🎀 | Trader | Medicine and surgery (MB;BS in view)🩺 | 💌starrgael@gmail.com | https://t.co/hFTg6Lpw6v | Level up with me 👉 https://t.co/HOc1mv5KrZ

How to get URL link on X (Twitter) App

It’s estimated that only 4% of traders pass a prop firm challenge.

It’s estimated that only 4% of traders pass a prop firm challenge.

I’ve traded crypto, forex, indices and synthetic indices but synthetics made me the most. This thread is pure experience, not theory.

I’ve traded crypto, forex, indices and synthetic indices but synthetics made me the most. This thread is pure experience, not theory.

I wasn’t always profitable.

I wasn’t always profitable.

I applied to different trading platforms that taught youngins for free but I was never lucky enough to be picked.

I applied to different trading platforms that taught youngins for free but I was never lucky enough to be picked.

Synthetic indices are artificial financial instruments replicating the volatility and risk observed in the real world financial markets.

Synthetic indices are artificial financial instruments replicating the volatility and risk observed in the real world financial markets.

Before you read on, understand that different trading strategies have their own ways of identifying key points.

Before you read on, understand that different trading strategies have their own ways of identifying key points.

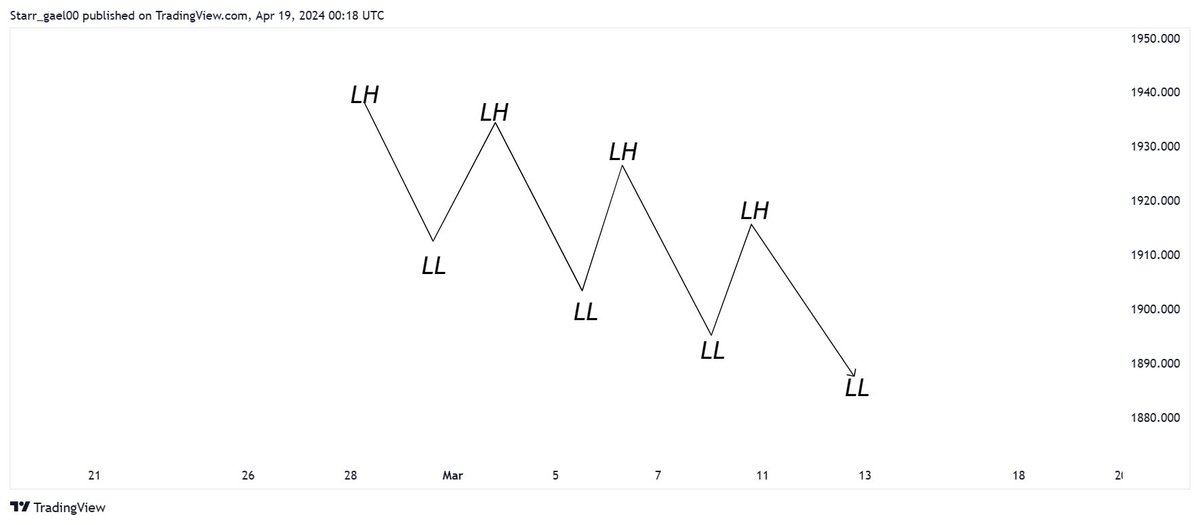

From your previous knowledge on TA and as shown above, you remember that an uptrend is formed by higher highs (HH) and higher lows (HL), and a downtrend is formed by lower highs (LH) and lower lows (LL).

From your previous knowledge on TA and as shown above, you remember that an uptrend is formed by higher highs (HH) and higher lows (HL), and a downtrend is formed by lower highs (LH) and lower lows (LL).

A fair value gap appears on the Chart in a three candle pattern, where

A fair value gap appears on the Chart in a three candle pattern, where

The best part of surveys is that you don't need any experience, skills, or capital to complete a survey. Grab your phone, share your thoughts, make money.

The best part of surveys is that you don't need any experience, skills, or capital to complete a survey. Grab your phone, share your thoughts, make money.

https://twitter.com/Starr_gael/status/1584175496019214336?t=jgk2FNtrp810Xb71x9DmCw&s=19

A breaker block is simply an Orderblock that was invalidated with momentum or without reaction.

A breaker block is simply an Orderblock that was invalidated with momentum or without reaction.

1. PREMIUM/ DISCOUNT PRICING; A high probability demand zone should be at the discount of price and supply at the premium of price. This helps us buy at cheaper prices and sell at expensive prices. Look out for demand zones in discount and look out for supply zones in premium.

1. PREMIUM/ DISCOUNT PRICING; A high probability demand zone should be at the discount of price and supply at the premium of price. This helps us buy at cheaper prices and sell at expensive prices. Look out for demand zones in discount and look out for supply zones in premium.