Climate, Investing, NBA, & Rap. SVP, Portfolio Manager - Sustainable Investing. Prev: Head of ESG, HY Credit, Startup (acq.) IB. Own Views. RTs ≠ endorsement.

How to get URL link on X (Twitter) App

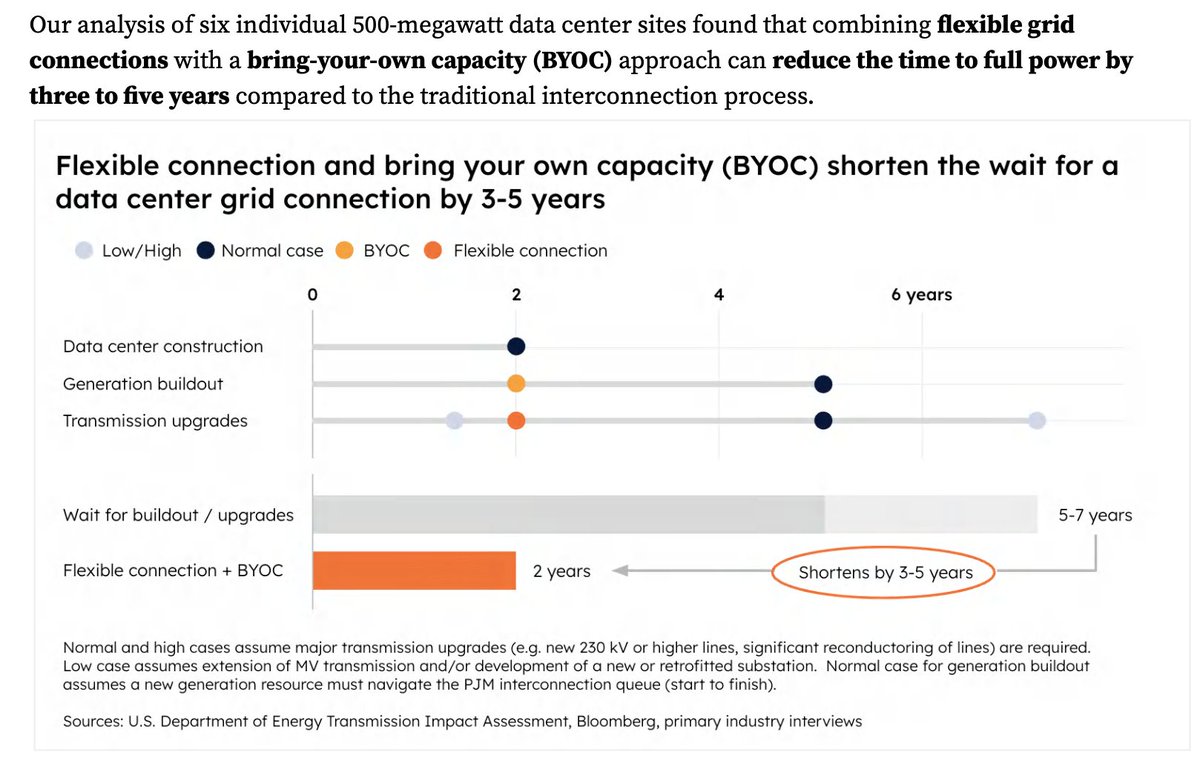

Speed to power economics: 3-5 years faster = $2.3-5.5B incremental EBITDA per 500 MW site. Flexibility infrastructure costs $1.2-1.4B. Net positive returns even at conservative $4M/MW revenue with just 2 years of time savings.

Speed to power economics: 3-5 years faster = $2.3-5.5B incremental EBITDA per 500 MW site. Flexibility infrastructure costs $1.2-1.4B. Net positive returns even at conservative $4M/MW revenue with just 2 years of time savings.

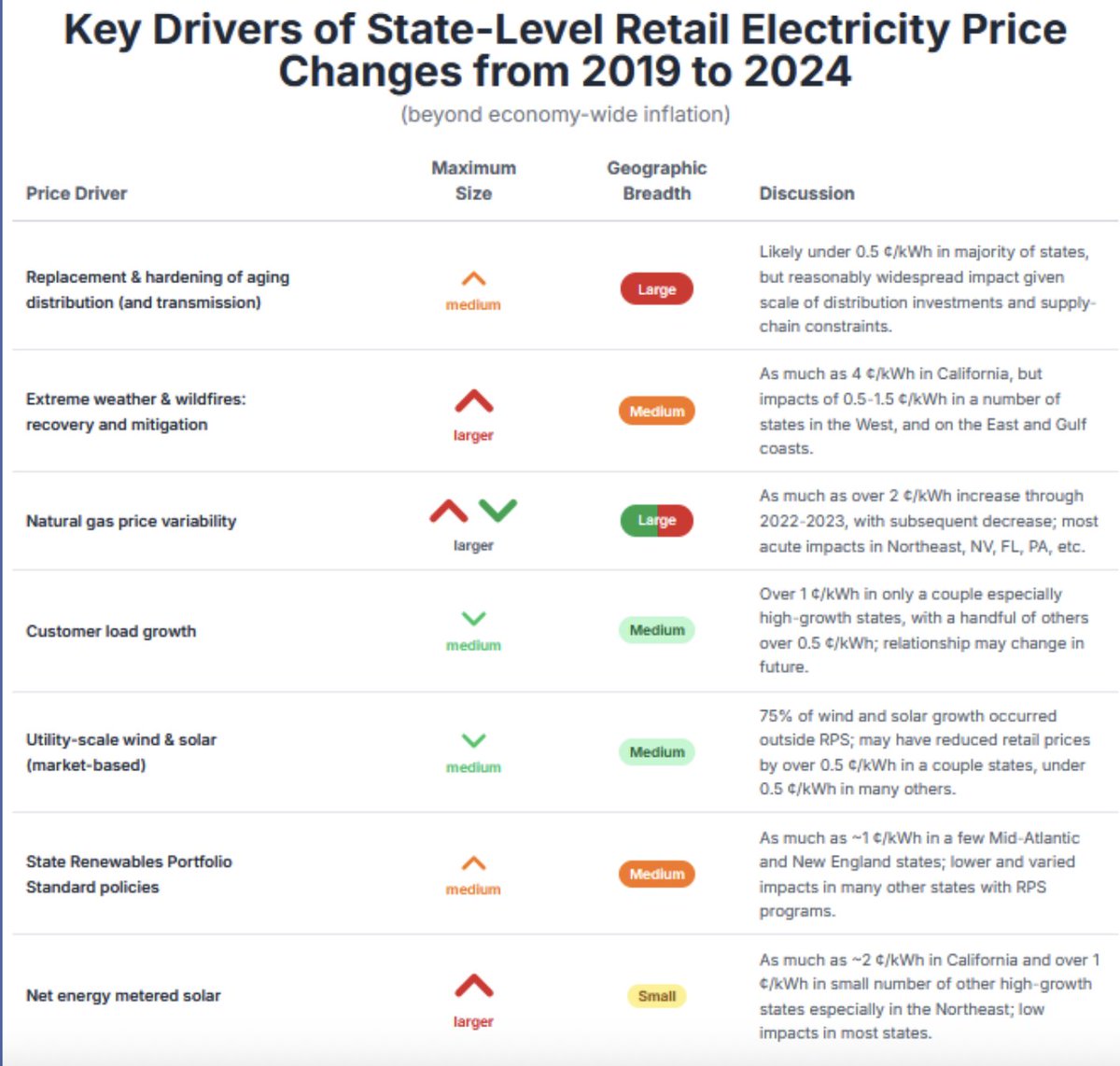

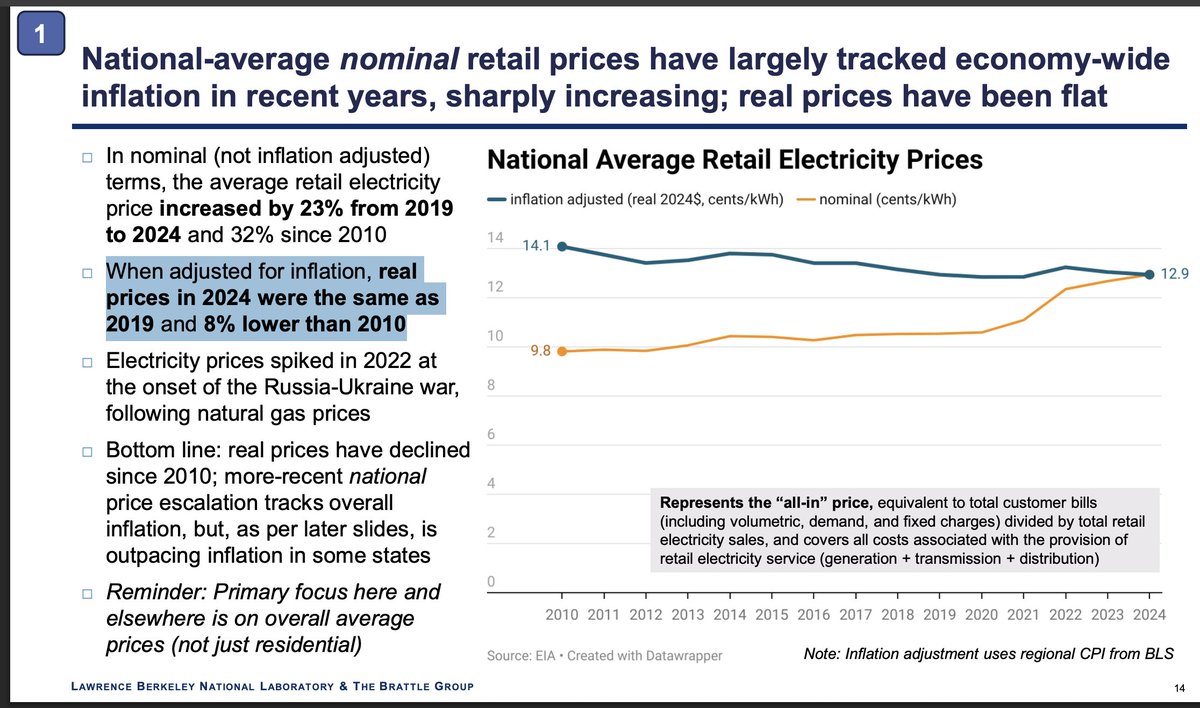

When adjusted for inflation, national avg. retail electricity real prices in 2024 were the same as 2019 and 8% lower than 2010

When adjusted for inflation, national avg. retail electricity real prices in 2024 were the same as 2019 and 8% lower than 2010

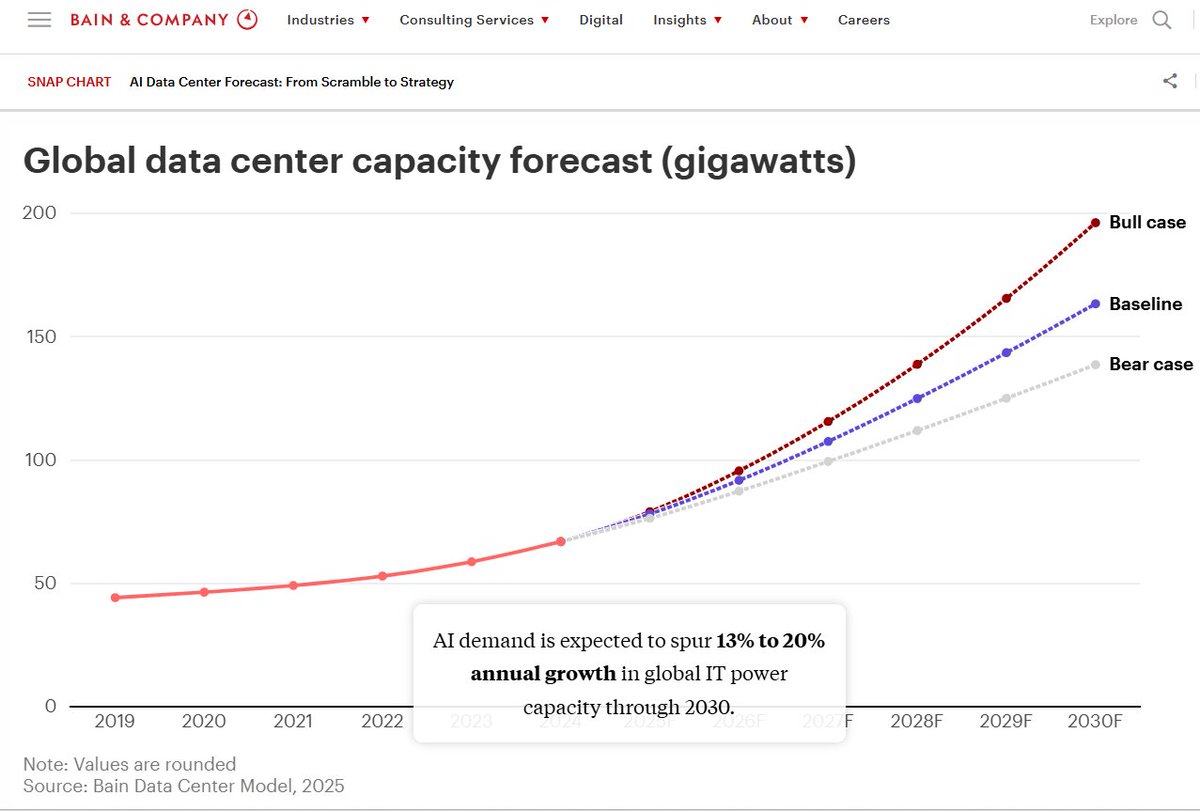

2020: 46GW

2020: 46GW

Pillar I: Accelerate AI Innovation

Pillar I: Accelerate AI Innovation

(2/9) Looking ahead to 2028, data centers could consume between 325-580 TWh annually - up to 12% of projected U.S. electricity use. This massive growth is primarily driven by AI workloads and GPU-accelerated computing.

(2/9) Looking ahead to 2028, data centers could consume between 325-580 TWh annually - up to 12% of projected U.S. electricity use. This massive growth is primarily driven by AI workloads and GPU-accelerated computing.

Electricity is the largest supplier of useful* energy.

Electricity is the largest supplier of useful* energy.

While we're at it, this is also true for all combustion of fossil fuels. Most of the energy burned becomes waste heat! I wish more people knew that when arguing this stuff. Imagine on a first principles basis arguing that the optimal state is one that wastes 2/3 of the output.

While we're at it, this is also true for all combustion of fossil fuels. Most of the energy burned becomes waste heat! I wish more people knew that when arguing this stuff. Imagine on a first principles basis arguing that the optimal state is one that wastes 2/3 of the output.

https://twitter.com/NatBullard/status/1624767603725029376Some of the charts/visuals/points that stood out most to me.

https://twitter.com/IEA/status/1531262914618871811More from executive summary: "The simultaneous electrification of road transport and the deployment of decentralised variable renewables such as rooftop solar will make power grid distribution more complex to manage."

Of that subgroup of consumers that rank clean products as very important, ~77% of consumers are willing to pay a premium

Of that subgroup of consumers that rank clean products as very important, ~77% of consumers are willing to pay a premium

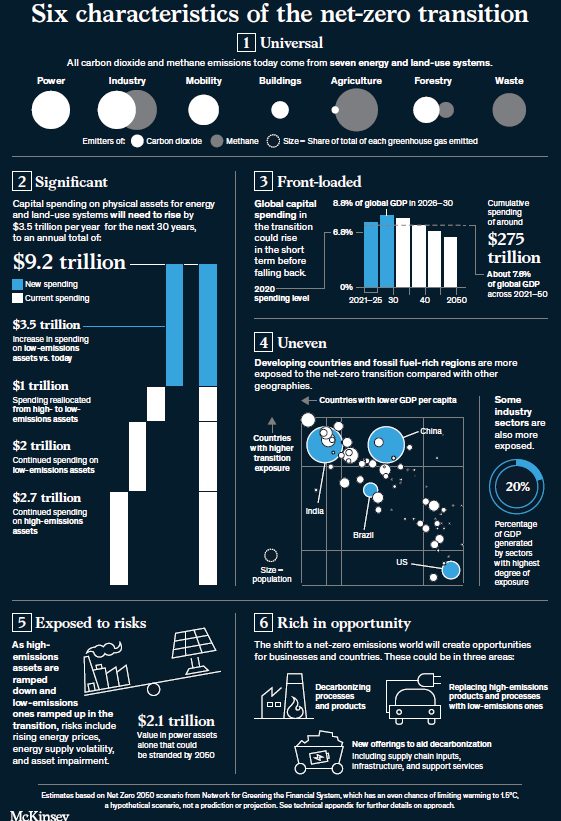

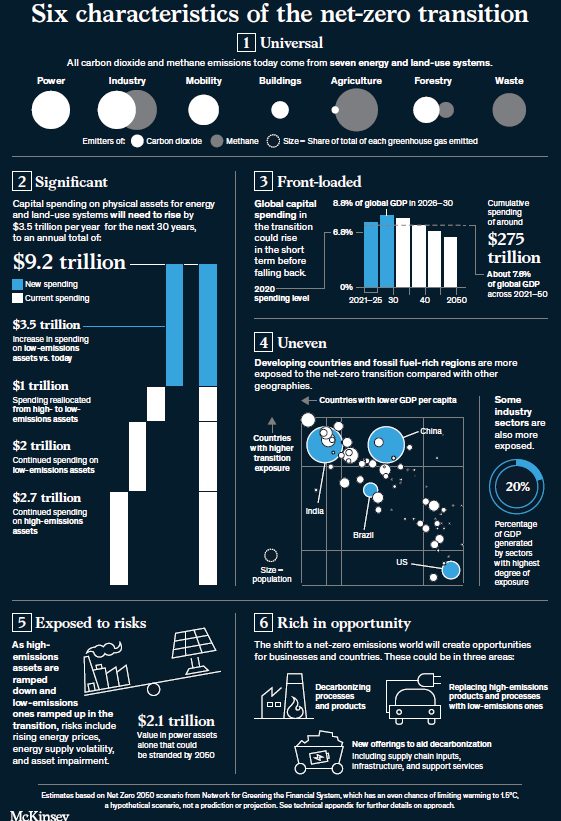

Cumulative spending on physical assets for Net Zero between 2021 and 2050 would be about ~$275 trillion. Means it will rise from ~$5.7 trillion today to an annual average of $9.2 trillion through 2050, an increase of $3.5 trillion.

Cumulative spending on physical assets for Net Zero between 2021 and 2050 would be about ~$275 trillion. Means it will rise from ~$5.7 trillion today to an annual average of $9.2 trillion through 2050, an increase of $3.5 trillion.

https://twitter.com/JohnSmillie42/status/1484382116972568576

1. Corn -> ethanol -> gasoline

1. Corn -> ethanol -> gasoline