Systems Engineer / Options trader of 4 years. Creator of The SMT Algorithm. Trading journal page using a self-developed strategy. Not Financial Advice

How to get URL link on X (Twitter) App

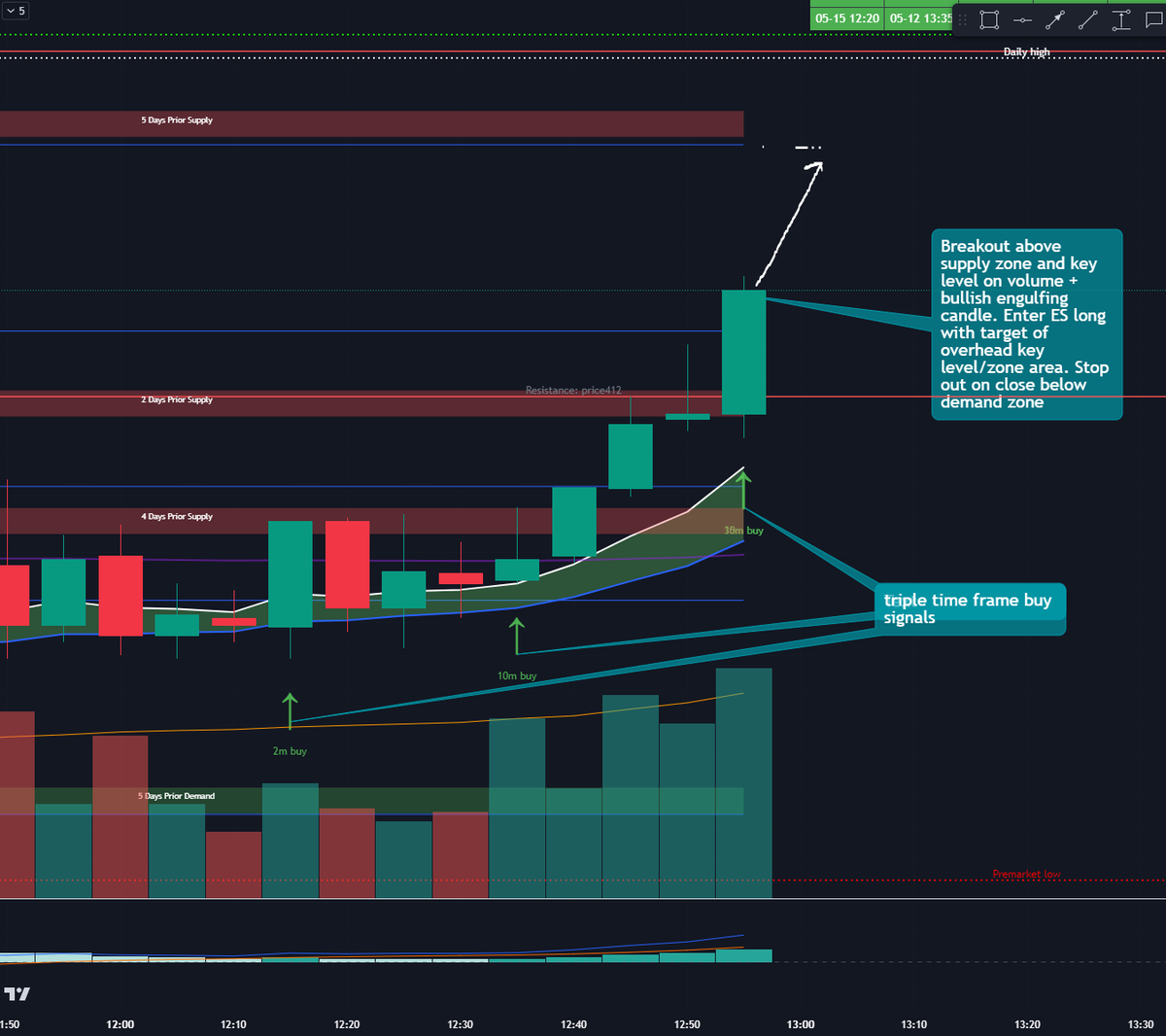

The first thing I will be adding to my chart is my "SPY Key Levels" script. This provides me with 54 automatically plotted key levels that I can use to help guide my trades. The key levels are clearly marked in blue - you can already see how well price action respected them.

The first thing I will be adding to my chart is my "SPY Key Levels" script. This provides me with 54 automatically plotted key levels that I can use to help guide my trades. The key levels are clearly marked in blue - you can already see how well price action respected them.