How to get URL link on X (Twitter) App

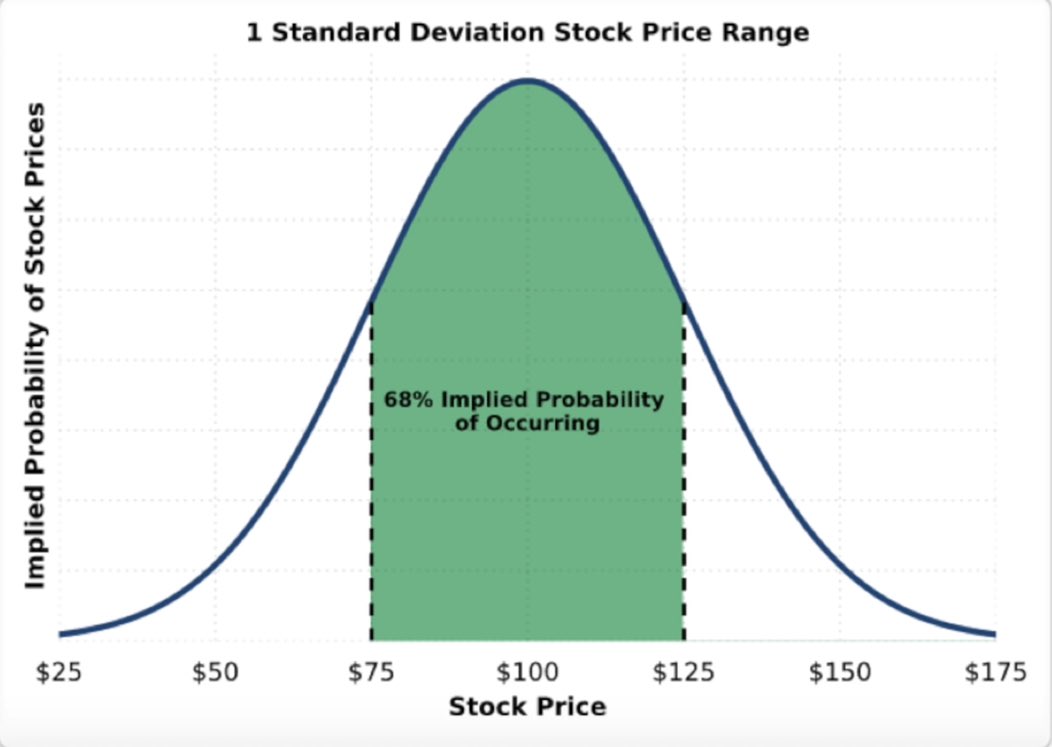

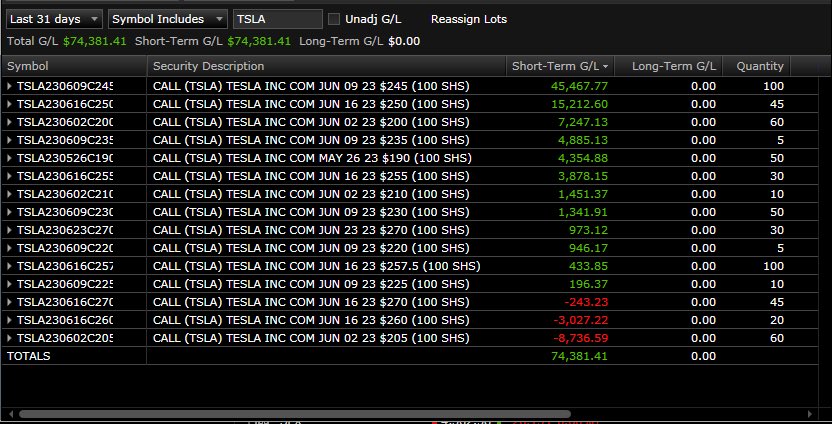

When a stock is breaking out, as traders we really don’t know how far it can actually go, yes we set targets and profit levels but sometimes our targets get hit and stock continues to the upside even higher

When a stock is breaking out, as traders we really don’t know how far it can actually go, yes we set targets and profit levels but sometimes our targets get hit and stock continues to the upside even higher

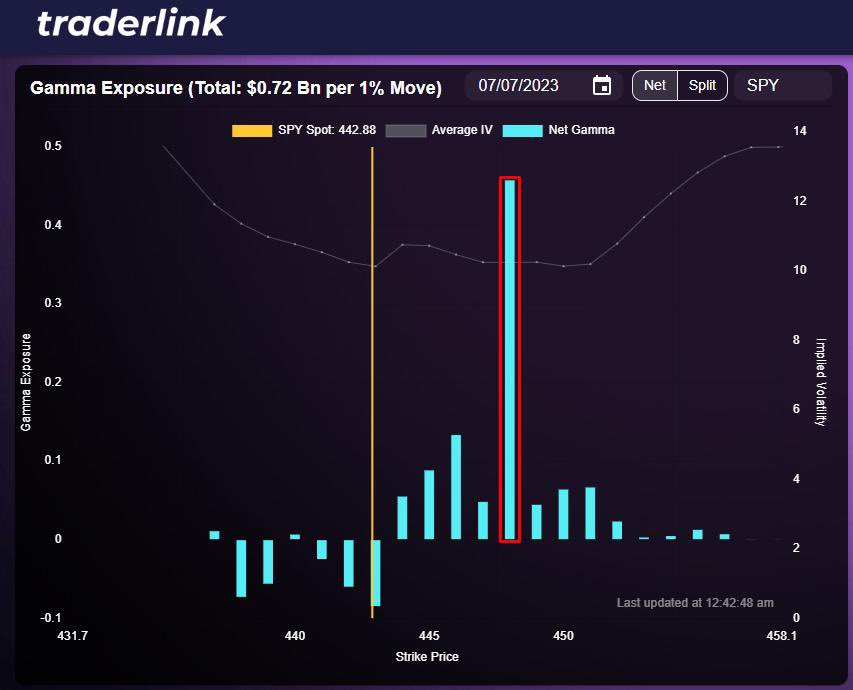

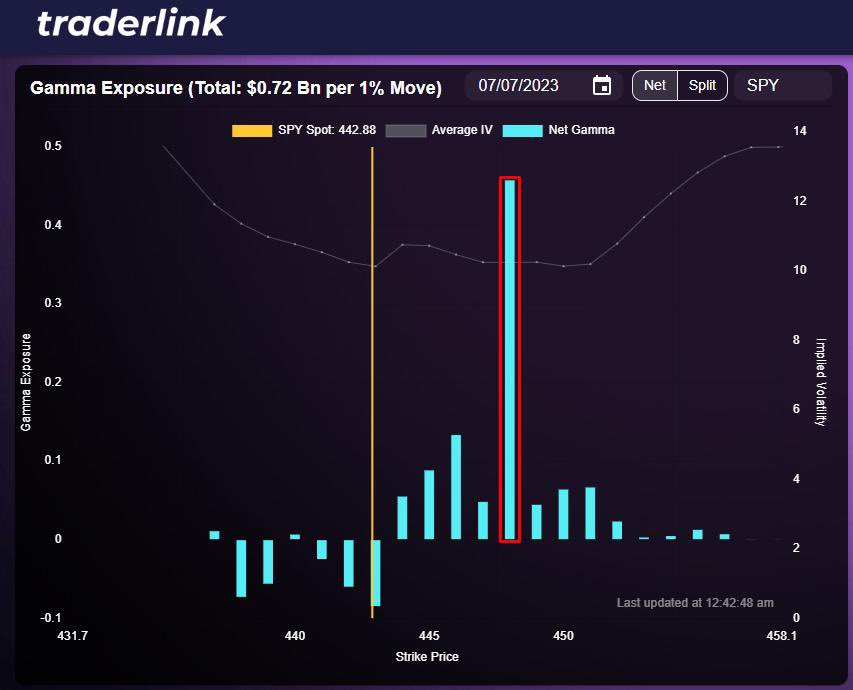

So off open we rejected 4175 area before dumping towards 4160 and holding as a bounce level

So off open we rejected 4175 area before dumping towards 4160 and holding as a bounce level