How to get URL link on X (Twitter) App

Every trading model must have these essential aspects to be considered a proper model.

Every trading model must have these essential aspects to be considered a proper model.

Approach everything with a logical approach and a structured framework.

Approach everything with a logical approach and a structured framework.

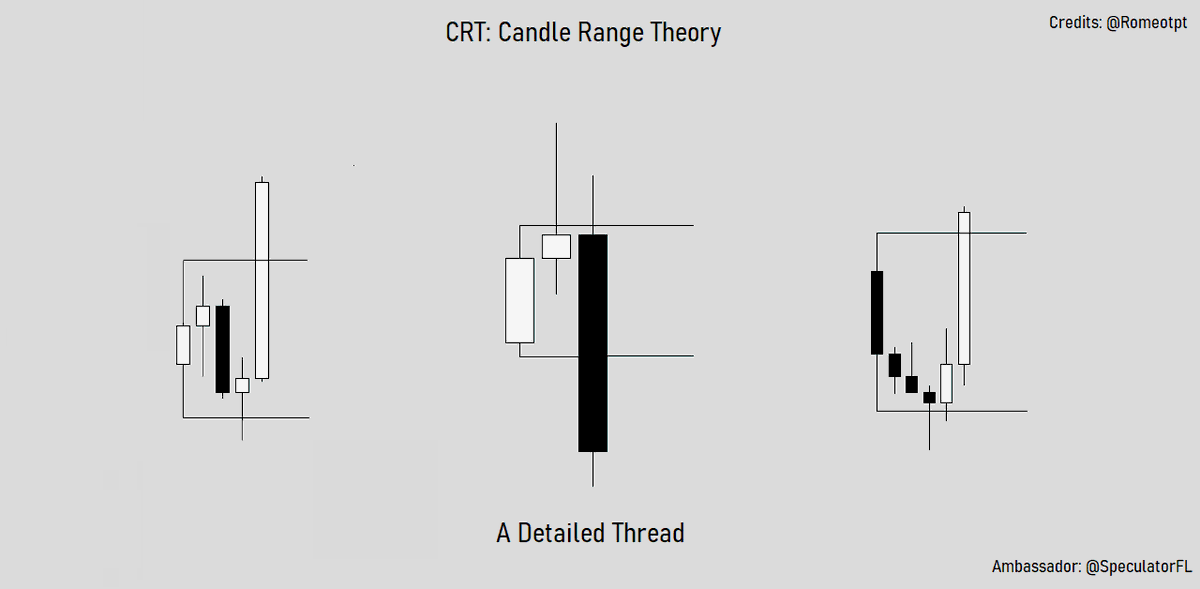

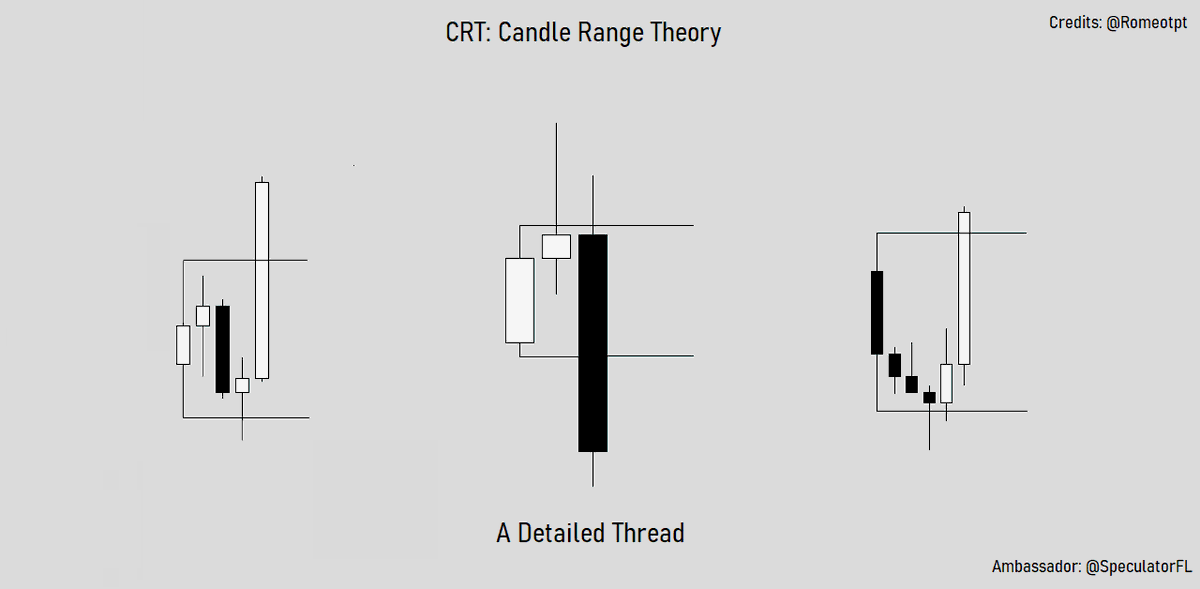

The origins of CRT:

The origins of CRT:

https://twitter.com/SpeculatorFL/status/1780825580789014848

Inside bar candles:

Inside bar candles: