Former financial journalist, currently consulting with @FinMinIndia | Author of 'From Cowrie to Crypto: Blockchain & the Future of Money' | Tweets are personal

How to get URL link on X (Twitter) App

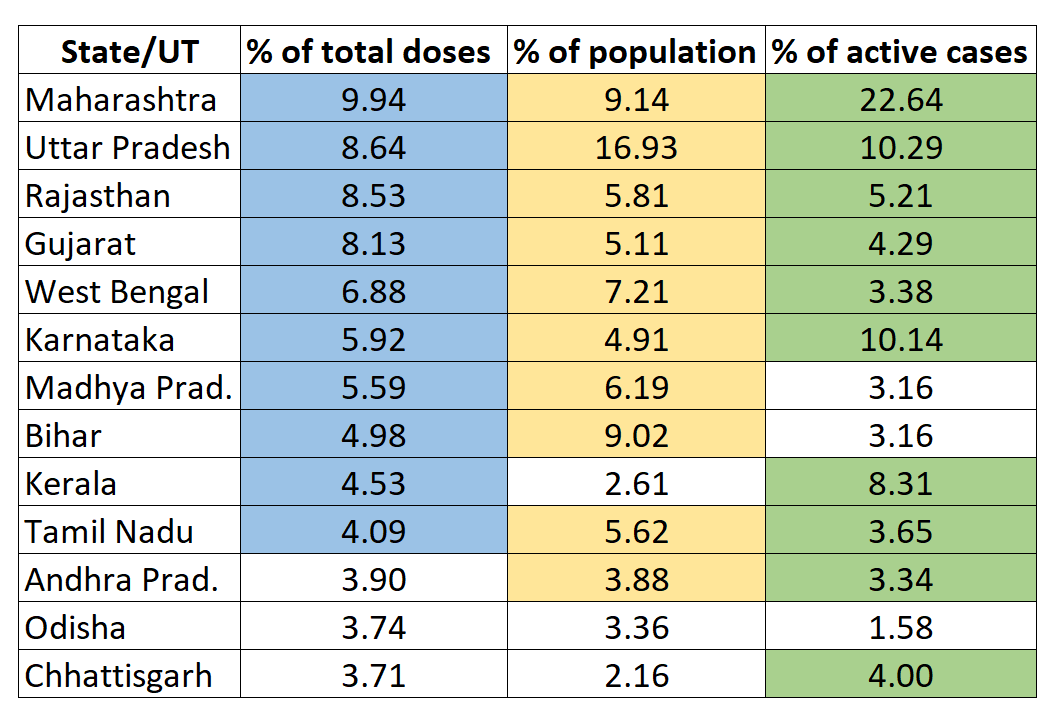

https://twitter.com/PIB_India/status/1387332434274910212?s=20There is a strong correlation between a State's share in total vaccines sent out by the Centre and that State's share in India's population. That correlation is 0.87. In simple terms, the most populous States received the highest shares of vaccine doses.