Tech enthusiast | Diving into quantum, AI, & space $IONQ ….| Insights on future-shaping companies🚀 | Follow me!

How to get URL link on X (Twitter) App

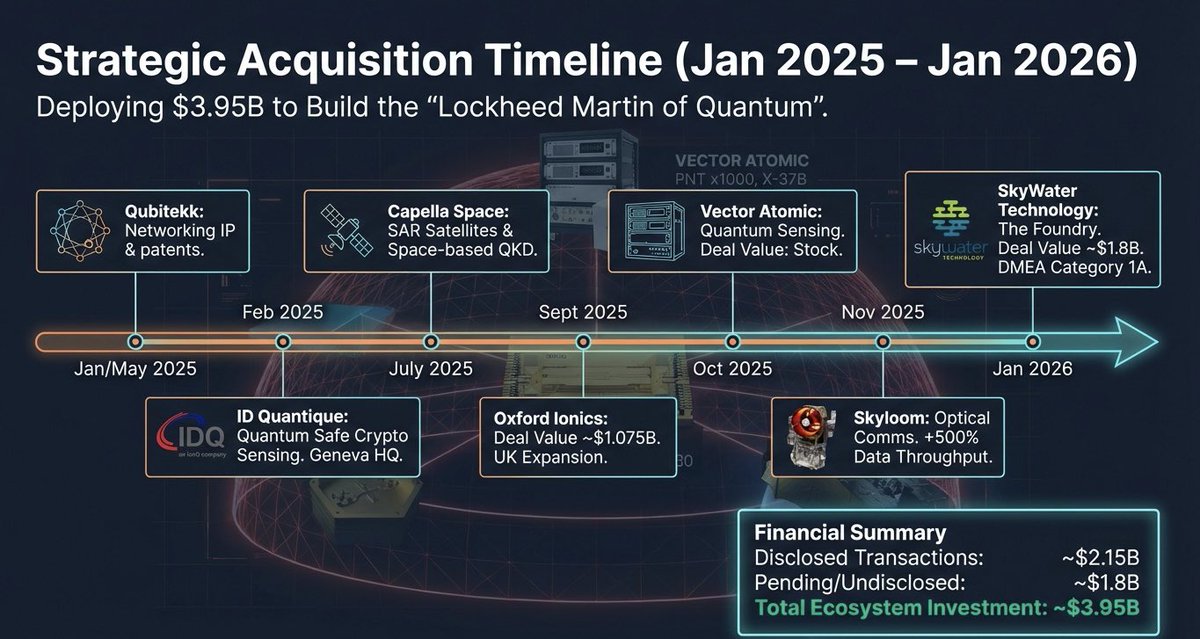

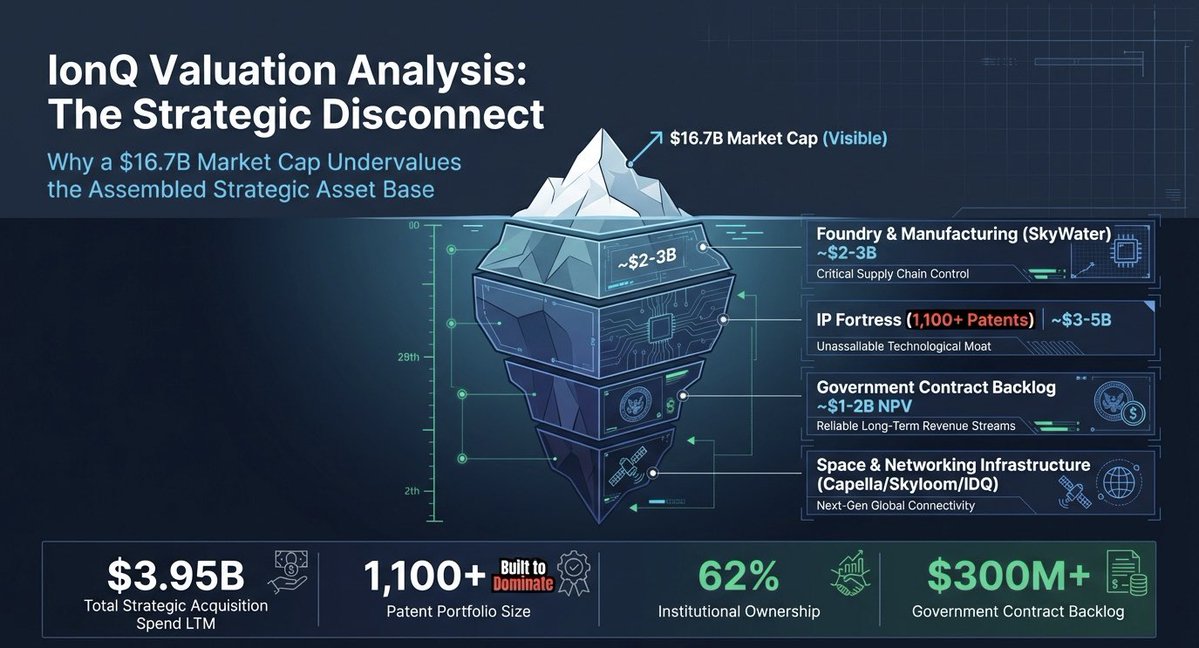

STRATEGIC ACQUISITION TIMELINE: $3.95B Investment Building Vertical Integration

STRATEGIC ACQUISITION TIMELINE: $3.95B Investment Building Vertical Integration