DeFi, DeFAI and Layer 2 connoisseur

Nothing gets my libido going like triple digit APRs

NFA - i'm just educating

10 subscribers

How to get URL link on X (Twitter) App

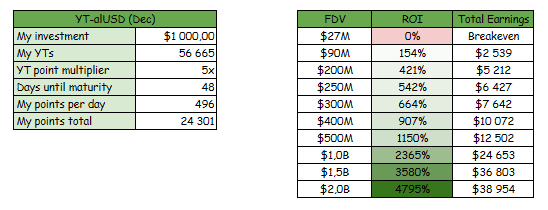

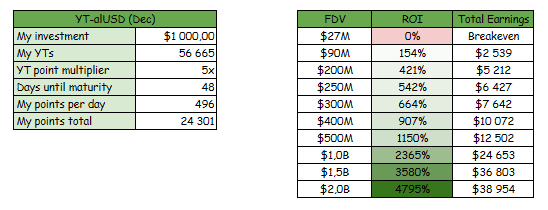

The alUSD market for October expired today Oct 23rd

The alUSD market for October expired today Oct 23rd

Fair warning that you will only enjoy this thread if you're a massive (and i mean MASSIVE) defi nerd

Fair warning that you will only enjoy this thread if you're a massive (and i mean MASSIVE) defi nerd

1/15

1/15

1/21

1/21

1/14

1/14

1/10

1/10

/1

/1

1/

1/

1/38

1/38

1/29

1/29

1/29

1/29

1/30

1/30

1/42

1/42

1/12

1/12 https://twitter.com/francescoweb3/status/1667161142932963328

1/21

1/21

1/30

1/30

1/27

1/27

1/30

1/30

1/19

1/19

1/

1/

1/28

1/28