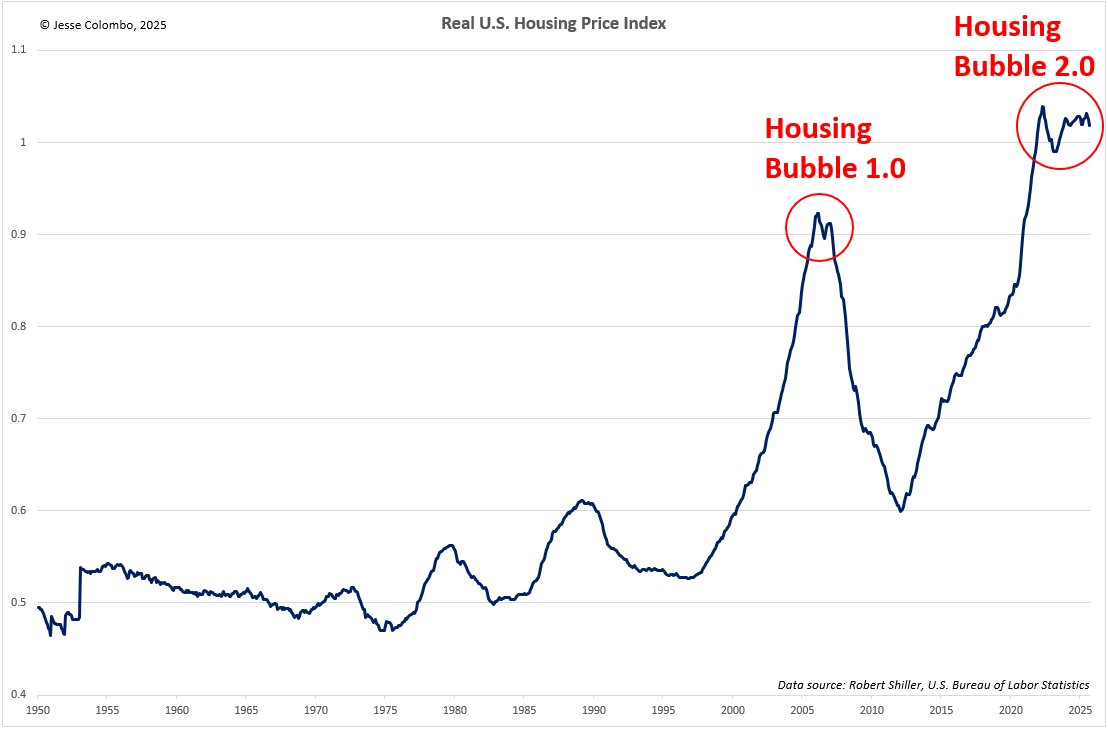

Publisher of the best-selling precious metals newsletter, The Bubble Bubble Report. Recognized by the London Times for predicting the Global Financial Crisis.

How to get URL link on X (Twitter) App

To learn much more about the massive U.S. housing bubble, stock market bubble, and many other bubbles currently developing around the world, I recommend signing up as a free or paid subscriber to my best-selling Substack newsletter, The Bubble Bubble Report:

To learn much more about the massive U.S. housing bubble, stock market bubble, and many other bubbles currently developing around the world, I recommend signing up as a free or paid subscriber to my best-selling Substack newsletter, The Bubble Bubble Report:

Here's the link—

Here's the link—

2) The highly accurate New York Fed Recession Probability Model shows that the economy is almost guaranteed to be in a recession—particularly because it's turning down, which is what happens once the recession starts.

2) The highly accurate New York Fed Recession Probability Model shows that the economy is almost guaranteed to be in a recession—particularly because it's turning down, which is what happens once the recession starts.

After the October 18th breakout, the banking cartel essentially engineered silver lower to prevent them from losing on their short position.

After the October 18th breakout, the banking cartel essentially engineered silver lower to prevent them from losing on their short position.https://x.com/TheBubbleBubble/status/1854301421971050985

2) Here's the link to my new report:

2) Here's the link to my new report:

2) The first condition is straightforward yet largely overlooked by investors and has proven surprisingly challenging to achieve:

2) The first condition is straightforward yet largely overlooked by investors and has proven surprisingly challenging to achieve:

2) While silver has been acting soggy in recent months, the good news is that it closed above an important downtrend line that was looming over its head for months.

2) While silver has been acting soggy in recent months, the good news is that it closed above an important downtrend line that was looming over its head for months.

2) When priced in other major currencies, gold had made little to no progress since April. The silver lining, however, was that gold was poised to enter a much stronger bull market once it achieved a breakout across all major currencies.

2) When priced in other major currencies, gold had made little to no progress since April. The silver lining, however, was that gold was poised to enter a much stronger bull market once it achieved a breakout across all major currencies.

2) Here's gold priced in euros. It hasn't broken out yet:

2) Here's gold priced in euros. It hasn't broken out yet:

Please read my recent report to understand the significance of today's silver breakout:

Please read my recent report to understand the significance of today's silver breakout:

Did you know that the U.S. dollar lost roughly 50% of its purchasing power since the year 2000?!

Did you know that the U.S. dollar lost roughly 50% of its purchasing power since the year 2000?! https://twitter.com/TheBubbleBubble/status/1764663801427743206

Since the early-2000s, gold has been in a confirmed uptrend according to the most widely accepted tenets of technical analysis.

Since the early-2000s, gold has been in a confirmed uptrend according to the most widely accepted tenets of technical analysis.

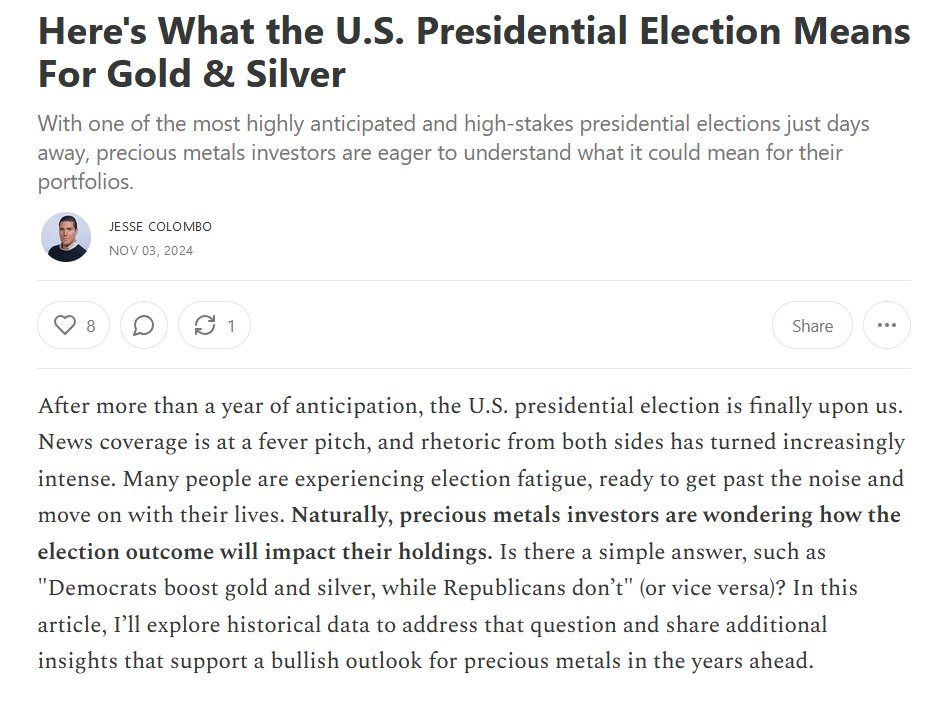

When central banks run financial toxic waste (most crypto, SPACs, tech stocks, etc.) up to the moon, ignorance gets rewarded & we collectively become more ignorant.

When central banks run financial toxic waste (most crypto, SPACs, tech stocks, etc.) up to the moon, ignorance gets rewarded & we collectively become more ignorant.https://twitter.com/TheBubbleBubble/status/1485684766666108933

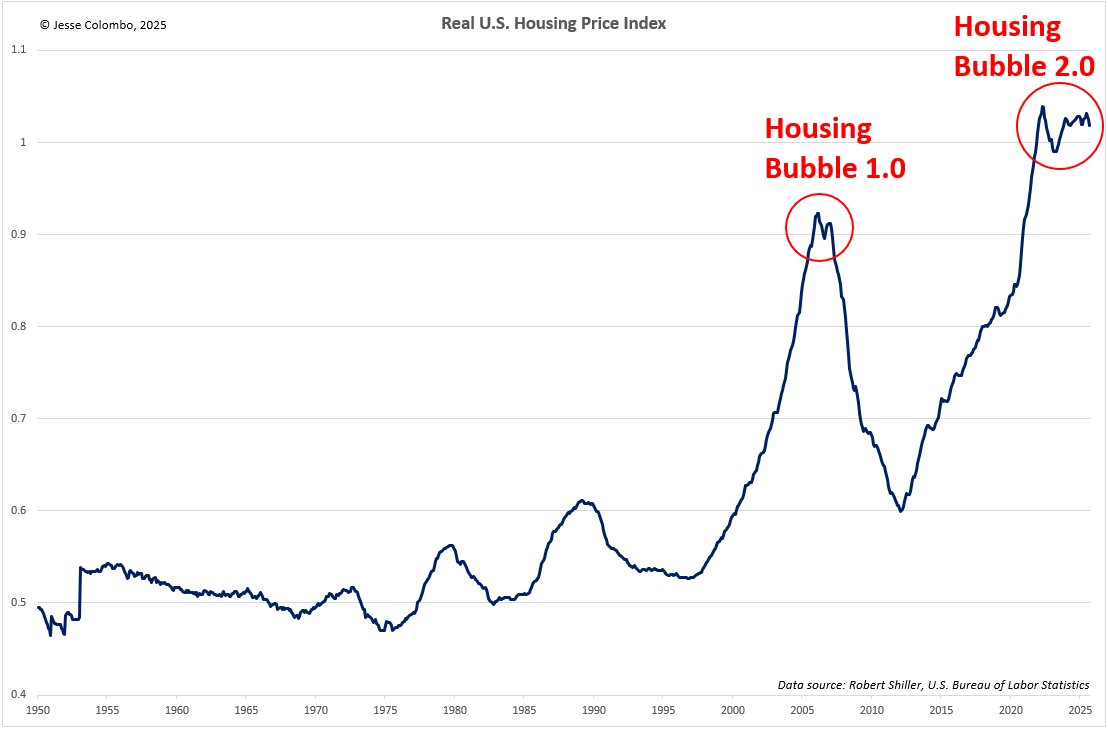

The spurious global economic boom since 2009 is largely based on bubbles like this. It's happening virtually everywhere at this point.

The spurious global economic boom since 2009 is largely based on bubbles like this. It's happening virtually everywhere at this point. https://twitter.com/TheBubbleBubble/status/1484235831321808902

As with heroin addiction, the economy builds up a tolerance to stimulus and requires more and more to prevent "dope sickness."

As with heroin addiction, the economy builds up a tolerance to stimulus and requires more and more to prevent "dope sickness."https://twitter.com/TheBubbleBubble/status/1365007195058958339?s=20

Here’s the backstory for those who don’t know:

Here’s the backstory for those who don’t know:https://twitter.com/TheBubbleBubble/status/1317970110313910273?s=20

Bitcoin has long been on my list of favorite alternative investments, but I’ve never been a fanatic like much of the HODLer community.

Bitcoin has long been on my list of favorite alternative investments, but I’ve never been a fanatic like much of the HODLer community.https://twitter.com/TheBubbleBubble/status/1131971143139811331?s=20

https://twitter.com/Sseeji/status/1362106201694035969?s=20People laugh at me for being a prepper.

https://twitter.com/TheBubbleBubble/status/1317970110313910273?s=20

https://twitter.com/TheBubbleBubble/status/1361761183695446019?s=20

Fund Manager Mark Yusko: US stocks are in a bubble - "Look at the parabolic moves by a number of companies like Tesla": cnn.com/2021/02/08/inv… @MarkYusko @MattEganCNN $TSLA $QQQ

Fund Manager Mark Yusko: US stocks are in a bubble - "Look at the parabolic moves by a number of companies like Tesla": cnn.com/2021/02/08/inv… @MarkYusko @MattEganCNN $TSLA $QQQ