I Code algos that beat Mr. Market | Growth Investor | 'Be like Water' | Having a plan is better than having great timing | Find a process | Link to free tools

How to get URL link on X (Twitter) App

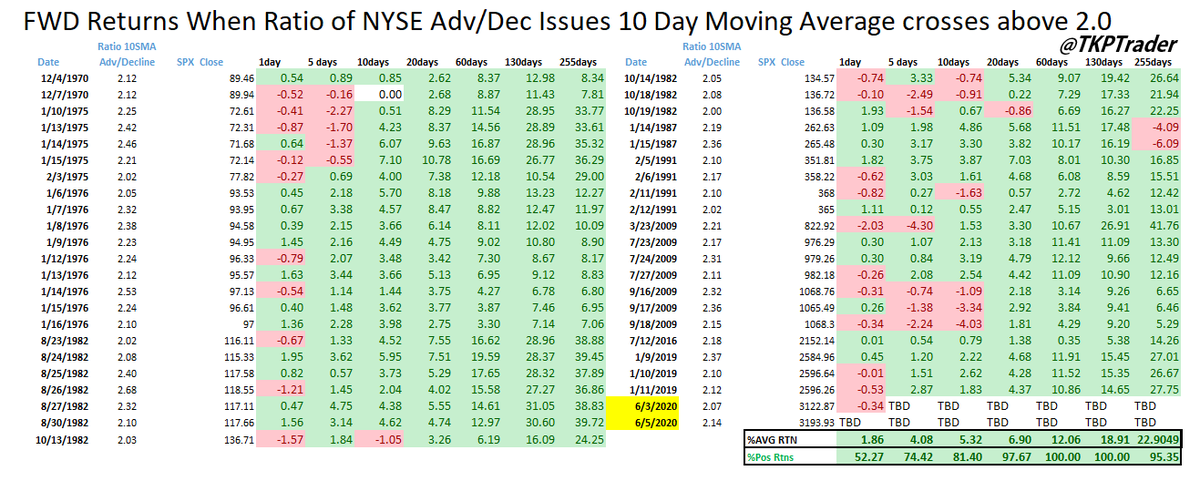

We saw SEVERAL historical signals in March-June.... It has been a busy 3 months, so to remind ourselves the bullishness of some of these signals, here's one that also Fired in June: Ratio of NYSE Adv/Dec Issues 10 Day MA crossed above 2, Which practically has NO Neg Returns (2/n)

We saw SEVERAL historical signals in March-June.... It has been a busy 3 months, so to remind ourselves the bullishness of some of these signals, here's one that also Fired in June: Ratio of NYSE Adv/Dec Issues 10 Day MA crossed above 2, Which practically has NO Neg Returns (2/n)

2nd we has a very rare signal when %NYSE Stocks above 50 day cross above 90% (2/n)

2nd we has a very rare signal when %NYSE Stocks above 50 day cross above 90% (2/n)