Macro cycles. Liquidity. Risk.

Signal over noise.

Focused on regime shifts that move markets.

Research & commentary.

10 subscribers

How to get URL link on X (Twitter) App

2/ Momentum is fading. Structure is complete. The poster child of the rally is stretched thin. Yet everyone thinks it's “just consolidating.” They’re sleepwalking into the edge.

2/ Momentum is fading. Structure is complete. The poster child of the rally is stretched thin. Yet everyone thinks it's “just consolidating.” They’re sleepwalking into the edge.

1) The top doesn’t announce itself.

1) The top doesn’t announce itself.

1/ Late 1999 - The Climax of Exuberance: The Nasdaq surges, driven by tech and internet stocks. It’s a frenzy of IPOs with valuations based on potential rather than profit. Alan Greenspan, then Fed Chairman, warns of “irrational exuberance” in the markets.

1/ Late 1999 - The Climax of Exuberance: The Nasdaq surges, driven by tech and internet stocks. It’s a frenzy of IPOs with valuations based on potential rather than profit. Alan Greenspan, then Fed Chairman, warns of “irrational exuberance” in the markets.

1/ Debt accumulation by consumers, businesses, or governments means future spending is brought forward. This spending creates a temporary boost in economic activity but at the cost of future demand.

1/ Debt accumulation by consumers, businesses, or governments means future spending is brought forward. This spending creates a temporary boost in economic activity but at the cost of future demand.

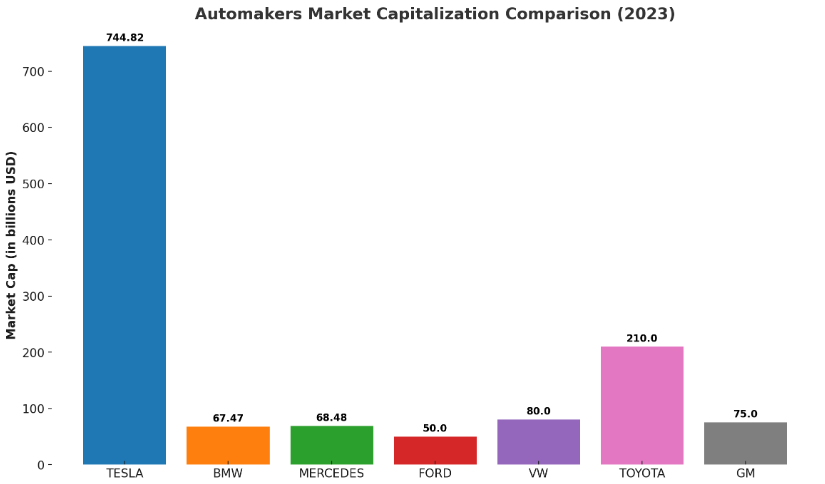

1/10 Overblown Valuation?: Tesla's staggering $744.82 billion market cap overshadows BMW's $67.47 billion and Mercedes's $68.48 billion by over 10 times. Considering Tesla's lower car sales volumes, this valuation discrepancy is hard to justify.

1/10 Overblown Valuation?: Tesla's staggering $744.82 billion market cap overshadows BMW's $67.47 billion and Mercedes's $68.48 billion by over 10 times. Considering Tesla's lower car sales volumes, this valuation discrepancy is hard to justify.

2) Emerging markets are the leading edge of this implosion but the U.S. equity markets will suffer as well. High quality bonds, particularly Treasuries, will be in big demand as investors seek shelter from the storm.

2) Emerging markets are the leading edge of this implosion but the U.S. equity markets will suffer as well. High quality bonds, particularly Treasuries, will be in big demand as investors seek shelter from the storm.