Managed $2B+ at Goldman. Education/Ideas: M&A Arb, Value+Catalyst, Growth, CEFs, REITs, Prefs, SPACs, Bonds, BK/Distressed. Discord team: https://t.co/Ix6dovncRx

10 subscribers

How to get URL link on X (Twitter) App

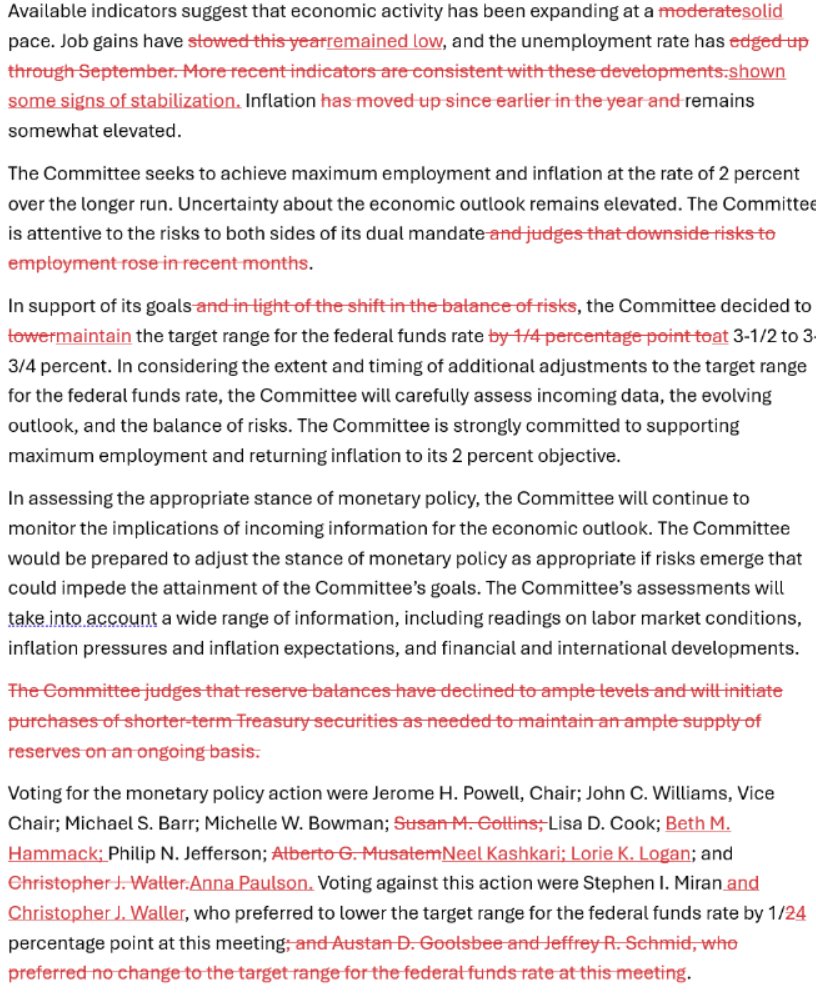

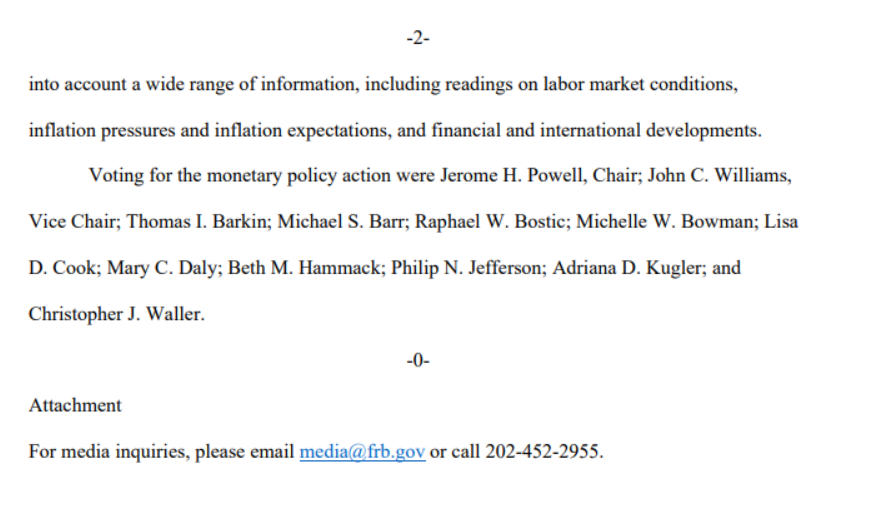

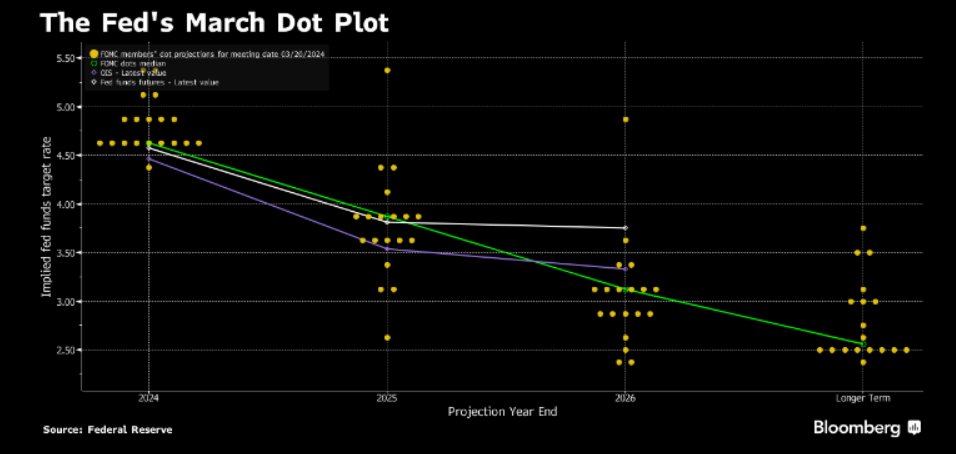

2/ Fed removes language from statement that had noted “downside risks to employment rose in recent months”

2/ Fed removes language from statement that had noted “downside risks to employment rose in recent months”https://x.com/SpecialSitsNews/status/1884678452172775876

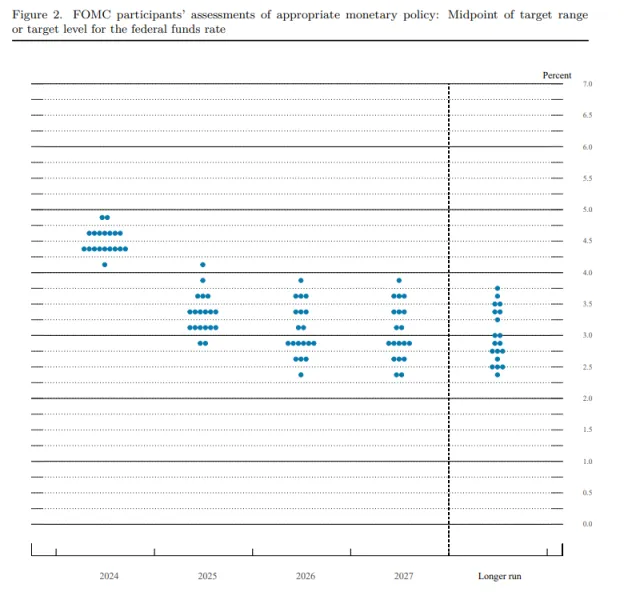

2/ Former Fed Vice Chair Rich Clarida tells Bloomberg TV the “Powell Fed” will just keep doing what they’re doing despite external events.

2/ Former Fed Vice Chair Rich Clarida tells Bloomberg TV the “Powell Fed” will just keep doing what they’re doing despite external events.

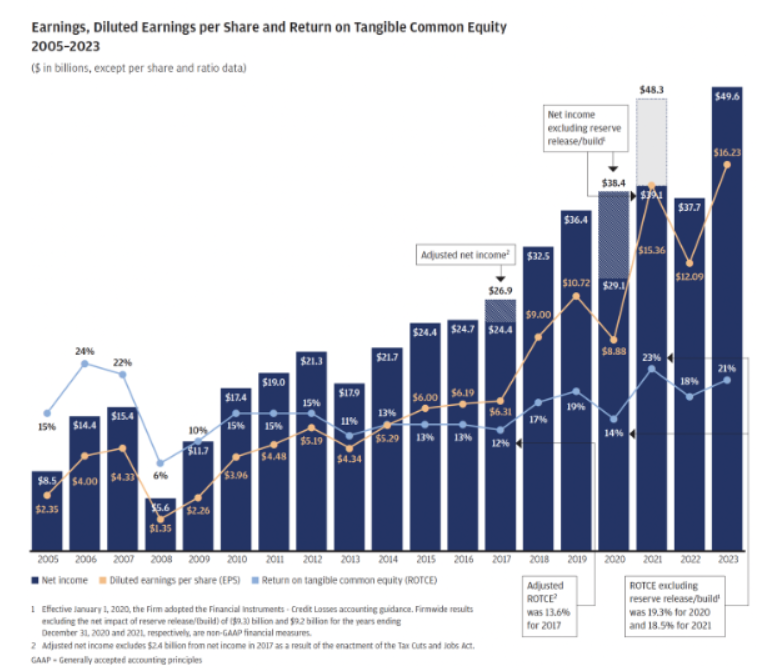

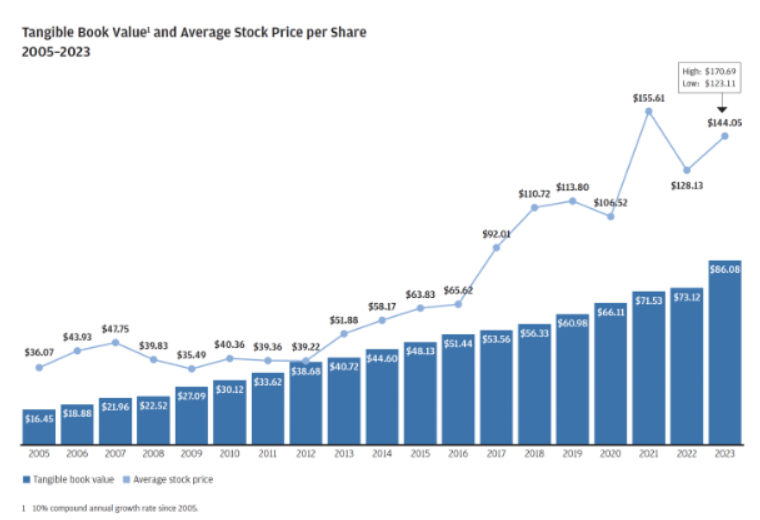

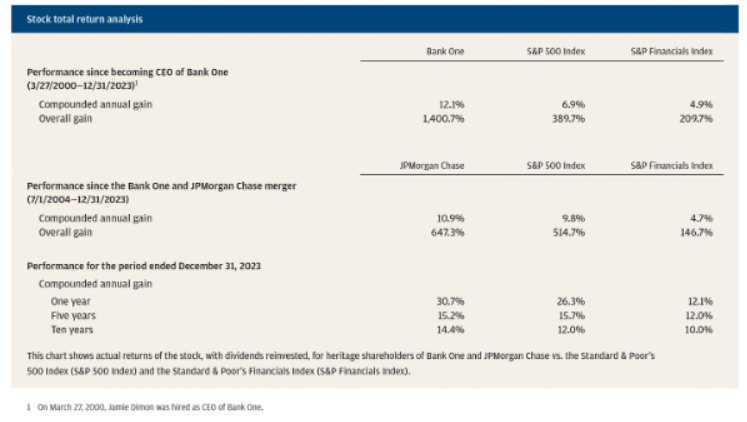

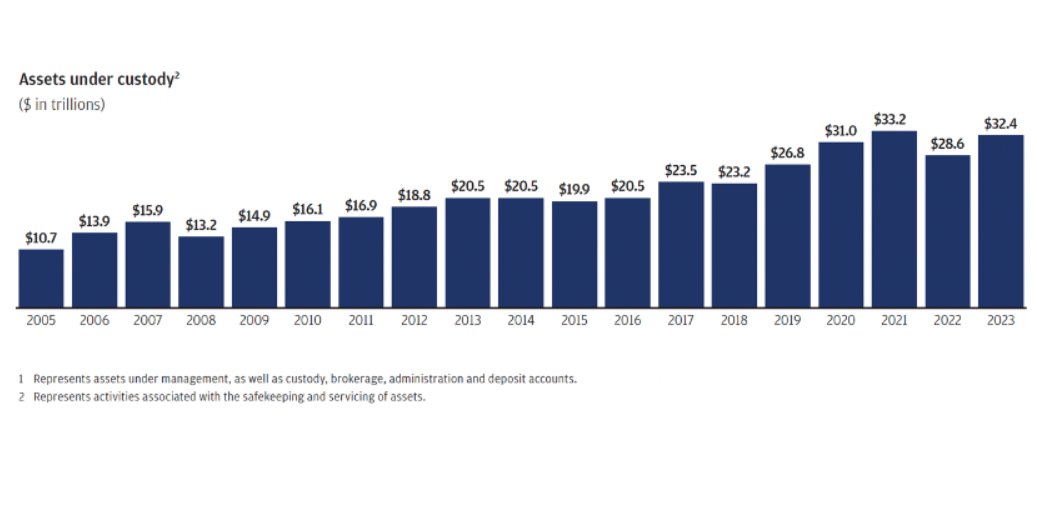

2/ The bank is reporting 1Q earnings on 4/12/24, but earnings over the past 20 years have been incredible

2/ The bank is reporting 1Q earnings on 4/12/24, but earnings over the past 20 years have been incredible

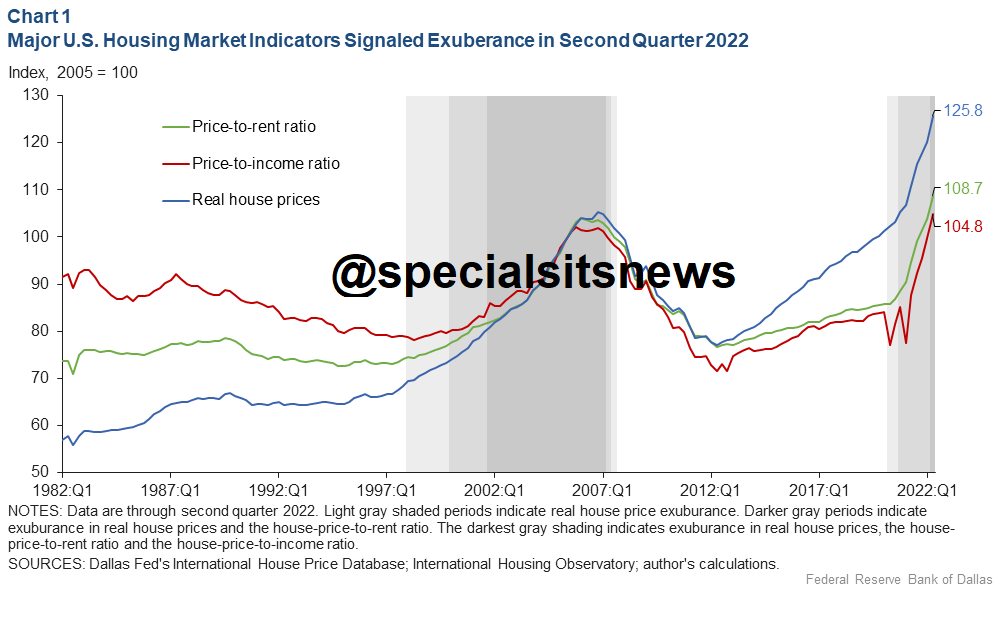

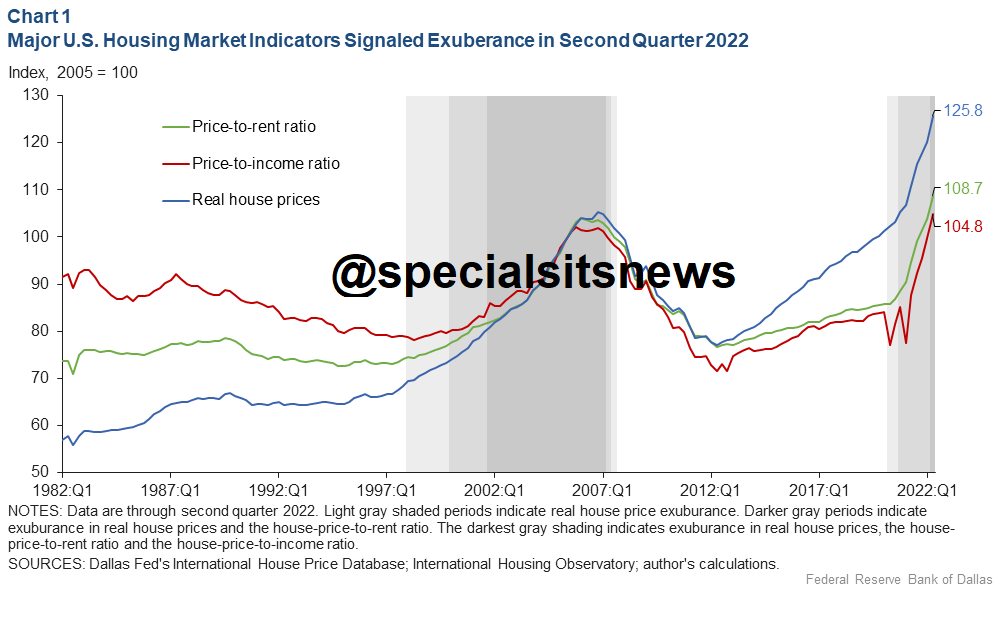

2/ "U.S. house prices appreciated a remarkable 94.5% from 1Q2013 to second quarter 2022—a 60.8 percent rise after adjusting for inflation. The magnitude of the increase is even larger than that of the preceding housing boom, from first quarter 1998 to second quarter 2007."

2/ "U.S. house prices appreciated a remarkable 94.5% from 1Q2013 to second quarter 2022—a 60.8 percent rise after adjusting for inflation. The magnitude of the increase is even larger than that of the preceding housing boom, from first quarter 1998 to second quarter 2007."