1M+ users | File ITR in 3 minutes, Free Notice Compliance + 365 Days Support | 4.9* Google Rating | 16,000+ reviews

How to get URL link on X (Twitter) App

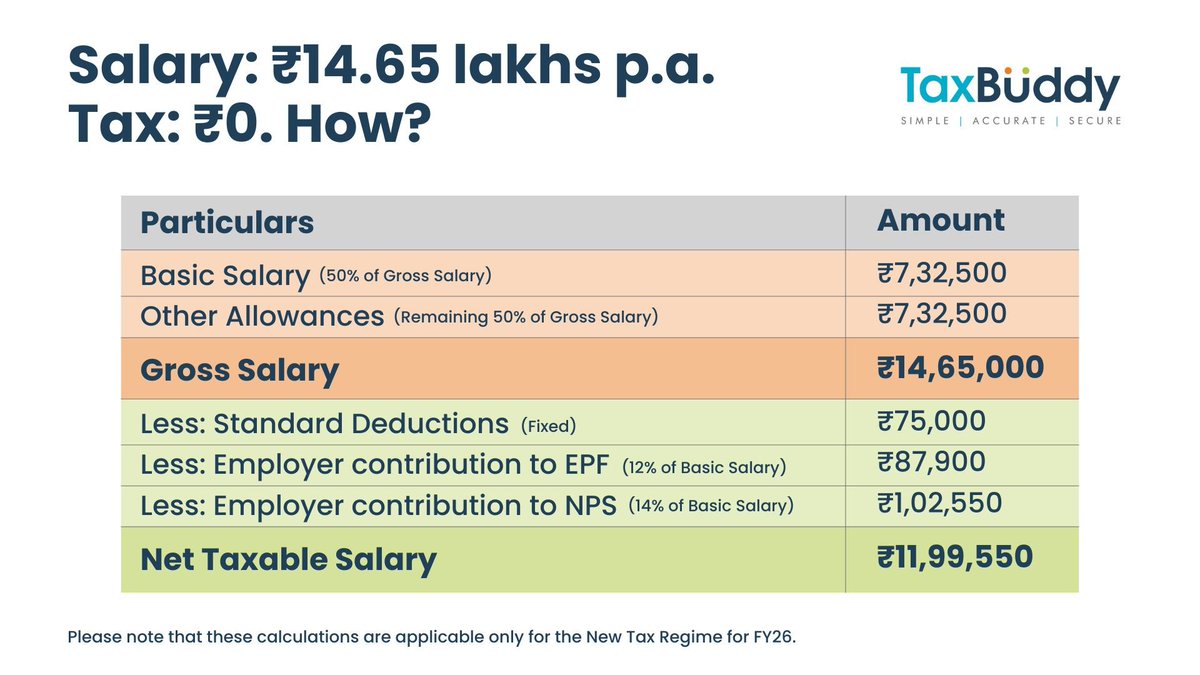

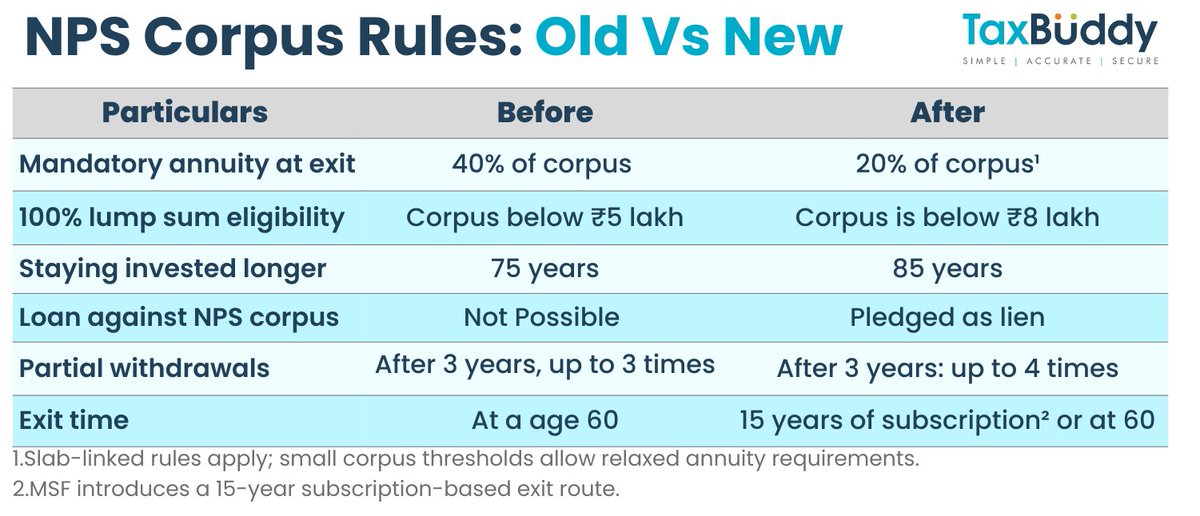

[1] Who gets this upgrade

[1] Who gets this upgrade

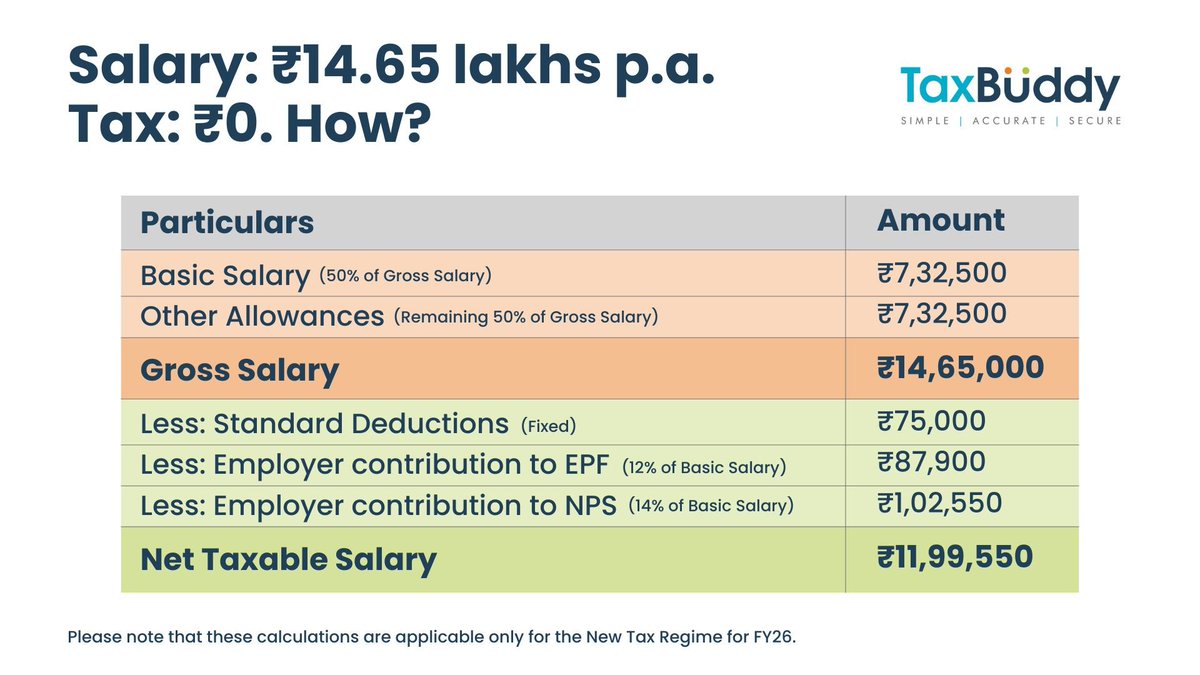

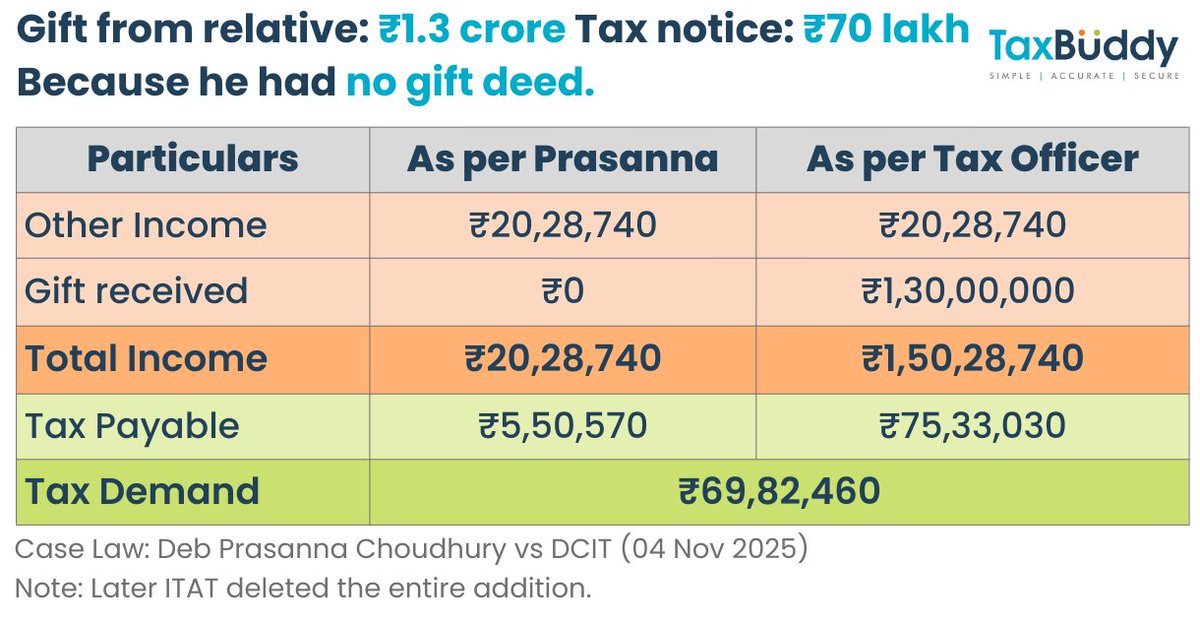

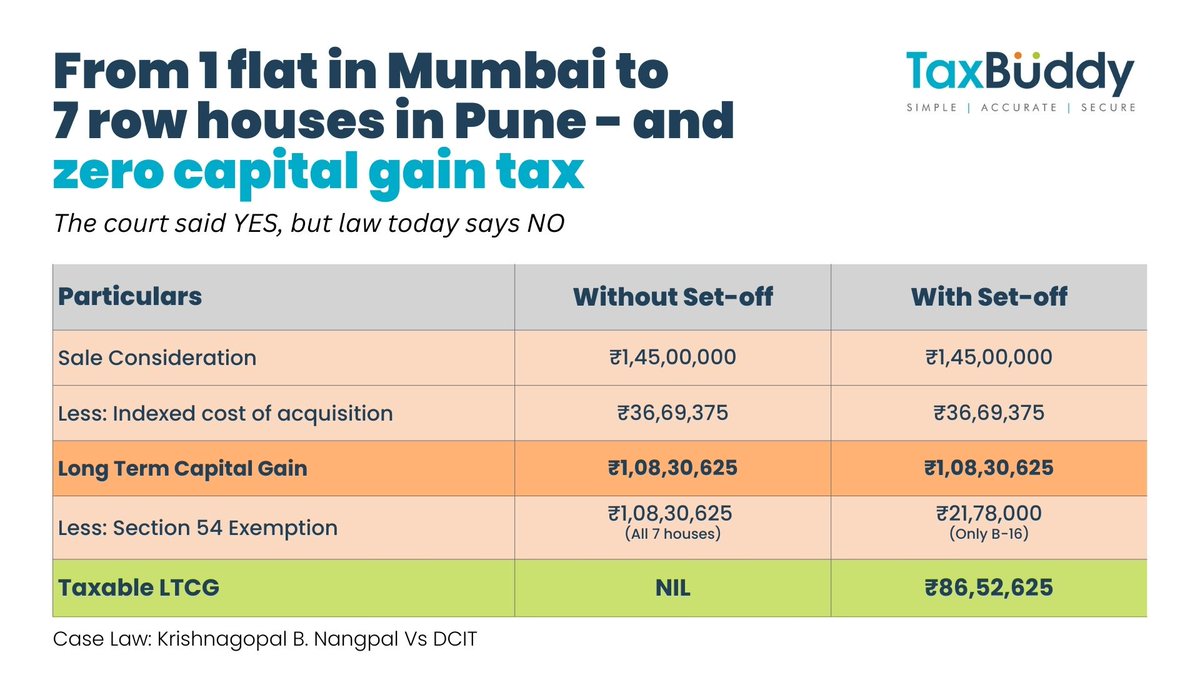

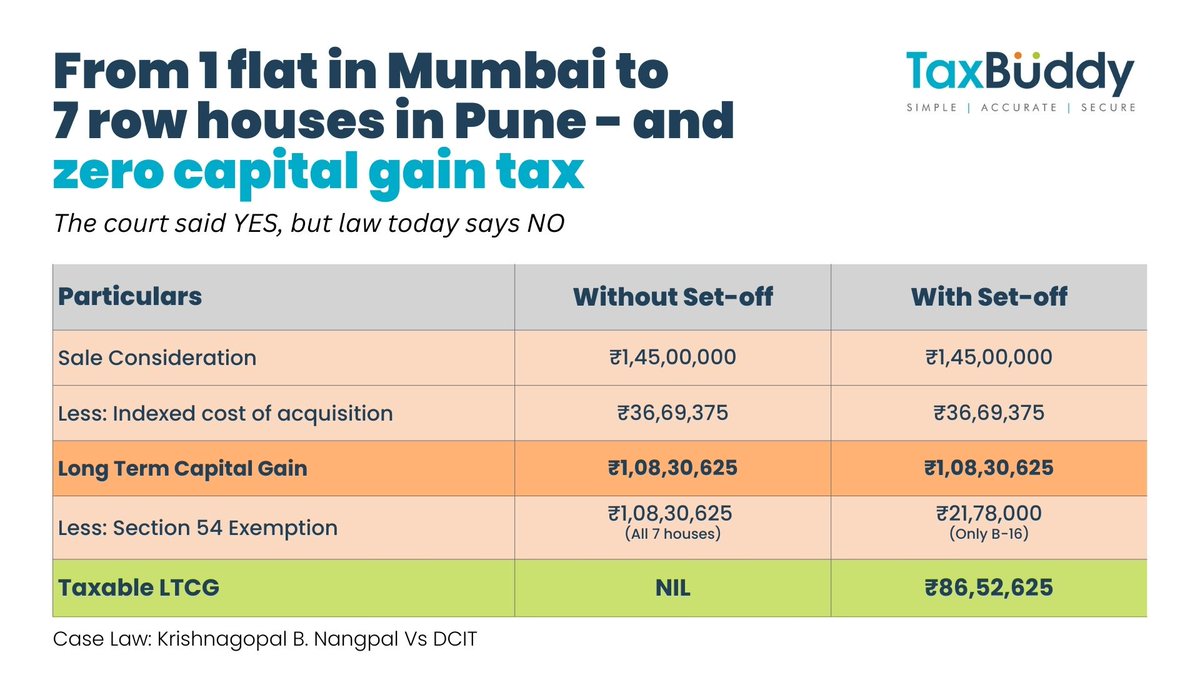

[1] The Case

[1] The Case

[1] Facts of the case

[1] Facts of the case

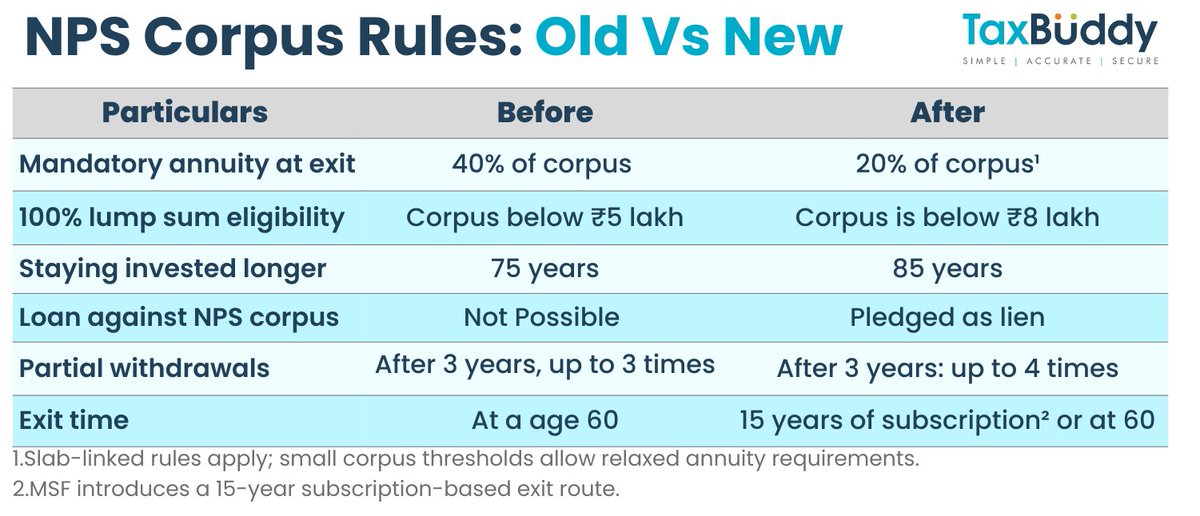

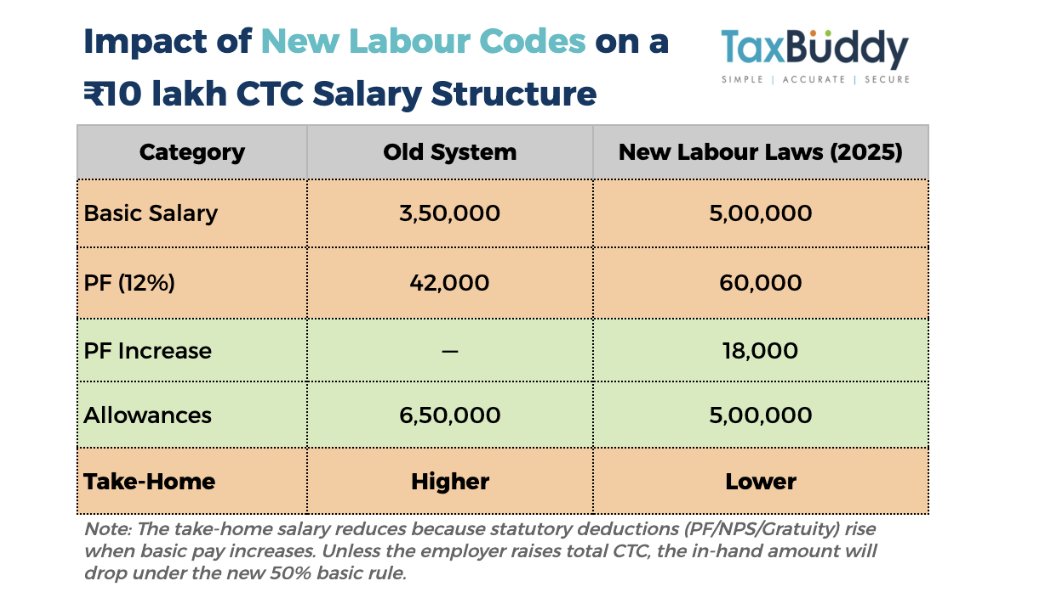

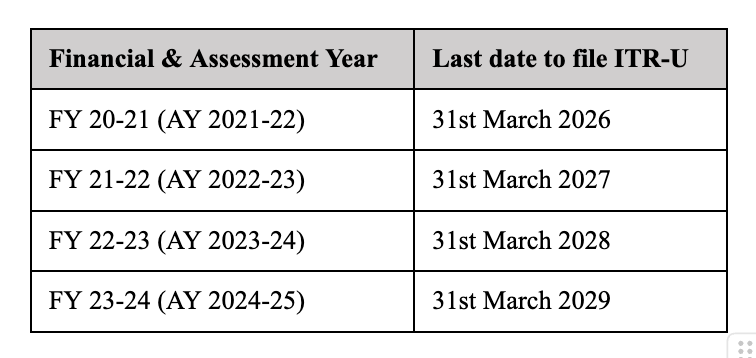

[1] What’s changing

[1] What’s changing

[1] Use tax-free gifts properly

[1] Use tax-free gifts properly

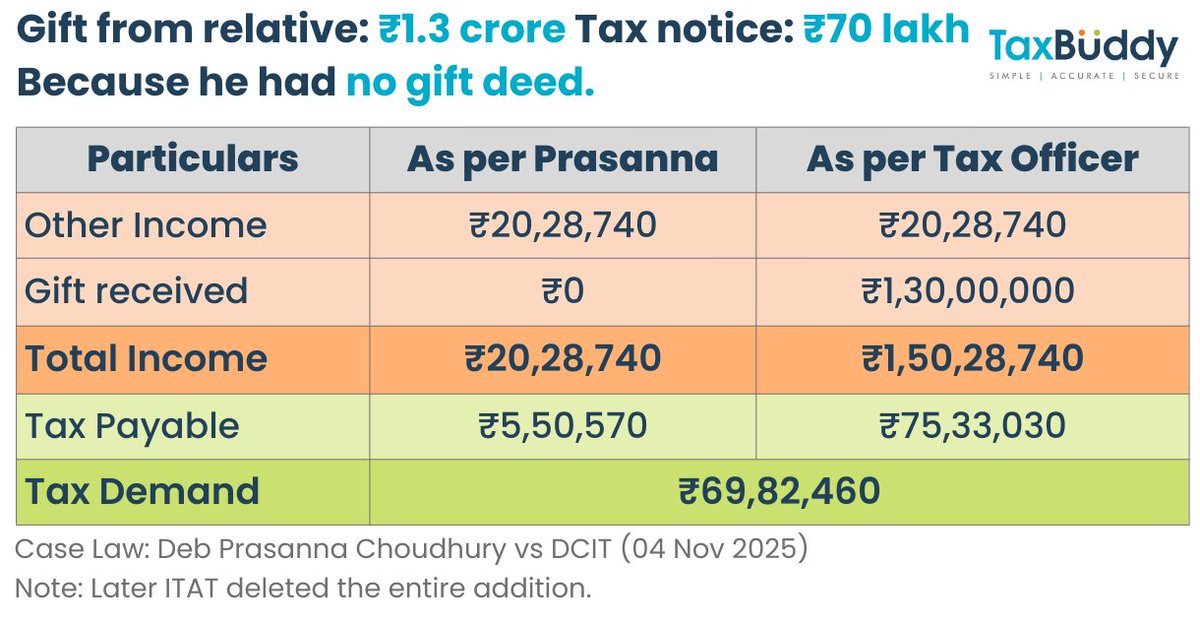

[1] Facts of the case:

[1] Facts of the case:

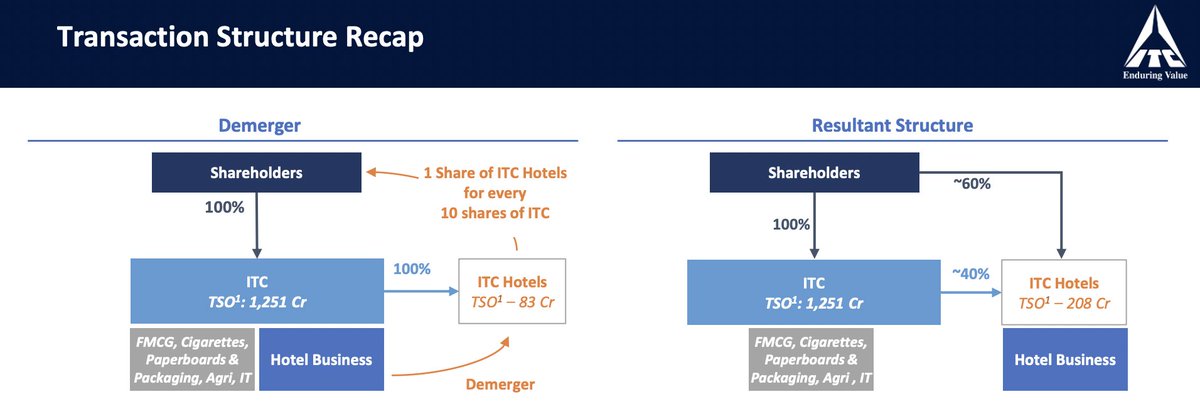

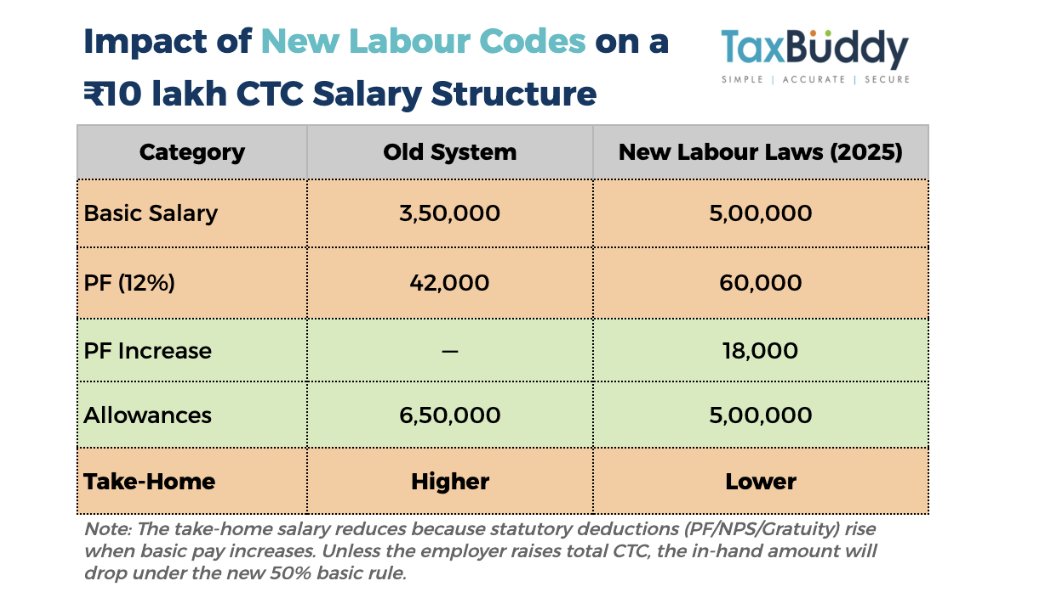

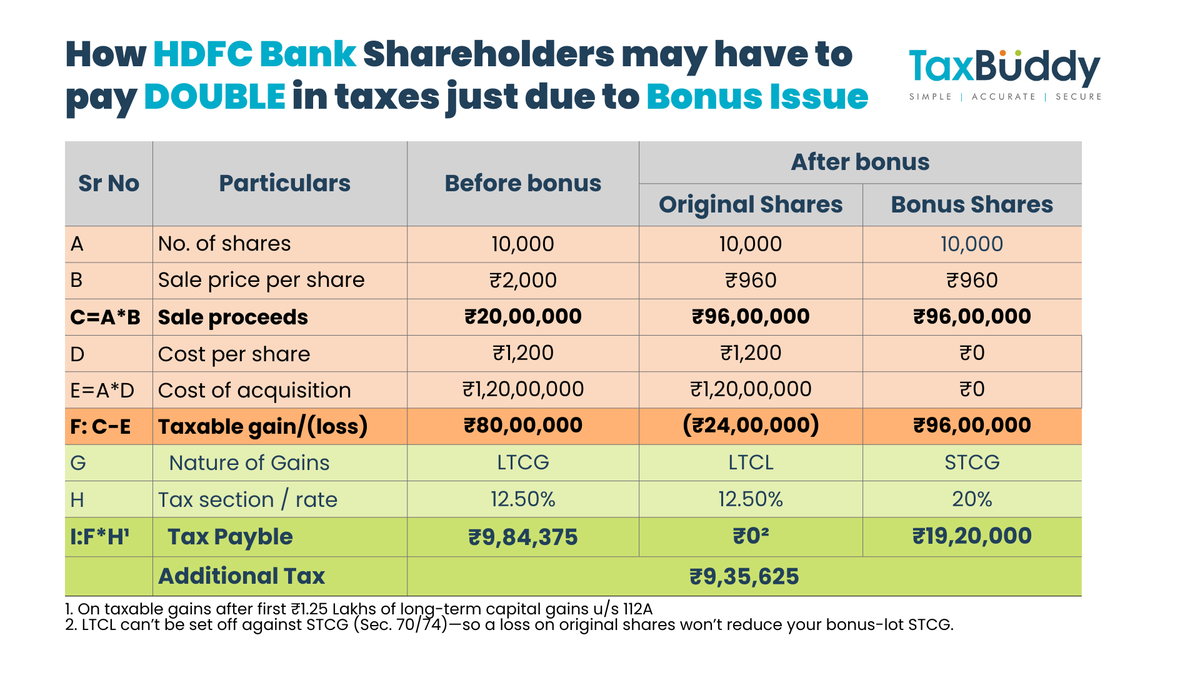

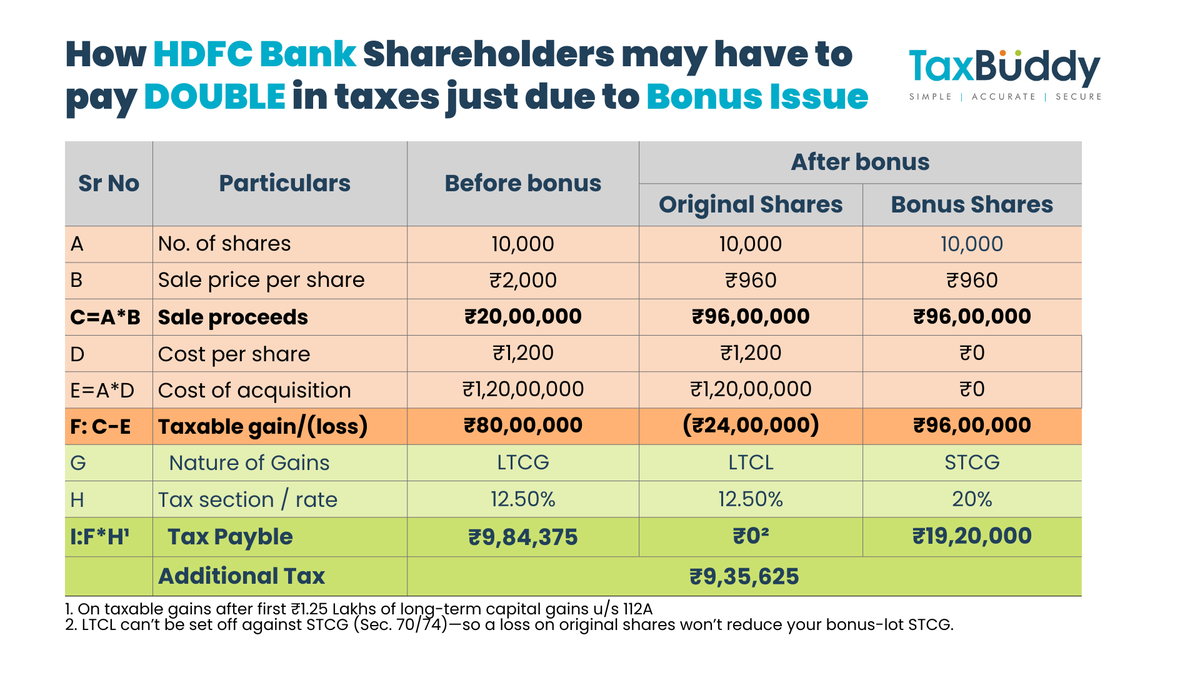

[1] Why a 1:1 bonus looks like a 50% price fall

[1] Why a 1:1 bonus looks like a 50% price fall

[1] Inheritance → Sale → Reinvestment

[1] Inheritance → Sale → Reinvestment

[1] The case

[1] The case