Founder of The Profit Zone (newsletter) and The Profit Academy (community) | Teaching every day investors how to build wealth using the stock market | NFA

How to get URL link on X (Twitter) App

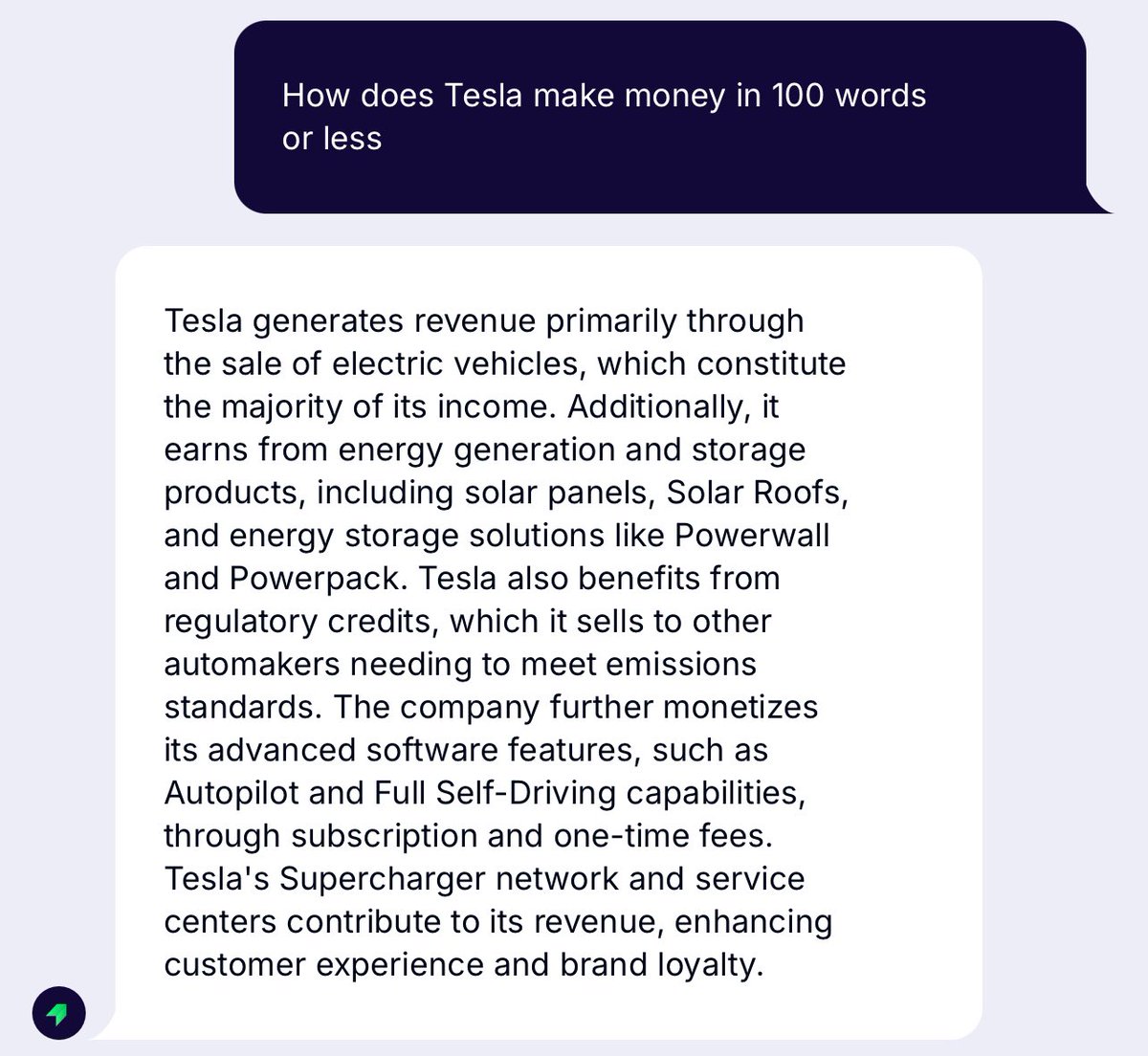

$VTI seeks to provide broader exposure to the entire U.S. market, holding a mixture of small-cap and large-cap stocks

$VTI seeks to provide broader exposure to the entire U.S. market, holding a mixture of small-cap and large-cap stocks

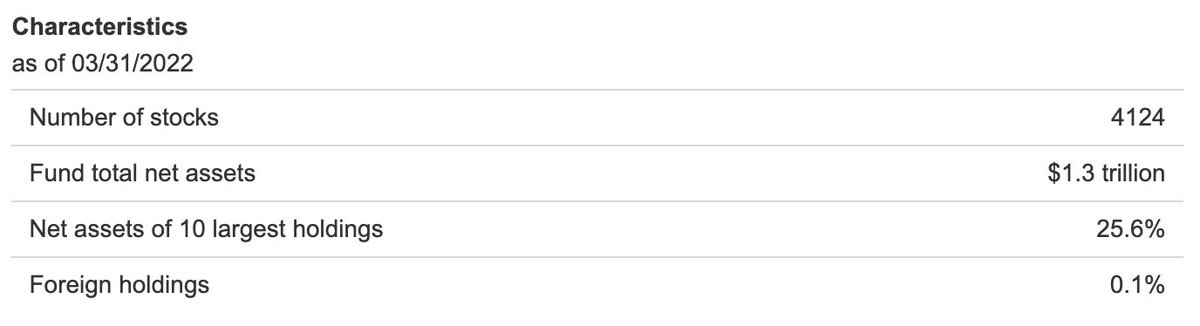

There are actually more than 500 companies in the S&P 500 because some stocks trade under dual tickers

There are actually more than 500 companies in the S&P 500 because some stocks trade under dual tickers

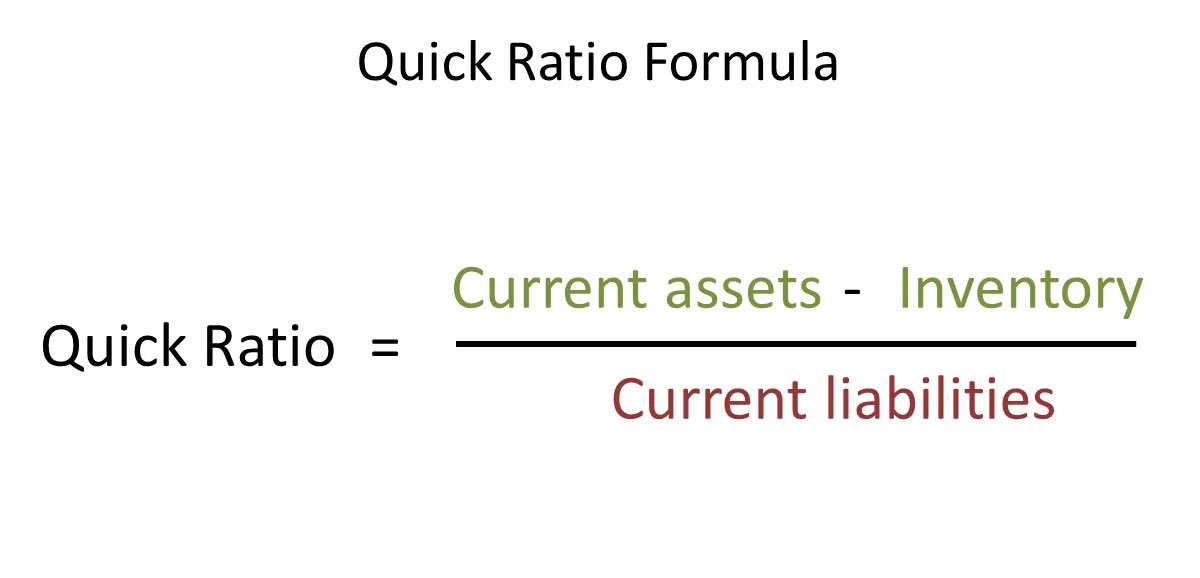

Lesson #1

Lesson #1