How to get URL link on X (Twitter) App

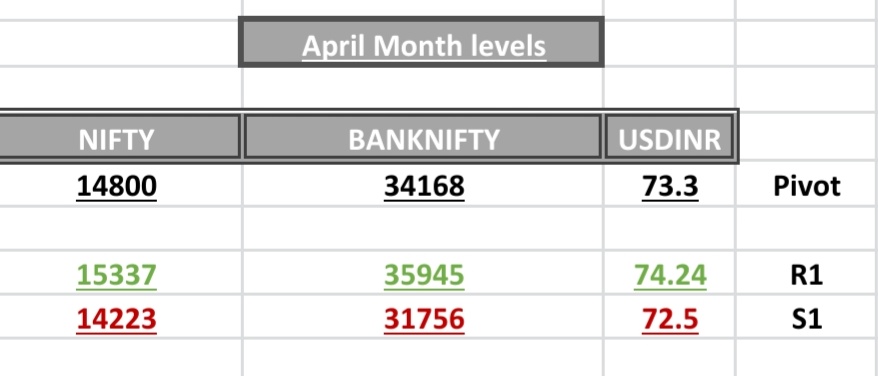

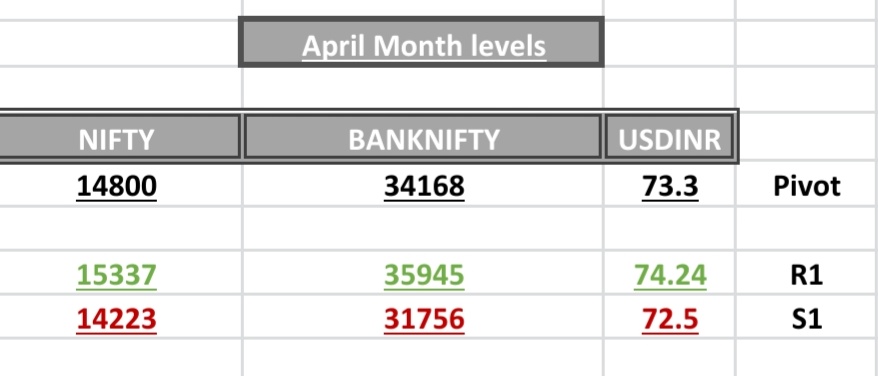

Idea 1:- Use pivot level like 14800 in case of nifty and sell 14800straddle monthly expiry (365+335) exit if nifty closes on daily basis below S1 or above R1

Idea 1:- Use pivot level like 14800 in case of nifty and sell 14800straddle monthly expiry (365+335) exit if nifty closes on daily basis below S1 or above R1

Setup1 :- after evaluating R1 S1

Setup1 :- after evaluating R1 S1

Setup 1:-

Setup 1:-