● System Trader

● Risk: Max 1% loss of capital per day

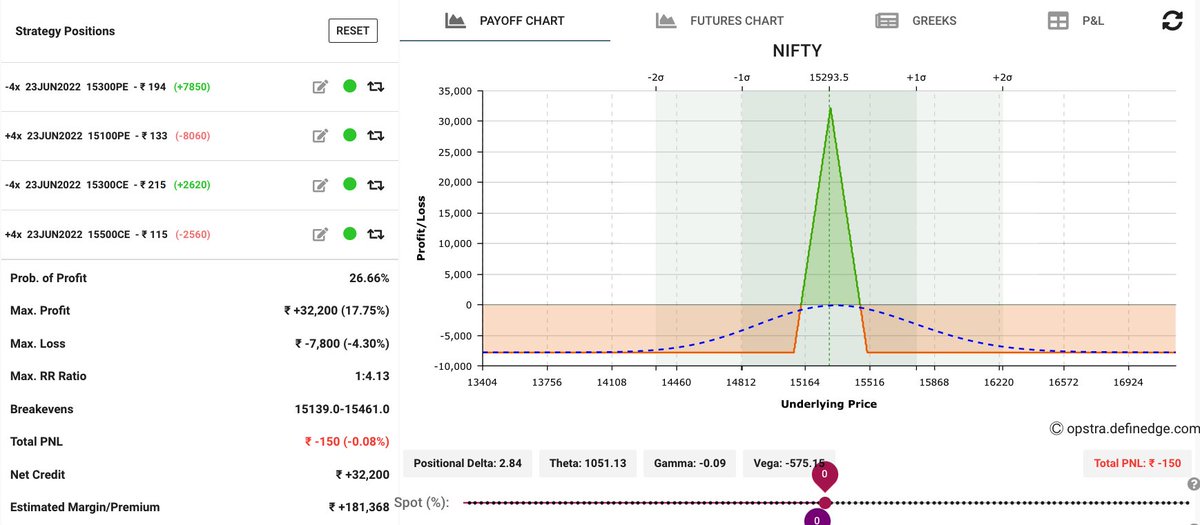

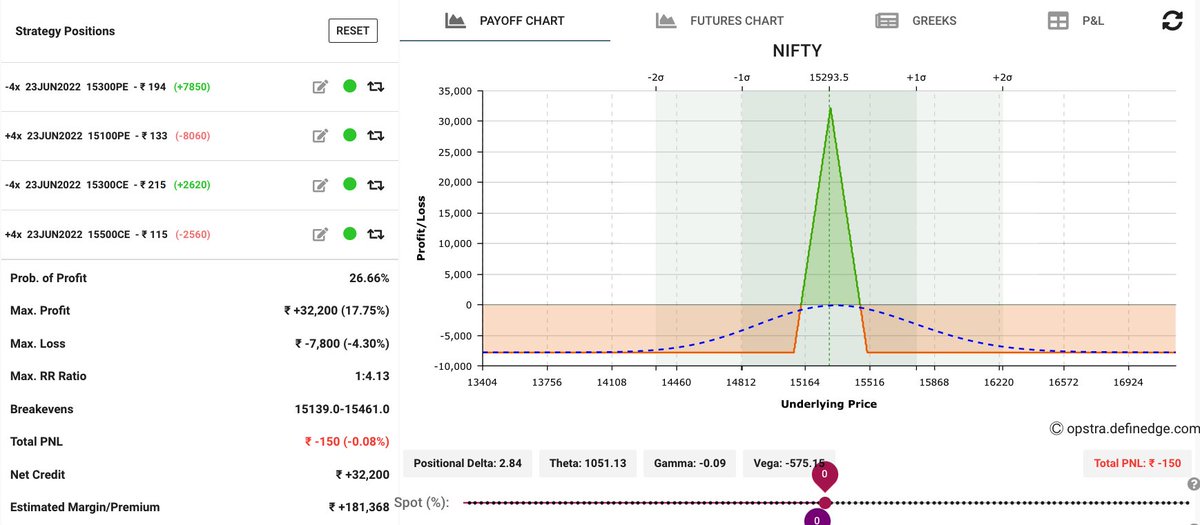

● If positional, ALWAYS hedge (Sleep well @ night)

How to get URL link on X (Twitter) App

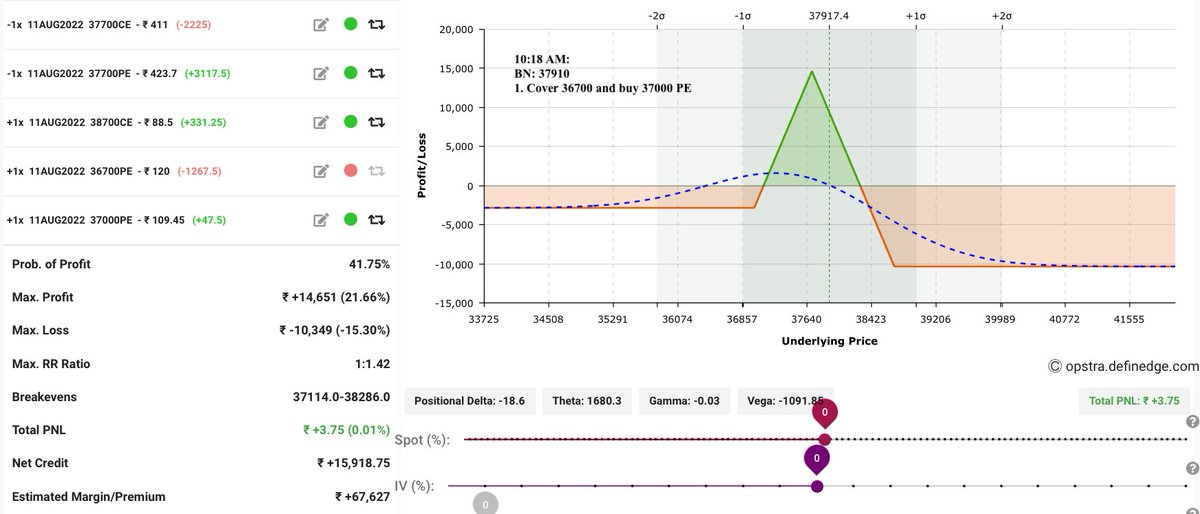

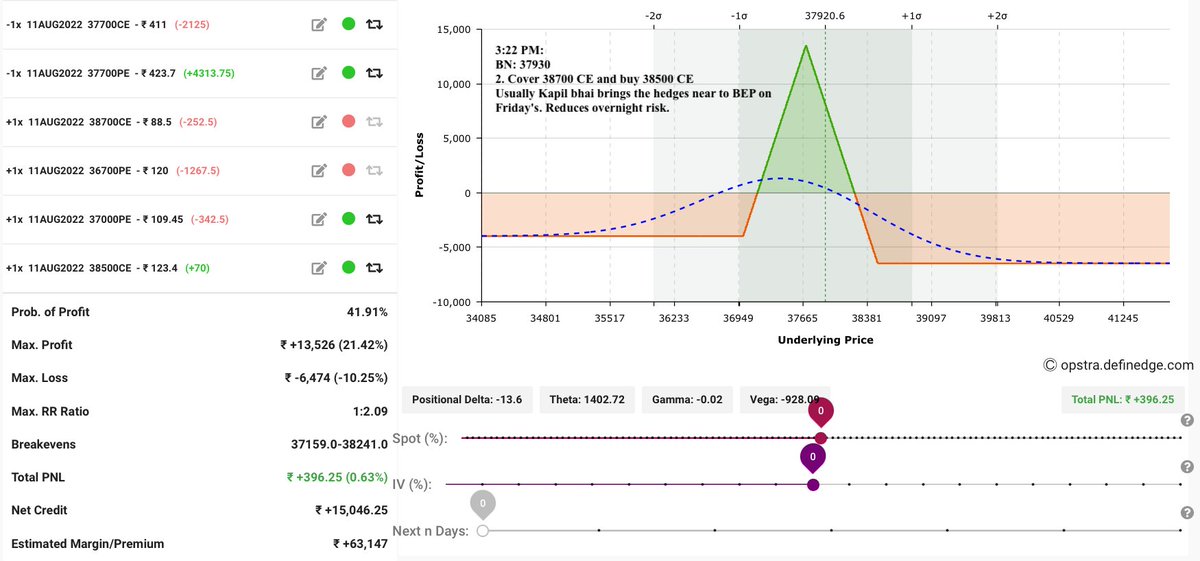

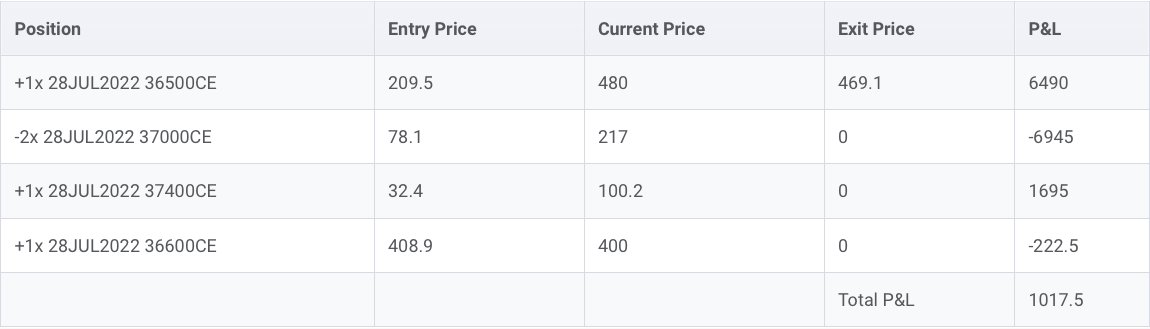

05-Aug (Fri)

05-Aug (Fri)

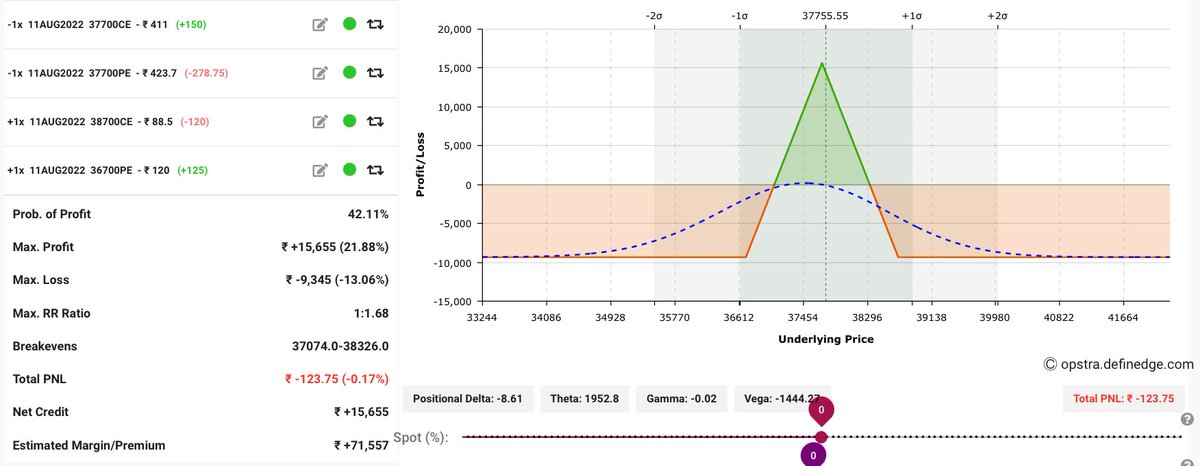

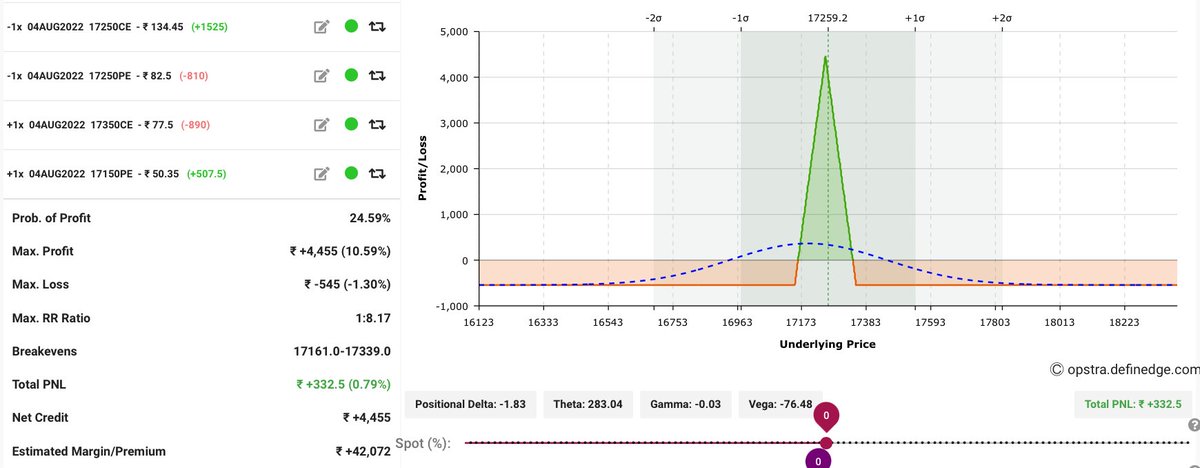

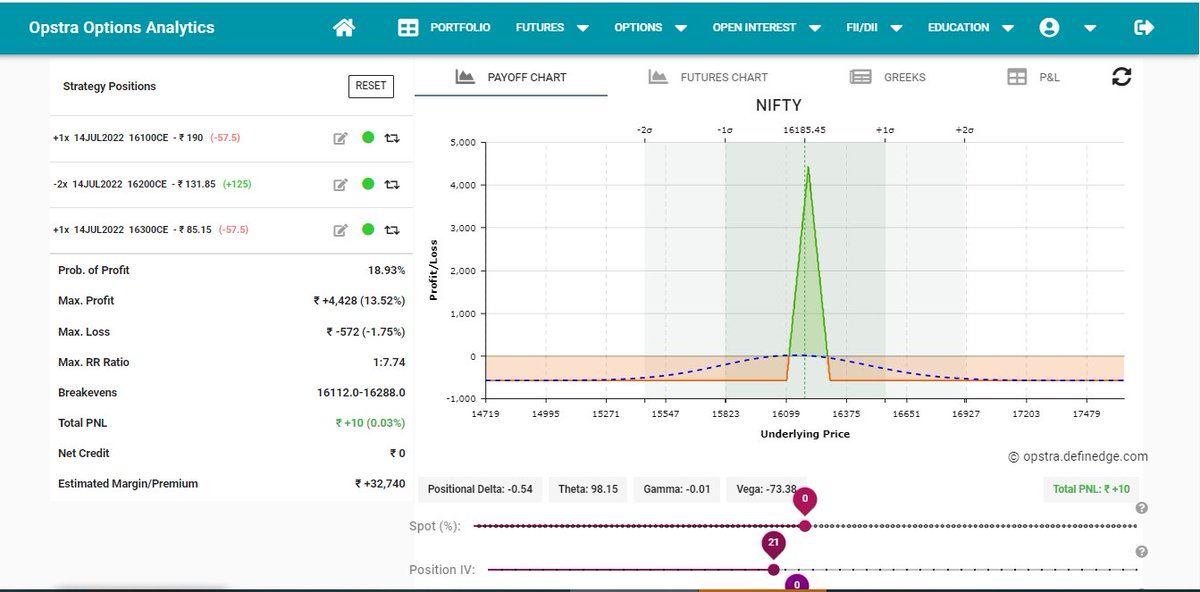

22-Jul (Fri)

22-Jul (Fri)

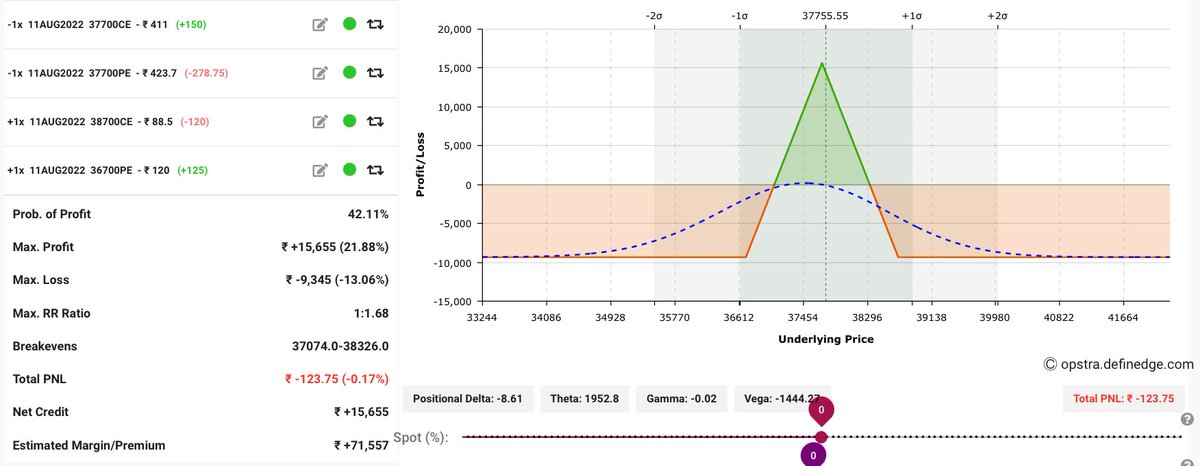

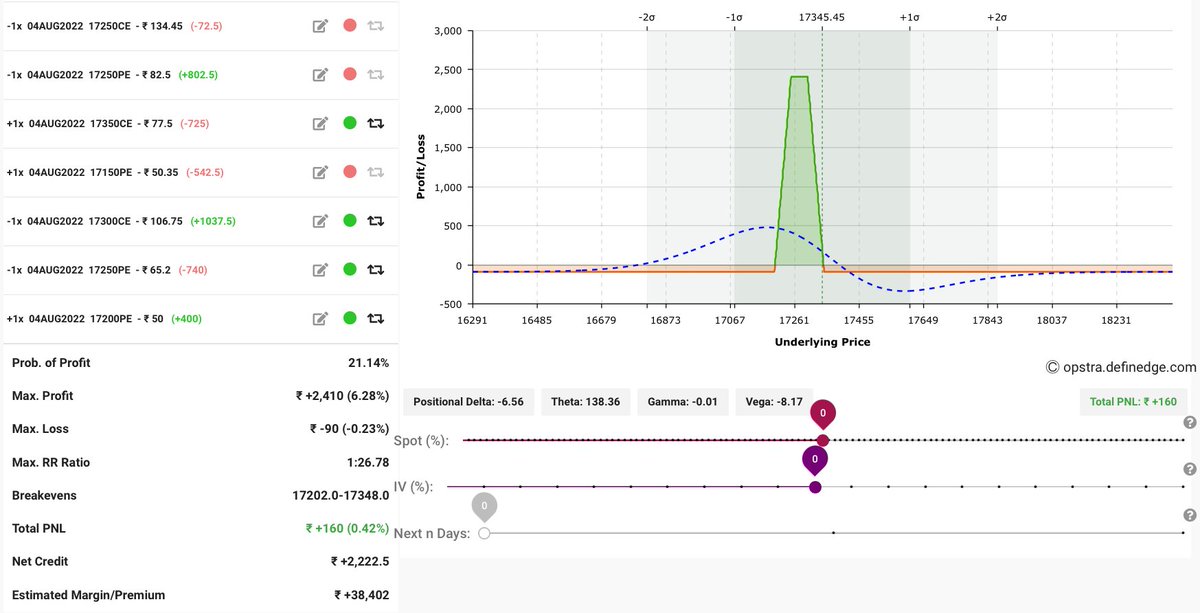

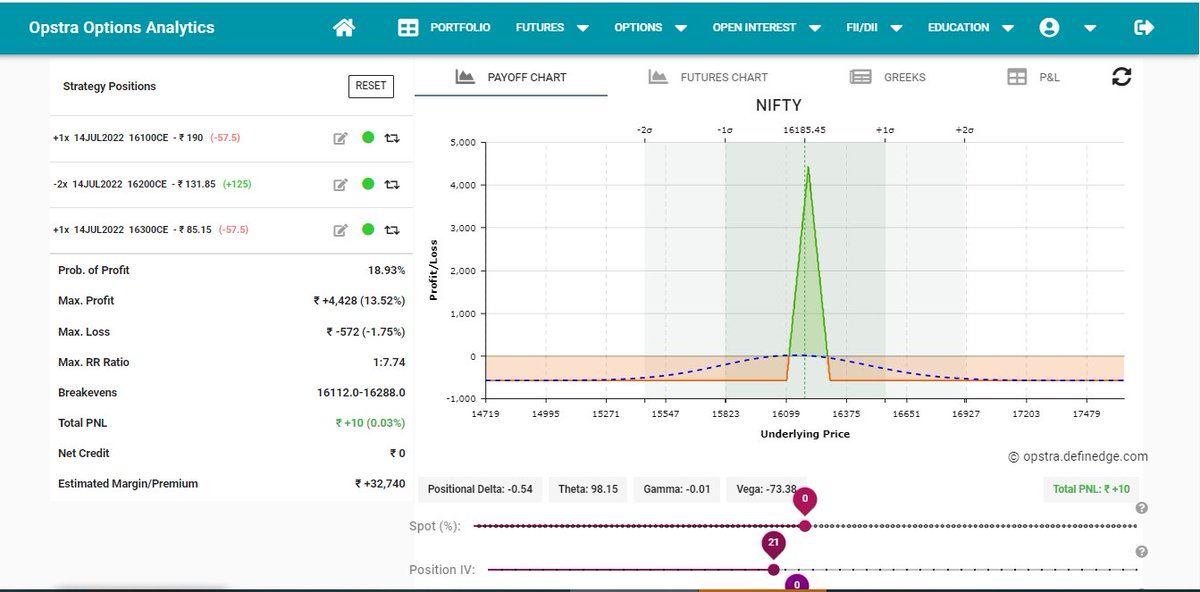

04-Jul (Mon)

04-Jul (Mon)

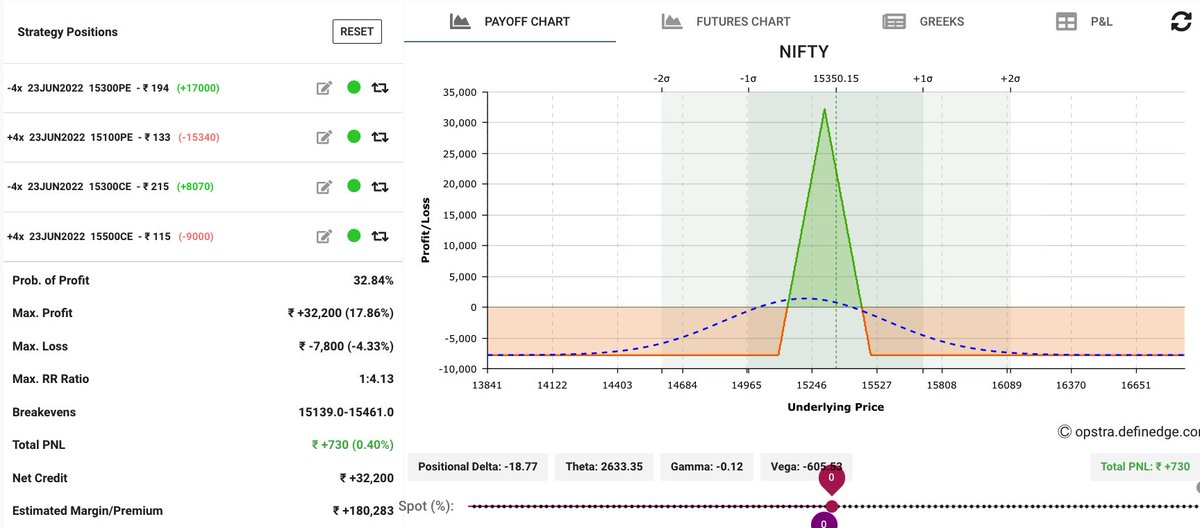

20-Jun (Mon)

20-Jun (Mon)