✨ dabbler 👨💻 @initialcommitco 🪀 @superfantoys 🧪 @proxyuserai ⏪ @usererun ❌ @botblockai

How to get URL link on X (Twitter) App

https://x.com/Shpigford/status/1765527392410321055

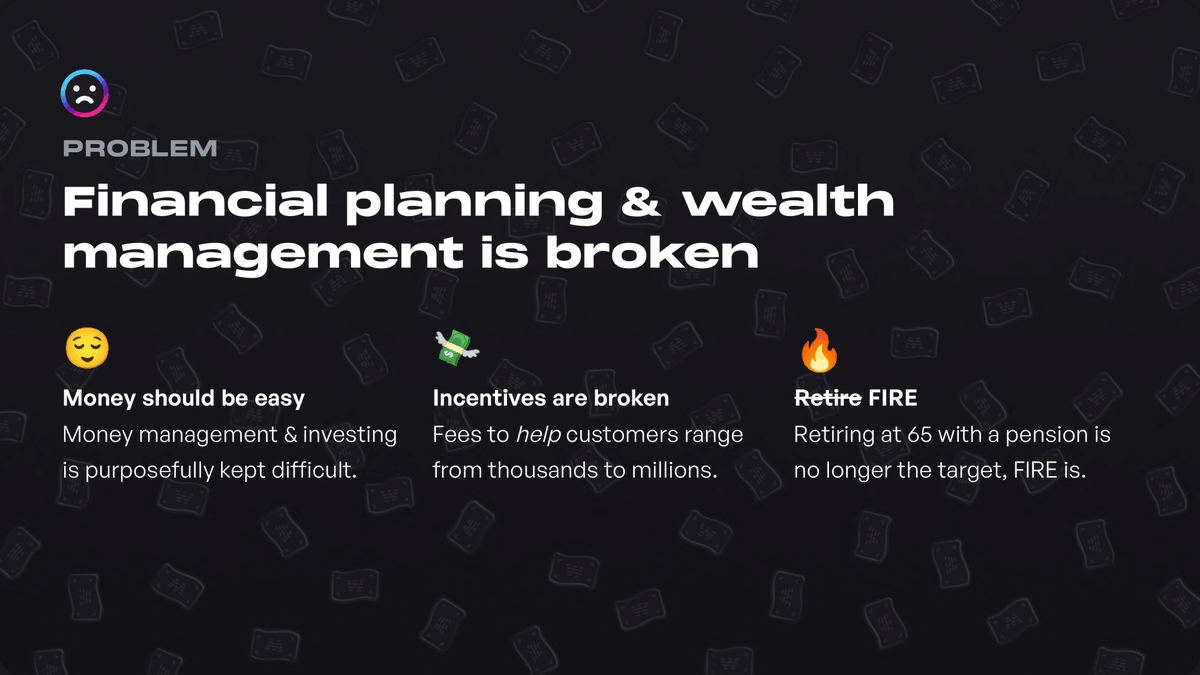

Real, meaningful financial planning and wealth management is currently reserved for people who are willing to pay %-based AUM fees and stay in the dark on how to actually grow their wealth.

Real, meaningful financial planning and wealth management is currently reserved for people who are willing to pay %-based AUM fees and stay in the dark on how to actually grow their wealth.

2/ What I traded away on "managing people" I replaced with infinitely more work around "managing projects". There was just so much overhead to get even basic things done.

2/ What I traded away on "managing people" I replaced with infinitely more work around "managing projects". There was just so much overhead to get even basic things done.https://twitter.com/Shpigford/status/14368790829904732172/ Look. We can either do the filtering at the start of the process, or you can get days/weeks in to the process & still, statistically speaking, get filtered out.