September 2008 - June 2015: Accountant at BDO

March 2013 - nu: Symmetry Invest A/S

Tweets are own opinions not investment advice

How to get URL link on X (Twitter) App

There has been a lot of fears that the company will try to use the cash to invest in the business or do more M&A etc. etc. Here is why i think that fear are no accurate and that a total sale of the company is the most likely outcome within the next 12 months.

There has been a lot of fears that the company will try to use the cash to invest in the business or do more M&A etc. etc. Here is why i think that fear are no accurate and that a total sale of the company is the most likely outcome within the next 12 months.

They will consolidate SportnCo from 1/4 and have already secured deals together and have 40% of pipeline as combined deals.

They will consolidate SportnCo from 1/4 and have already secured deals together and have 40% of pipeline as combined deals.

BUT! - Since 2018 they have been focusing on turning around the business, improving underwriting, ramping innovations investments and improving the balance sheet

BUT! - Since 2018 they have been focusing on turning around the business, improving underwriting, ramping innovations investments and improving the balance sheet

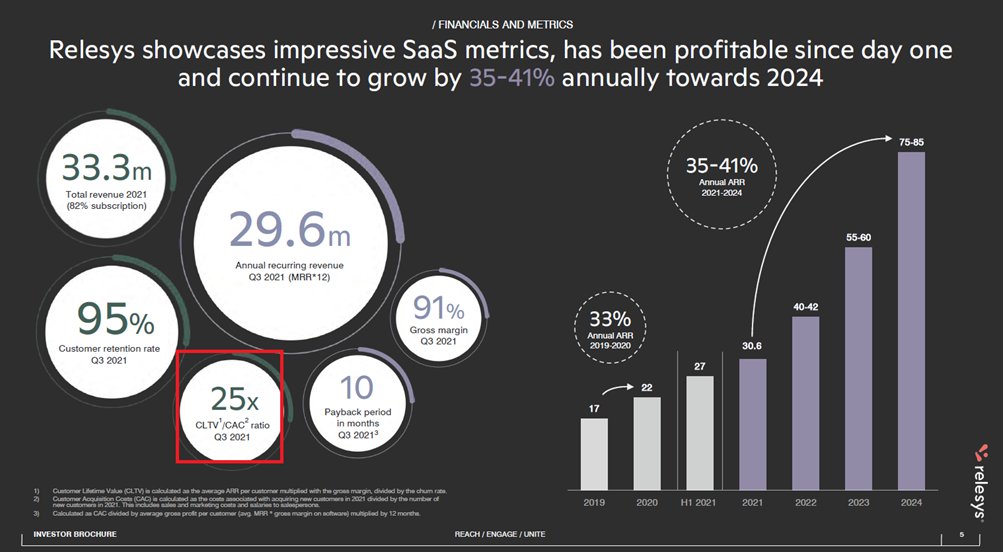

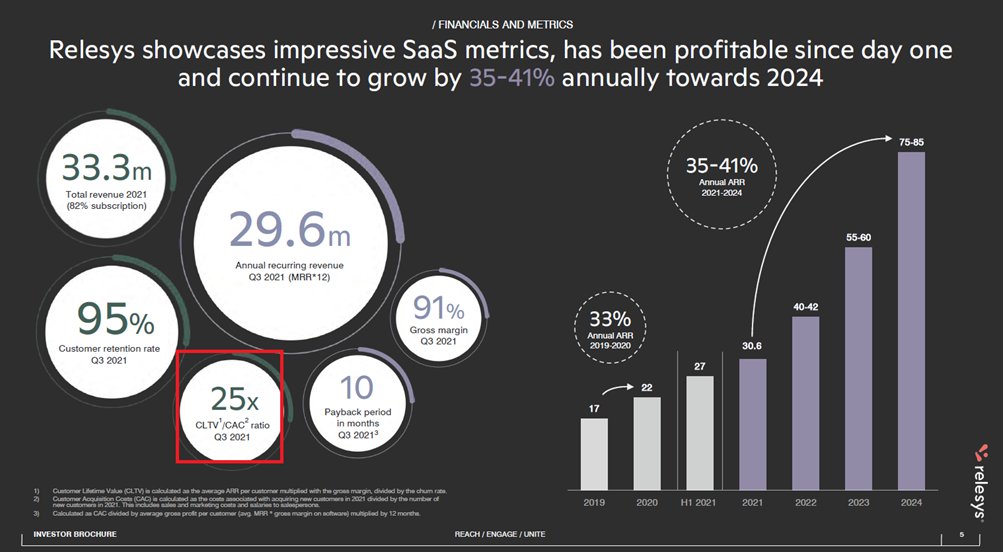

https://twitter.com/venturaFPC/status/1462353341477015552Five reasons why we are attracted to Relesys:

First of all its important to look at the business as 2 seperate entities. While there is a lot of synergies and collaborations between the segments from a valuation perspective its quite important.

First of all its important to look at the business as 2 seperate entities. While there is a lot of synergies and collaborations between the segments from a valuation perspective its quite important.