How to get URL link on X (Twitter) App

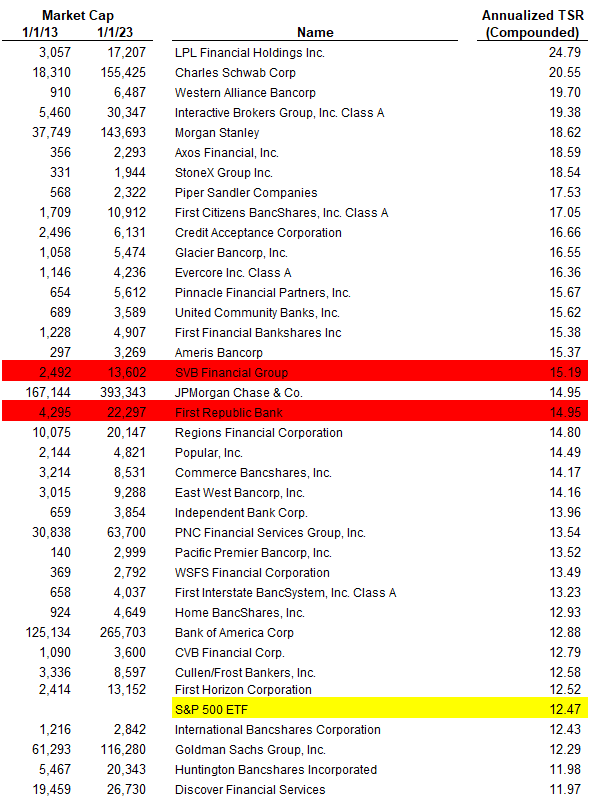

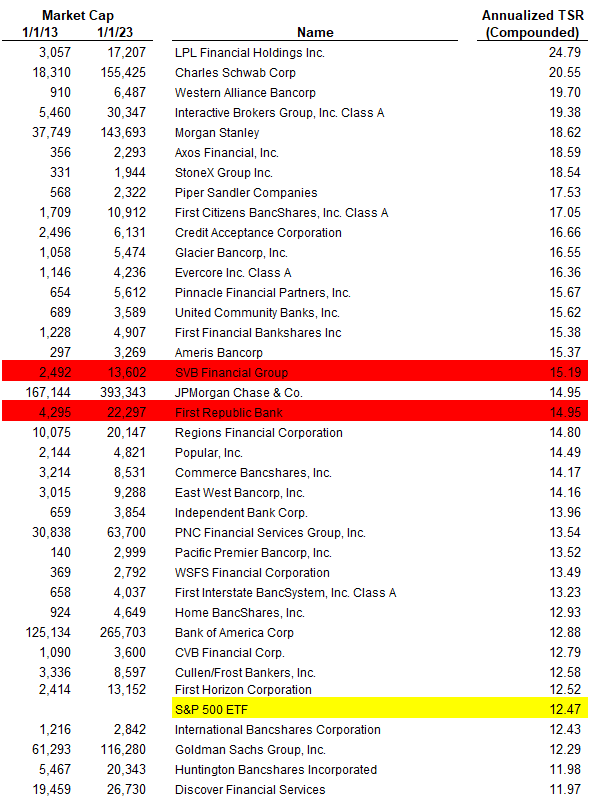

And if you restrict that to banks that were actually large enough to be investable 10 years ago... it's a pretty short list.

And if you restrict that to banks that were actually large enough to be investable 10 years ago... it's a pretty short list.

The ultimate product is very good! Yes, they are levered and the fees are high... but the net outcome is great.

The ultimate product is very good! Yes, they are levered and the fees are high... but the net outcome is great.

https://twitter.com/shortsightedcap/status/1586034413787570177This is in contrast to pure subscription models, which could decelerate far more sharply if the downturn persists.

1) Bravo Bundle - takeout candidates. Despite the group name, some (e.g. TWLO, OKTA) would almost have to go to strategic buyers.

1) Bravo Bundle - takeout candidates. Despite the group name, some (e.g. TWLO, OKTA) would almost have to go to strategic buyers.

https://twitter.com/ShortSightedCap/status/1580117378062426112I want to say, "worst case it trades like IBM".

Can't really see it in the prior Chart due to the Y-axis:

Can't really see it in the prior Chart due to the Y-axis: