Head of Policy, @basepowerco. Lecturer @uchicago.

Past: @nrgenergy, @RSI, @mt_psc Commish & @NARUC President. Husband & father. Feed = my personal take.

How to get URL link on X (Twitter) App

2. These rate cases? They are complex amirite? More process & time for rate cases. The public will go line by line through these rate cases until they find the affordability.

2. These rate cases? They are complex amirite? More process & time for rate cases. The public will go line by line through these rate cases until they find the affordability.

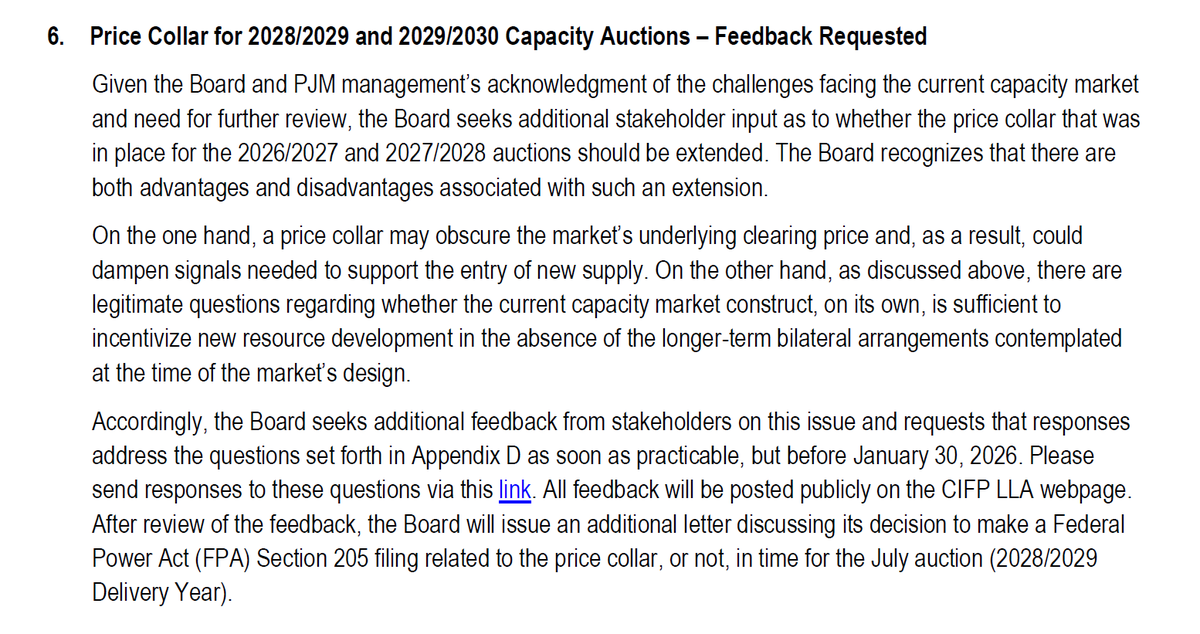

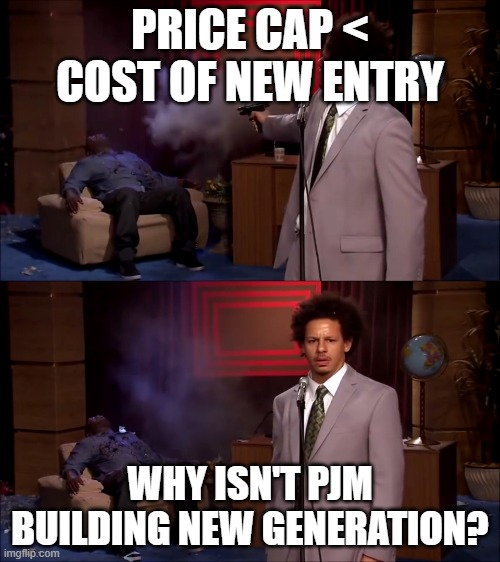

The price cap (& the lingering will they/won't they debate on its extension) made it inevitable the @pjminterconnect market either would

The price cap (& the lingering will they/won't they debate on its extension) made it inevitable the @pjminterconnect market either would

https://twitter.com/TKavulla/status/2002025512353362394I personally think that there are huge beneficial network effects of front-of-meter arrangements, but those are certainly offset when you bring a 300-MW project to your local utility in 2025 and they tell you it'll be served no sooner than 2030.

It's crazy that utilities

It's crazy that utilities

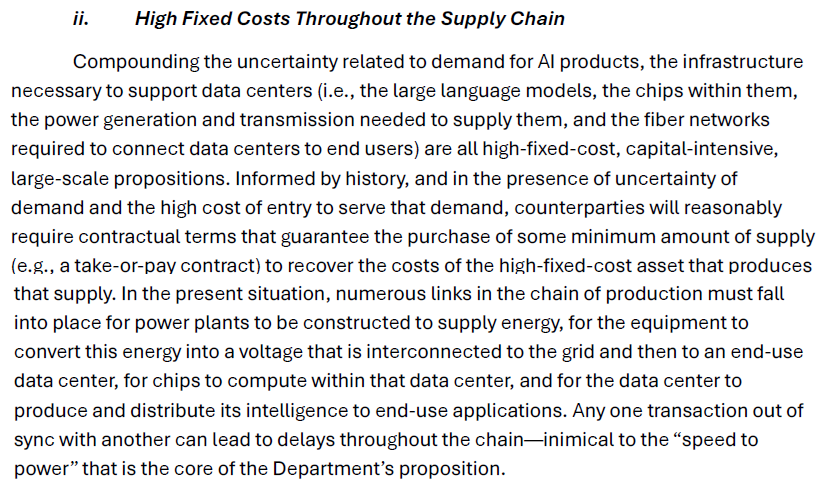

2) A supply chain where each link costs a fortune in fixed costs is more likely to have everyone hold their wallets close...

2) A supply chain where each link costs a fortune in fixed costs is more likely to have everyone hold their wallets close...

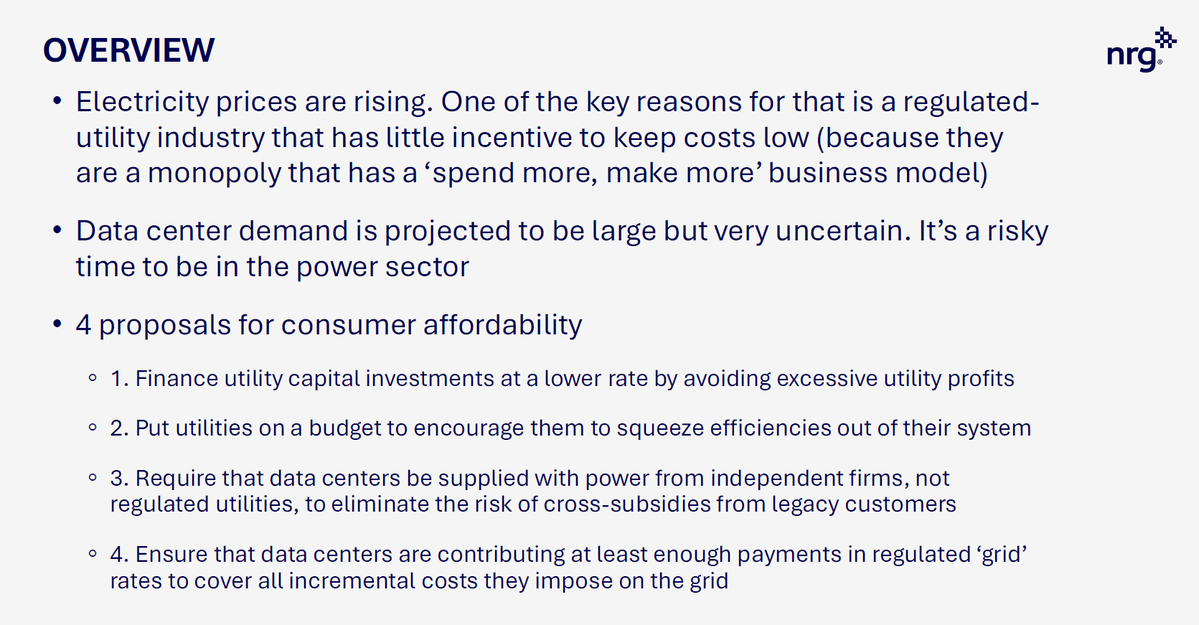

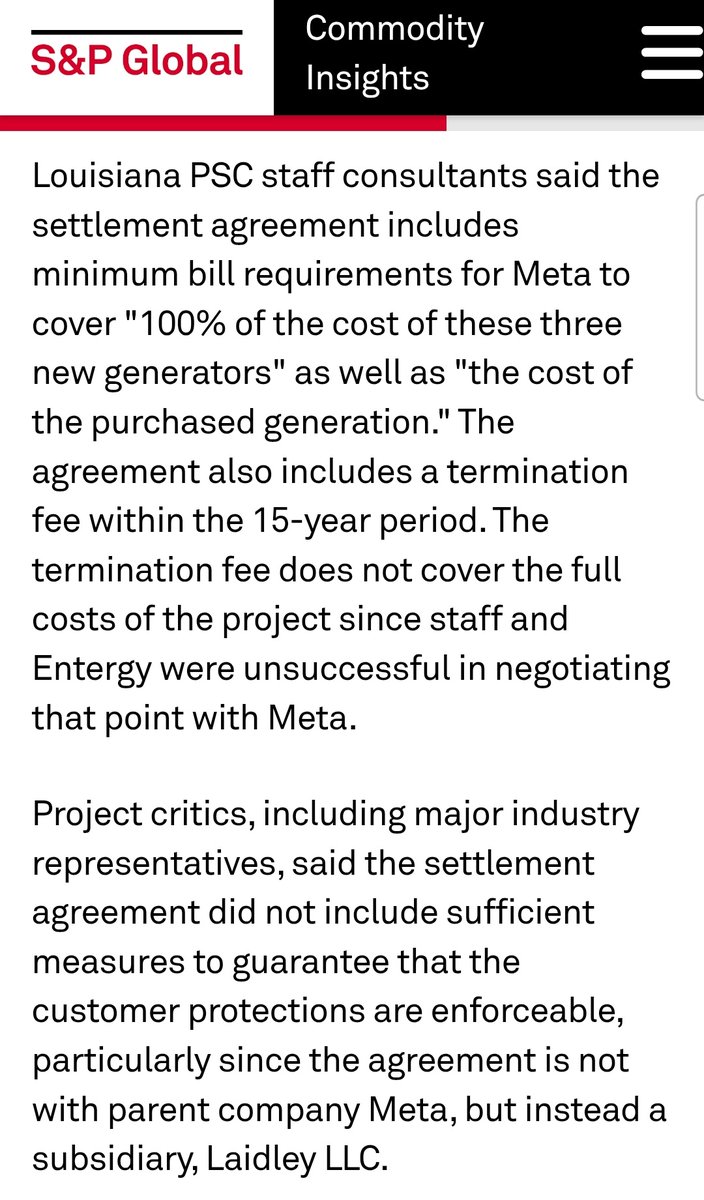

I really have no strong opinion on what the hyperscaler is doing here, but I do wonder why a utility commission would allow itself to be razzle-dazzled into allowing a utility fight out of legacy customers' pocketbooks to supply this load.

I really have no strong opinion on what the hyperscaler is doing here, but I do wonder why a utility commission would allow itself to be razzle-dazzled into allowing a utility fight out of legacy customers' pocketbooks to supply this load.

Reading between the lines -- the most detailed parts of this complaint are redacted -- it looks like the utility is blockading the data centers until the latter pay a gross-up for taxes: a *32.6%* adder to all payments made to the utility to offset infrastructure costs

Reading between the lines -- the most detailed parts of this complaint are redacted -- it looks like the utility is blockading the data centers until the latter pay a gross-up for taxes: a *32.6%* adder to all payments made to the utility to offset infrastructure costs

The Regional Greenhouse Gas Initiative is the northeast's cap-and-trade market for carbon. It's limited to the power sector and it is, important for this analysis, limited to only some of the states within power markets that have opted in.

The Regional Greenhouse Gas Initiative is the northeast's cap-and-trade market for carbon. It's limited to the power sector and it is, important for this analysis, limited to only some of the states within power markets that have opted in.

I have no idea why any utility regulator would let monopoly utilities gamble on AI-based load growth. Letting them fight out of ratepayers’ pocketbooks for power-generation investments is utterly dumb. A competitive market exists for that. Full stop.

I have no idea why any utility regulator would let monopoly utilities gamble on AI-based load growth. Letting them fight out of ratepayers’ pocketbooks for power-generation investments is utterly dumb. A competitive market exists for that. Full stop.

1. You make up new "benefits" -- apparently including corporate renewable goals? -- to fit into cost-benefit analysis, weighting it toward an inevitable conclusion that b>c

1. You make up new "benefits" -- apparently including corporate renewable goals? -- to fit into cost-benefit analysis, weighting it toward an inevitable conclusion that b>c

https://twitter.com/TKavulla/status/1616649276758671360

2. This step accomplishes a few things, all of them good:

2. This step accomplishes a few things, all of them good: