I write The Tech Friend newsletter at The Washington Post. shira.ovide@washpost.com

Formers: @nytimes On Tech newsletter, @opinion & @WSJ

How to get URL link on X (Twitter) App

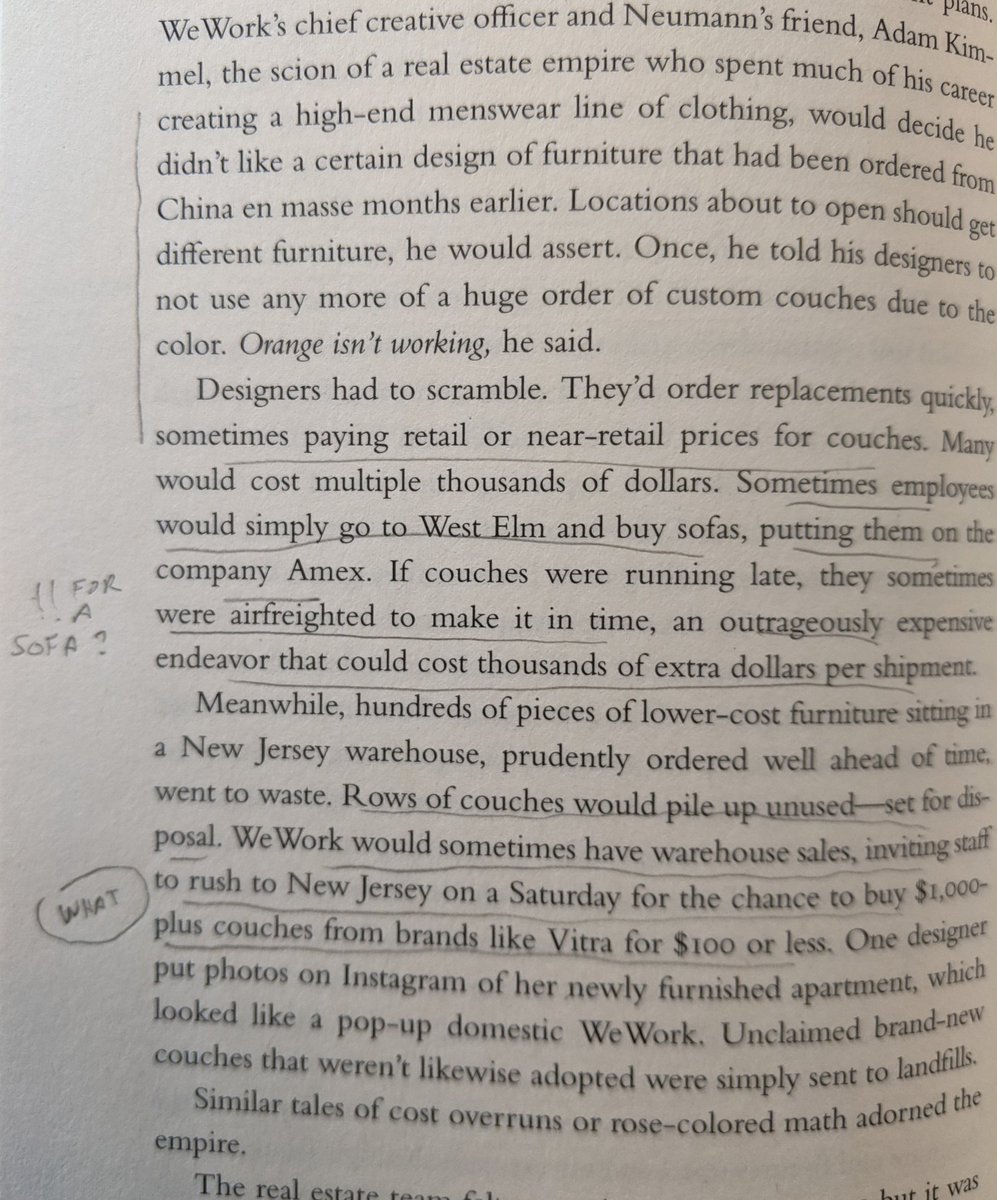

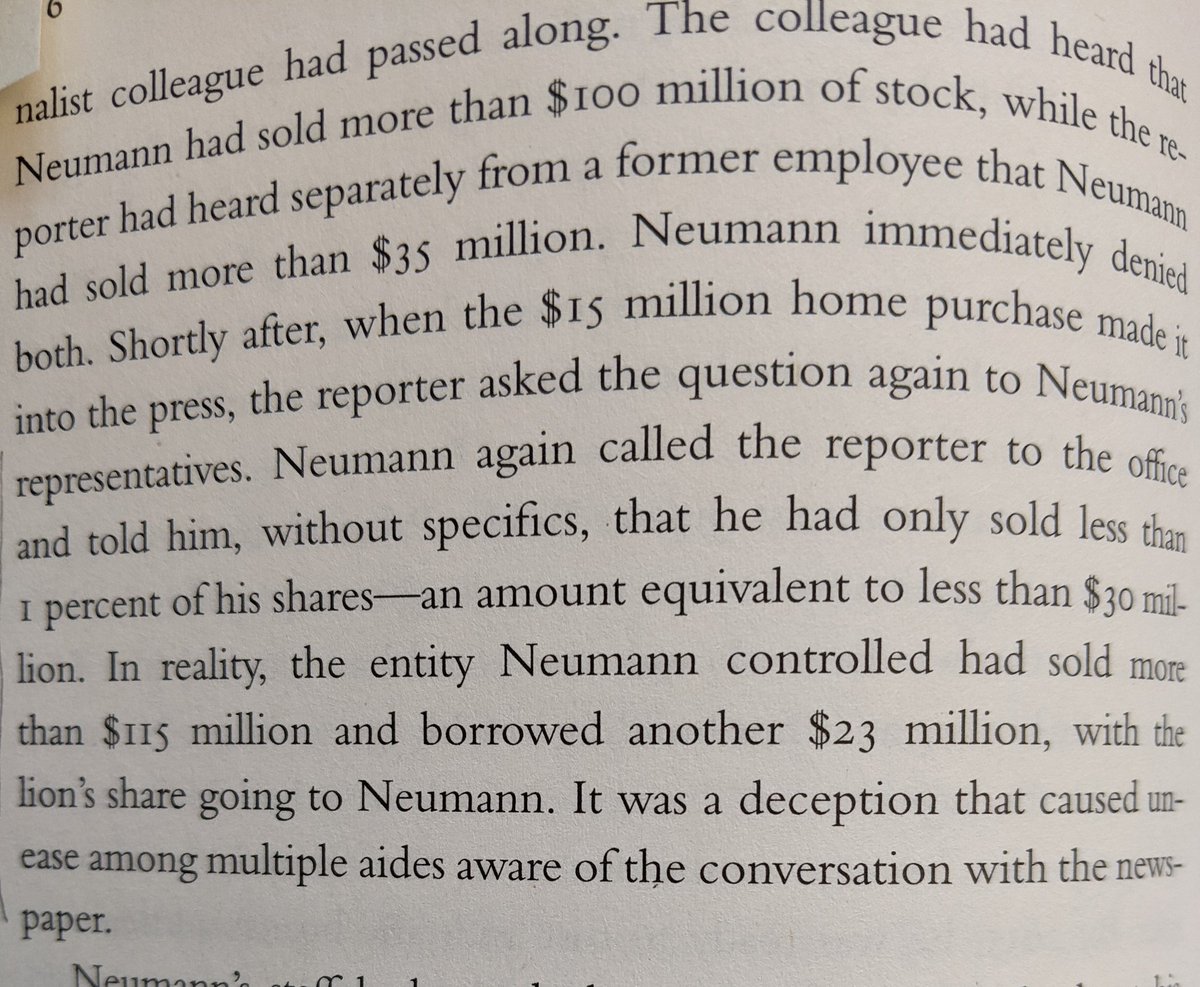

Also, my God, how many times can someone say something untrue in public?

Also, my God, how many times can someone say something untrue in public?

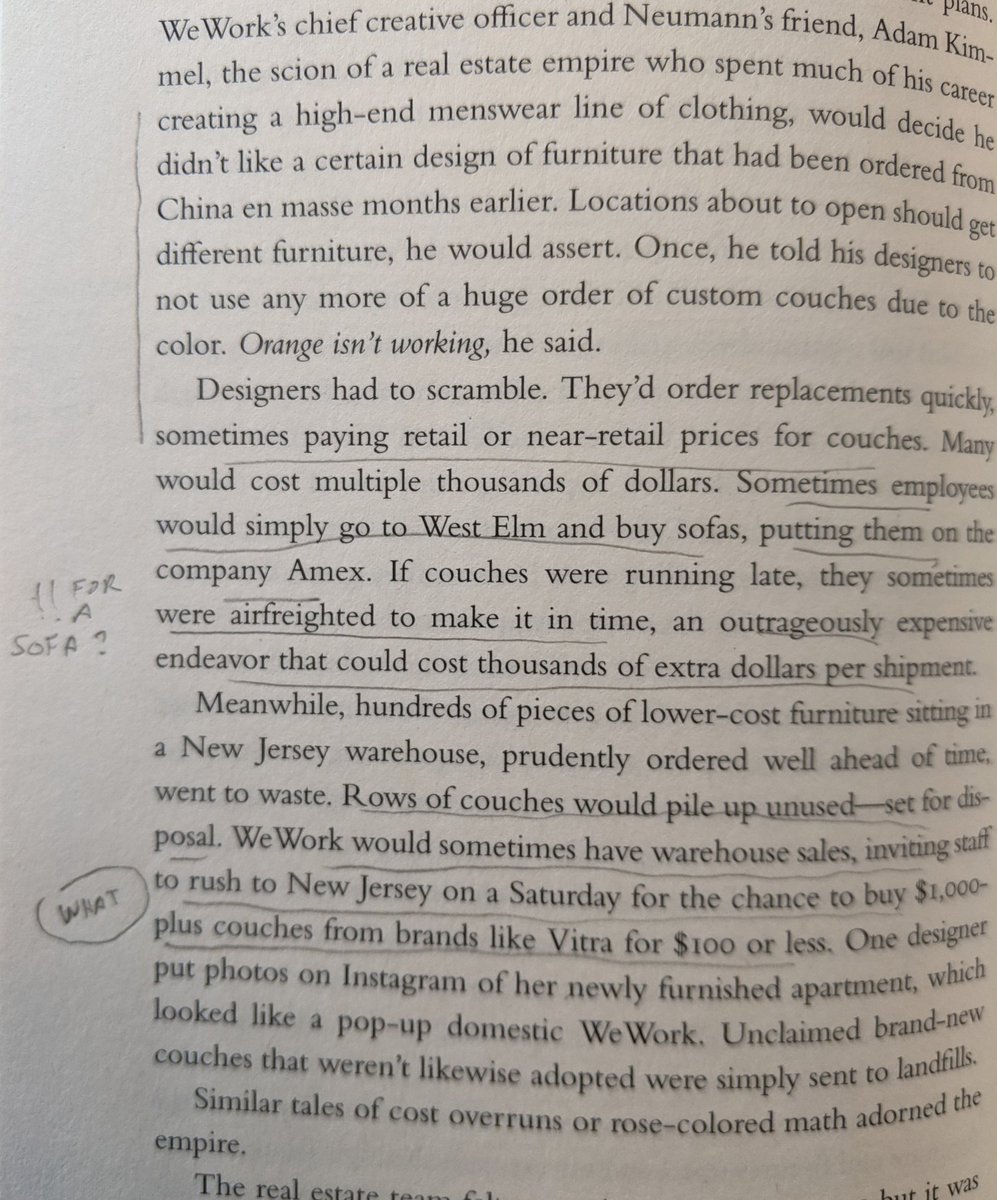

I'm genuinely struck by the fury in these pages at what the House members saw as arrogant, evasive behavior by the tech companies.

I'm genuinely struck by the fury in these pages at what the House members saw as arrogant, evasive behavior by the tech companies.

https://twitter.com/fbnewsroom/status/1239703497479614466See also:

https://twitter.com/sarahfrier/status/1239699644046696450?s=19