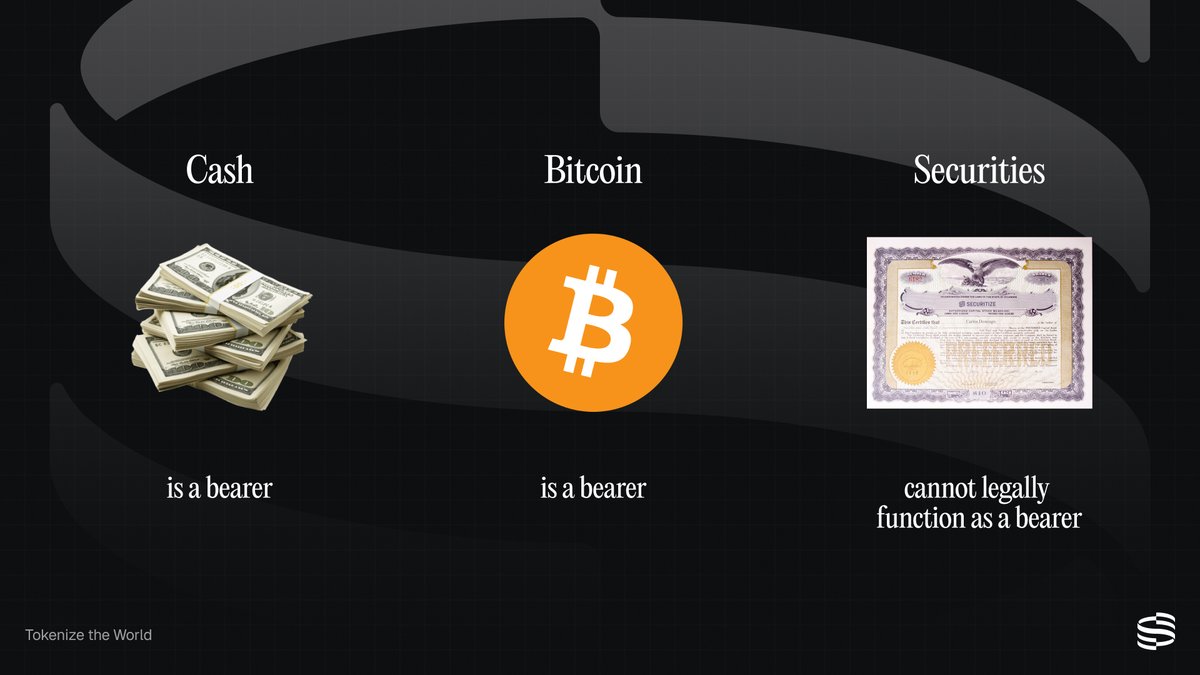

2/ Are bearer securities legal?

2/ Are bearer securities legal?