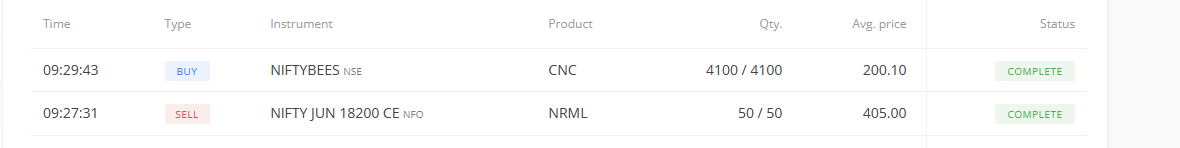

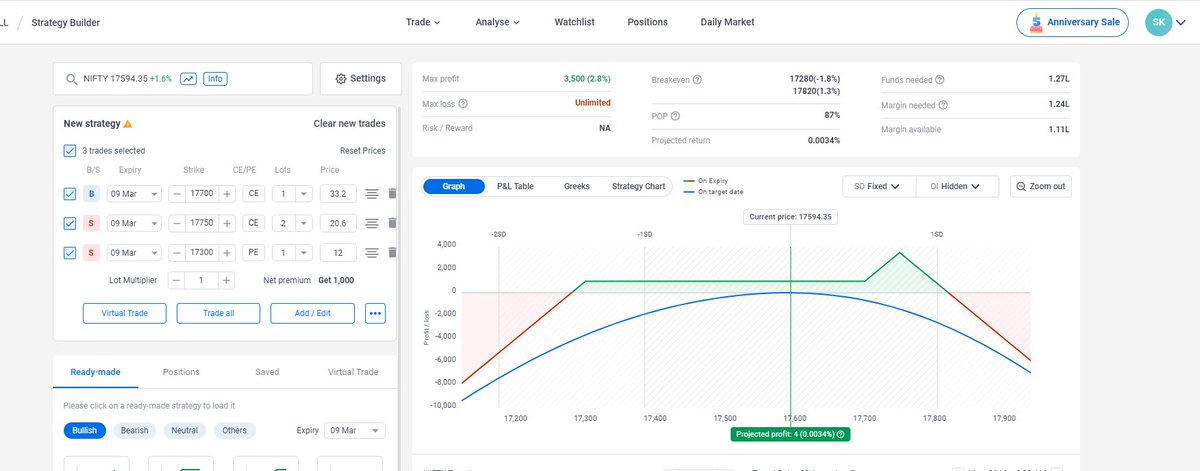

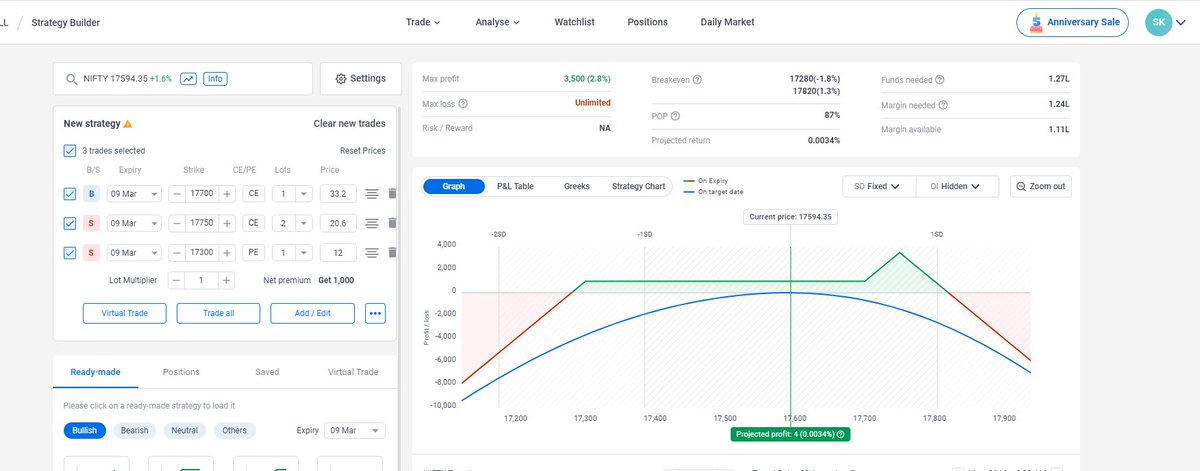

Covered Call in Nifty ✌️✌️

To Join session with me

Book 1:1 on https://t.co/L3dzIrIkGx

How to get URL link on X (Twitter) App

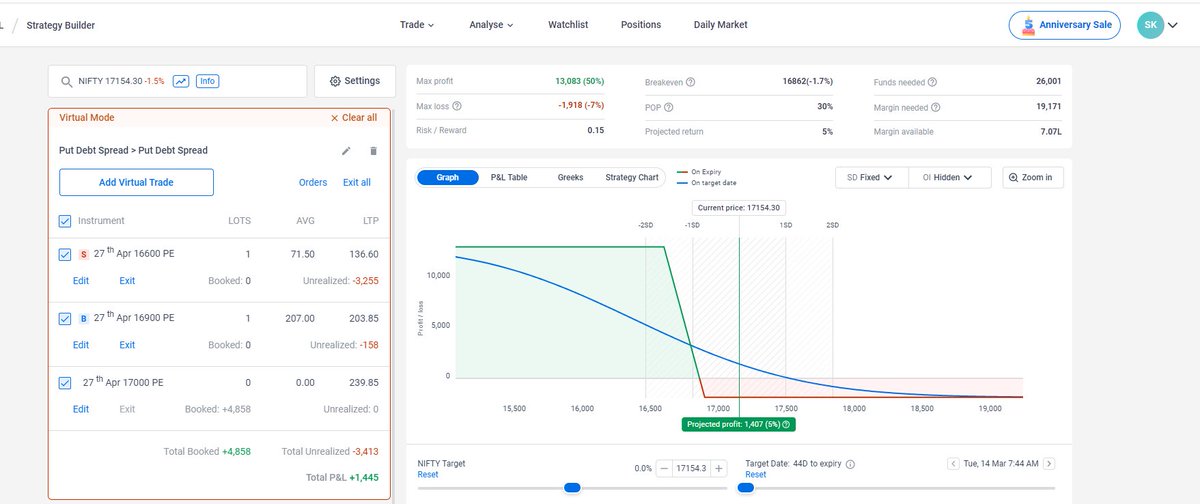

https://twitter.com/Suresh_kumar047/status/16775373269296947202. What if market rally 1000 points up

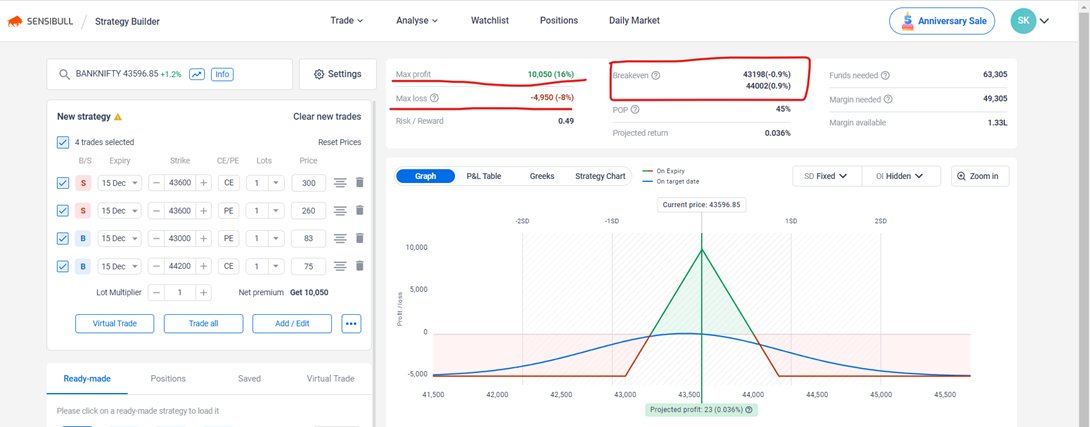

The time when i entered it is showing 3.5k max loss with 1 lot.

The time when i entered it is showing 3.5k max loss with 1 lot.

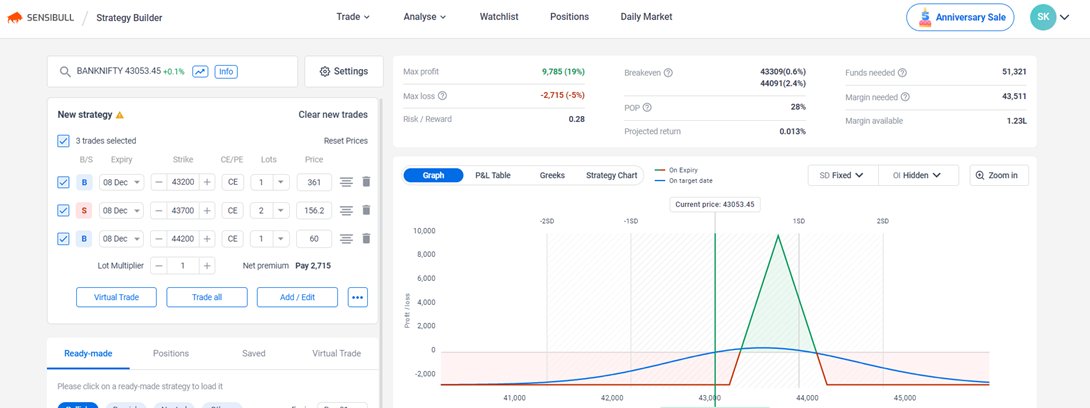

This Strategy you can adjust easily :-

This Strategy you can adjust easily :-

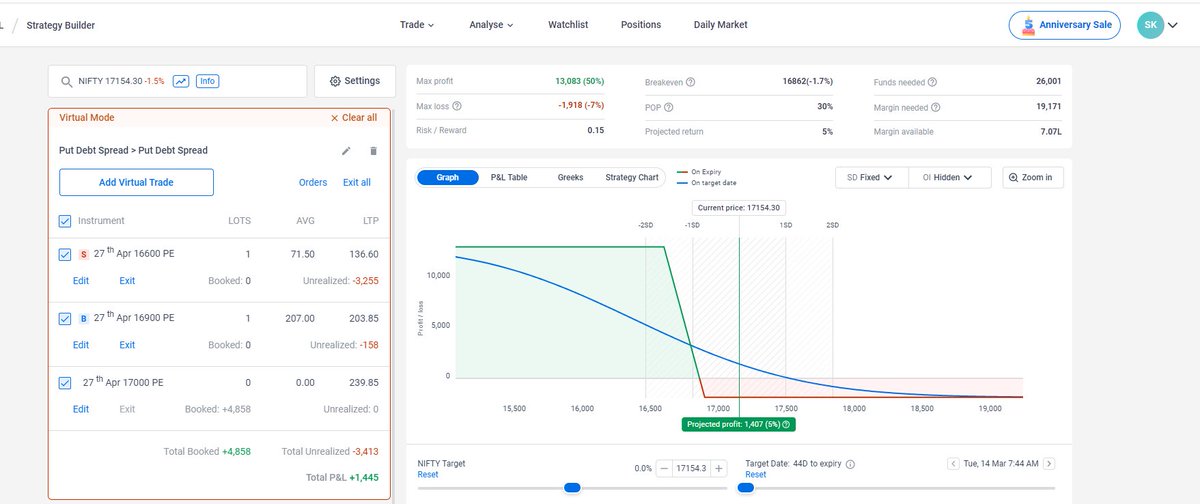

In This my plan is to invest 1000 quantity bank bees in every year .

In This my plan is to invest 1000 quantity bank bees in every year .https://twitter.com/Suresh_kumar047/status/1601392850192986113?s=20Butterfly Strategy

https://twitter.com/Suresh_kumar047/status/1598860669084135424?s=20