How to get URL link on X (Twitter) App

One particular data point has proven to be very useful through time—and it's fun because it's illustrative of the underlying reality.

One particular data point has proven to be very useful through time—and it's fun because it's illustrative of the underlying reality.

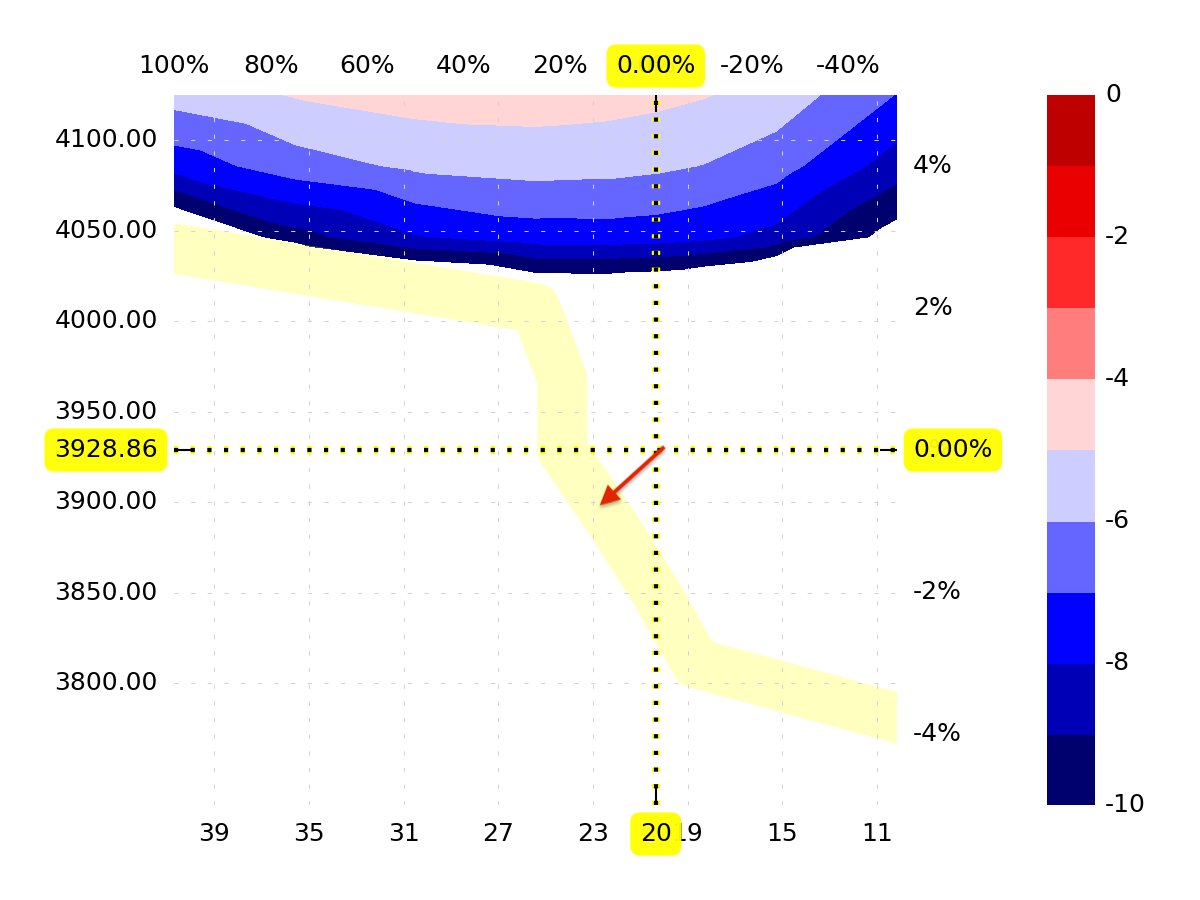

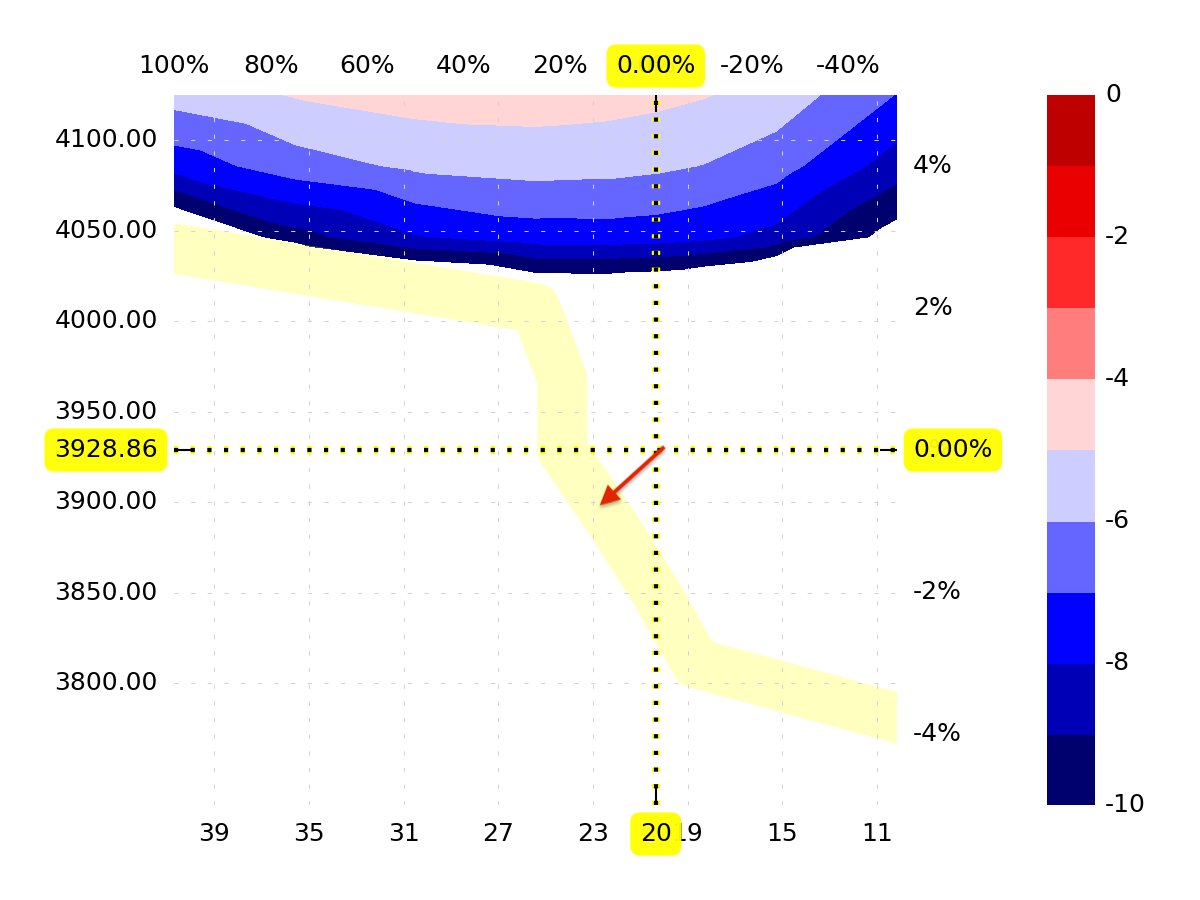

The CFTC CoT (TFF) data covering E-minis has been delayed for many weeks due to a "cyber incident," but when they finally release data from after January 24th, you'll likely note that Dealer Intermediaries have taken on a large short position in the intervening time.

The CFTC CoT (TFF) data covering E-minis has been delayed for many weeks due to a "cyber incident," but when they finally release data from after January 24th, you'll likely note that Dealer Intermediaries have taken on a large short position in the intervening time.

...you learn a lot about the way a stock trades that you wouldn't be able to learn by simply looking at a chart.

...you learn a lot about the way a stock trades that you wouldn't be able to learn by simply looking at a chart.

https://twitter.com/SqueezeMetrics/status/141465829936295117645.1%

https://twitter.com/SqueezeMetrics/status/1414658299362951176

https://twitter.com/SqueezeMetrics/status/1433465692934844418SPX now down 40, VIX flat.

https://twitter.com/SqueezeMetrics/status/1433123991854649344The missing piece is Net Put Delta (NPD).

https://twitter.com/SqueezeMetrics/status/1432440859426009090A "bad time" is when everyone is overexposed to the same thing. This makes the market fragile.

https://twitter.com/SqueezeMetrics/status/1430185120548392975It's the other 50%.

https://twitter.com/SqueezeMetrics/status/1430041315983732751

Normally, this would be an opportunity for us to plug gamma exposure (GEX).

Normally, this would be an opportunity for us to plug gamma exposure (GEX).