Founding Partner @Delphi_Ventures | Co-Founder @Delphi_Digital | Host @PodcastDelphi | Built @VenturesRobot | All My Own Opinions

6 subscribers

How to get URL link on X (Twitter) App

1a/ One standout example: DeepSeek-R1. Karpathy highlights it as a reasoning LLM pushed to its limits with reinforcement learning

1a/ One standout example: DeepSeek-R1. Karpathy highlights it as a reasoning LLM pushed to its limits with reinforcement learning

Excited to introduce DelphAI, Delphi Ventures' AI analyst that's transforming how we evaluate crypto projects

Excited to introduce DelphAI, Delphi Ventures' AI analyst that's transforming how we evaluate crypto projects

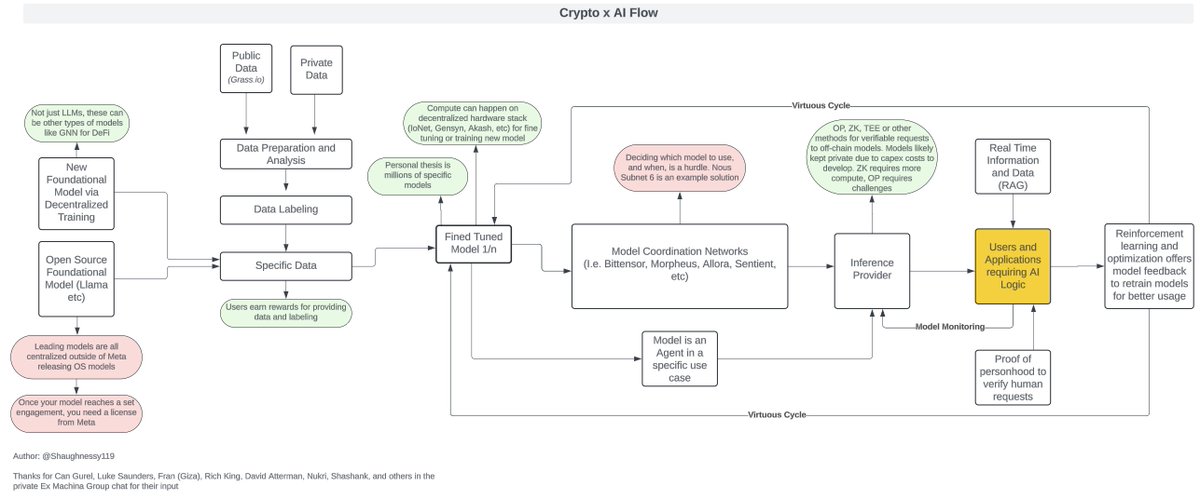

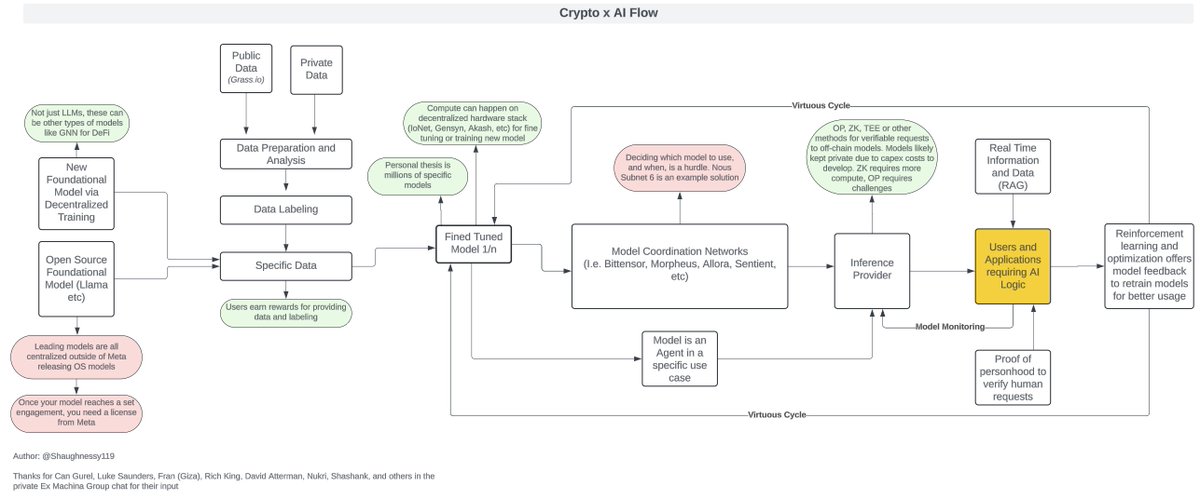

Danger of Centralized AI's effects on millions of applications reaching billions of users.

Danger of Centralized AI's effects on millions of applications reaching billions of users.

1/ Despite its long history and large AUM, @placeholdervc has only 6 full time people.

1/ Despite its long history and large AUM, @placeholdervc has only 6 full time people.

https://twitter.com/neelsalami/status/1708887005445369985My mental model on competing ecosystems is simple - the easiest and largest place to deploy will house the most viral applications

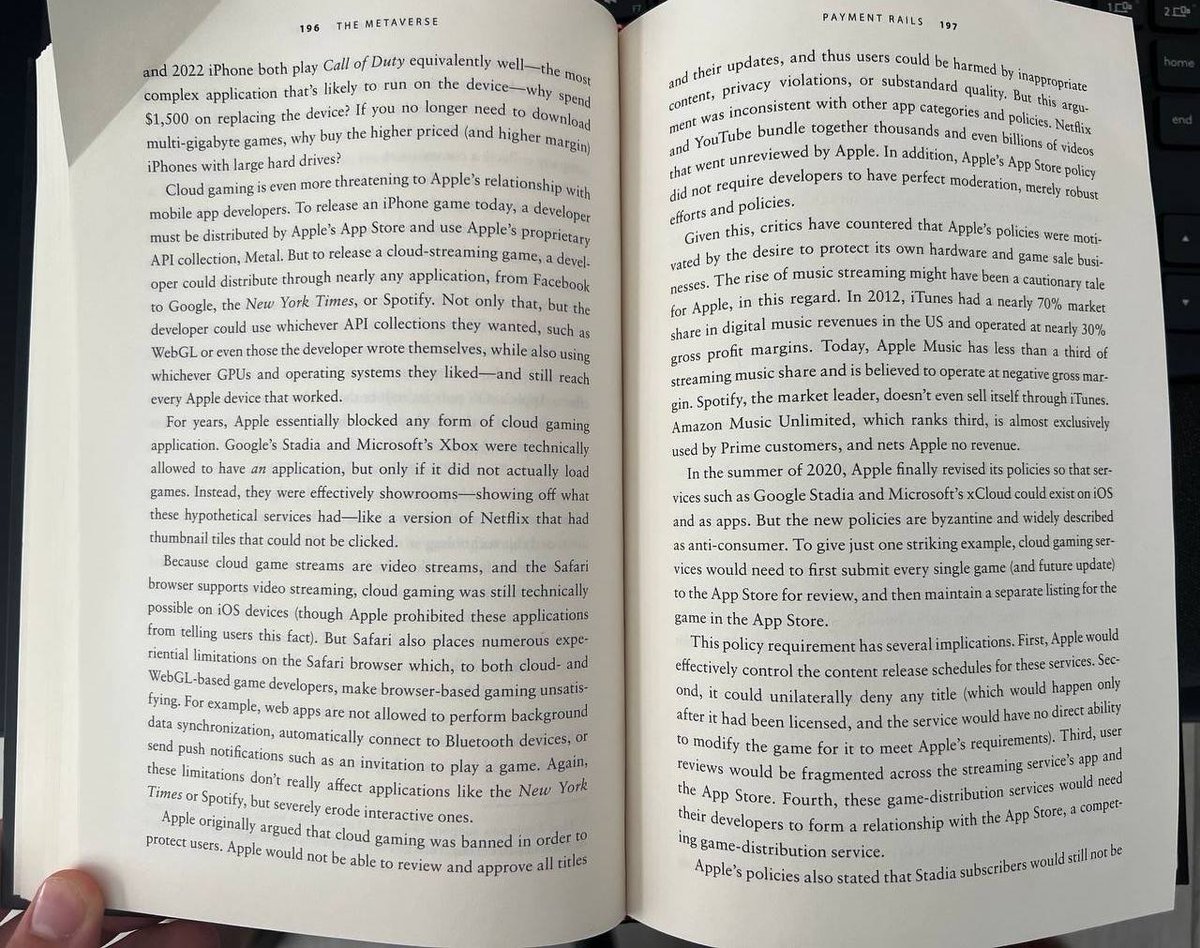

The goal of a large language model is to reasonably continue the text it already has

The goal of a large language model is to reasonably continue the text it already has

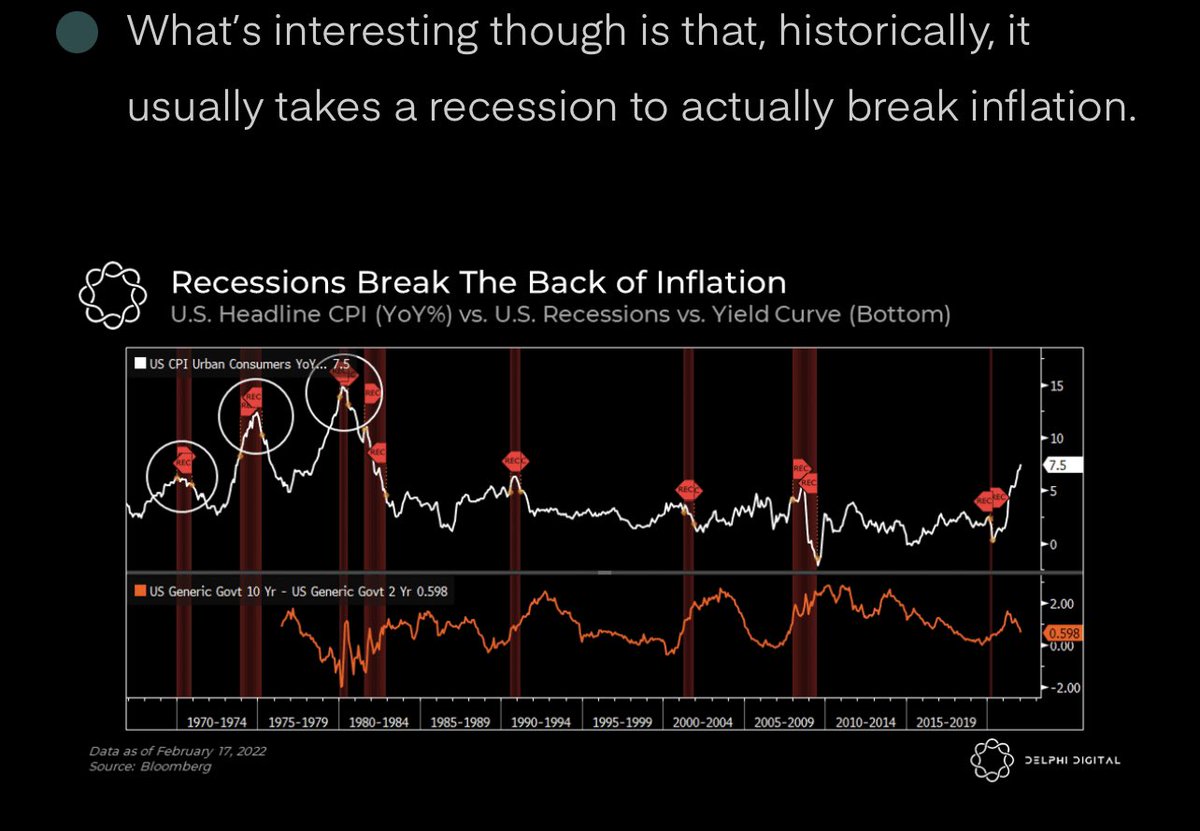

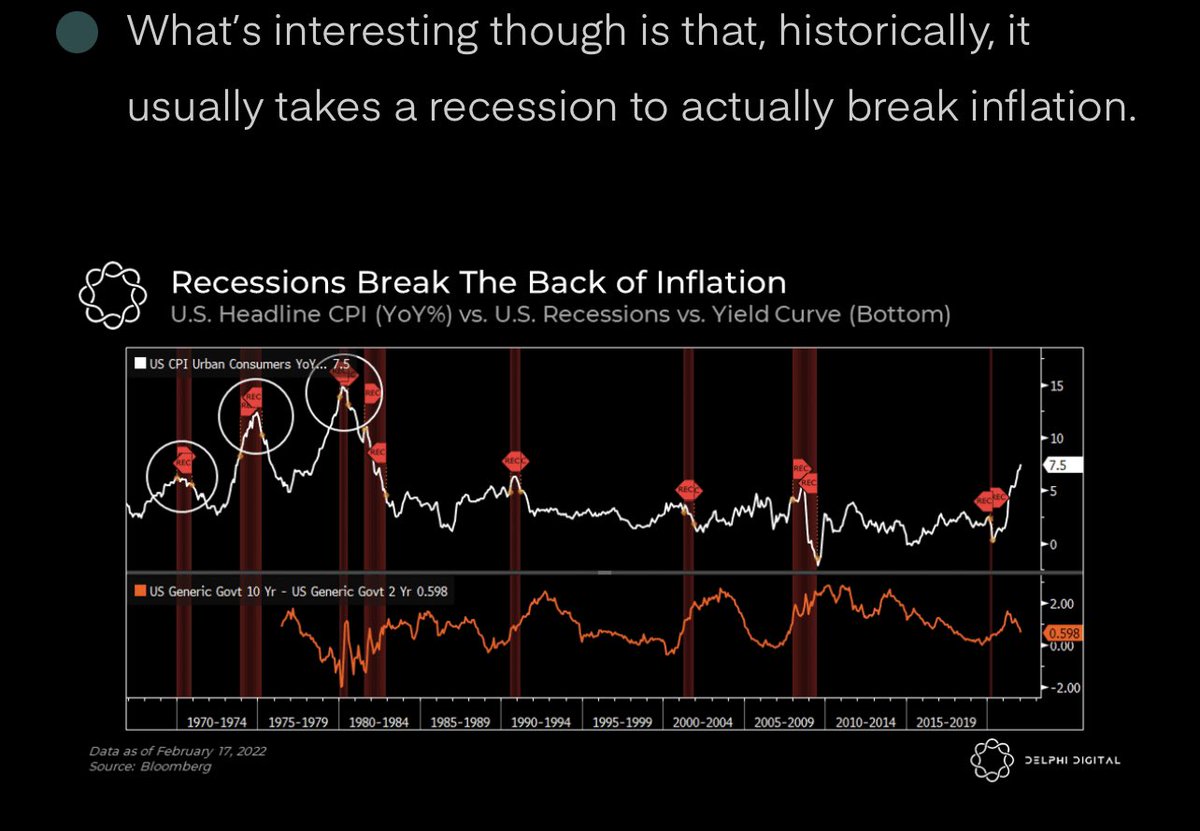

One of my favorite takeaways is on earnings declines during recessions (~26% on average in 01, 08 and 20) and currently NTM EPS estimates for the S&P500 are only down 4% from peak

One of my favorite takeaways is on earnings declines during recessions (~26% on average in 01, 08 and 20) and currently NTM EPS estimates for the S&P500 are only down 4% from peak

https://twitter.com/WSJBankruptcy/status/1611076805829476352Valuation multiples for asset management firms vary pretty widely from 1.5-2x for T-Rowe / Franklin Templeton to a few turns higher for other names like Blackrock at 4.5-6x.

To start, NOR is championing PlayFi where two non-overlapping magic circles exist

To start, NOR is championing PlayFi where two non-overlapping magic circles exist

2/ Helium's model made sense years ago since the project was completely inverting the traditional wireless

2/ Helium's model made sense years ago since the project was completely inverting the traditional wireless