Detailed equity research and balanced portfolio insights for serious investors who want analysis over hype. Invest with good reason here.

8 subscribers

How to get URL link on X (Twitter) App

2. "He who lives by the crystal ball will eat shattered glass." -- Ray Dalio

2. "He who lives by the crystal ball will eat shattered glass." -- Ray Dalio

1. Introduction

1. Introduction

1a. When to Sell?

1a. When to Sell?

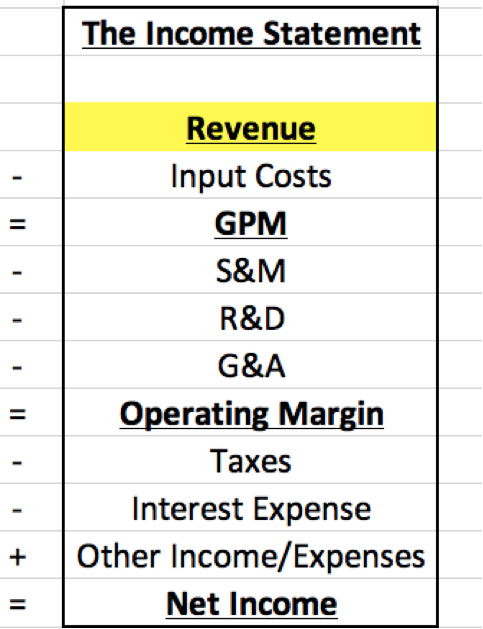

1. Finance & Accounting Basics

1. Finance & Accounting Basics

2. $MSFT

2. $MSFT

2. Branded Checkout

2. Branded Checkout

2. "Everyone has the brainpower to make money in stocks. Not everyone has the stomach." -- Peter Lynch

2. "Everyone has the brainpower to make money in stocks. Not everyone has the stomach." -- Peter Lynch

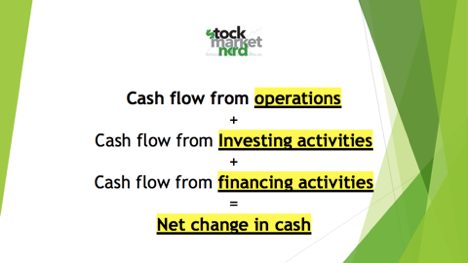

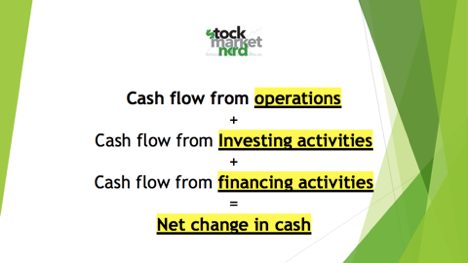

1a. Basics

1a. Basics

Can't call it a perfect Q.

Can't call it a perfect Q.

1. Introduction:

1. Introduction:

1. A full Understanding of the Business

1. A full Understanding of the Business