I traded in my Quotron for a pitchfork.

American.

Generally pissed off.

How to get URL link on X (Twitter) App

https://twitter.com/TheBondFreak/status/1600132407201394688Banks active in the paper gold market would face a liquidity shortfall, as all banks active in commodities tend to be long OTC derivative

$19.8M of the $20.1M came on the morning of the 18th. What 10b5-1 trading plan begins the aggressive selling during the first minute of the trading session following the company's biggest pump PR to date?

$19.8M of the $20.1M came on the morning of the 18th. What 10b5-1 trading plan begins the aggressive selling during the first minute of the trading session following the company's biggest pump PR to date?https://twitter.com/marcfriedrich7/status/1192346482403348480@zerohedge ZeroDown also makes money through a "concierge" service that connects their renters to things like babysitters and plumbers.

https://twitter.com/zerohedge/status/1007002602746400770The original insider purchase thread:

https://twitter.com/SheepleAnalytic/status/994233358346530816

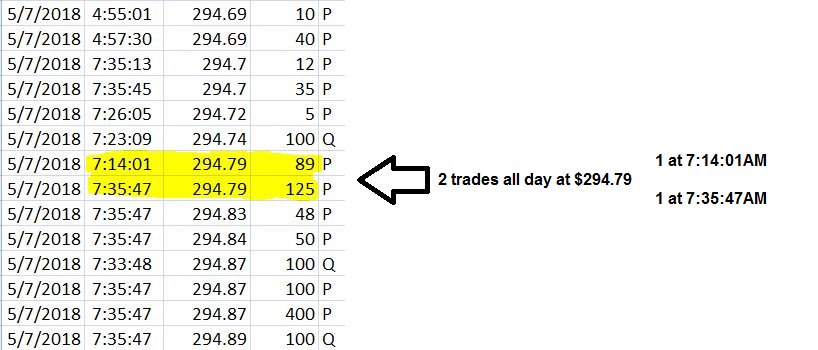

@htsfhickey 2nd step - Notice that the $294.79 fill price couldn't have happened during regular market hours.

@htsfhickey 2nd step - Notice that the $294.79 fill price couldn't have happened during regular market hours.