Infinitely curious. “Spend each day trying to be a little wiser than you were when you woke up.” - Charlie Munger

How to get URL link on X (Twitter) App

Here are two hypothetical scenarios for $MSFT capex (very high-level for simplicity) to think through implications for DC vs semis spending. Starting w/ now fully-guided FY25 capex of $88B and assuming +15% growth in Fy26 (in-line w/ IR's mid-teens framework from callbacks) and +10% in Fy27 (IR suggested a trendline decel) total MSFT capex could reach $111B in FY27. If DC mix went from 55/45 in FY25 to 30/70 as $MSFT IR has suggested, DC-related spending could decline significantly (30%+) from '25 to '27 even w/ growing overall capex. In a bear case where MSFT spend decelerates more quickly than expected and outright declines in FY27, DC revs could get cut nearly in half over 2yrs. Implied CY26 semis rev could still grow nicely in either scenario (note FY vs CY dynamics here for MSFT June year end). For $NVDA specifically this would be bullish but there is risk of share loss to ASICs that might cause them to under-grow these scenarios, plus idiosyncratic issues like China import bans, but this general framework is why ASICs stocks have performed better than $NVDA post $MSFT and $META earnings (plus META emphasizing broader use of ASICs in '25 and '26 for inference then training).

Here are two hypothetical scenarios for $MSFT capex (very high-level for simplicity) to think through implications for DC vs semis spending. Starting w/ now fully-guided FY25 capex of $88B and assuming +15% growth in Fy26 (in-line w/ IR's mid-teens framework from callbacks) and +10% in Fy27 (IR suggested a trendline decel) total MSFT capex could reach $111B in FY27. If DC mix went from 55/45 in FY25 to 30/70 as $MSFT IR has suggested, DC-related spending could decline significantly (30%+) from '25 to '27 even w/ growing overall capex. In a bear case where MSFT spend decelerates more quickly than expected and outright declines in FY27, DC revs could get cut nearly in half over 2yrs. Implied CY26 semis rev could still grow nicely in either scenario (note FY vs CY dynamics here for MSFT June year end). For $NVDA specifically this would be bullish but there is risk of share loss to ASICs that might cause them to under-grow these scenarios, plus idiosyncratic issues like China import bans, but this general framework is why ASICs stocks have performed better than $NVDA post $MSFT and $META earnings (plus META emphasizing broader use of ASICs in '25 and '26 for inference then training).

Paired with the additional windows that $DIS/$WBD films get, if a producer or star wants to get reach on a project, $NFLX isn’t the automatic destination of choice…

Paired with the additional windows that $DIS/$WBD films get, if a producer or star wants to get reach on a project, $NFLX isn’t the automatic destination of choice…

RBA made better than avg. inventory margins in '22 but incremental returns here are a headwind (easier to find $500M of bargains than $1B), & even at elevated margins inventory is much worse biz vs. auction/mktplce (10% GP on GTV vs. 14%) w/ more downside risk & capital intensity

RBA made better than avg. inventory margins in '22 but incremental returns here are a headwind (easier to find $500M of bargains than $1B), & even at elevated margins inventory is much worse biz vs. auction/mktplce (10% GP on GTV vs. 14%) w/ more downside risk & capital intensity

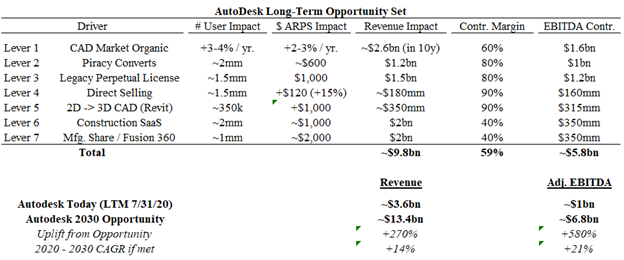

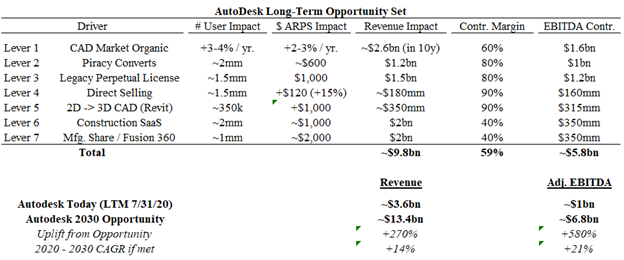

https://twitter.com/napkincapital/status/1464317558618742784Adsk is ~24x FY2 FCF. Yes, much of that is deferred rev, & ~25% will be SBC

It may not be immediately obvious why an already dominant, mature CAD business is an attractive growth story 40 years after its founding. Hopefully this thread makes the thesis clearer. This is just a fingerpainting exercise to size up some of the important initiatives underway.

It may not be immediately obvious why an already dominant, mature CAD business is an attractive growth story 40 years after its founding. Hopefully this thread makes the thesis clearer. This is just a fingerpainting exercise to size up some of the important initiatives underway.

2/x Construction of the C&O canal began in 1828, 5 years after the completion of the famous Erie Canal which inspired it. The Erie was such a success that businessmen south of New York wanted to copy its success and connect Eastern cities to the Midwest.

2/x Construction of the C&O canal began in 1828, 5 years after the completion of the famous Erie Canal which inspired it. The Erie was such a success that businessmen south of New York wanted to copy its success and connect Eastern cities to the Midwest.