Long-Term Investor With A Value Mindset | Focus on Quality Fundamental Analyses and Insights | Join 2500+ readers: https://t.co/XZyrRNC7WI

2 subscribers

How to get URL link on X (Twitter) App

1/ Origin story

1/ Origin story

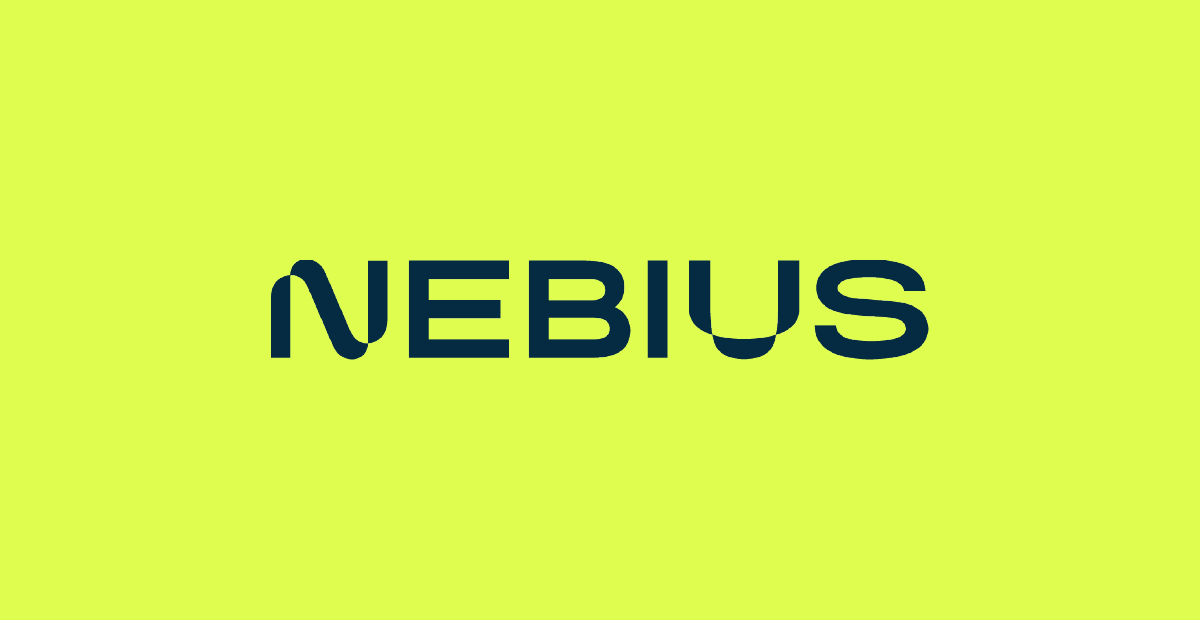

2/ $CRWV | Coreweave

2/ $CRWV | Coreweave

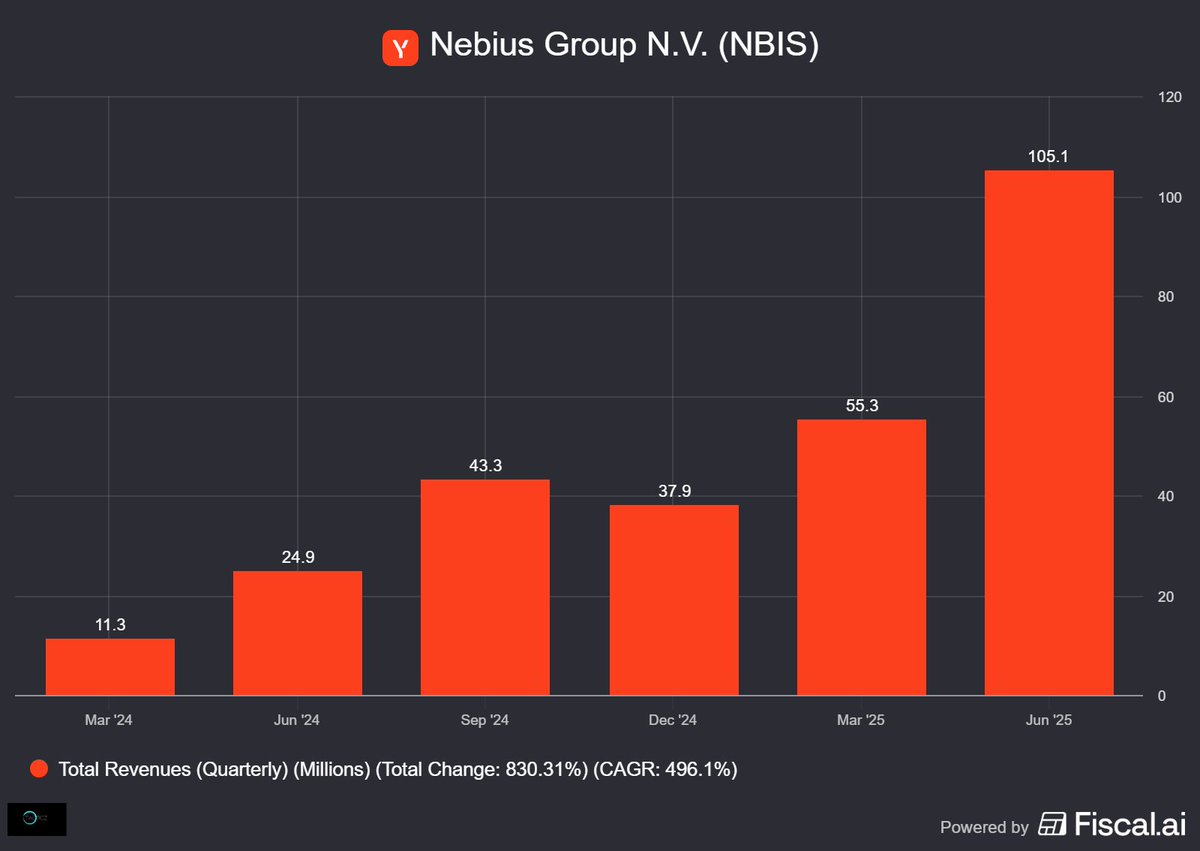

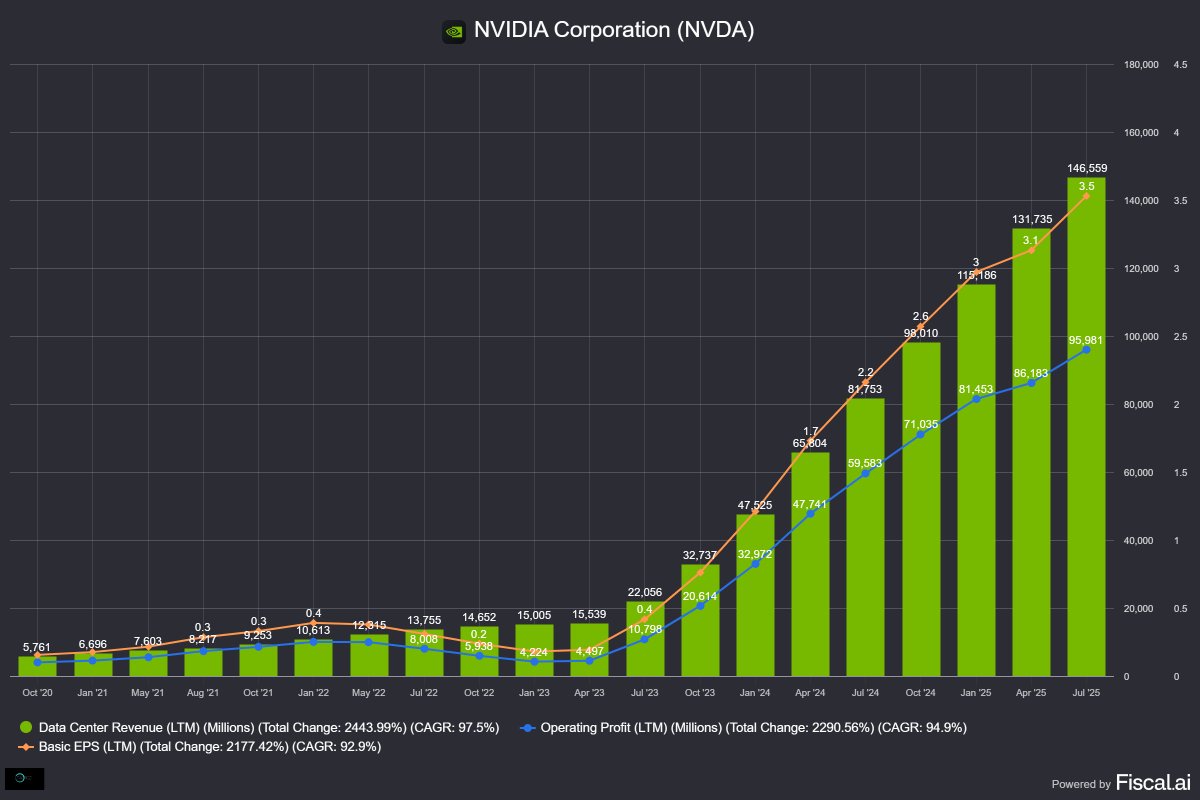

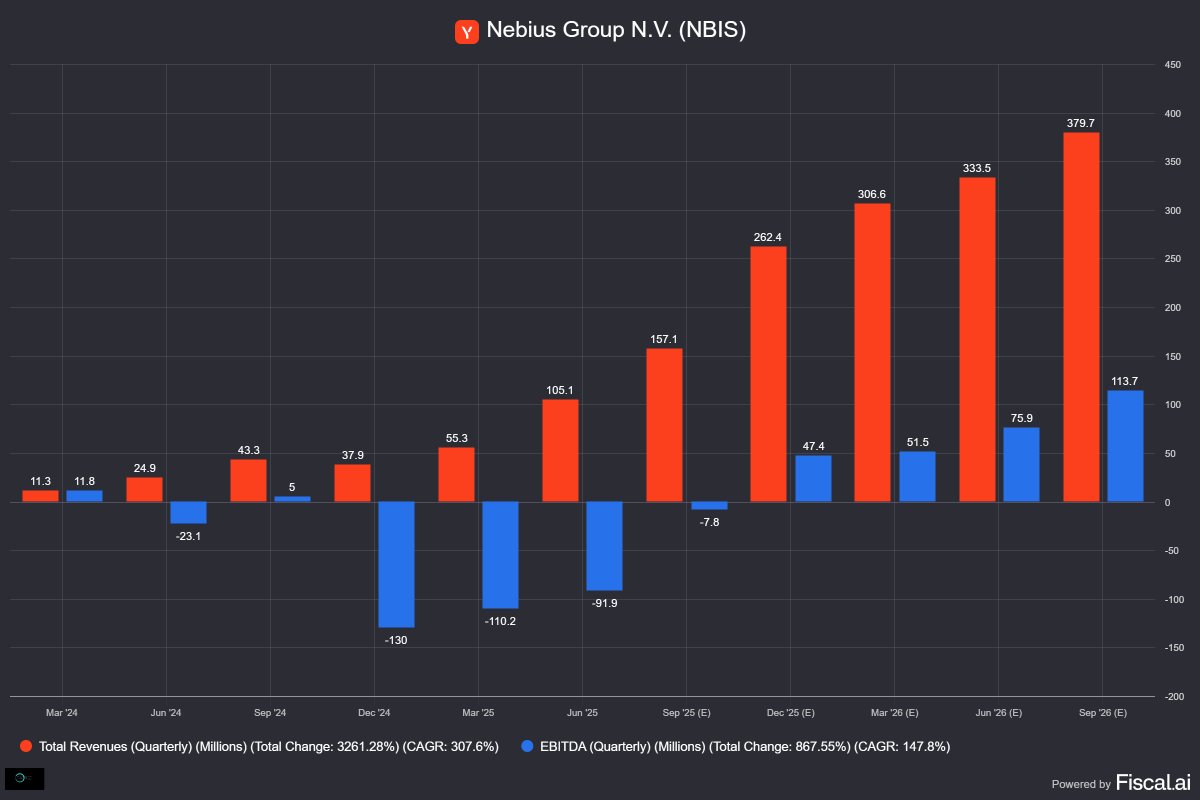

2/ $NBIS | Nebius

2/ $NBIS | Nebius

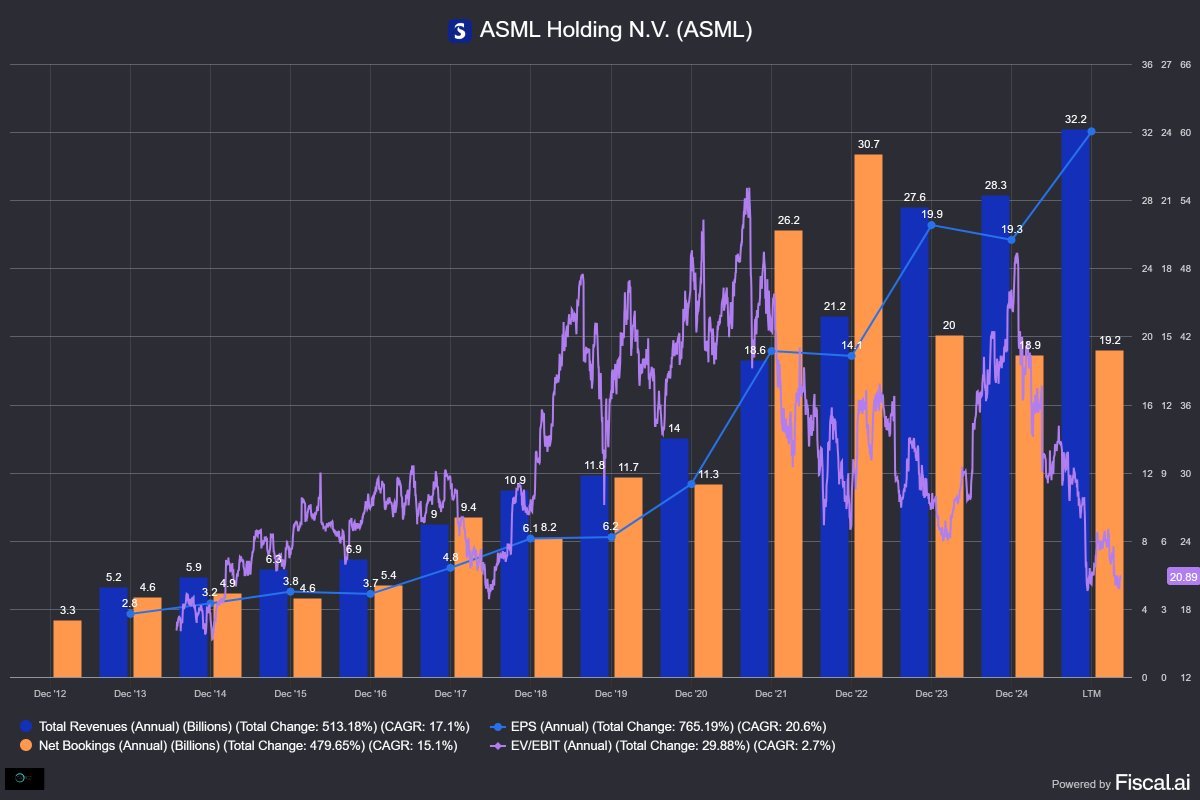

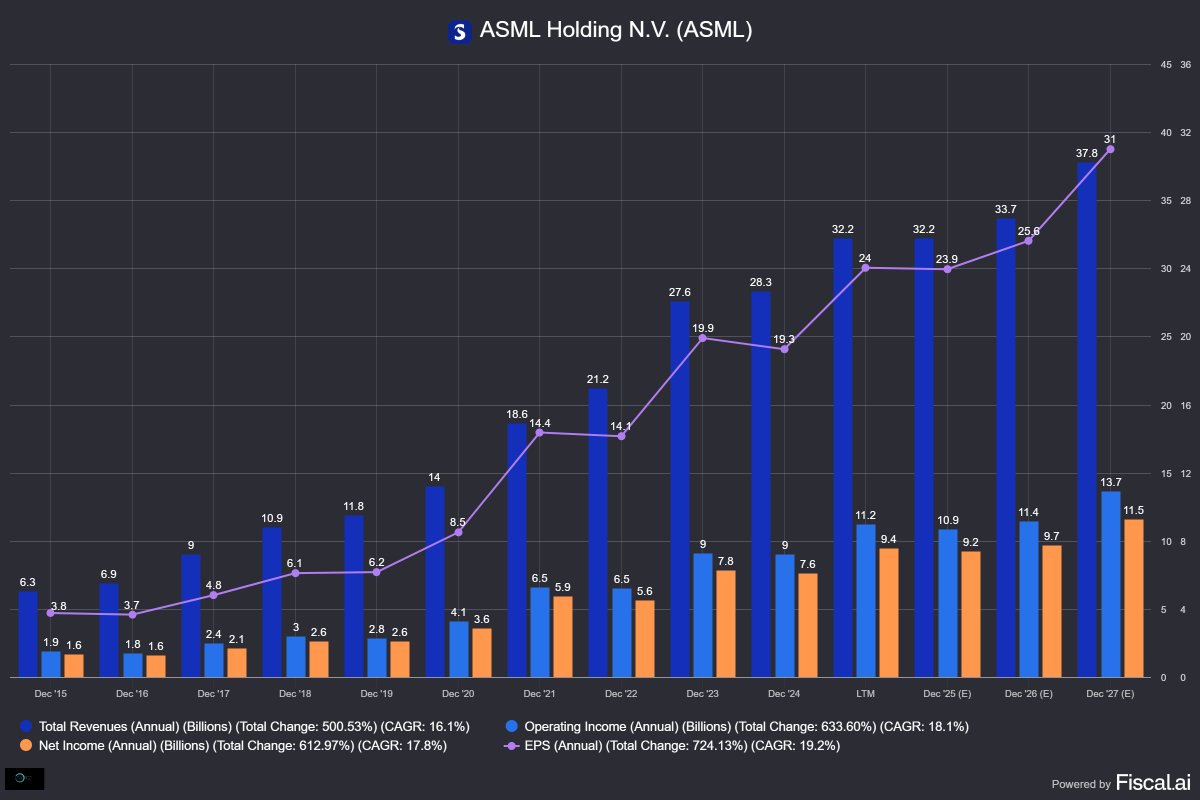

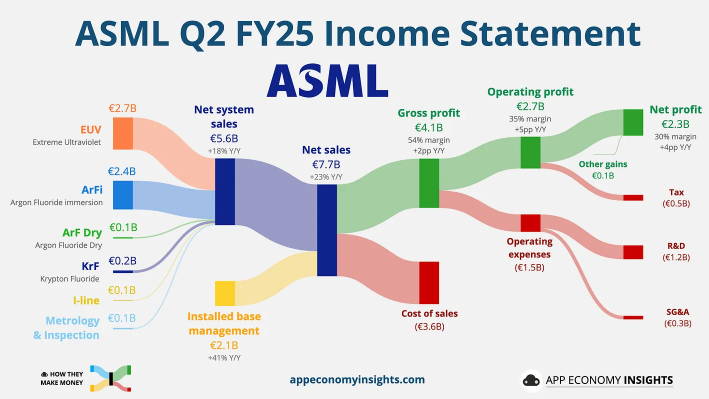

2/ $ASML | ASML

2/ $ASML | ASML

2/ The price collapse

2/ The price collapse

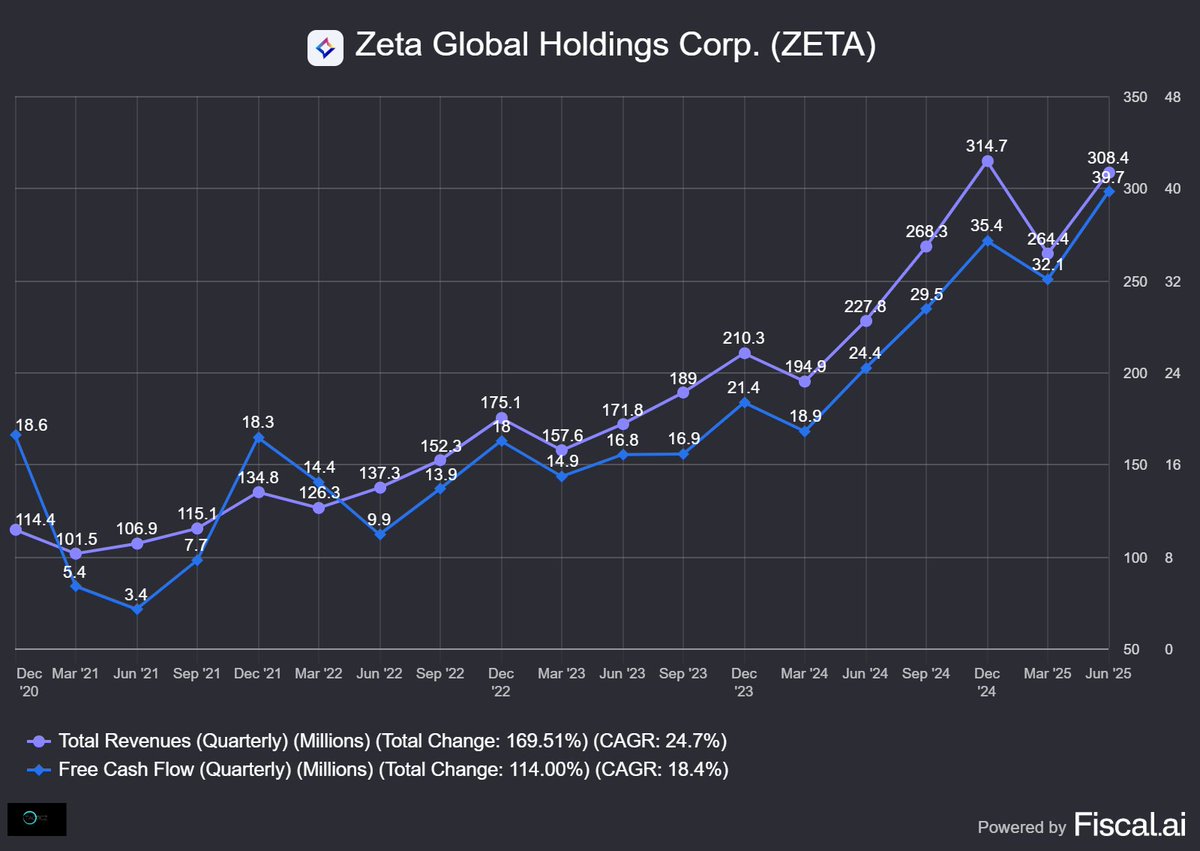

2/ $ZETA | Zeta Holdings

2/ $ZETA | Zeta Holdings

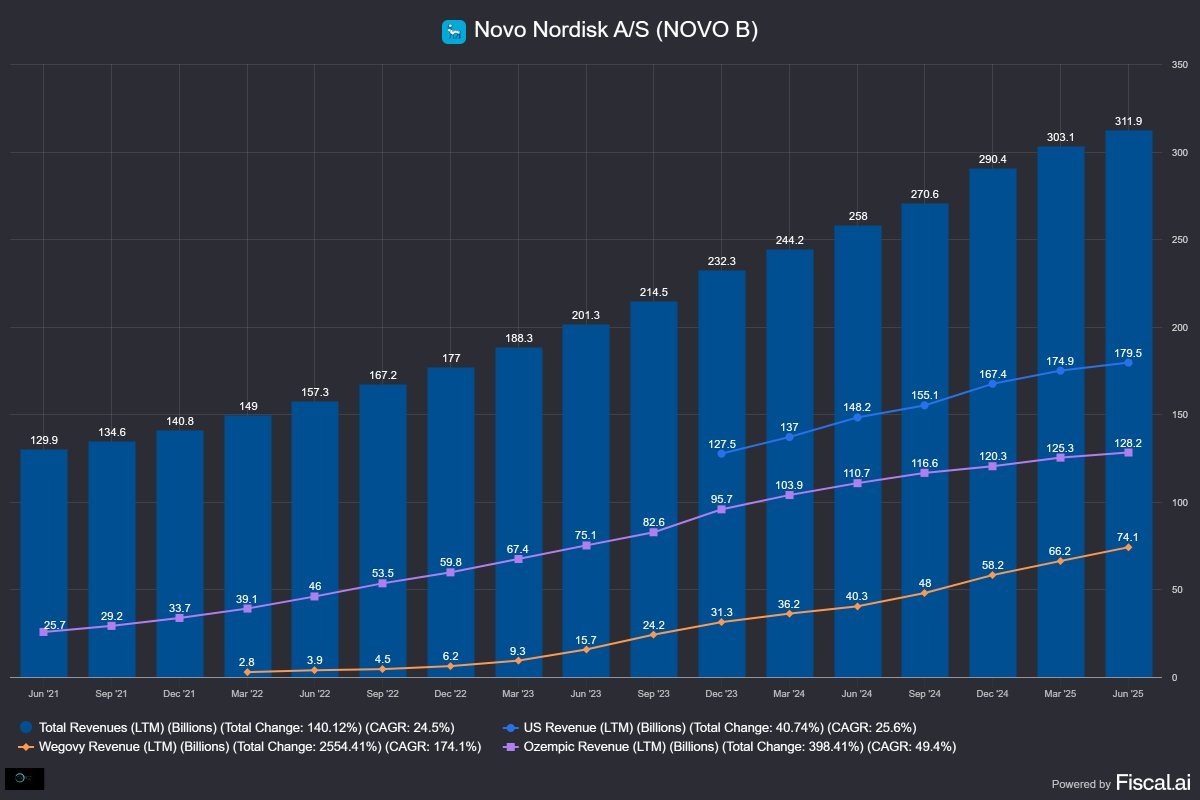

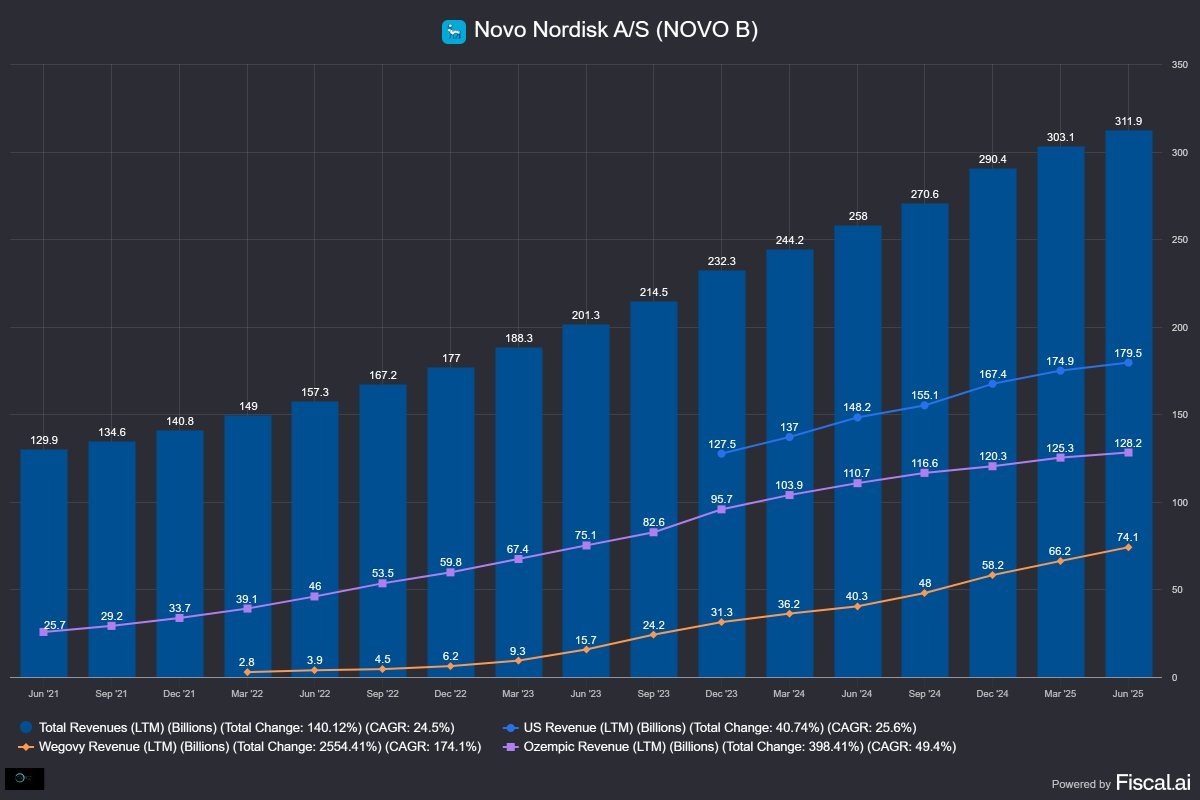

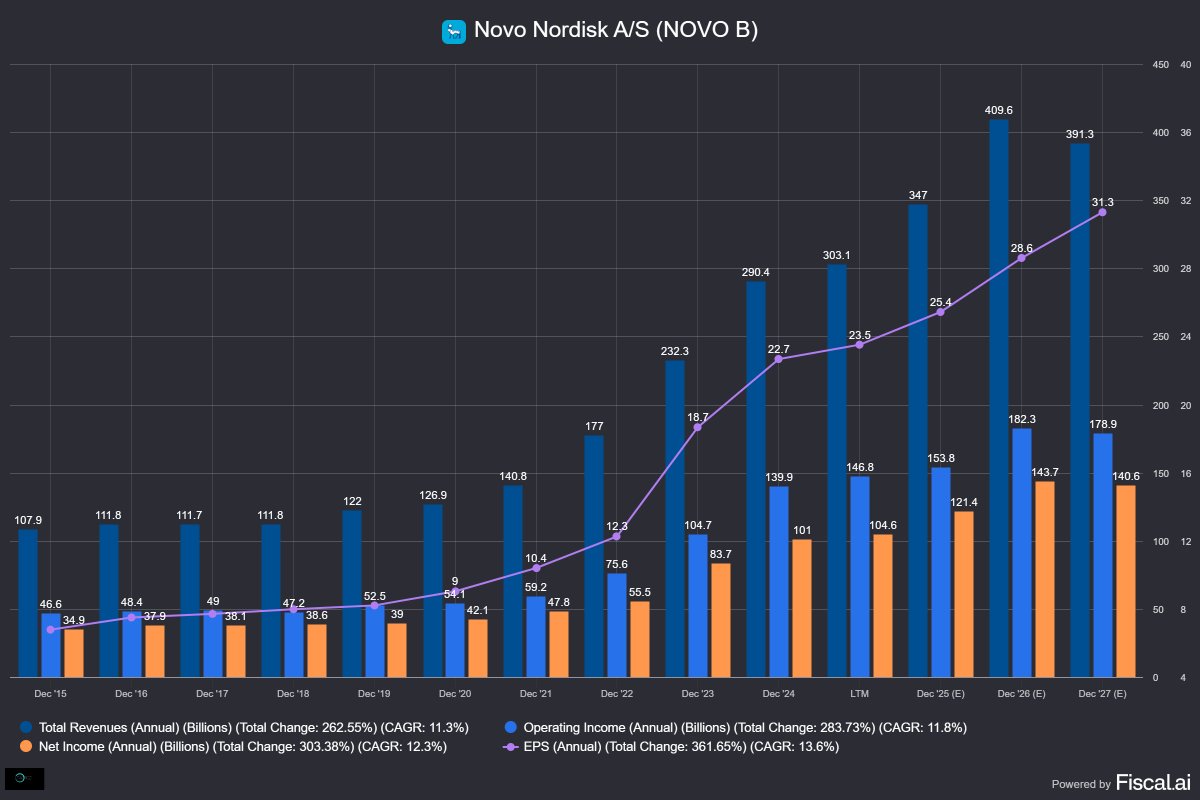

2/ $NVO

2/ $NVO

1/ The Company 🇩🇰

1/ The Company 🇩🇰

1/ $DLO The company 🇺🇾

1/ $DLO The company 🇺🇾

1/ The Company 🇳🇱

1/ The Company 🇳🇱

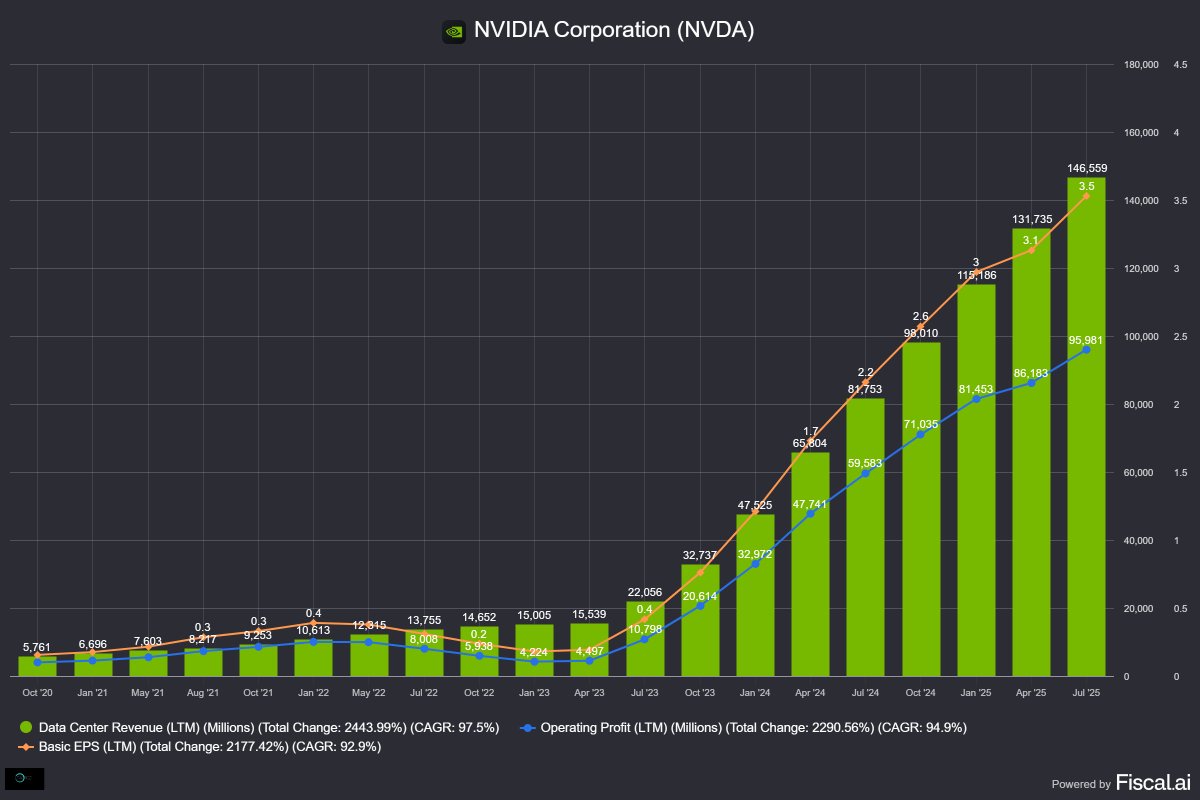

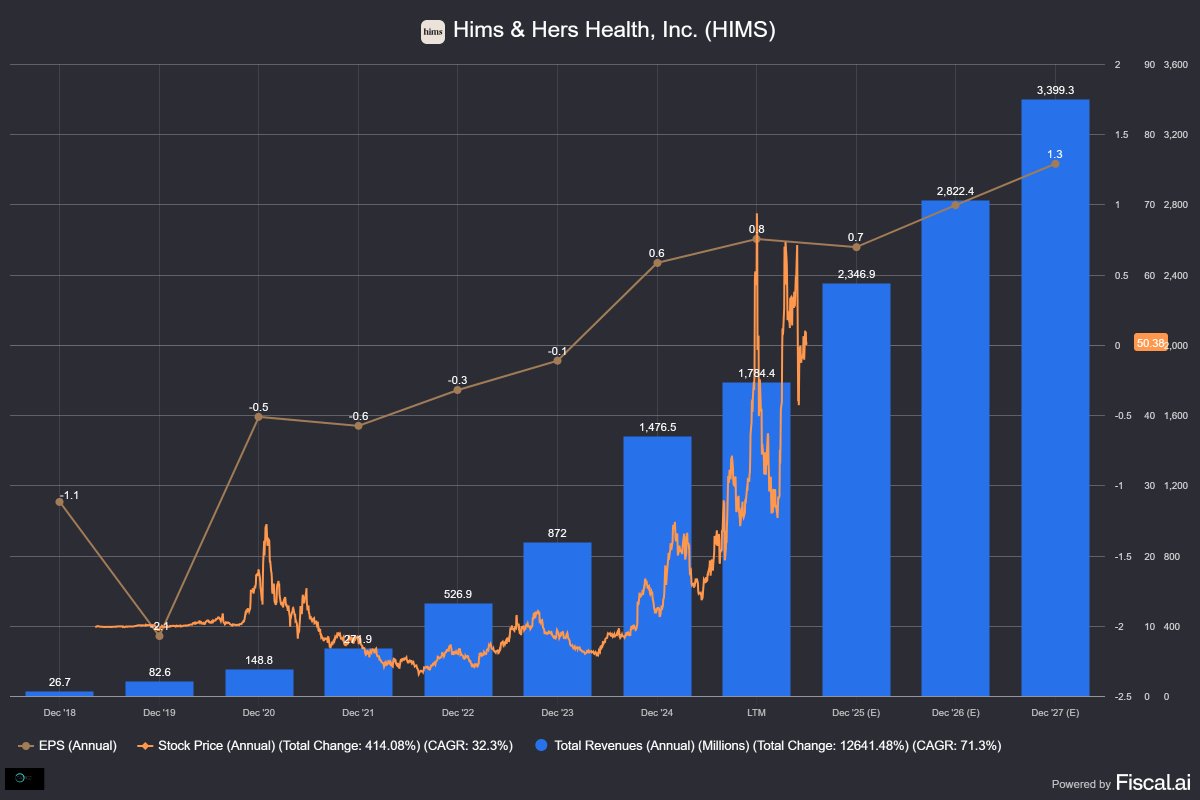

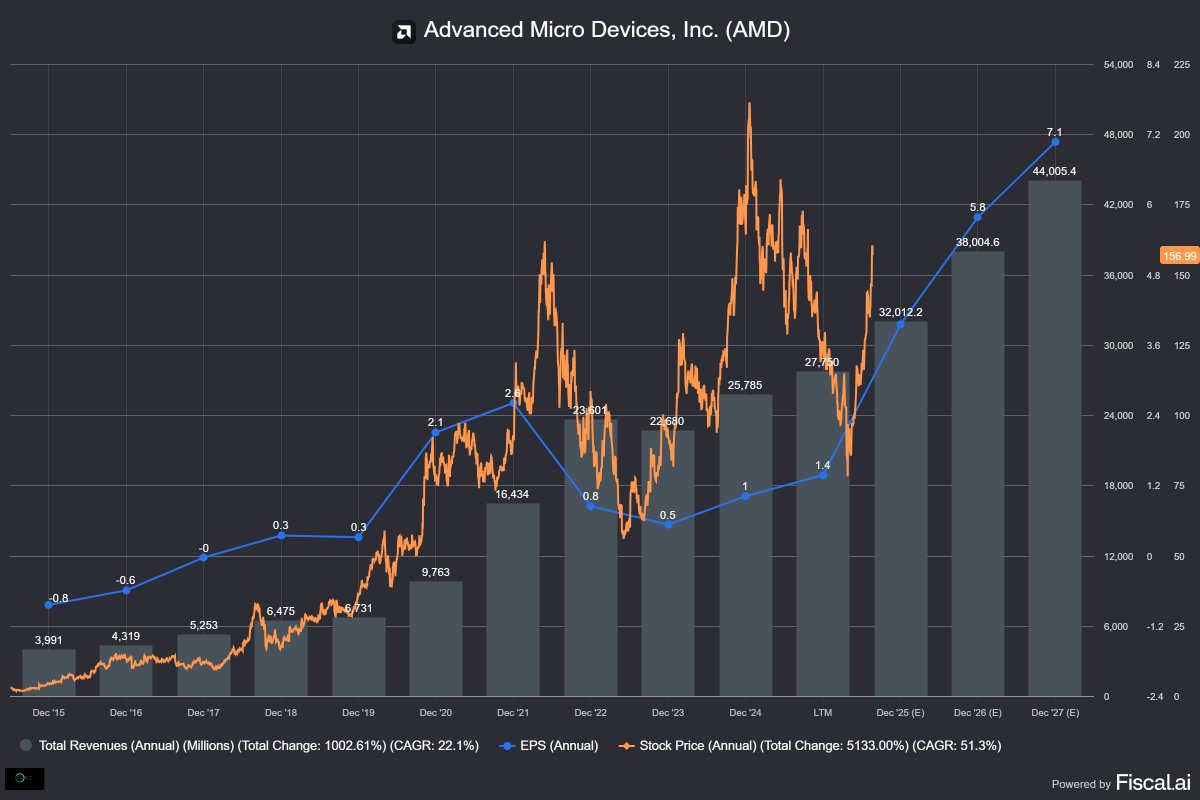

2/ $AMD

2/ $AMD

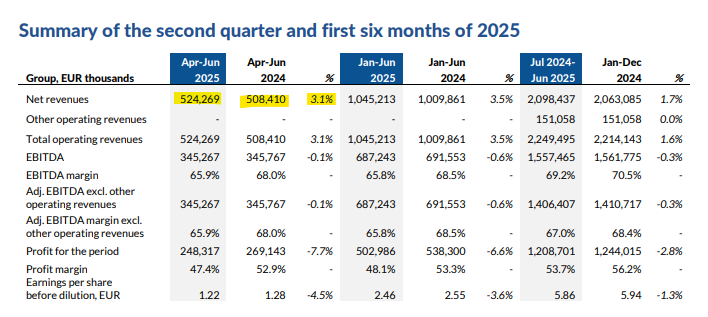

1/ $EVO Revenue growth accelerated

1/ $EVO Revenue growth accelerated

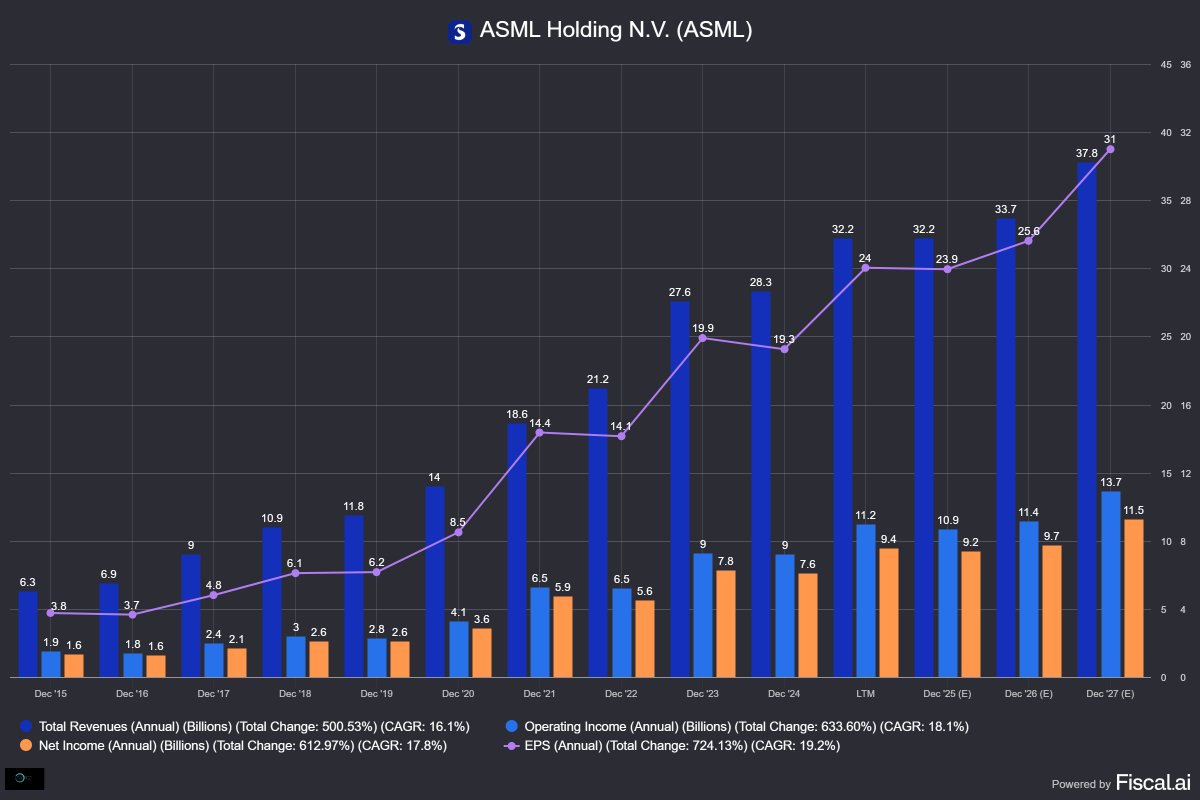

2/ ASML 🇳🇱

2/ ASML 🇳🇱

2/ $DLO

2/ $DLO

2/ $NVO

2/ $NVO

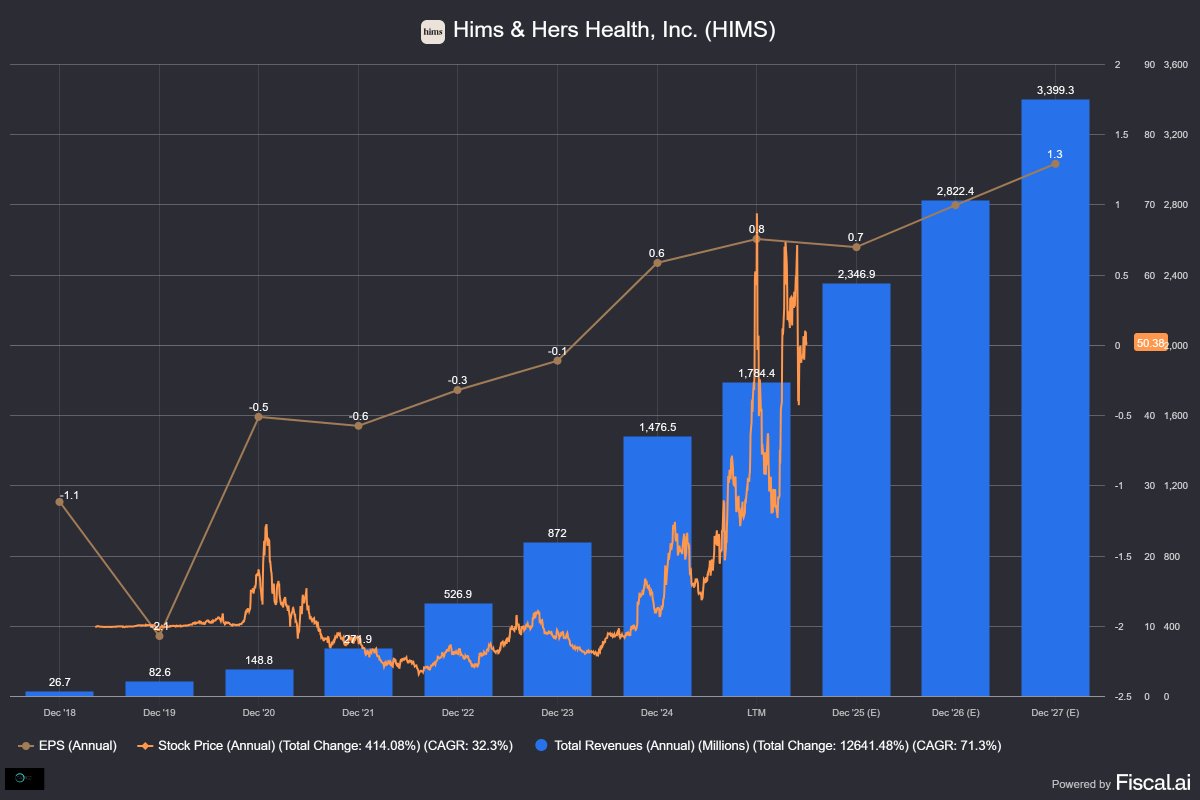

2/ One-stop Shop

2/ One-stop Shop

2/ Sign of confidence

2/ Sign of confidence

2/ $CRWV Coreweave

2/ $CRWV Coreweave

2/ $ASML's Core business

2/ $ASML's Core business

2. The platform

2. The platform