Co-Founder and COO, @SovrennOfficial | Microcap Investor | Ex-Credit Suisse research | Ex-Deutsche Bank | IIM Calcutta | IIT Kharagpur | Sharing views

How to get URL link on X (Twitter) App

Q. Could you please provide us with the history of Advait and how things initiated for the Company?

Q. Could you please provide us with the history of Advait and how things initiated for the Company?

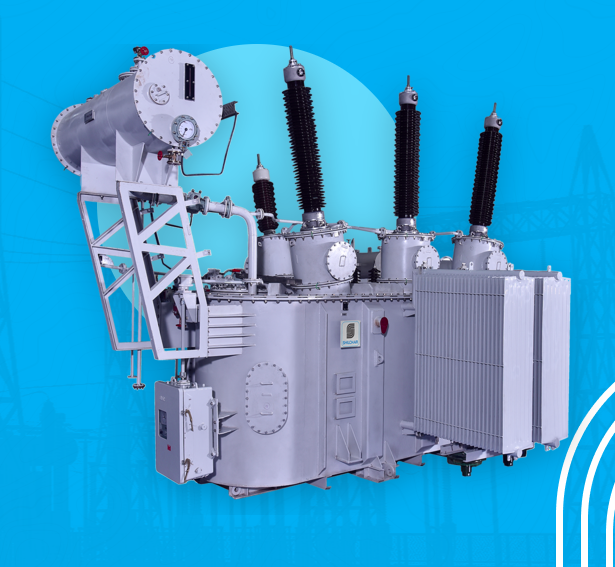

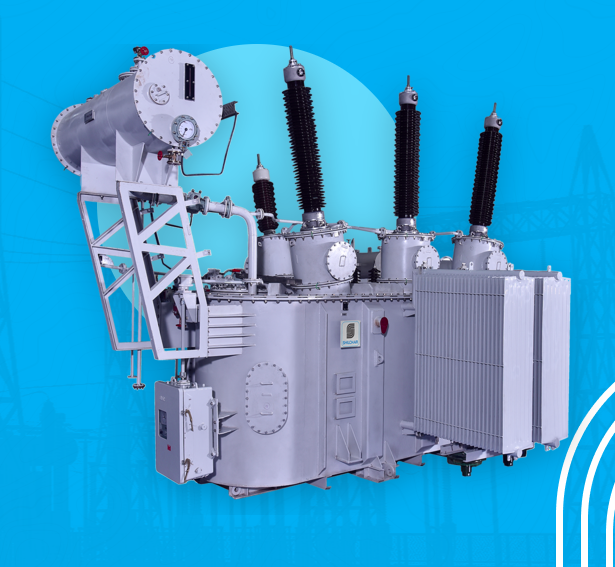

COMPANY OVERVIEW

COMPANY OVERVIEW

COMPANY OVERVIEW

COMPANY OVERVIEW

Please join the Sovrenn free WhatsApp community to stay in touch with Sovrenn updates:

Please join the Sovrenn free WhatsApp community to stay in touch with Sovrenn updates:

GUINNESS WORLD RECORD

GUINNESS WORLD RECORD

Mar '23 results:

Mar '23 results: