I talk about growth stock investing, fundamental analysis with a long-term mindset. I provide earnings reviews and key news updates.

How to get URL link on X (Twitter) App

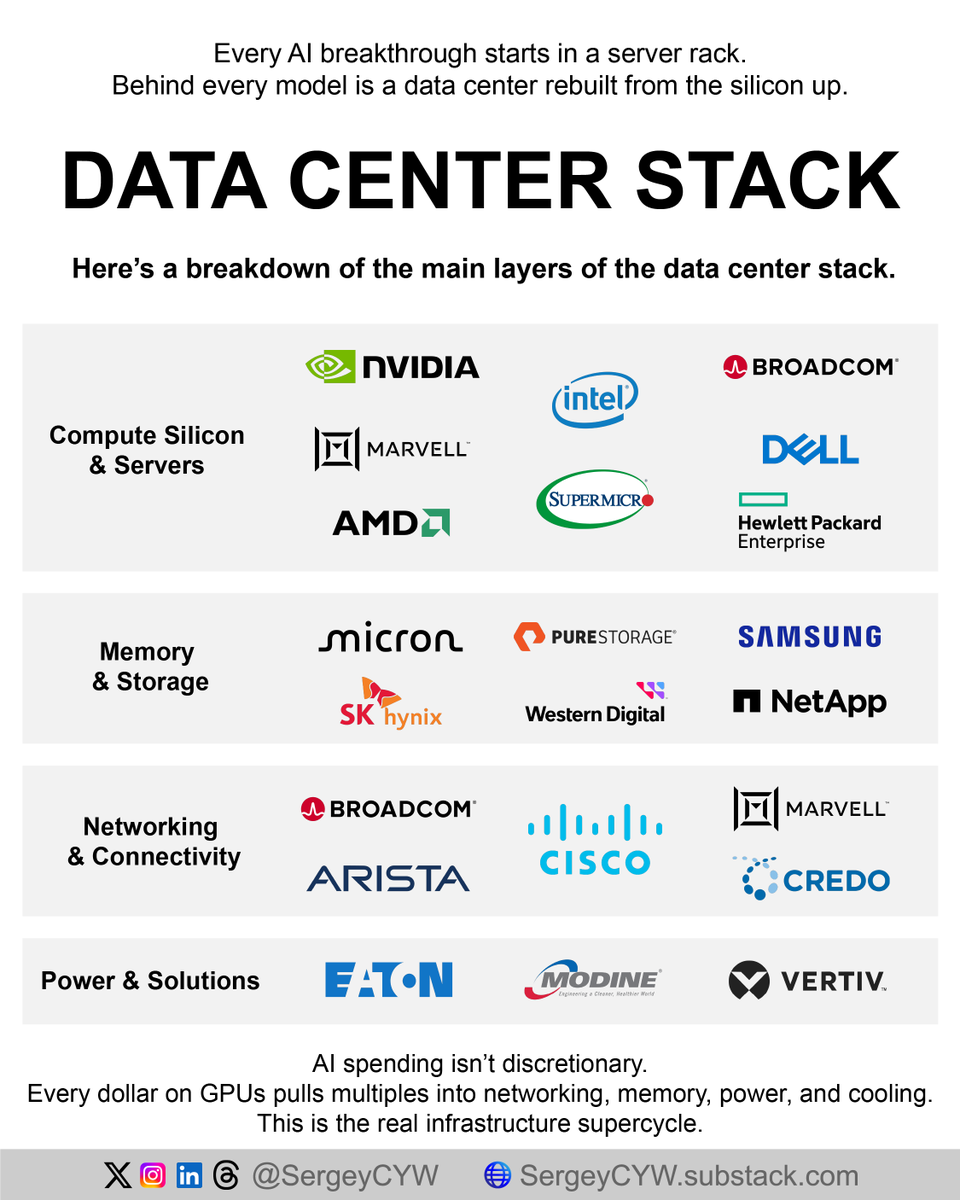

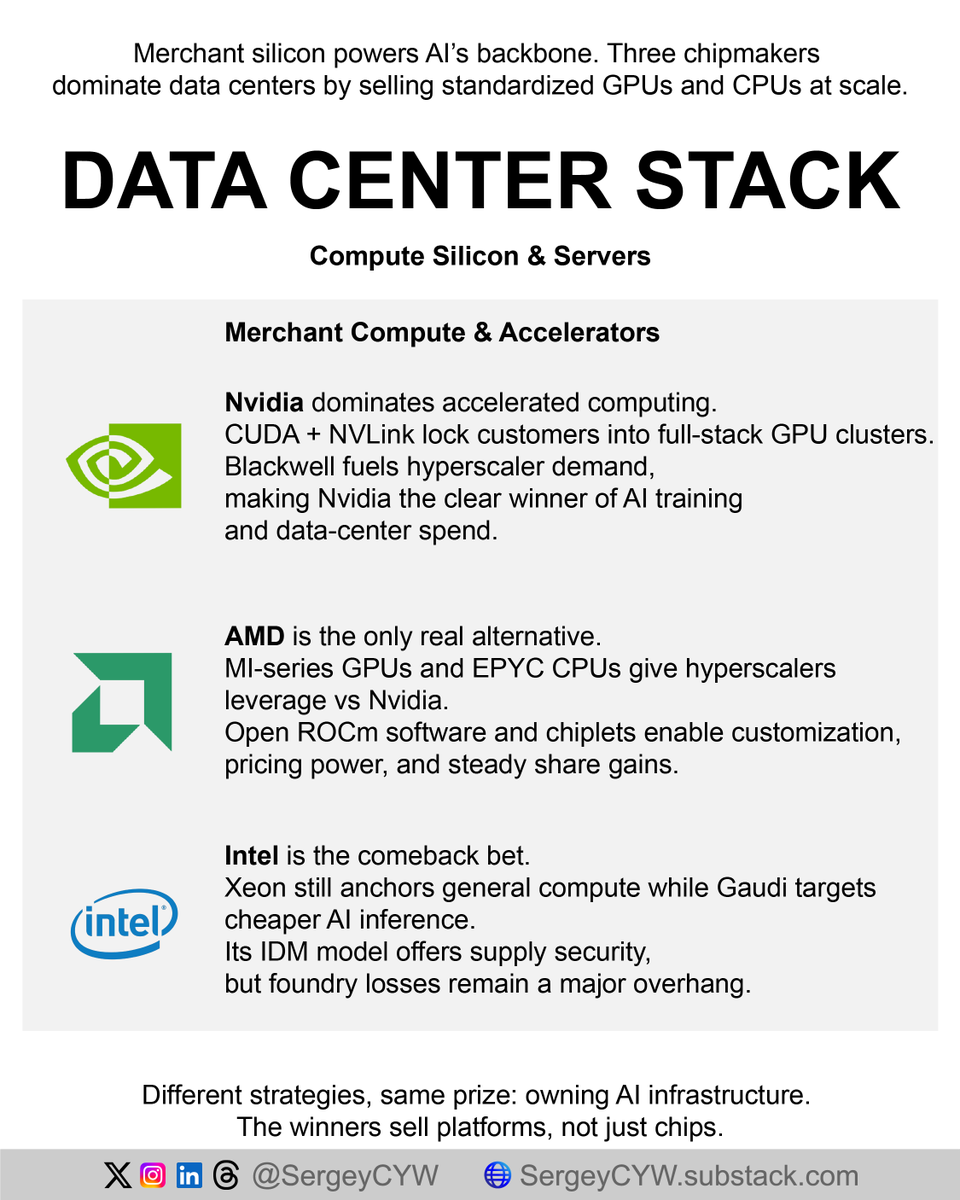

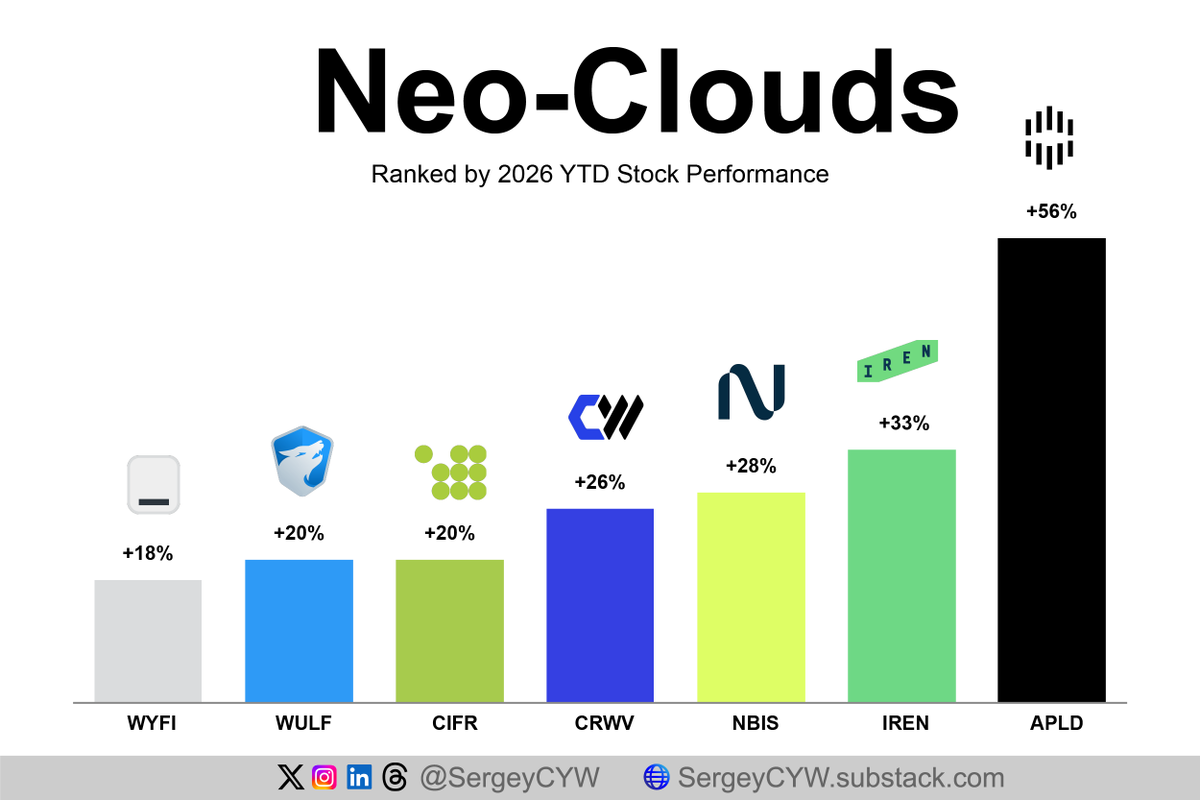

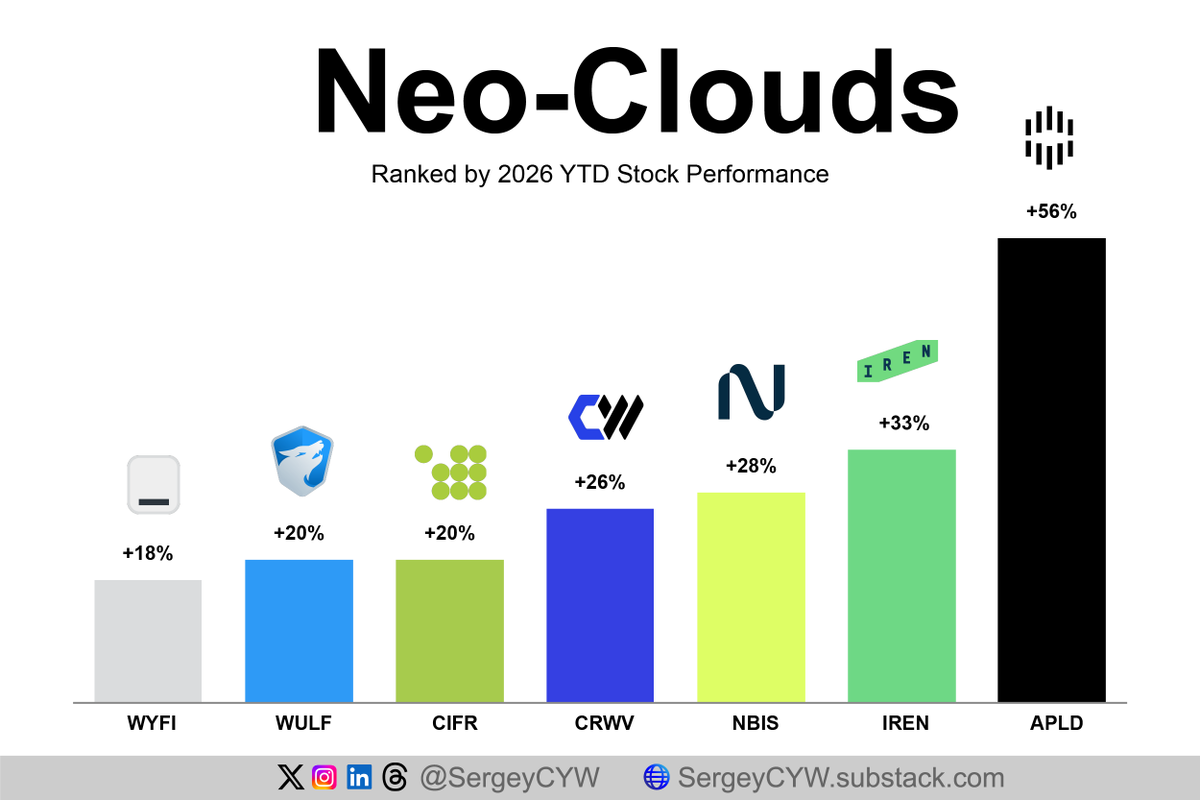

COMPUTE & SERVERS

COMPUTE & SERVERS

$IREN — Iren Limited +33%

$IREN — Iren Limited +33%

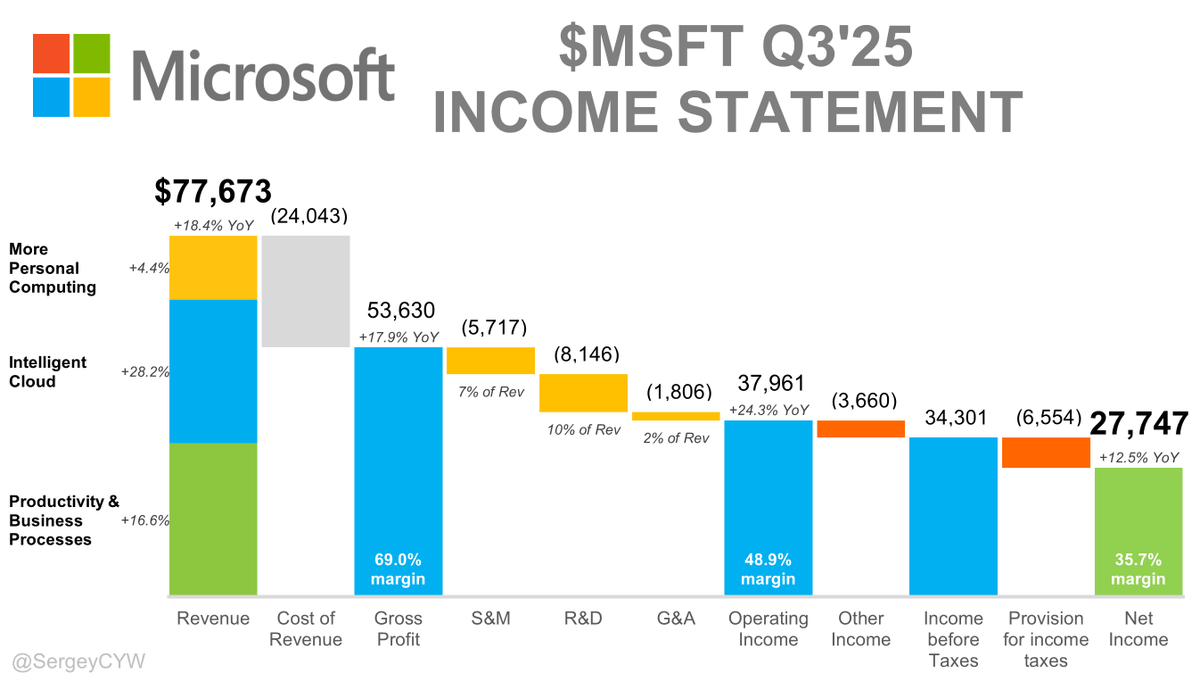

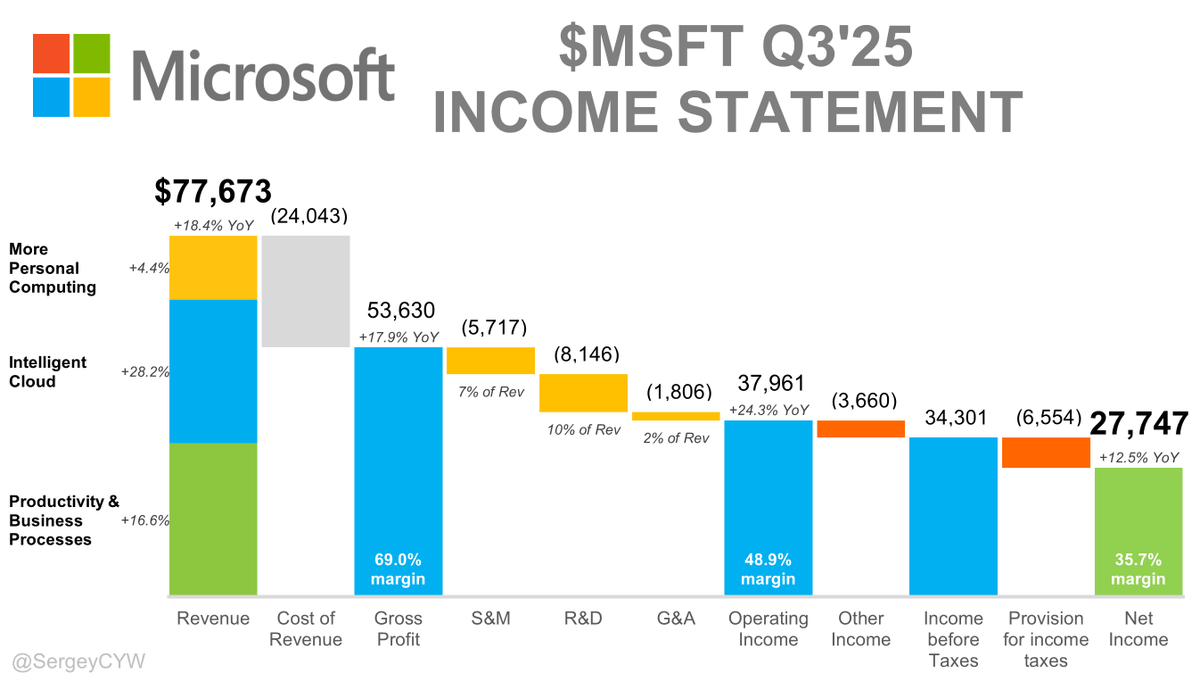

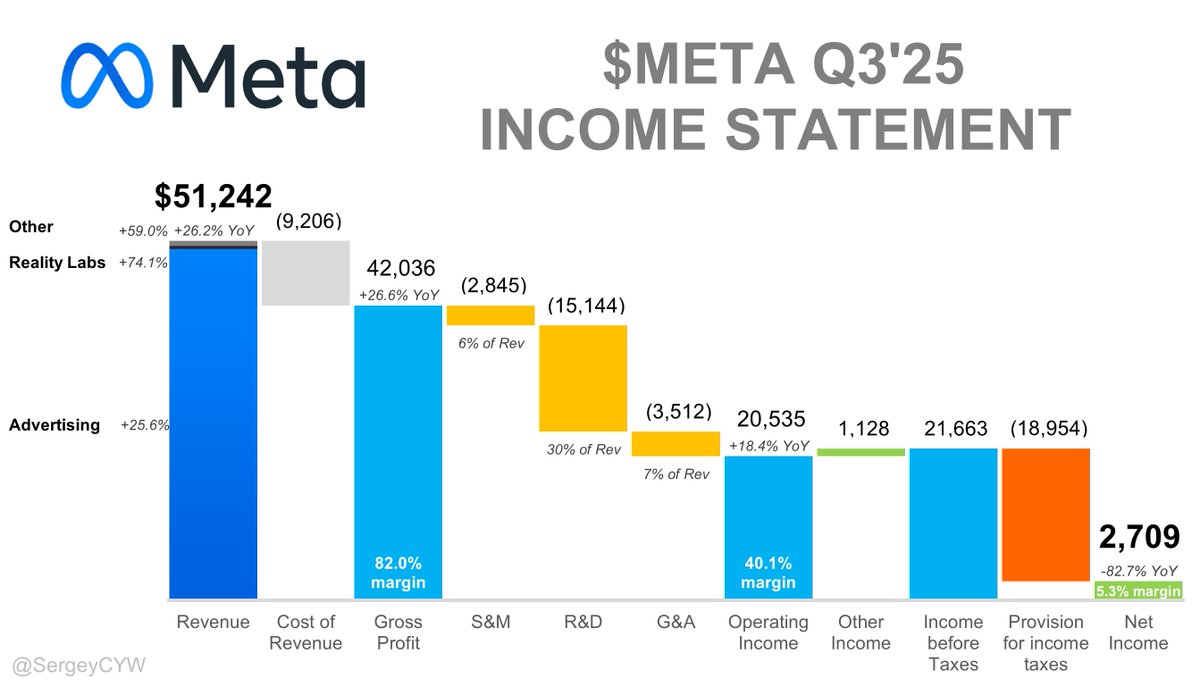

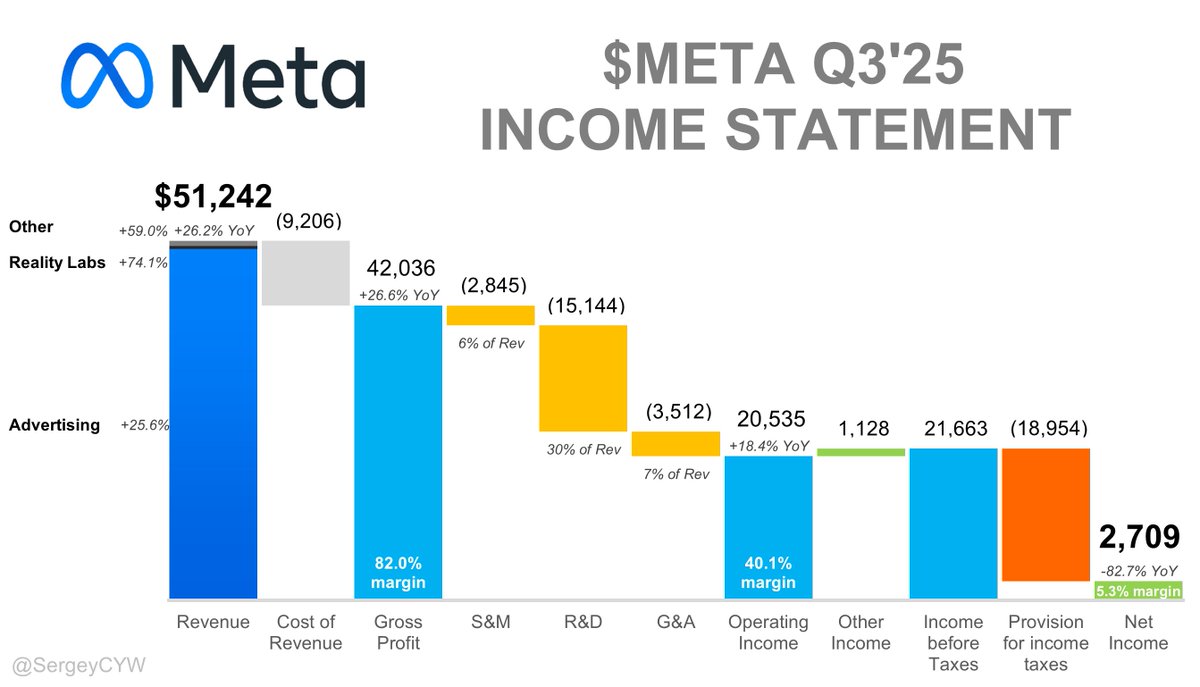

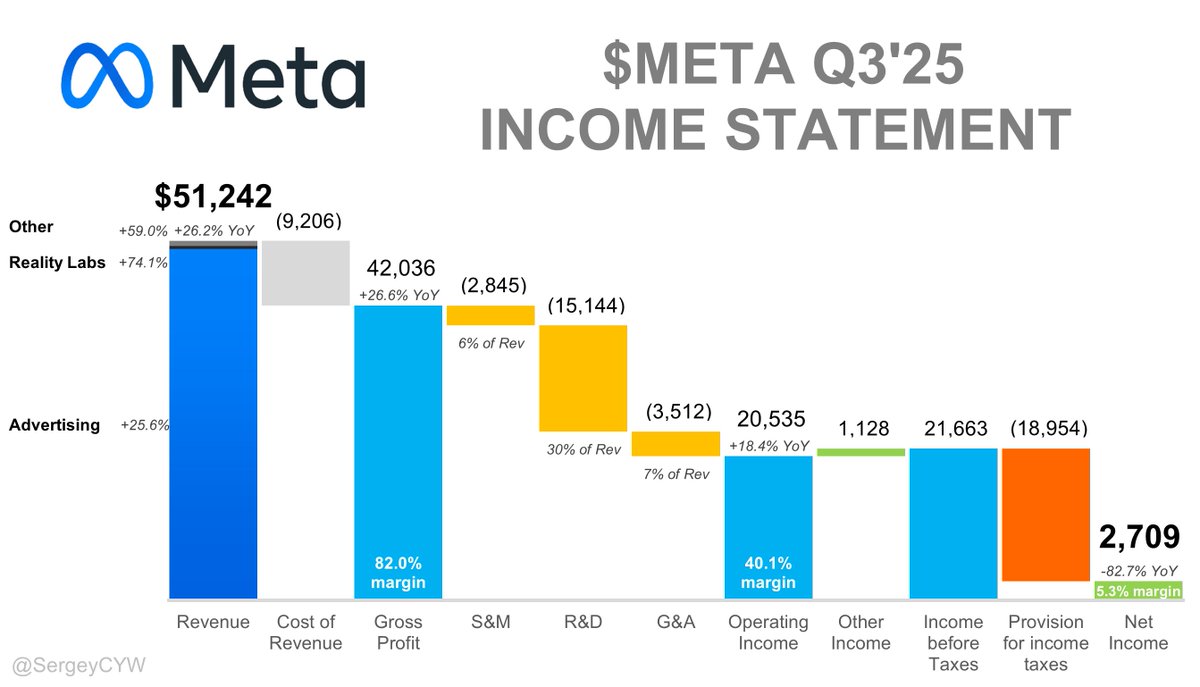

2) $META — Meta Platforms

2) $META — Meta Platforms

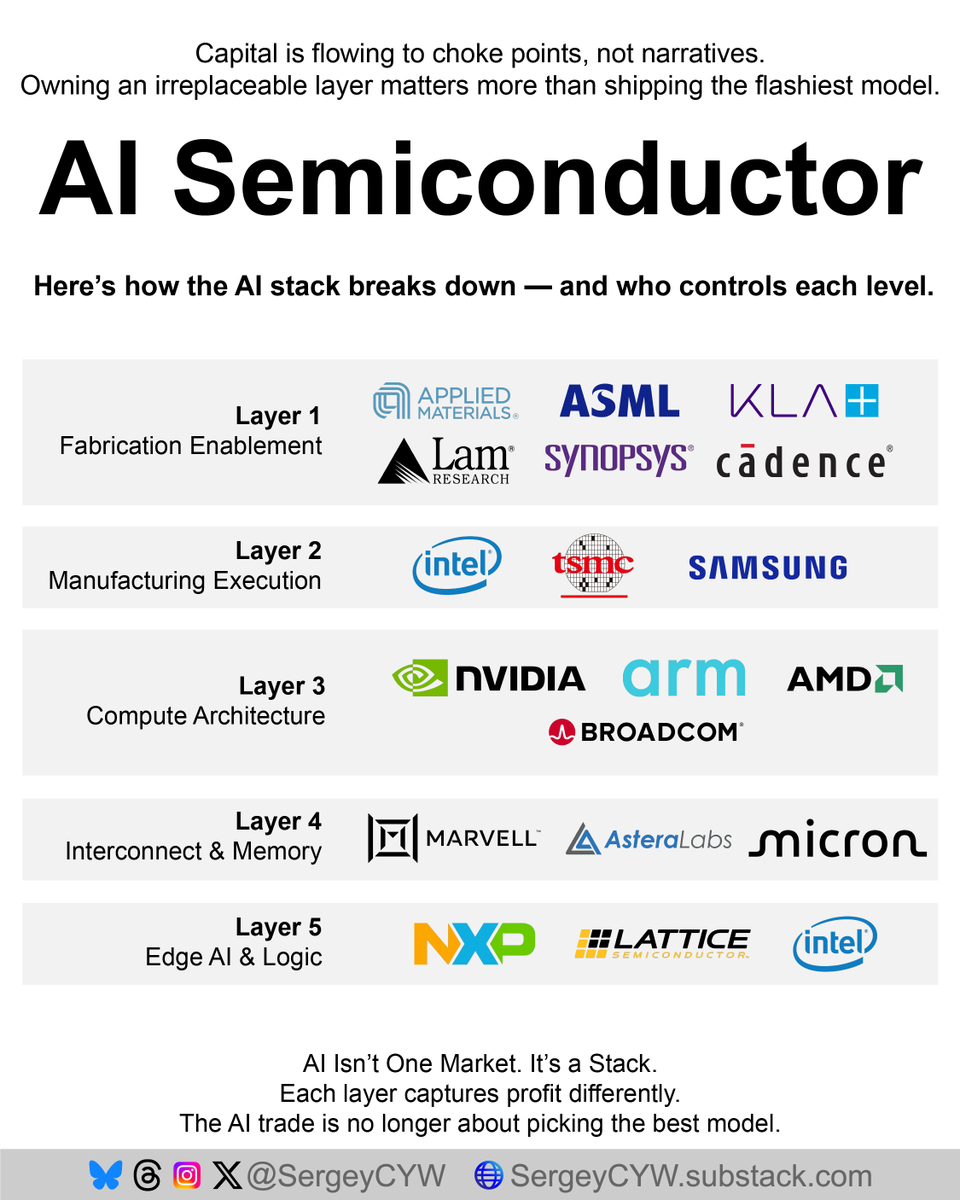

$ASML

$ASML

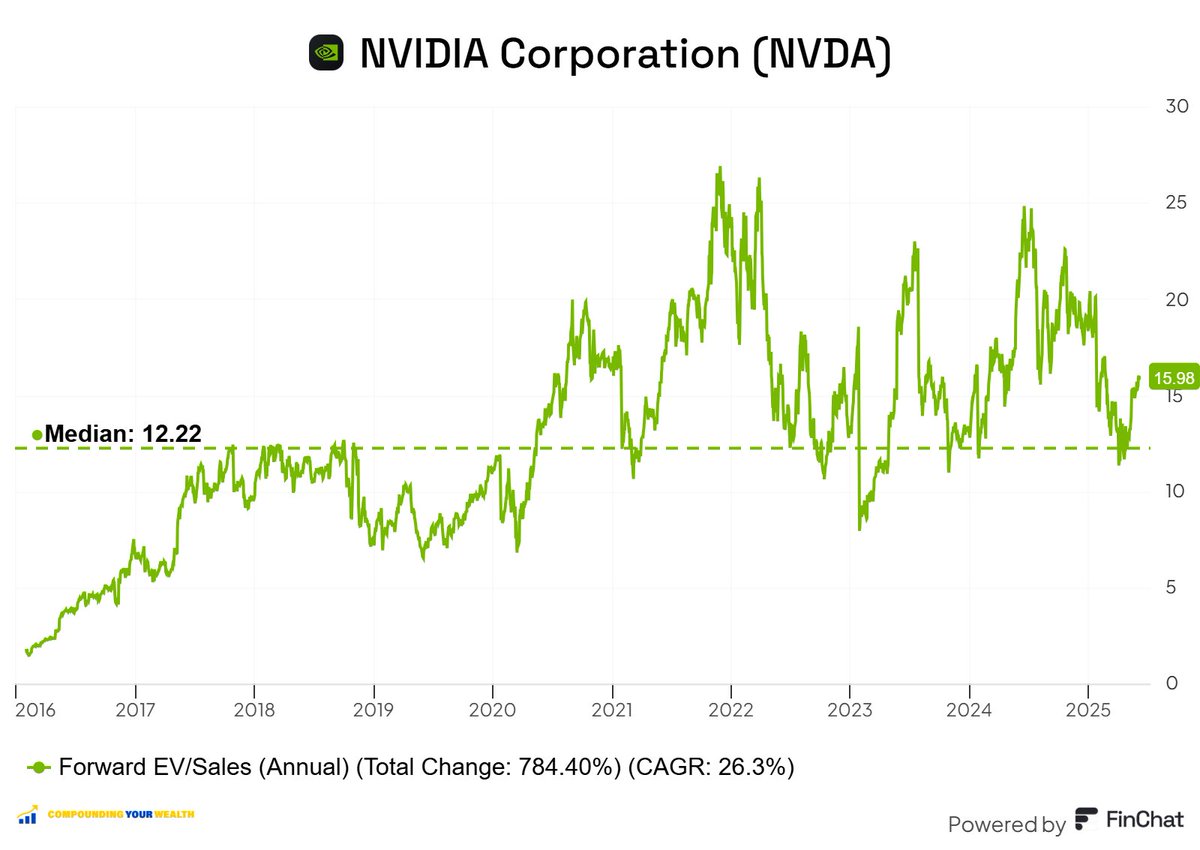

@samsolid57 @TheRayMyers @ftr_investors @micscofie1d @Stock_Opine @HedgeVision @FromValue Looking at $NVDA Nvidia's valuation through the Forward EV/Sales multiple, it stands at 15.9, above median of 12.2, and significantly lower than the January 2025 peak, when the multiple reached 20, as well as the 2024 high, when it peaked at 25.

@samsolid57 @TheRayMyers @ftr_investors @micscofie1d @Stock_Opine @HedgeVision @FromValue Looking at $NVDA Nvidia's valuation through the Forward EV/Sales multiple, it stands at 15.9, above median of 12.2, and significantly lower than the January 2025 peak, when the multiple reached 20, as well as the 2024 high, when it peaked at 25.

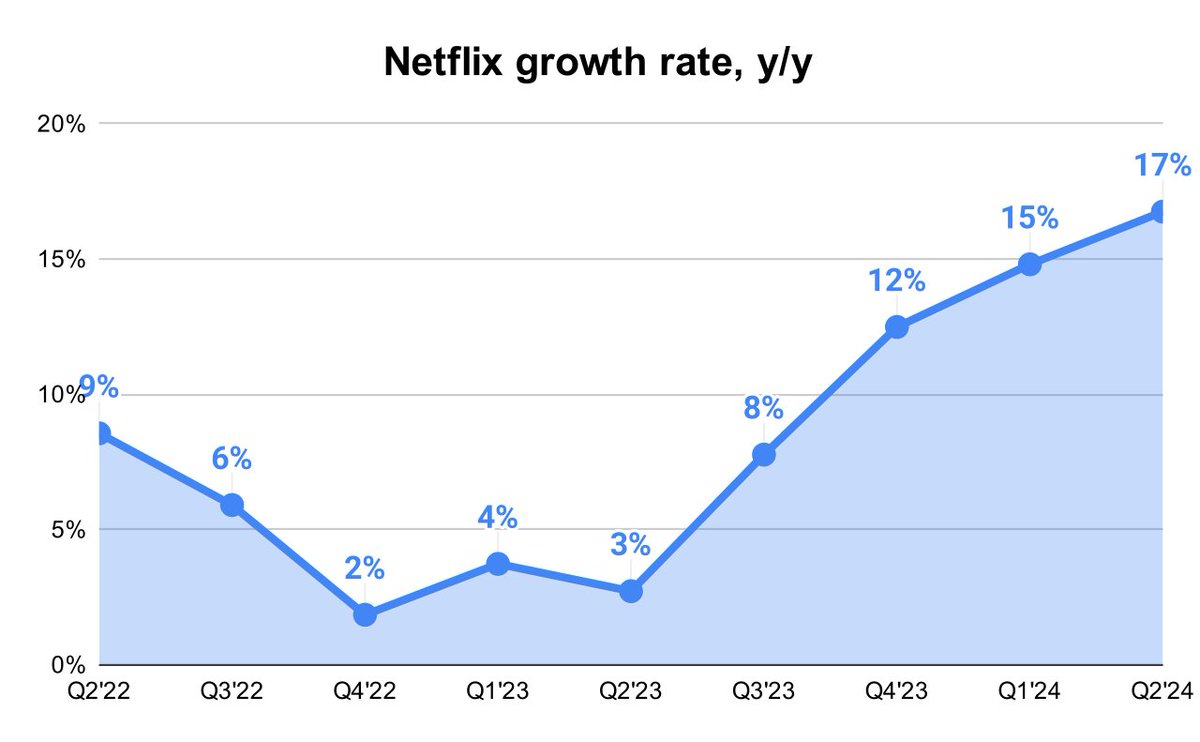

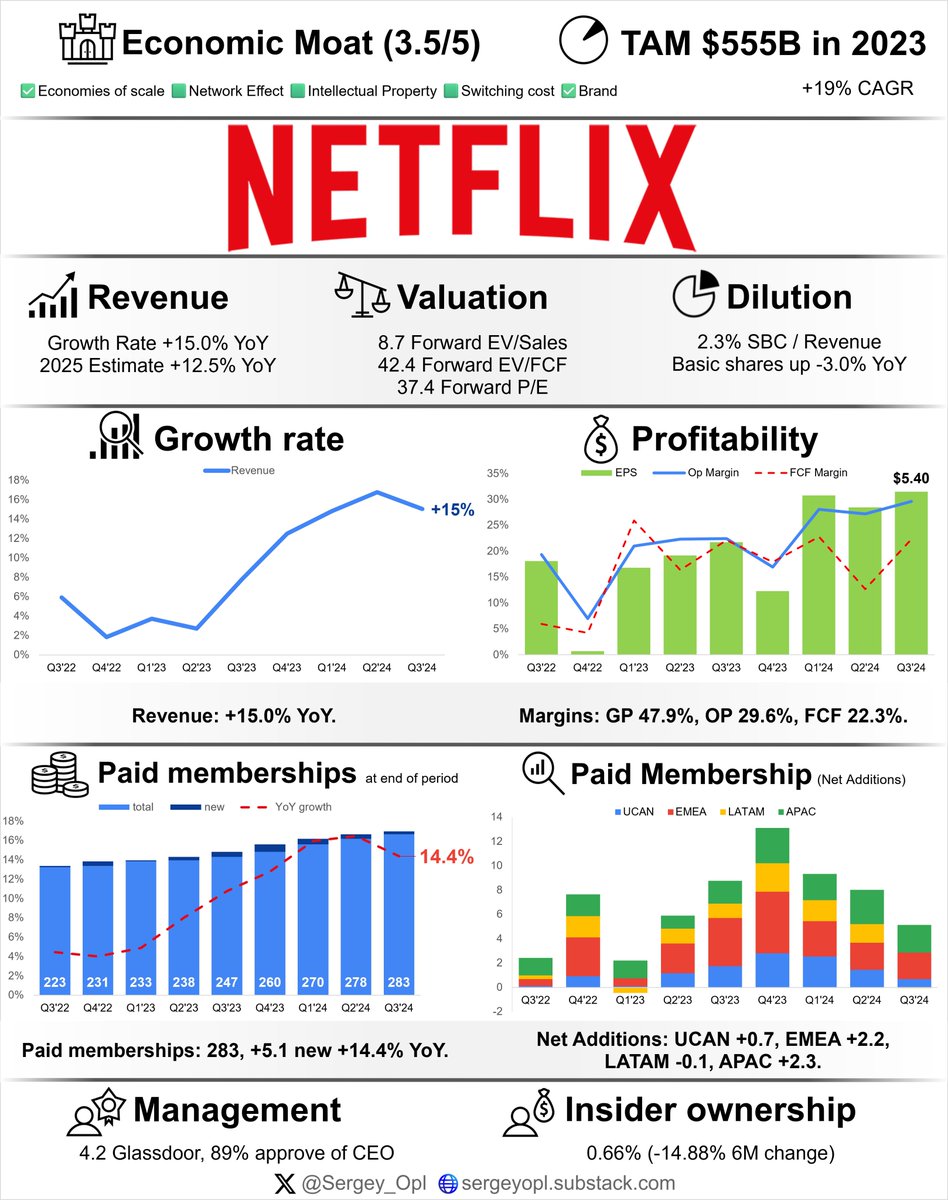

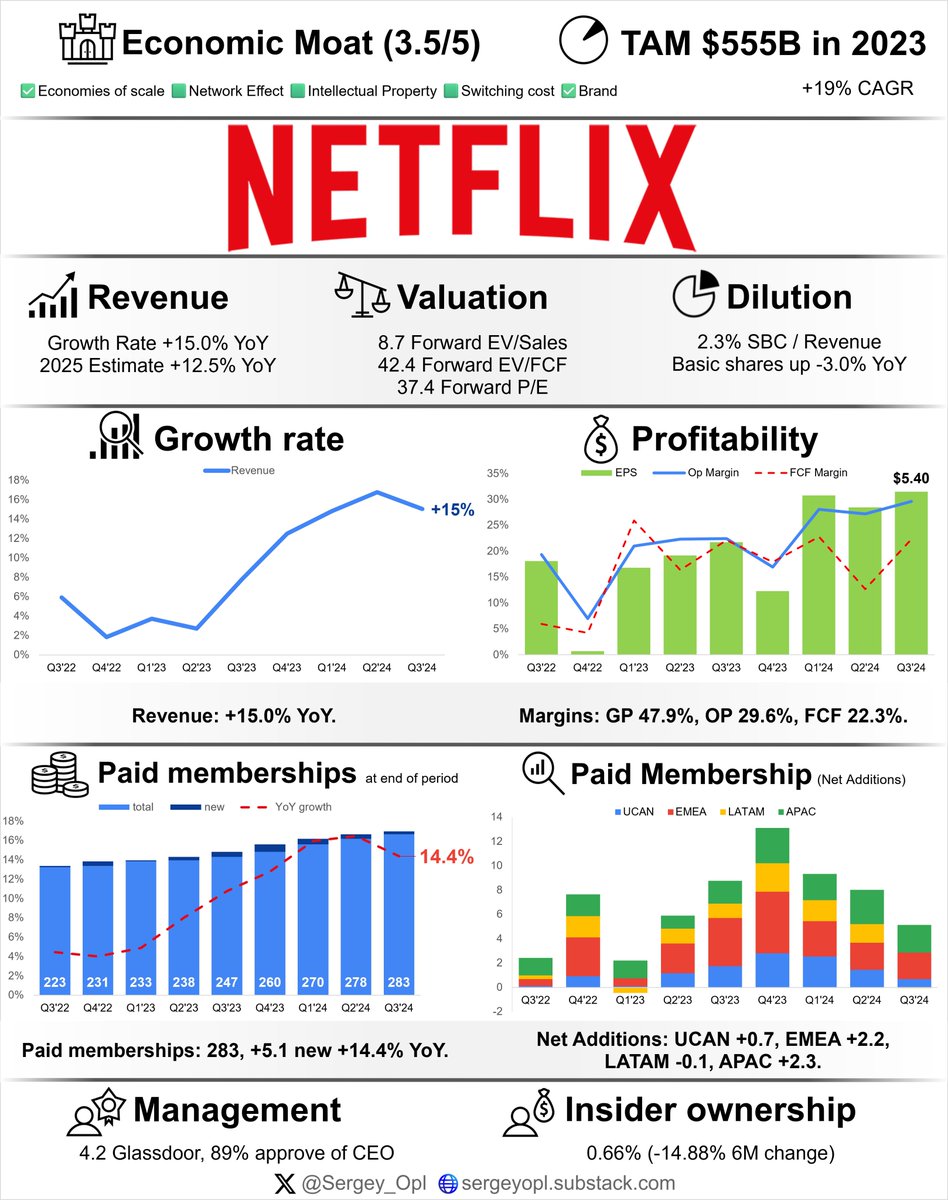

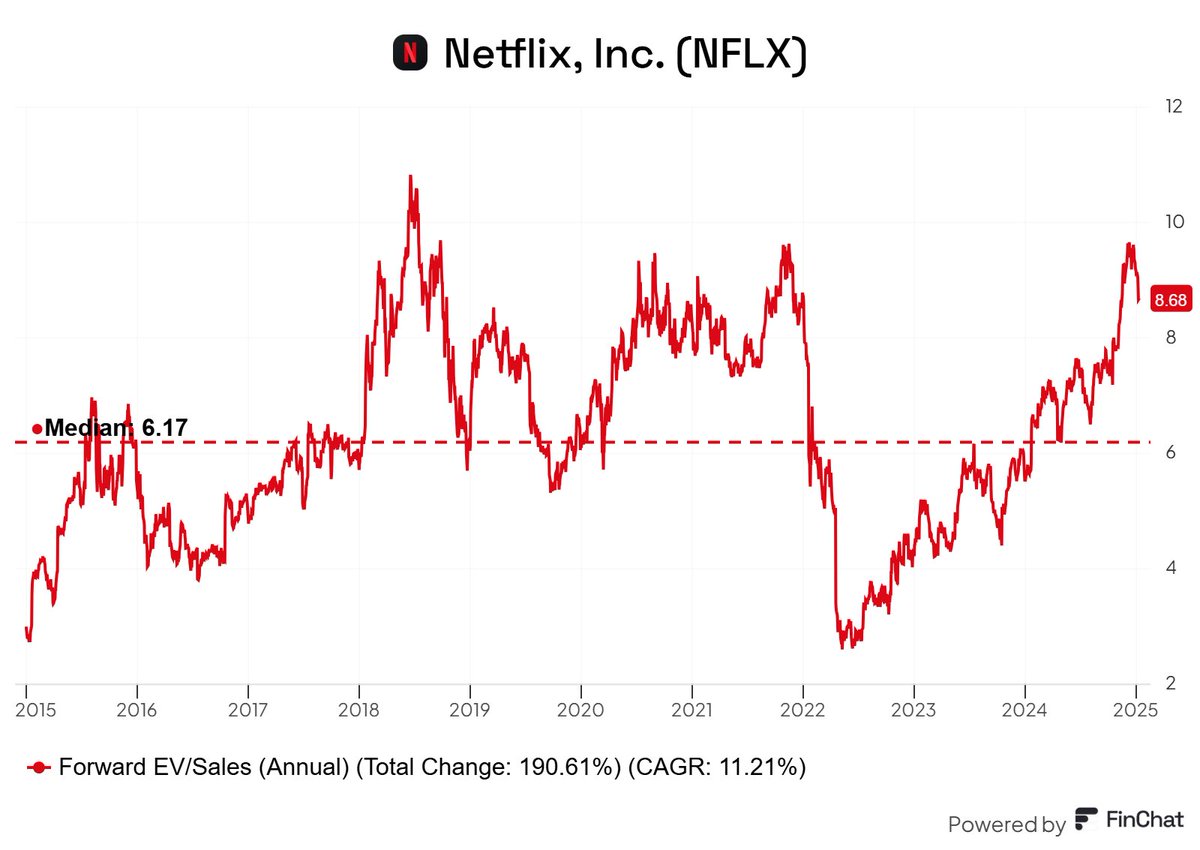

$NFLX Netflix is trading at a Forward EV/Sales multiple of 8.7, above the median of 6.2. The company's Forward EV/Sales multiple is near its historical highs.

$NFLX Netflix is trading at a Forward EV/Sales multiple of 8.7, above the median of 6.2. The company's Forward EV/Sales multiple is near its historical highs.

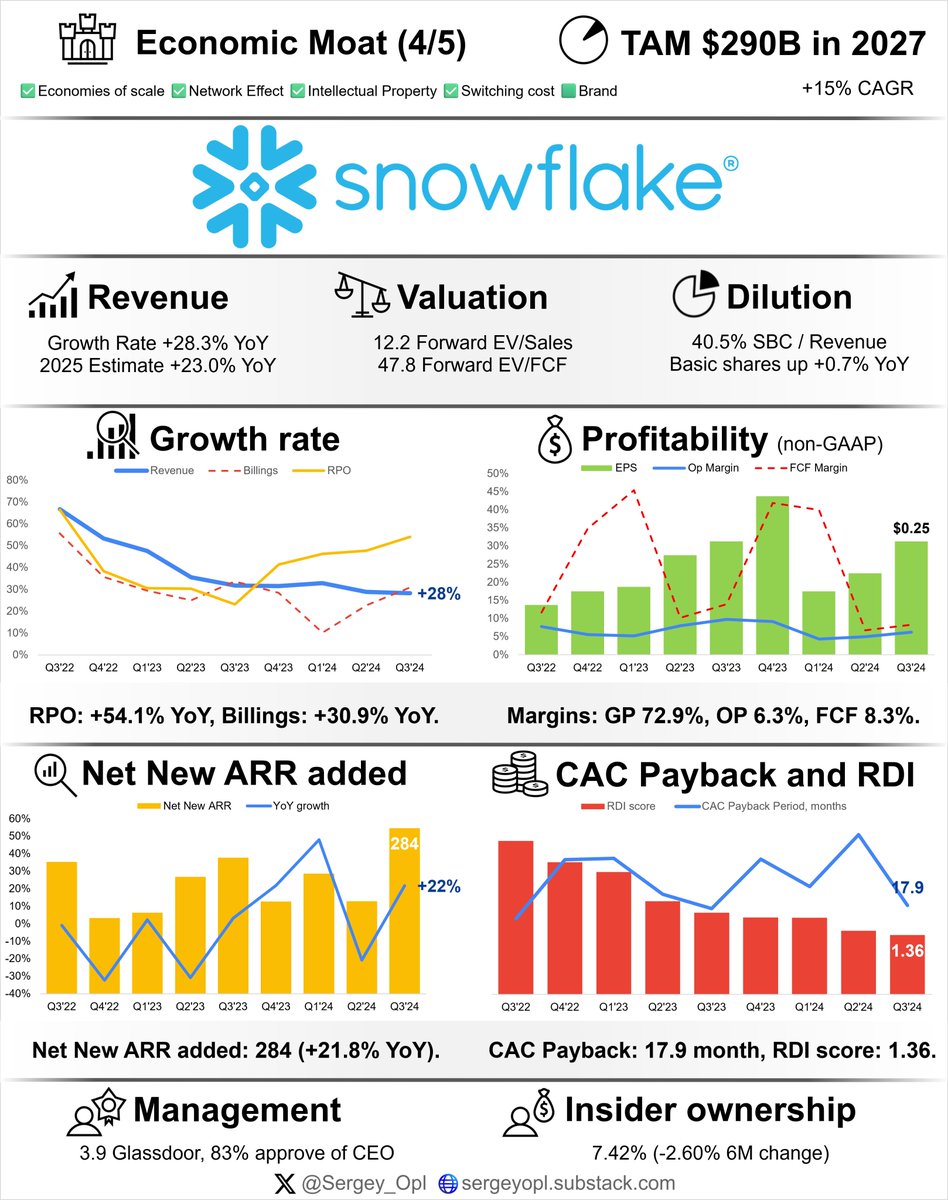

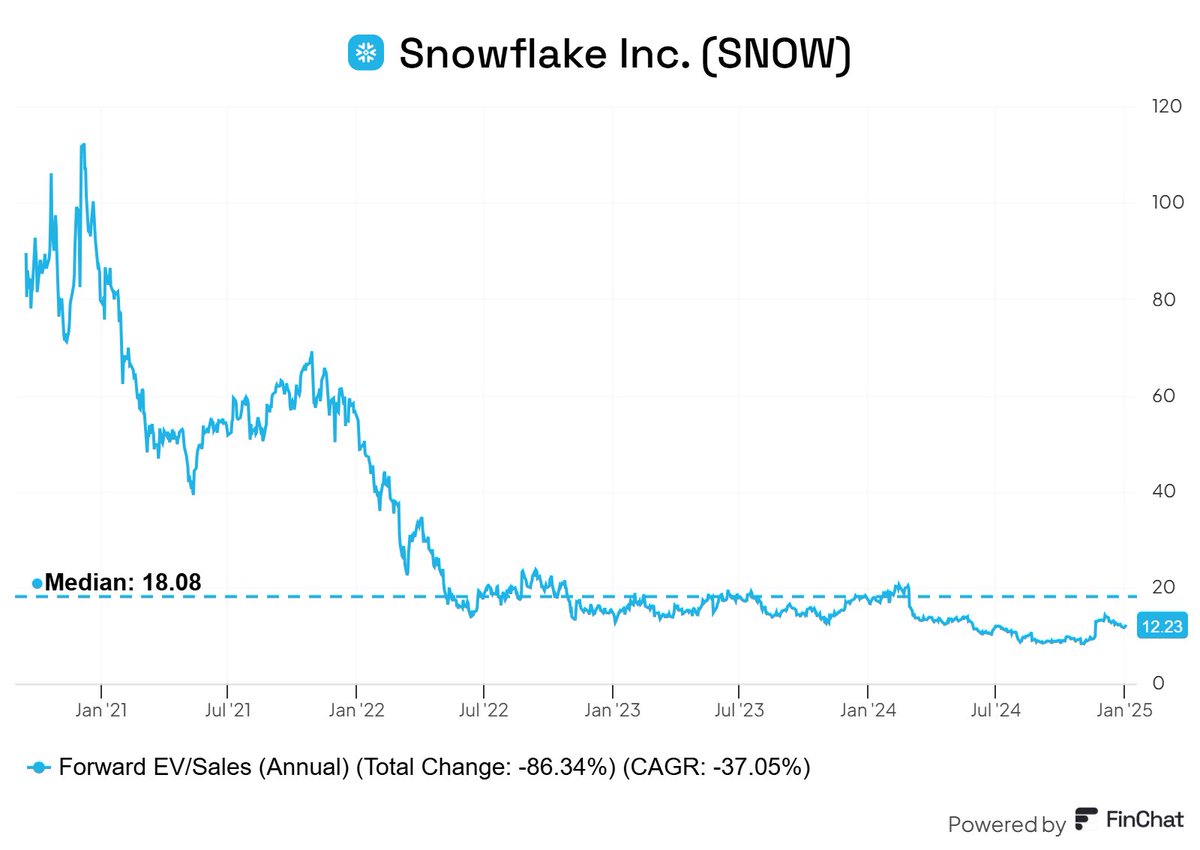

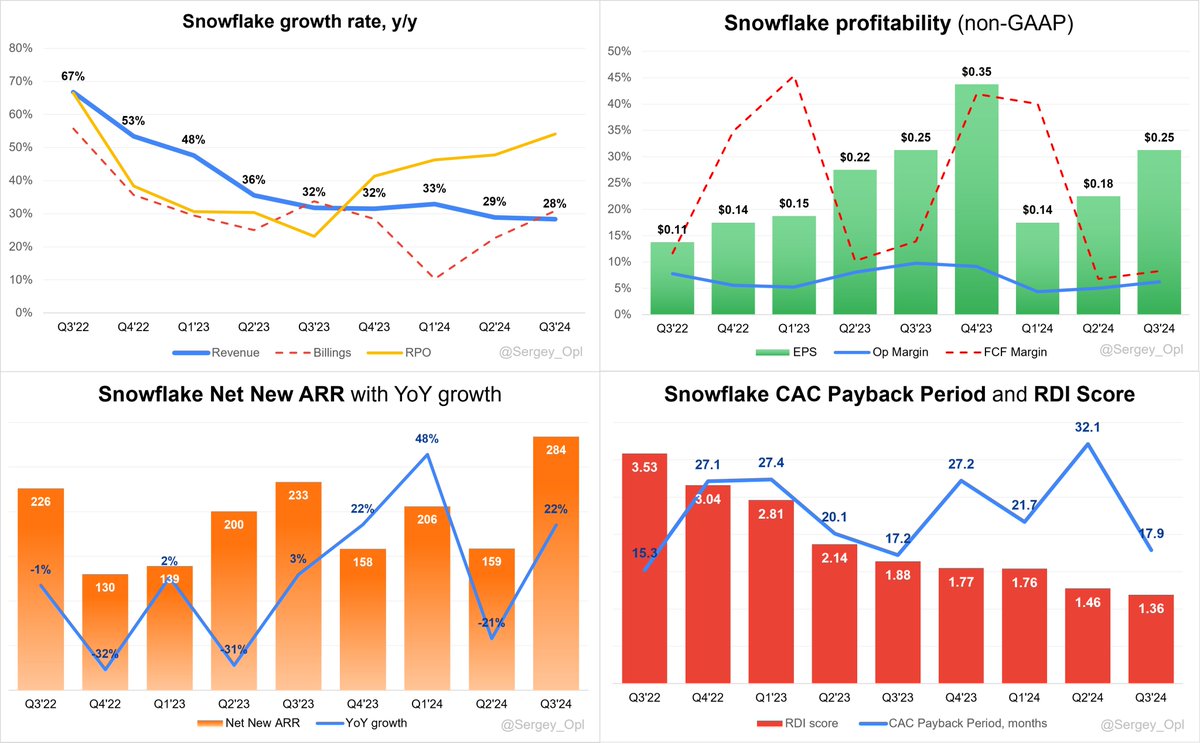

After a significant drop, $SNOW Snowflake is trading at a Forward EV/Sales multiple of 12.2—below the levels of 2022-2023 and significantly below the median level of 18.1.

After a significant drop, $SNOW Snowflake is trading at a Forward EV/Sales multiple of 12.2—below the levels of 2022-2023 and significantly below the median level of 18.1.

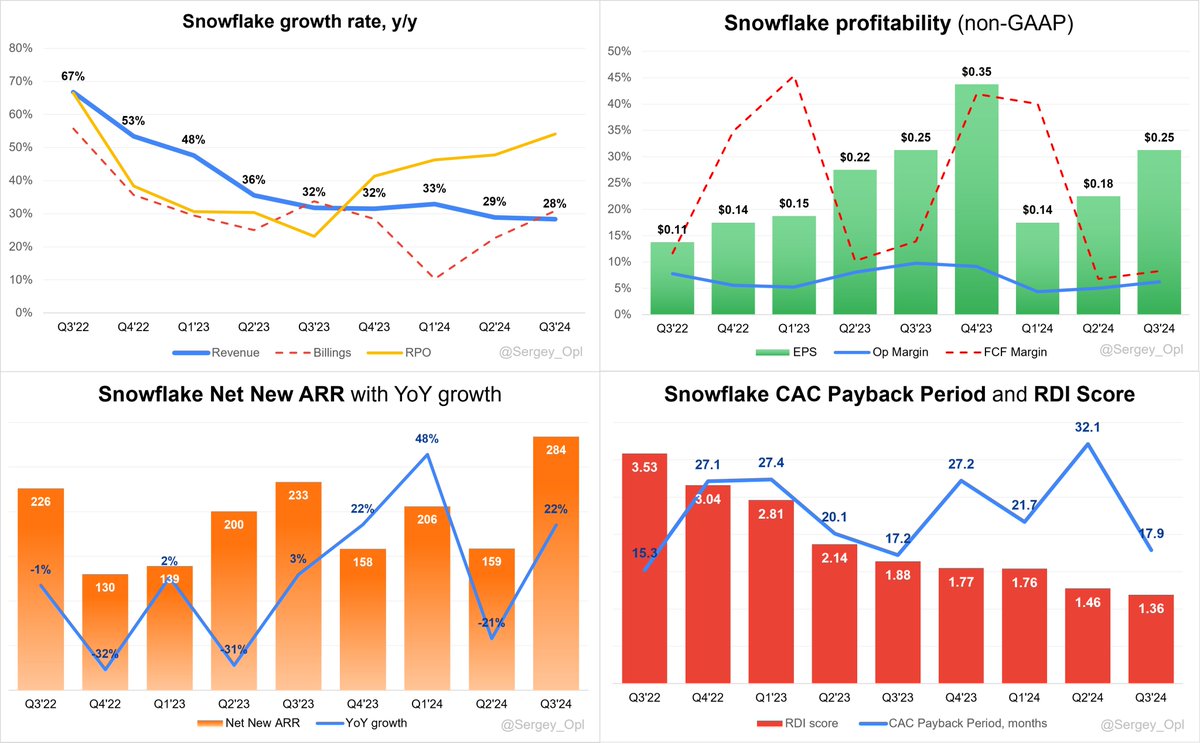

$SNOW Snowflake Customers

$SNOW Snowflake Customers

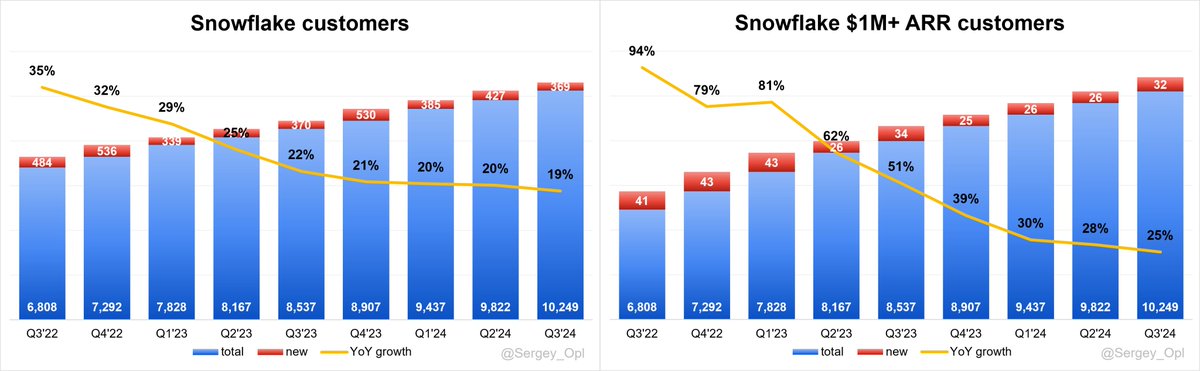

$ZS Zscaler is trading at a Forward EV/Sales multiple of 9.5, significantly below the average of 19.9.

$ZS Zscaler is trading at a Forward EV/Sales multiple of 9.5, significantly below the average of 19.9.

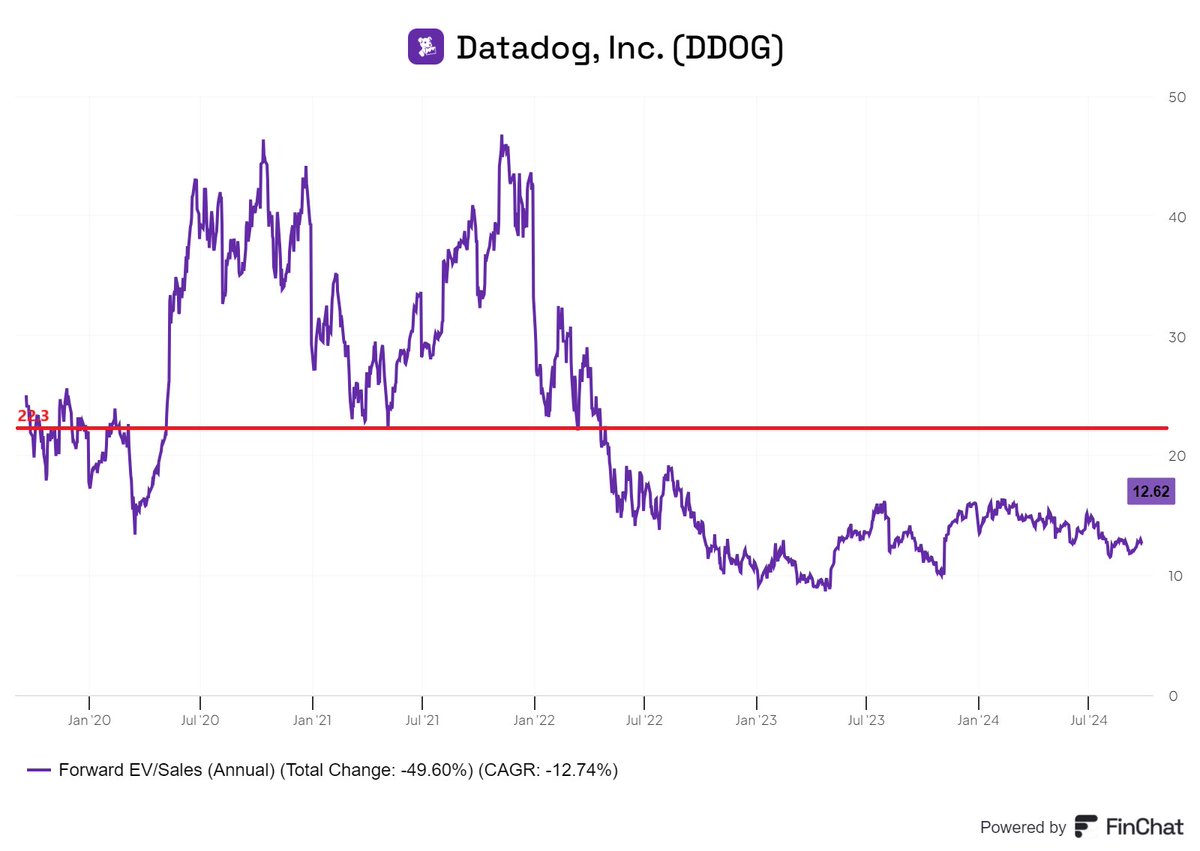

$DDOG Datadog is trading at a Forward EV/Sales multiple of 12.6, significantly below the average of 22.3 and lower than the valuations based on multiples before 2020.

$DDOG Datadog is trading at a Forward EV/Sales multiple of 12.6, significantly below the average of 22.3 and lower than the valuations based on multiples before 2020.

The revenue growth of $NFLX Netflix has accelerated over the last four quarters to 16.8%.

The revenue growth of $NFLX Netflix has accelerated over the last four quarters to 16.8%.