PhD | Writes Bitcoin Intelligence Report ⎮ The Quantile Model | https://t.co/dPYa0uiC1a

How to get URL link on X (Twitter) App

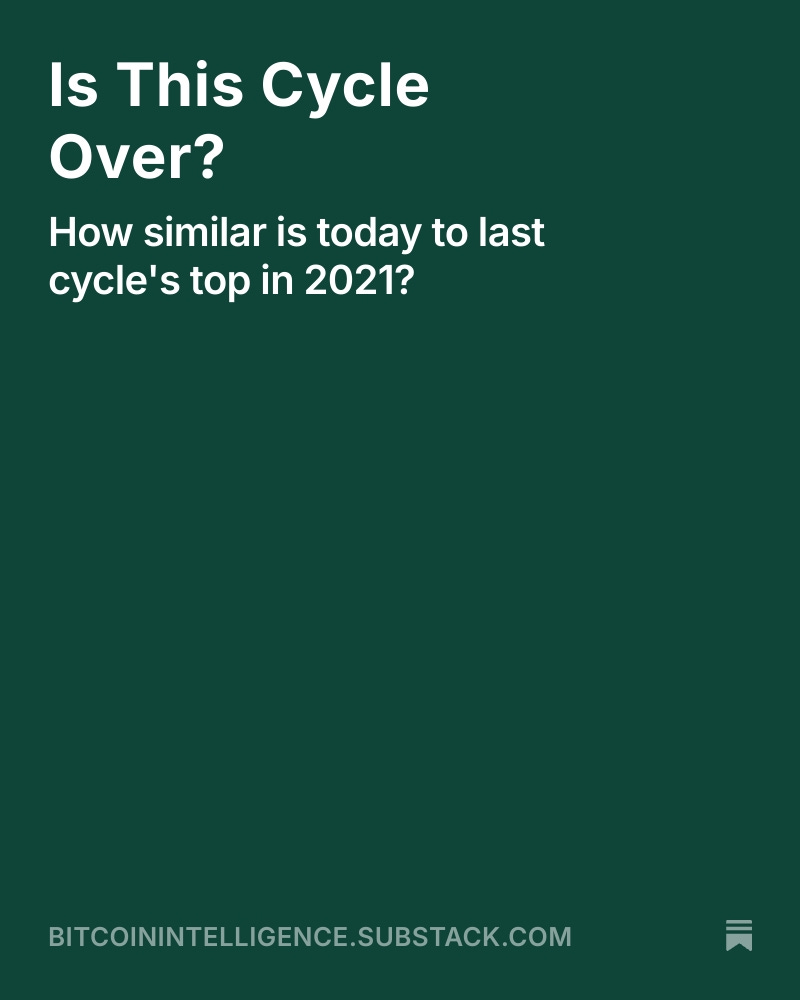

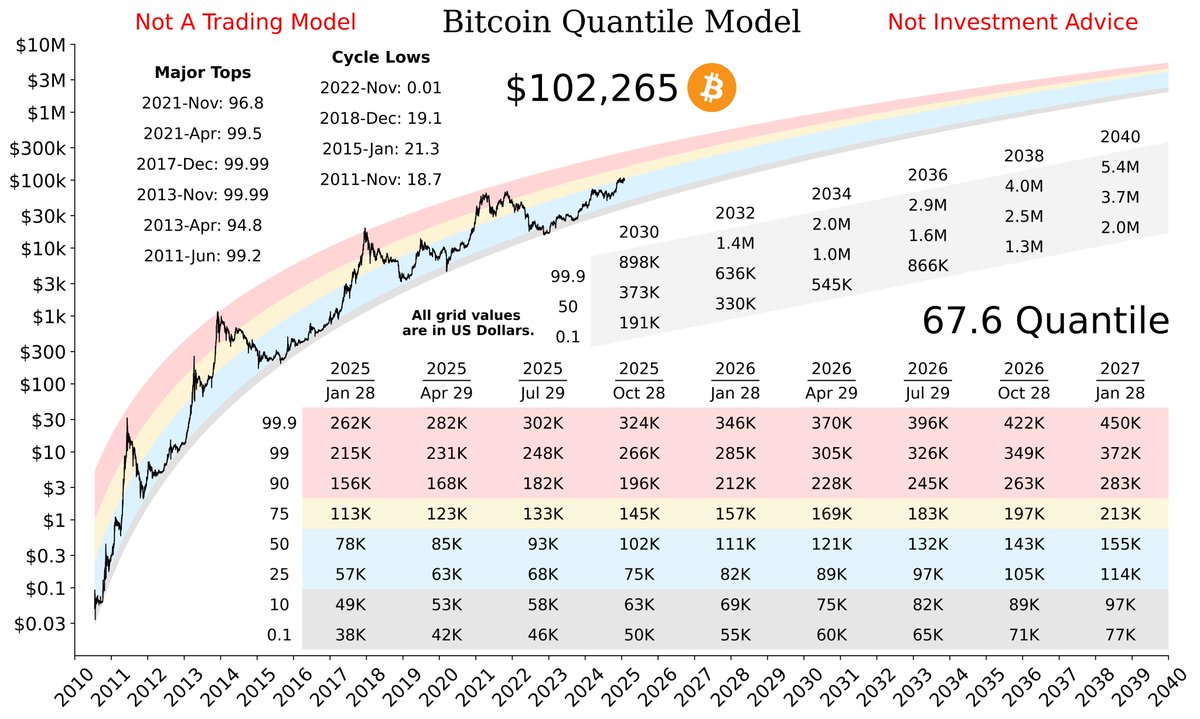

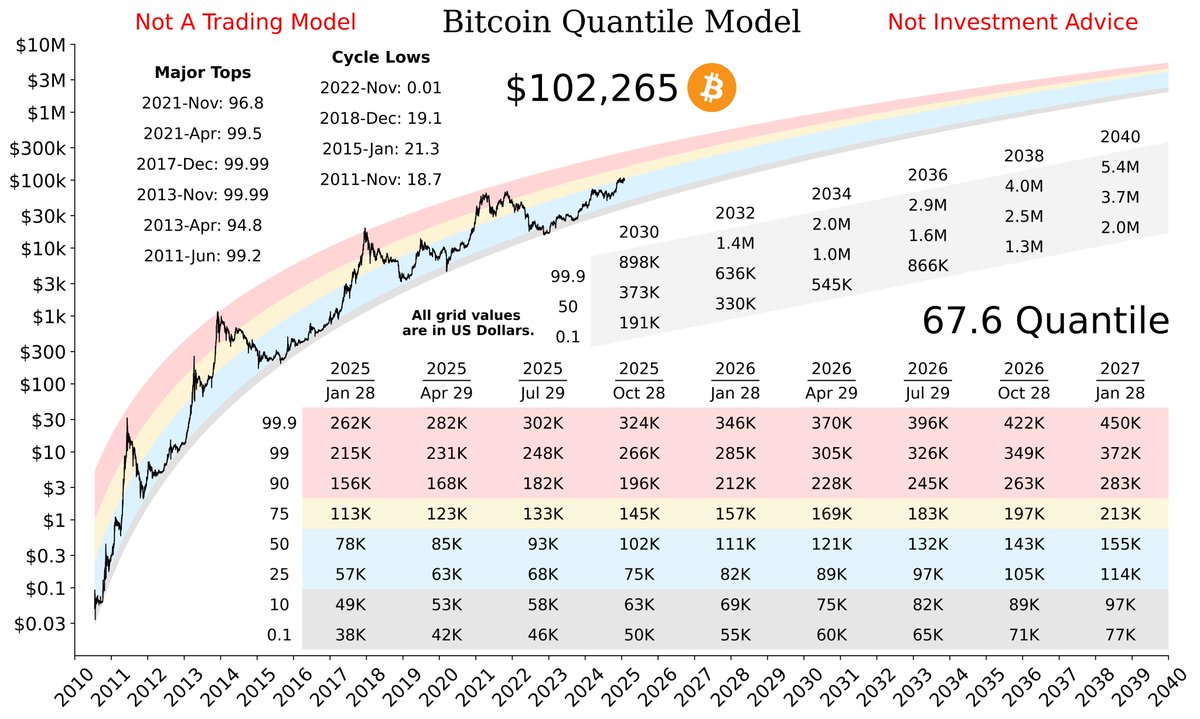

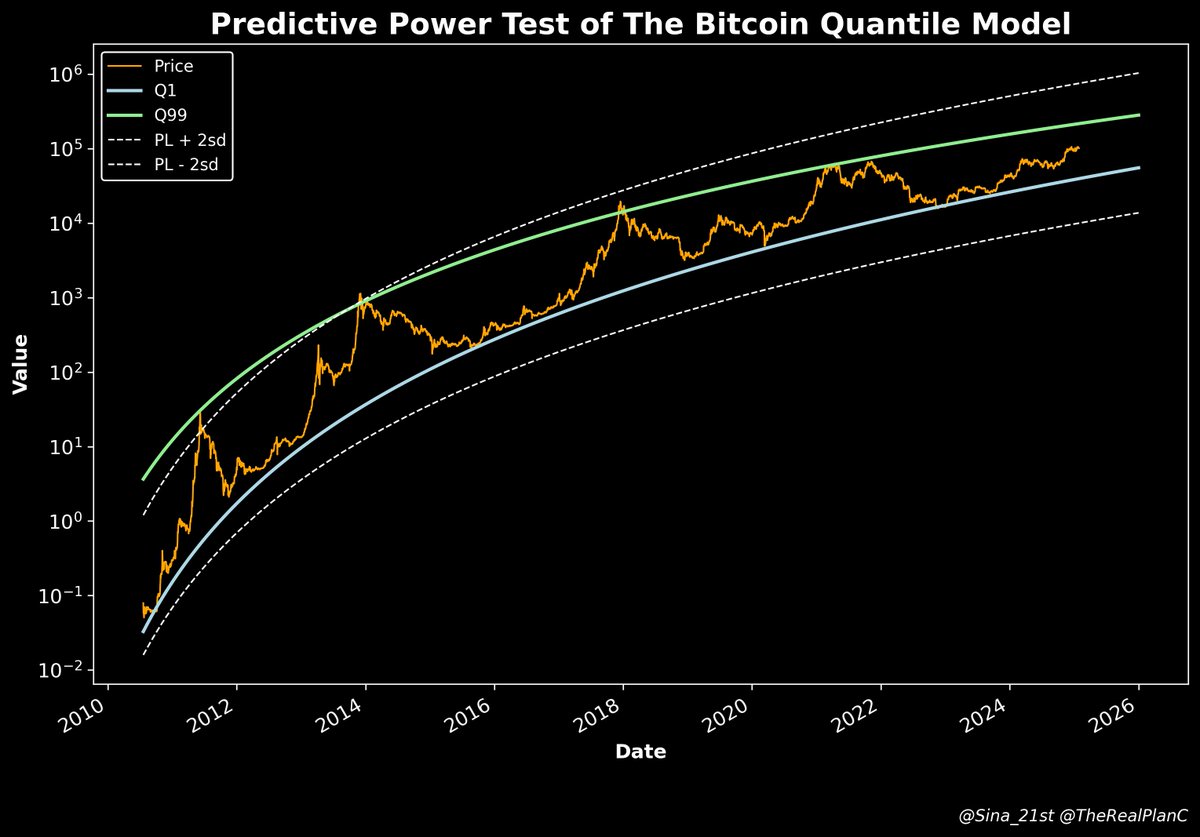

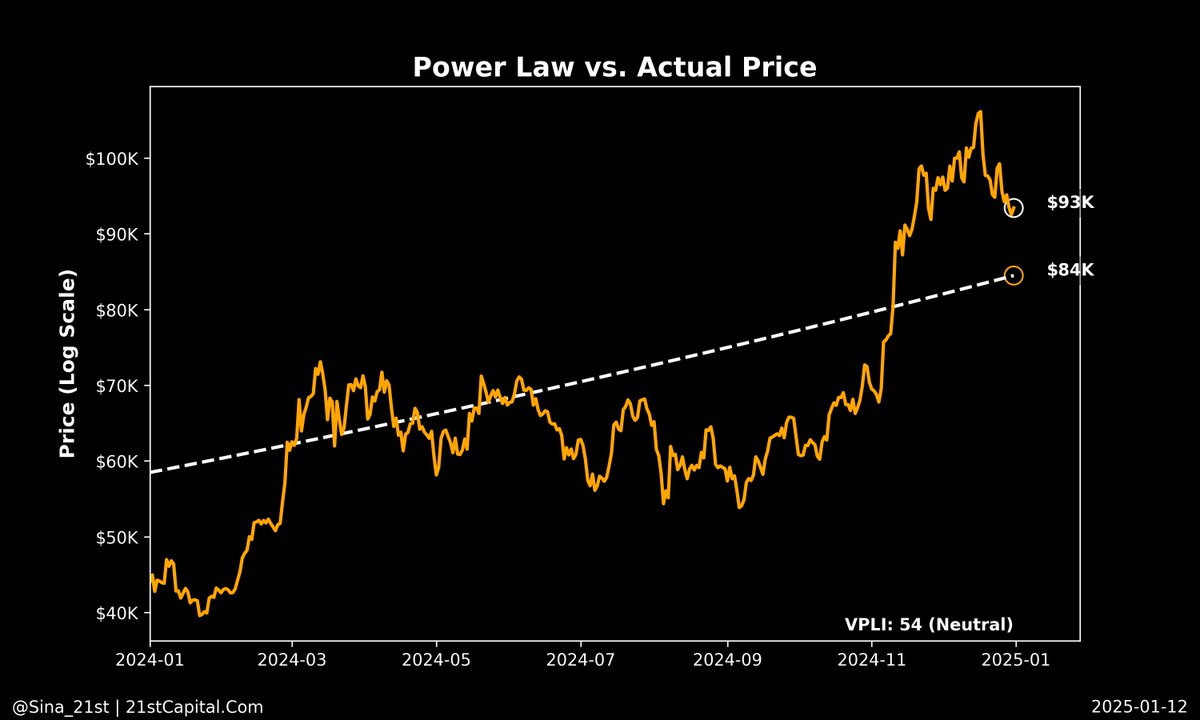

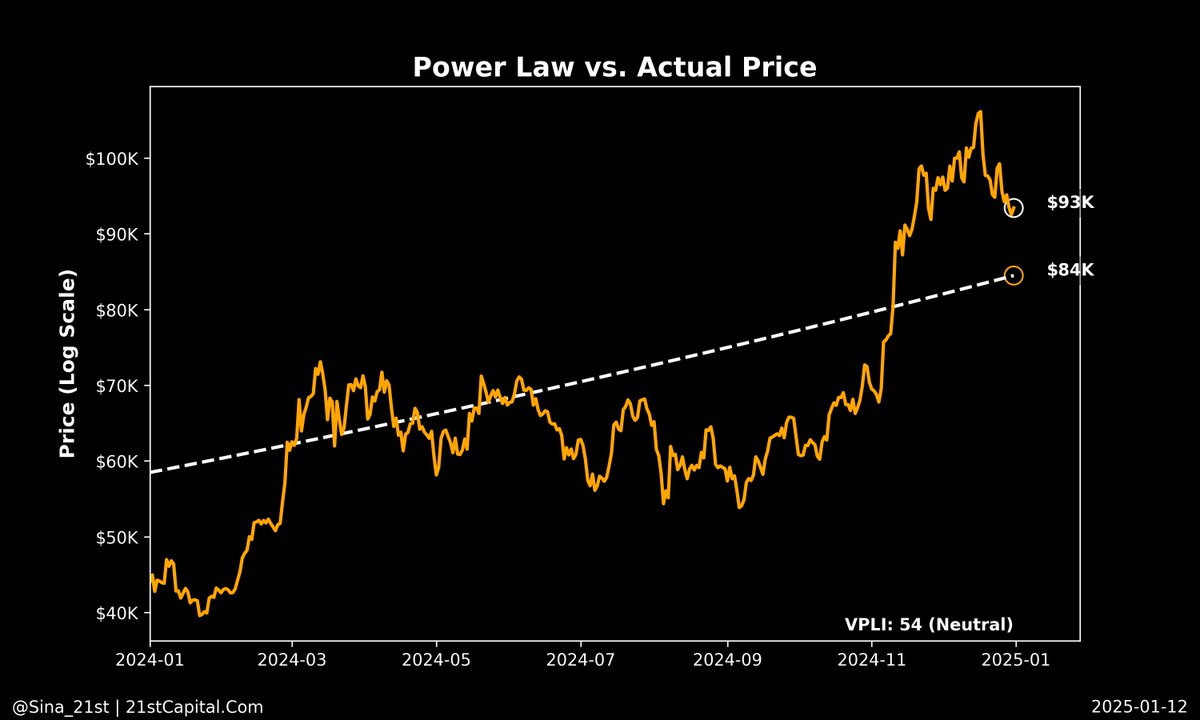

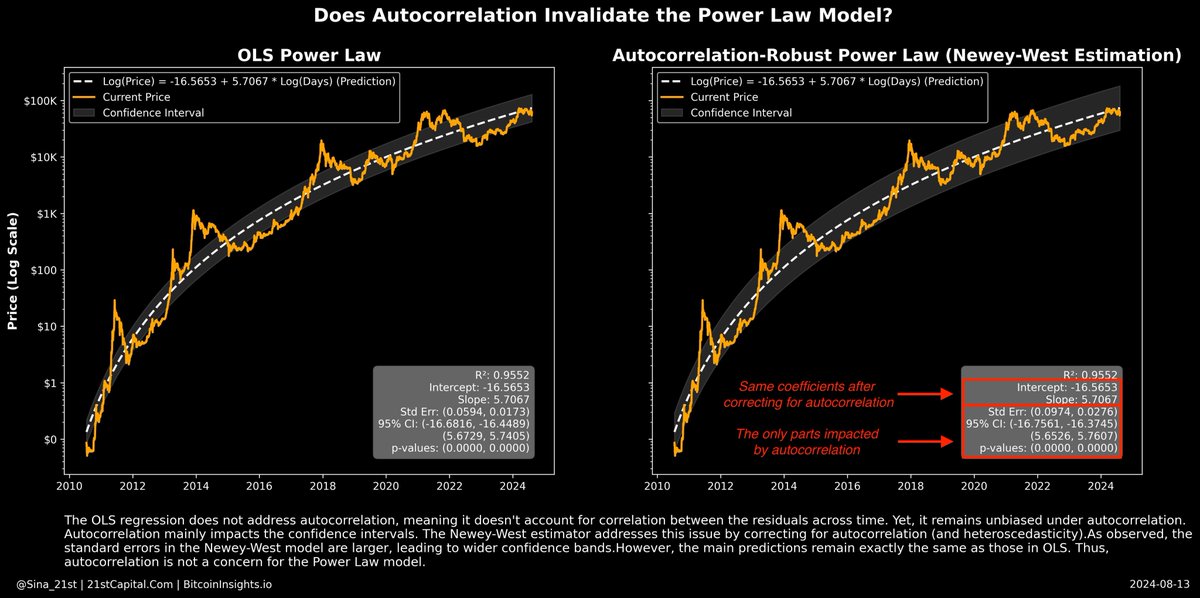

2/ I will organize this write-up into a few points with the aid of this chart.

2/ I will organize this write-up into a few points with the aid of this chart.

2/ The core of my thesis has been that Trump's policies are overall very bullish, with bearish components happening first.

2/ The core of my thesis has been that Trump's policies are overall very bullish, with bearish components happening first.

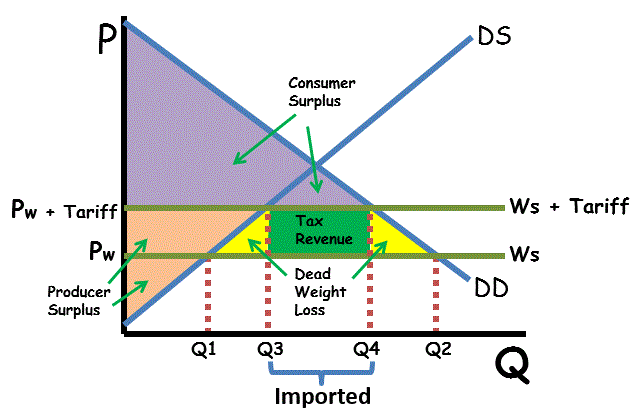

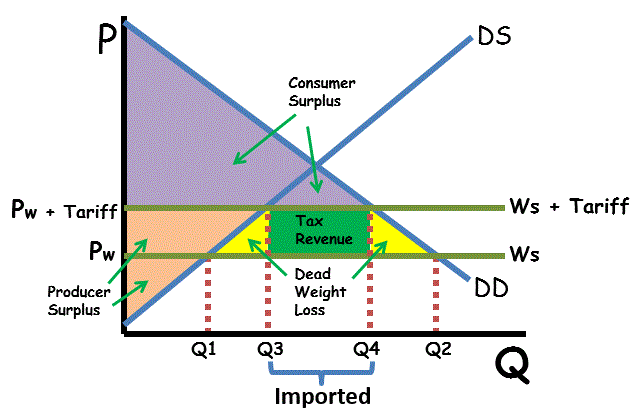

1/ Tariffs could serve positive strategic goals in bringing jobs onshore and keeping strategic industries competitive.

1/ Tariffs could serve positive strategic goals in bringing jobs onshore and keeping strategic industries competitive.

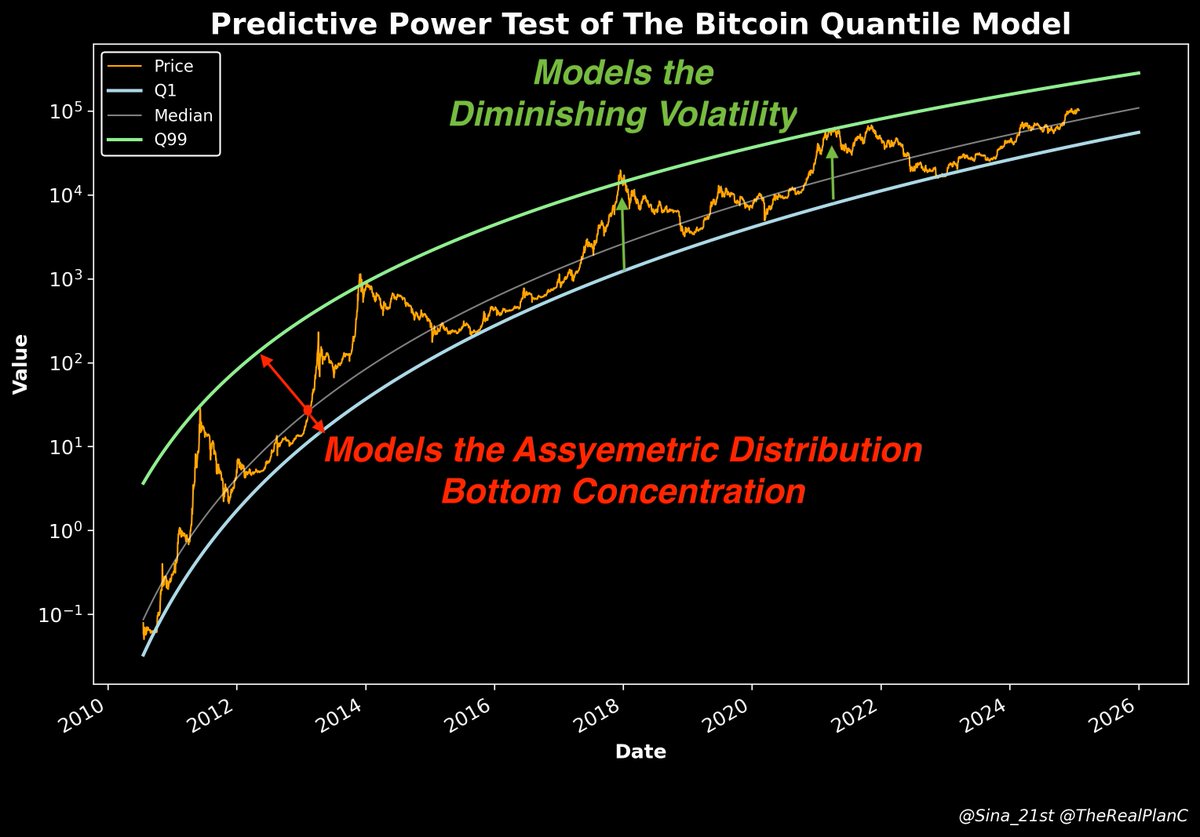

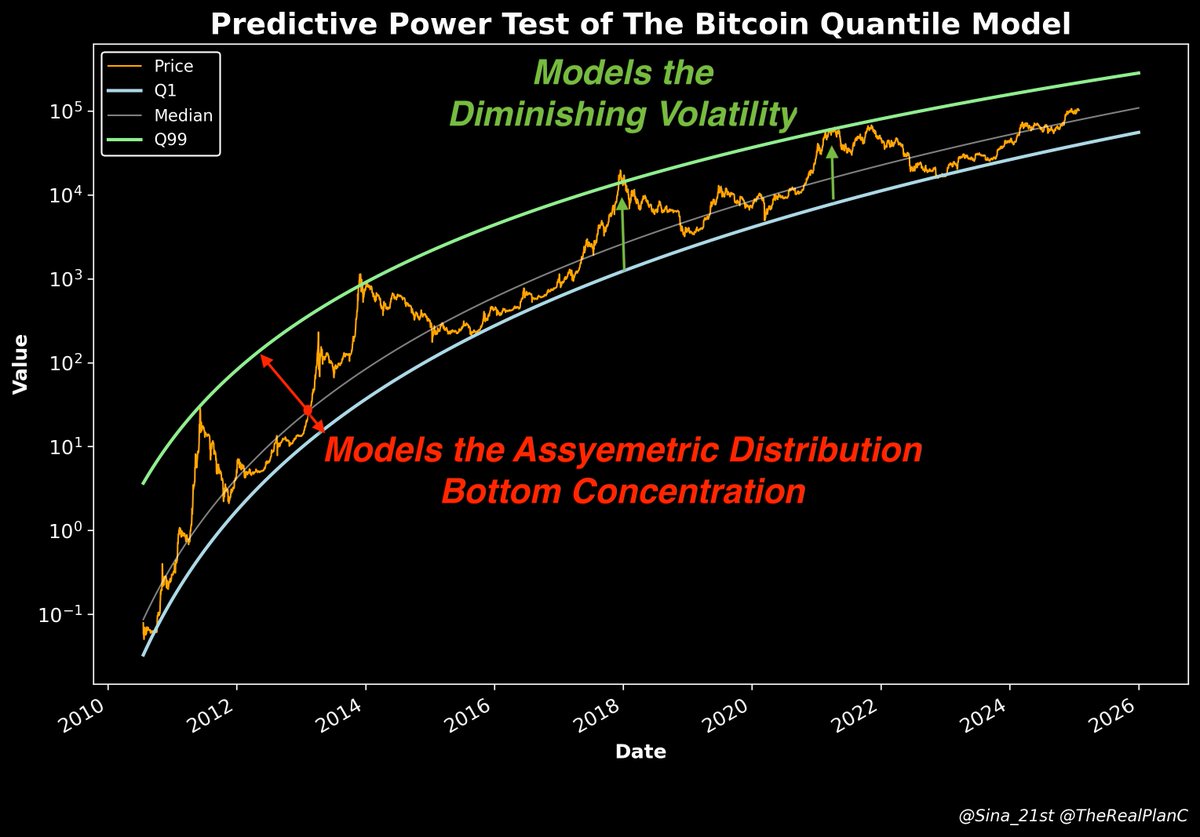

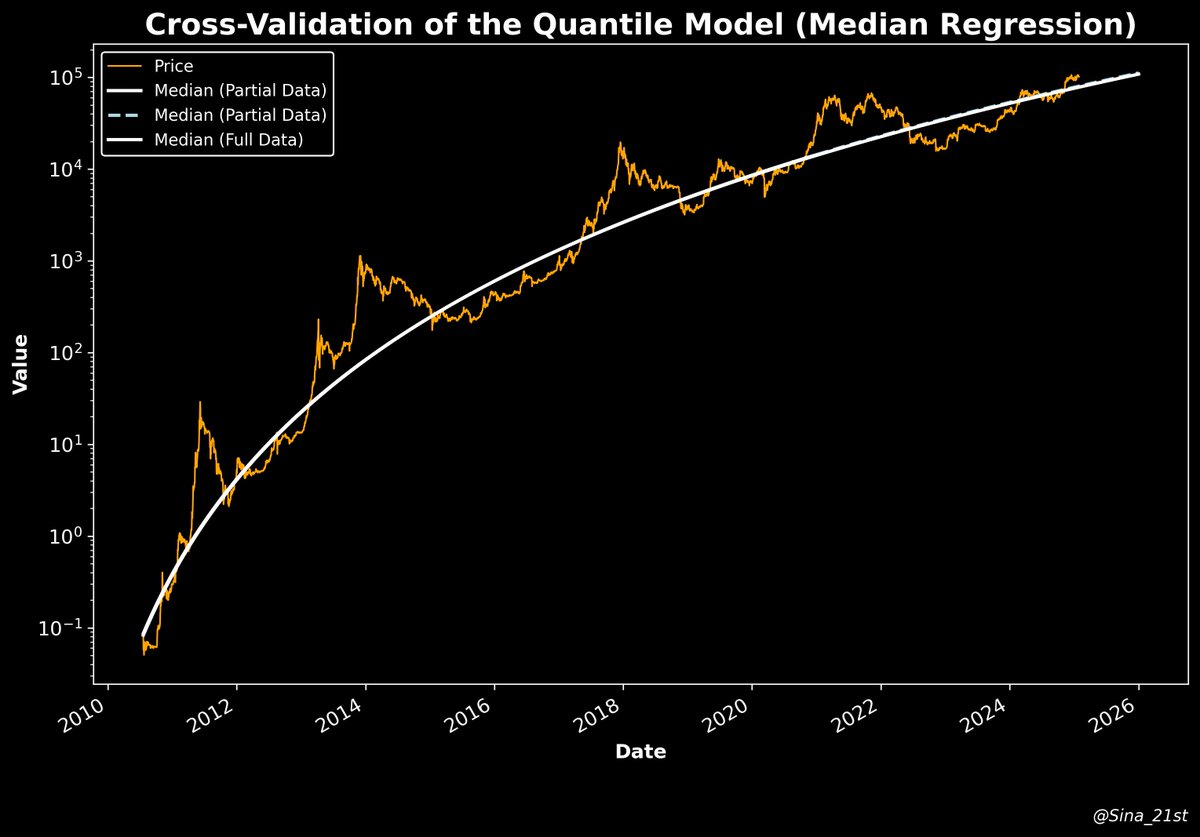

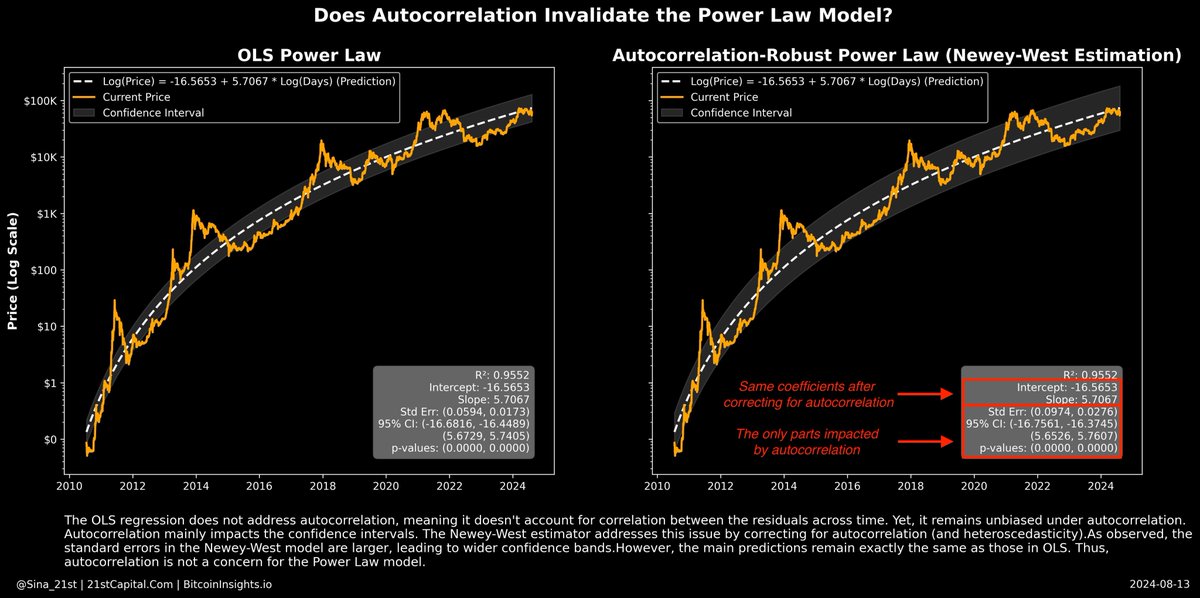

1/ First what is the model?

1/ First what is the model?

Our previous analysis

Our previous analysishttps://x.com/Sina_21st/status/1885382320313553010

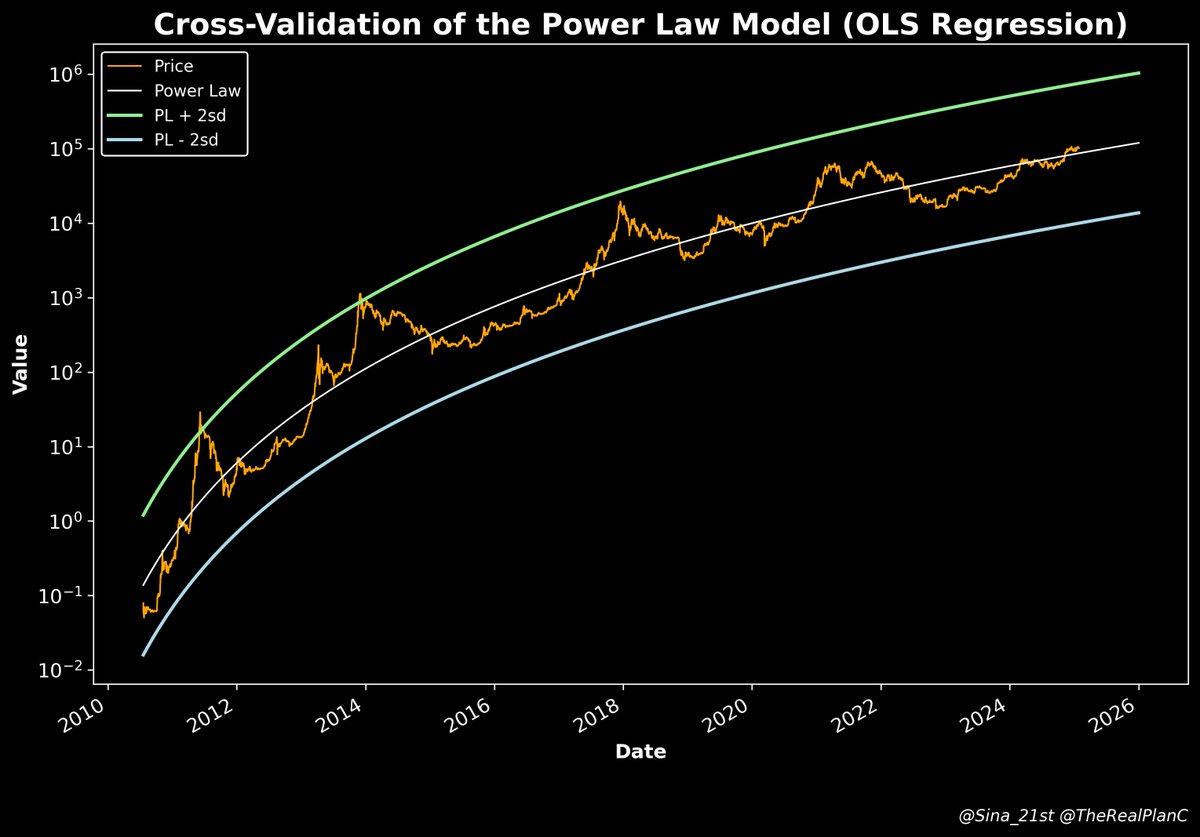

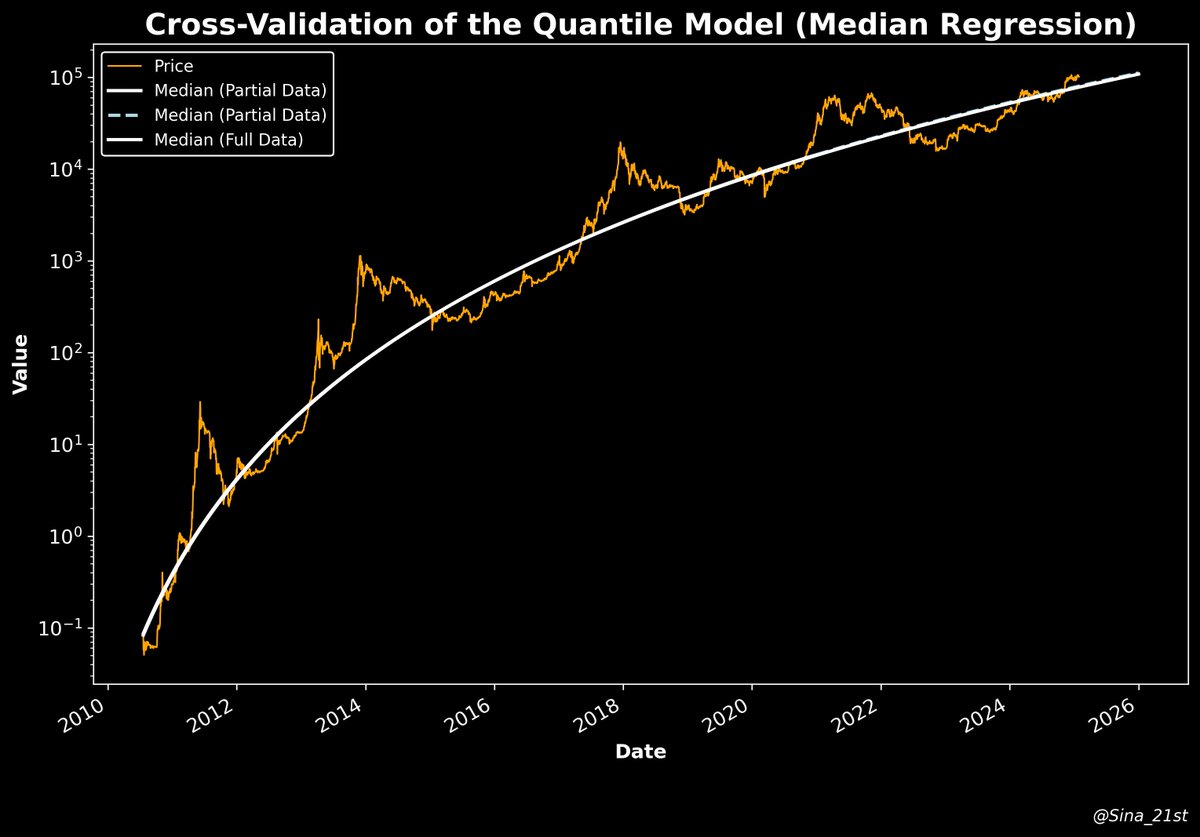

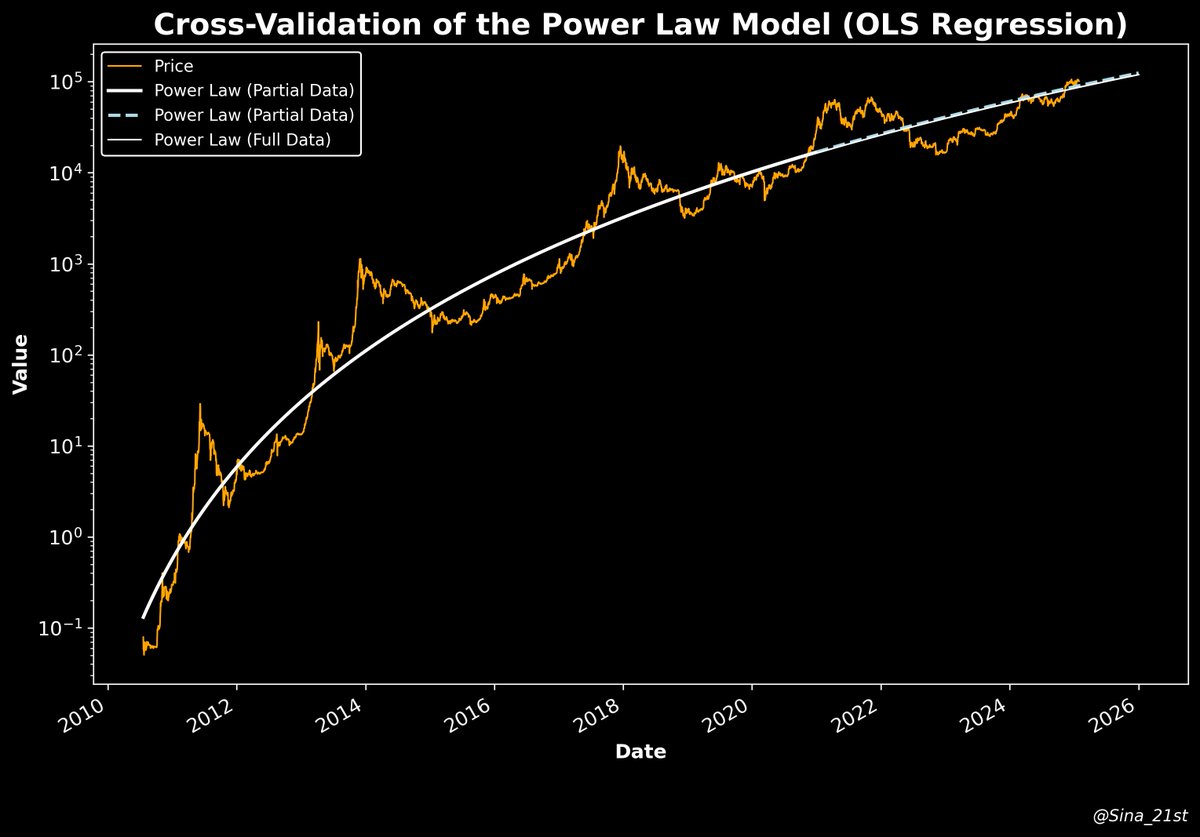

The Power Law model: it is similarly robust. The full-data and partial-data versions are similar.

The Power Law model: it is similarly robust. The full-data and partial-data versions are similar.

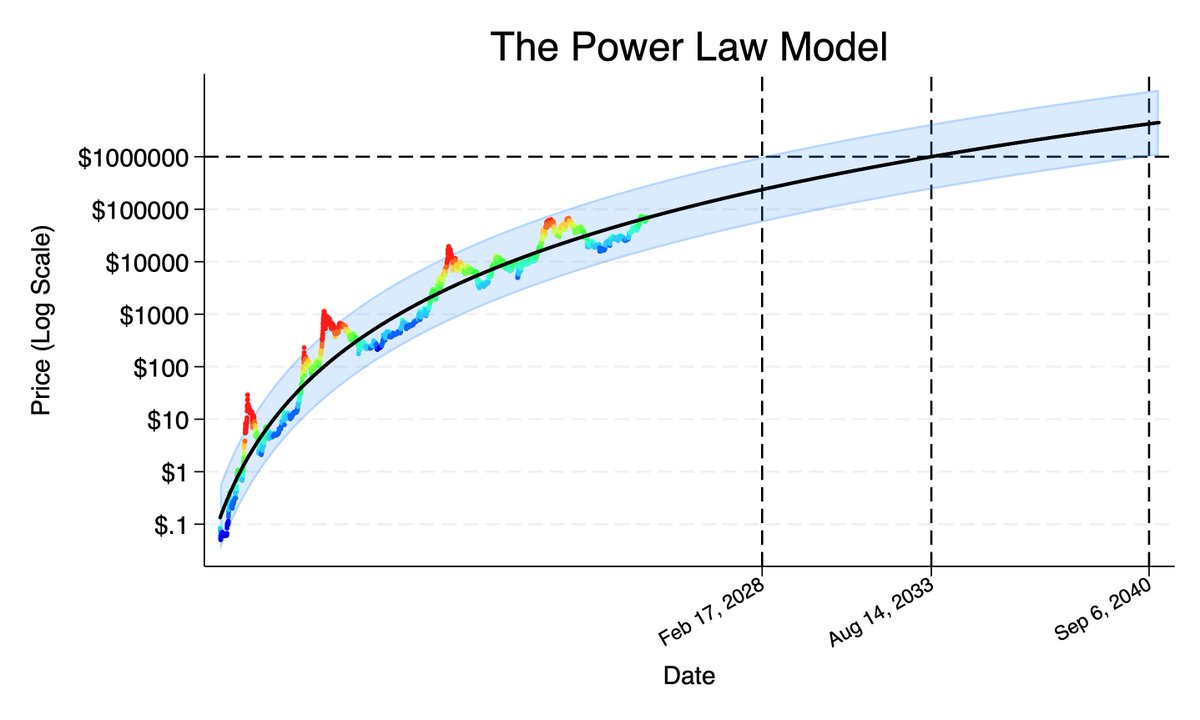

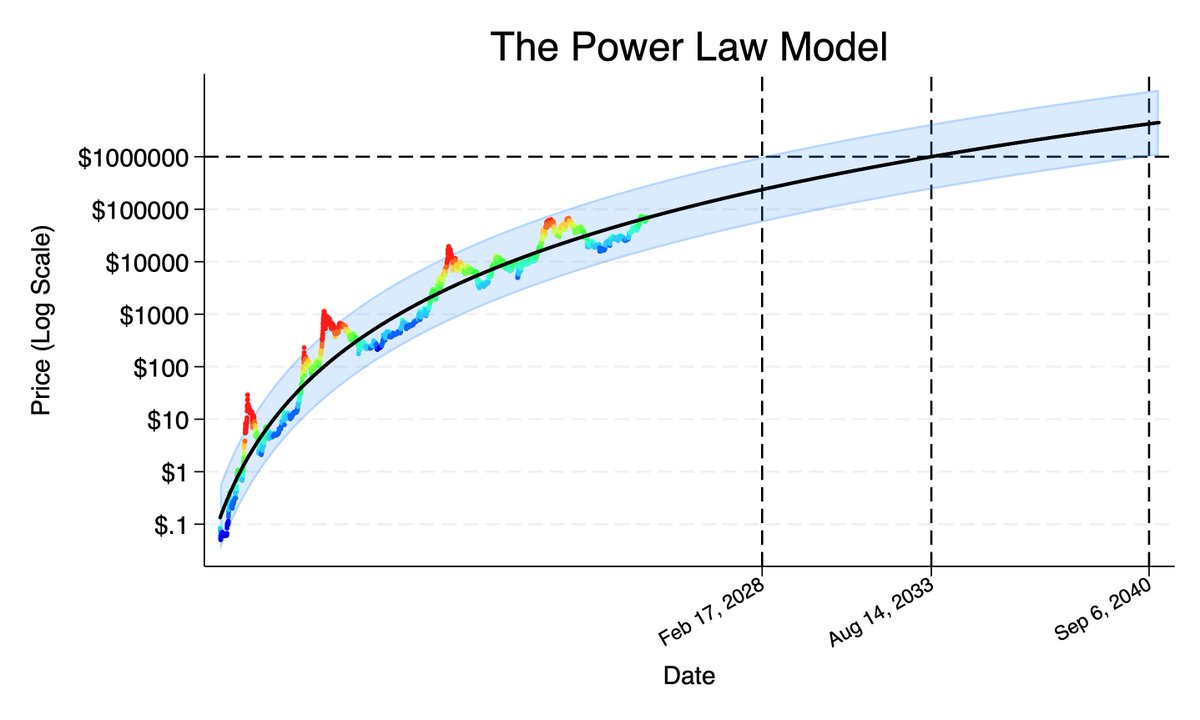

1/ The power law model predicts us getting to $1M in the next two cycles. The PL average will reach $1M by 2033.

1/ The power law model predicts us getting to $1M in the next two cycles. The PL average will reach $1M by 2033.

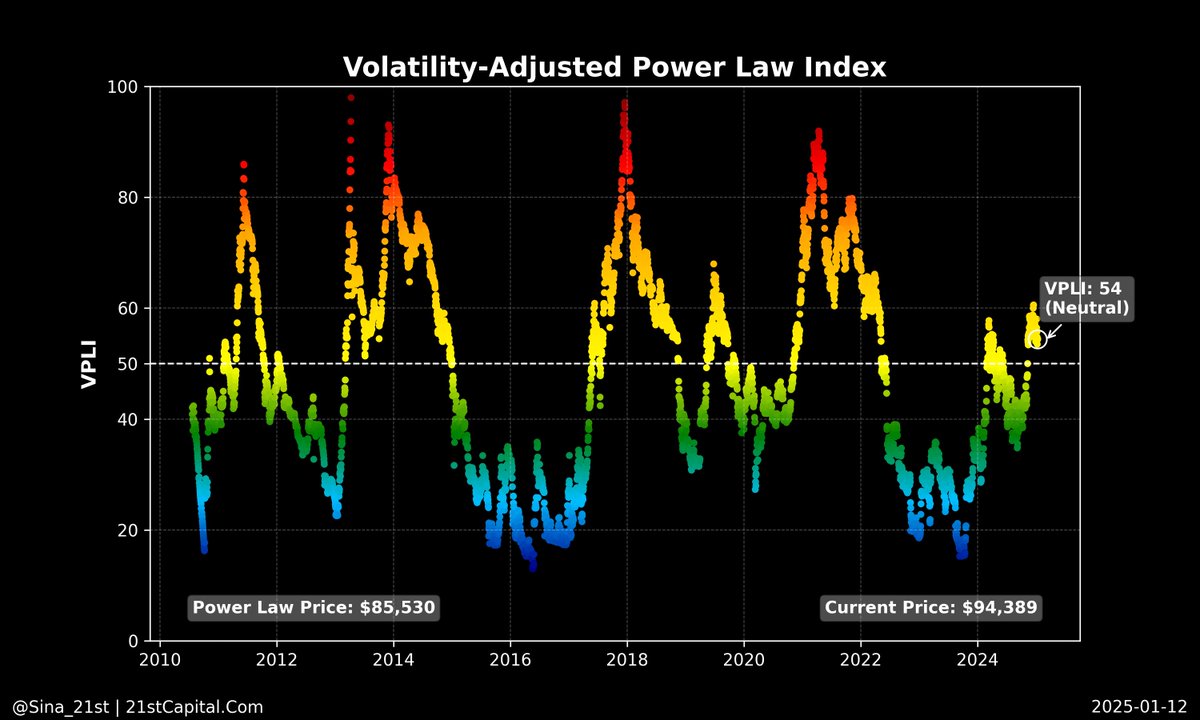

2) Volatility-Adjusted Power Law Index (VPLI)

2) Volatility-Adjusted Power Law Index (VPLI)

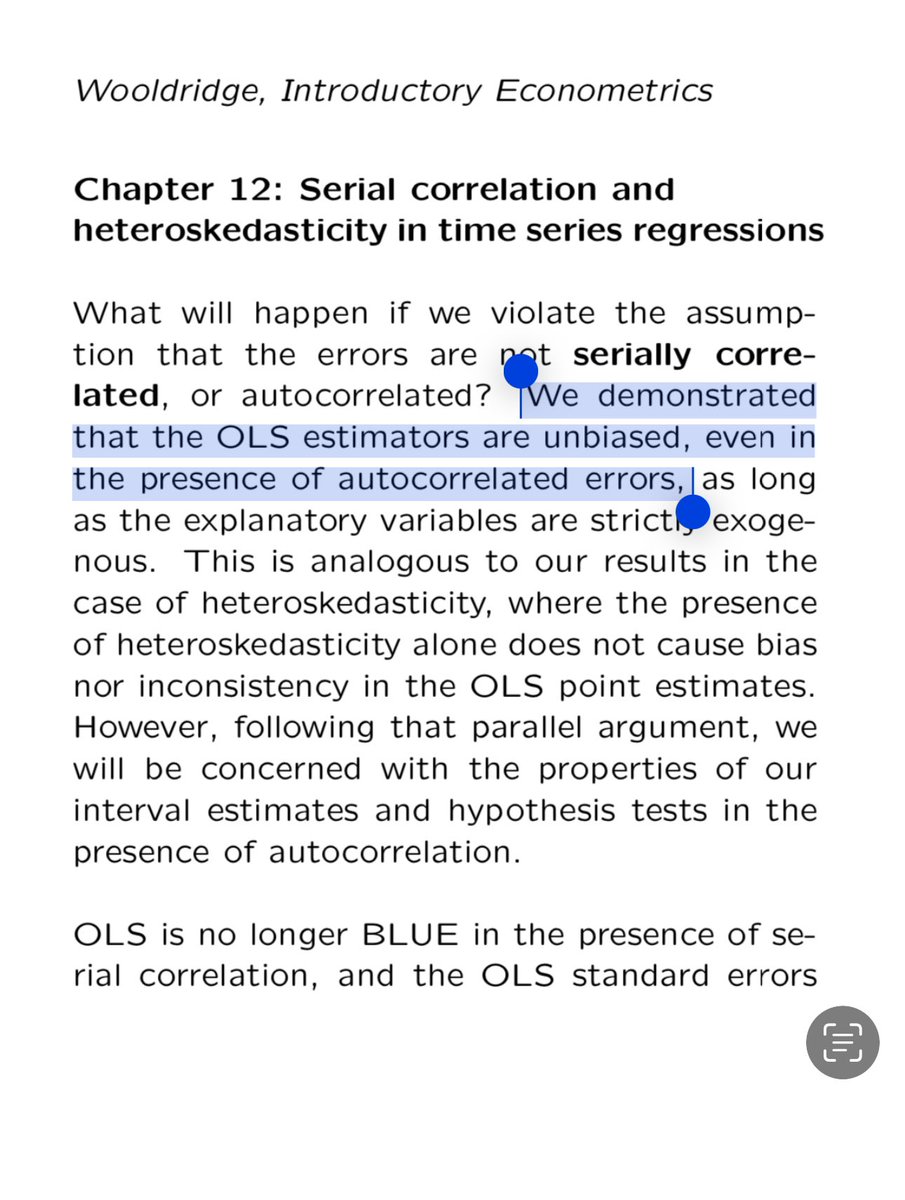

3/ ... In the “Introductory Econometrics,” the defacto undergrad econometrics textbook, Jeff Wooldridge, explains this as follows:

3/ ... In the “Introductory Econometrics,” the defacto undergrad econometrics textbook, Jeff Wooldridge, explains this as follows:

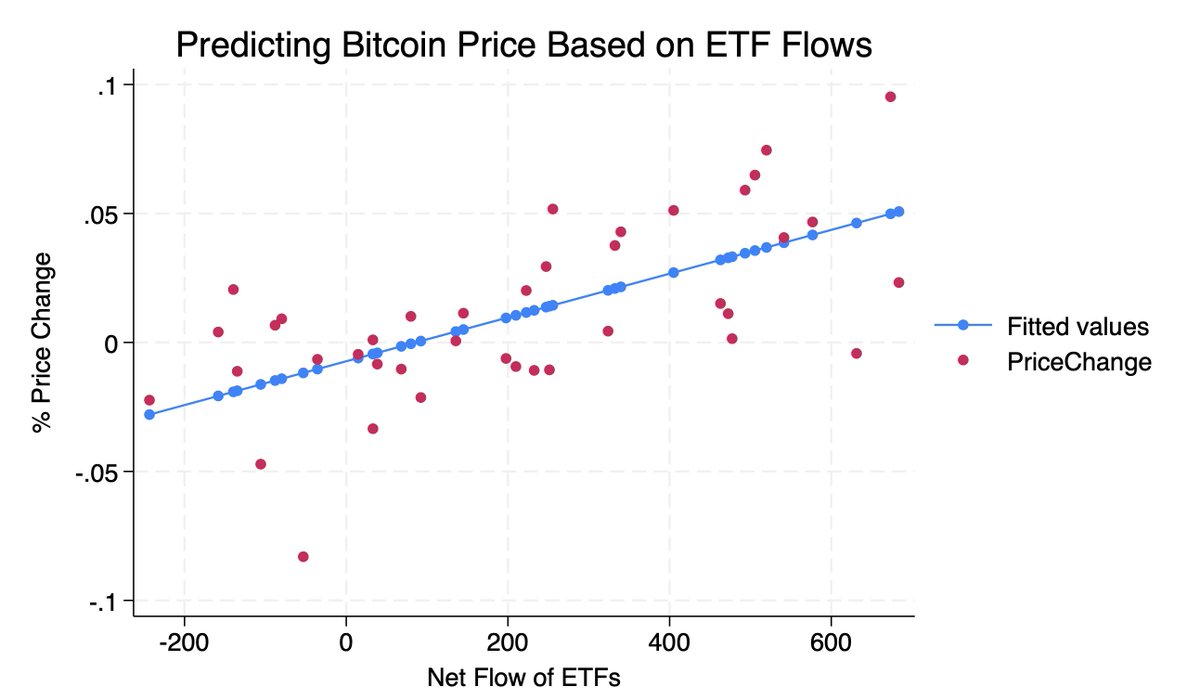

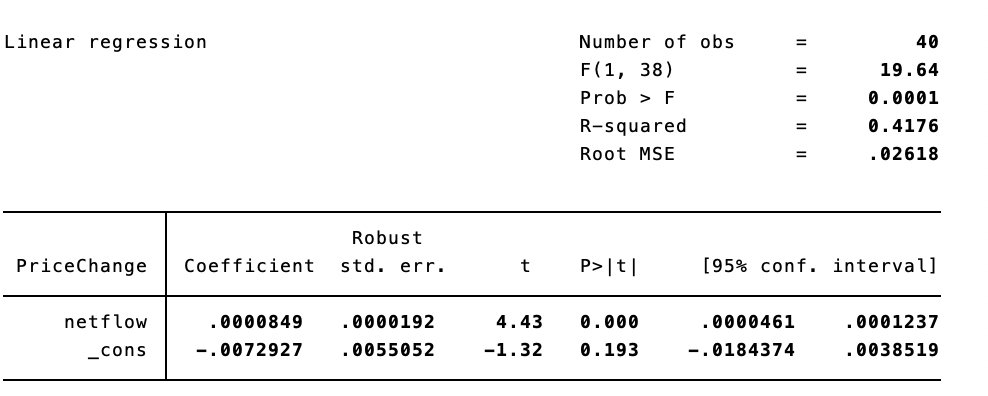

2/ It has an R2 of .42, meaning this model was able to predict 42% of the variations in price (%) just using the ETF flow. Given everything else that is going on in the market, 42% solely from ETF data is astounding.

2/ It has an R2 of .42, meaning this model was able to predict 42% of the variations in price (%) just using the ETF flow. Given everything else that is going on in the market, 42% solely from ETF data is astounding.

2/ When in fact, the blockchain holds all the prior transactions and ownerships in its 400Gb data.

2/ When in fact, the blockchain holds all the prior transactions and ownerships in its 400Gb data.