Long-term stock investing | Fundamental analysis | Earnings Reviews | Not an investment advice

How to get URL link on X (Twitter) App

2/ The IPO

2/ The IPO

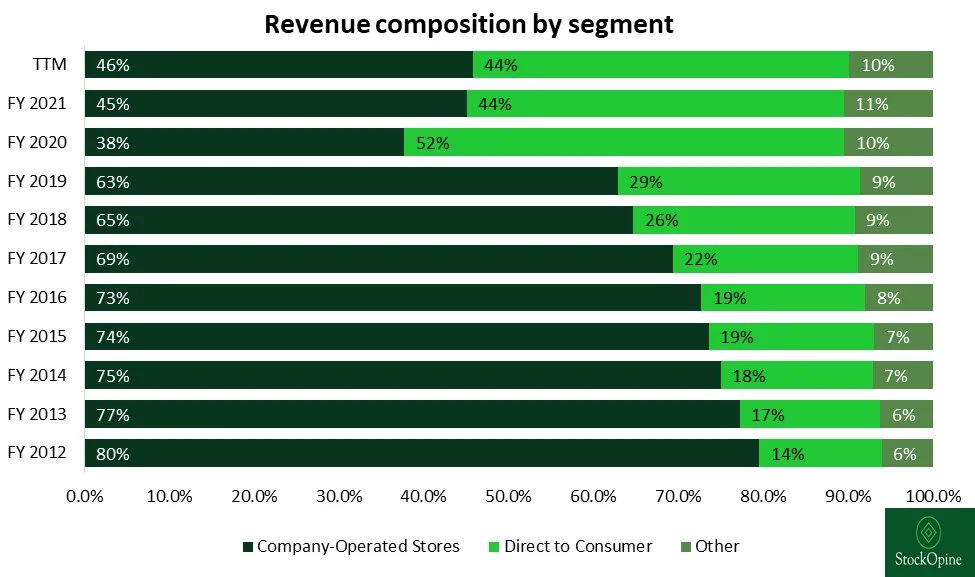

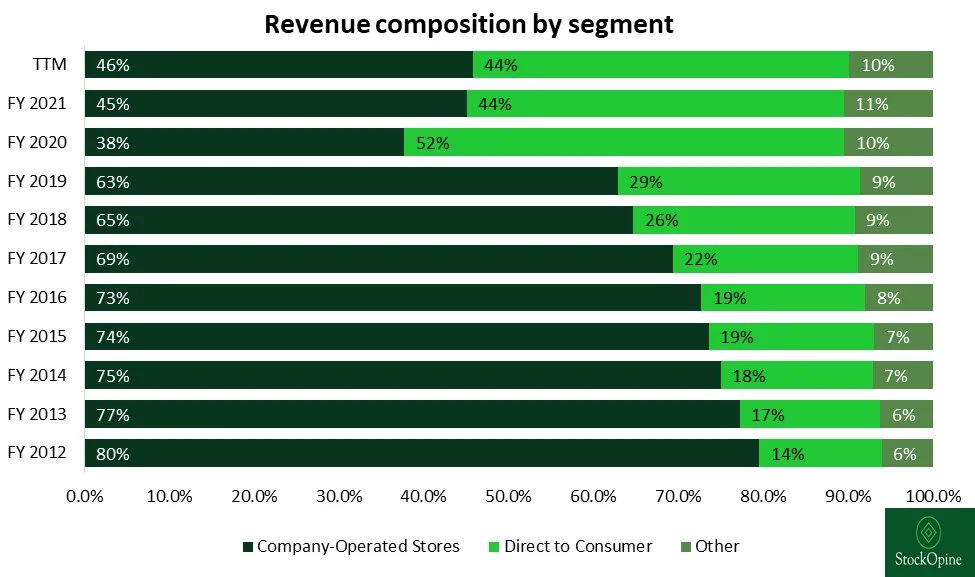

2/ The operating margin for Company-operated stores since FY12 until today averages at 27%, while the operating margin for Direct to Consumer averages at 42%. The higher margin of DTC is expected since costs like rent, electricity, and wages are minimized relative to COS.

2/ The operating margin for Company-operated stores since FY12 until today averages at 27%, while the operating margin for Direct to Consumer averages at 42%. The higher margin of DTC is expected since costs like rent, electricity, and wages are minimized relative to COS.

2/ International e-commerce growth and online grocery are expected to drive further growth for Amazon's online stores. Andrew Jassy, CEO, considers grocery a strategic area while he also anticipates a large profitable international e-commerce business.

2/ International e-commerce growth and online grocery are expected to drive further growth for Amazon's online stores. Andrew Jassy, CEO, considers grocery a strategic area while he also anticipates a large profitable international e-commerce business.

2/ Revenue 10.3% GAGR, is a result of 18.3% CAGR for the enterprise business and 0.2% for the online business.

2/ Revenue 10.3% GAGR, is a result of 18.3% CAGR for the enterprise business and 0.2% for the online business.