How to get URL link on X (Twitter) App

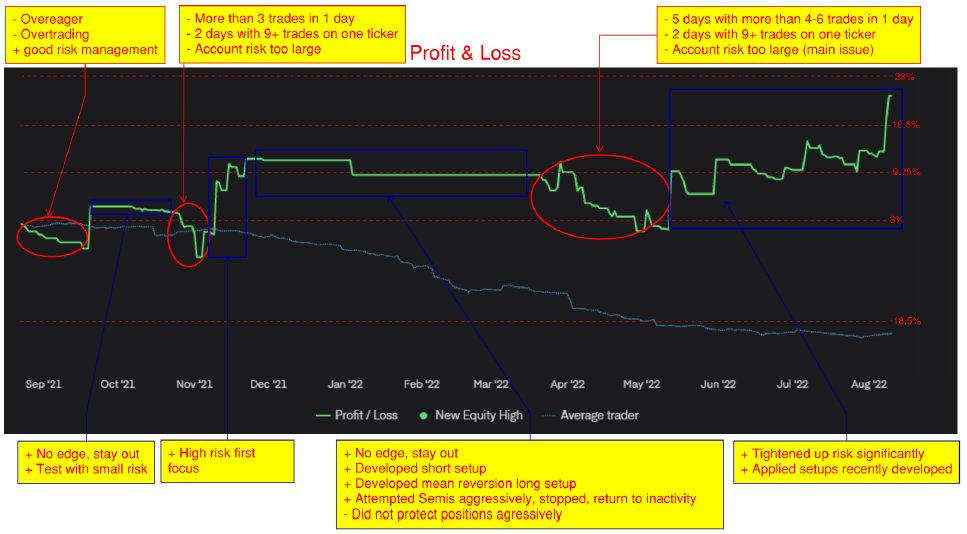

- the top of third leg coincided with the semi top and did not participate in leg 4 during blowoff

- the top of third leg coincided with the semi top and did not participate in leg 4 during blowoff

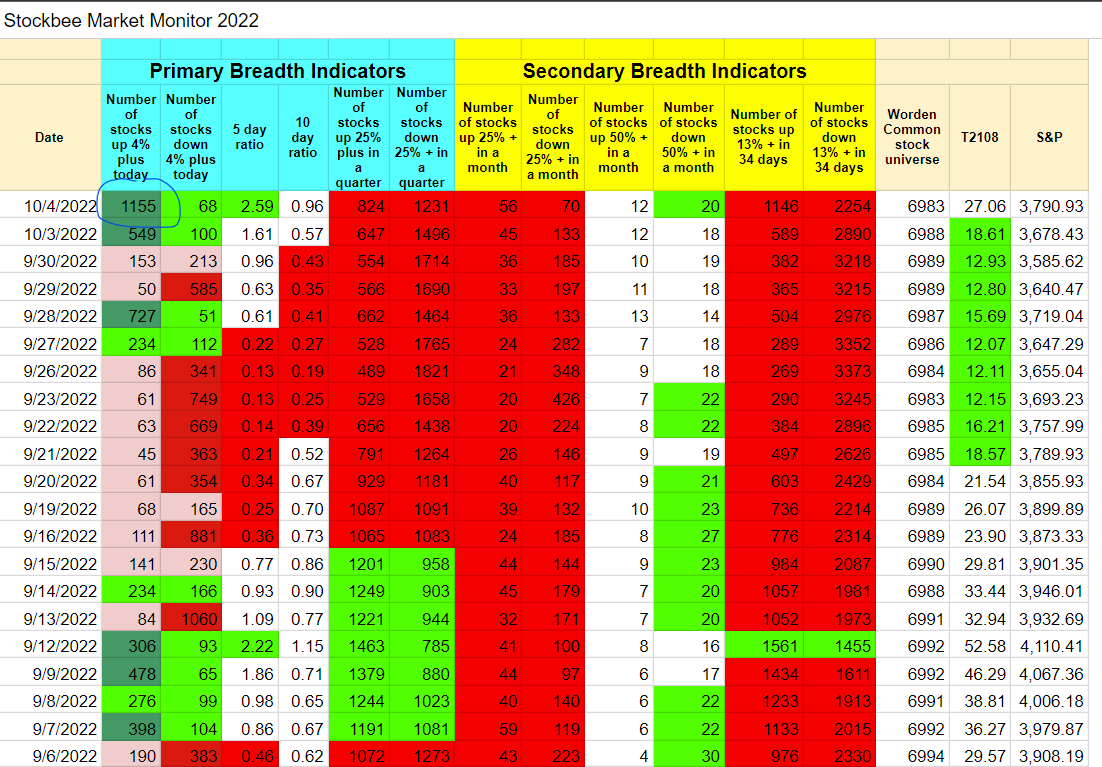

- keep mental image of where we are relative to indexes

- keep mental image of where we are relative to indexes

https://twitter.com/thebadtrader/status/1580084818255437824?s=20

This post from last September still applies

This post from last September still applieshttps://twitter.com/thebadtrader/status/1575496514662961160?s=20

https://twitter.com/jordipamiest/status/1467438112259325953?s=20&t=2hs5LXT5Y6YCblifokB86A

https://twitter.com/thebadtrader/status/1576839734399500288

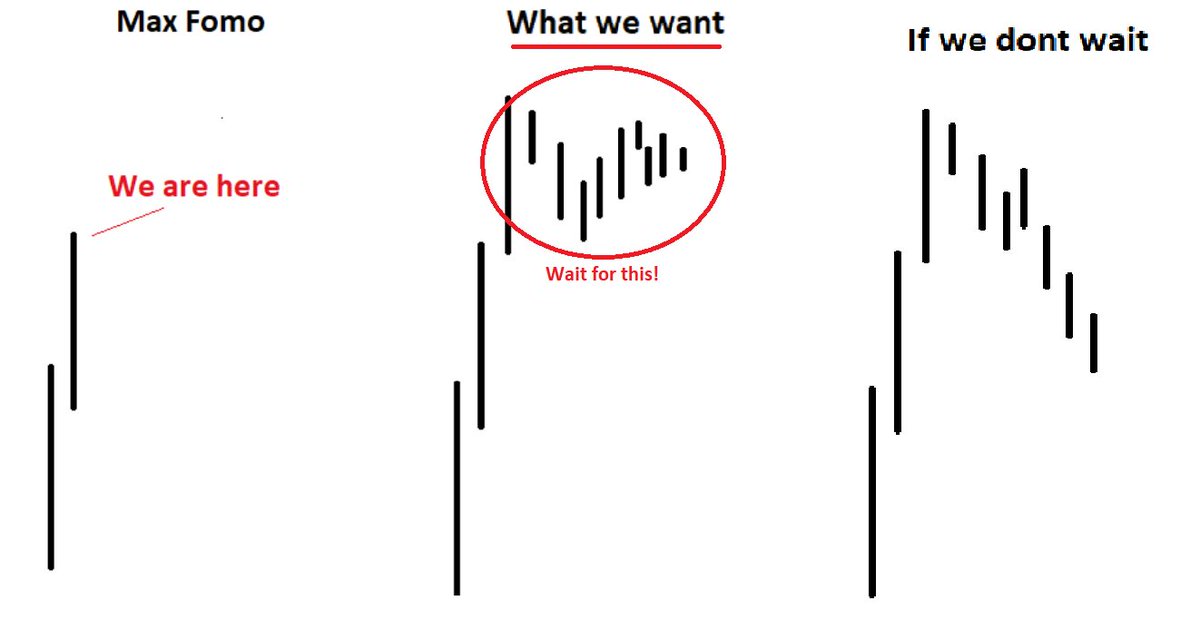

What I need to see

What I need to see

https://twitter.com/thebadtrader/status/1576826977671348224

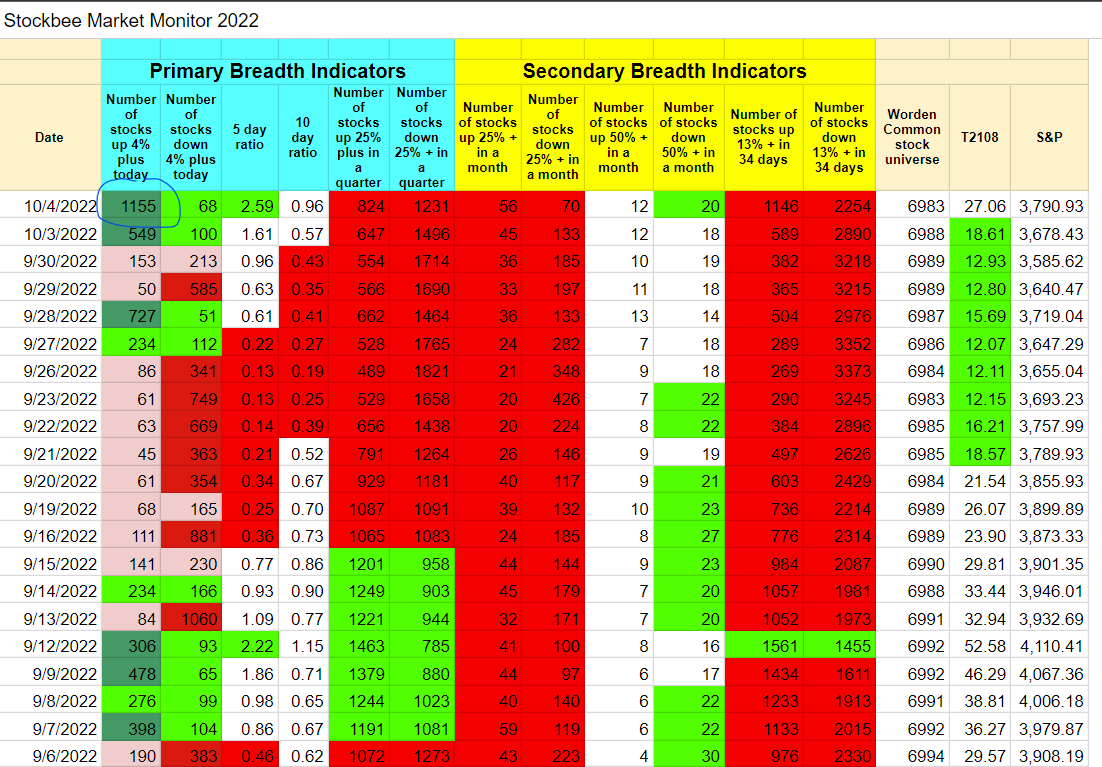

1. Indicator first principles: The purpose of the breadth indicator is to show how the average market stock is performing

1. Indicator first principles: The purpose of the breadth indicator is to show how the average market stock is performing

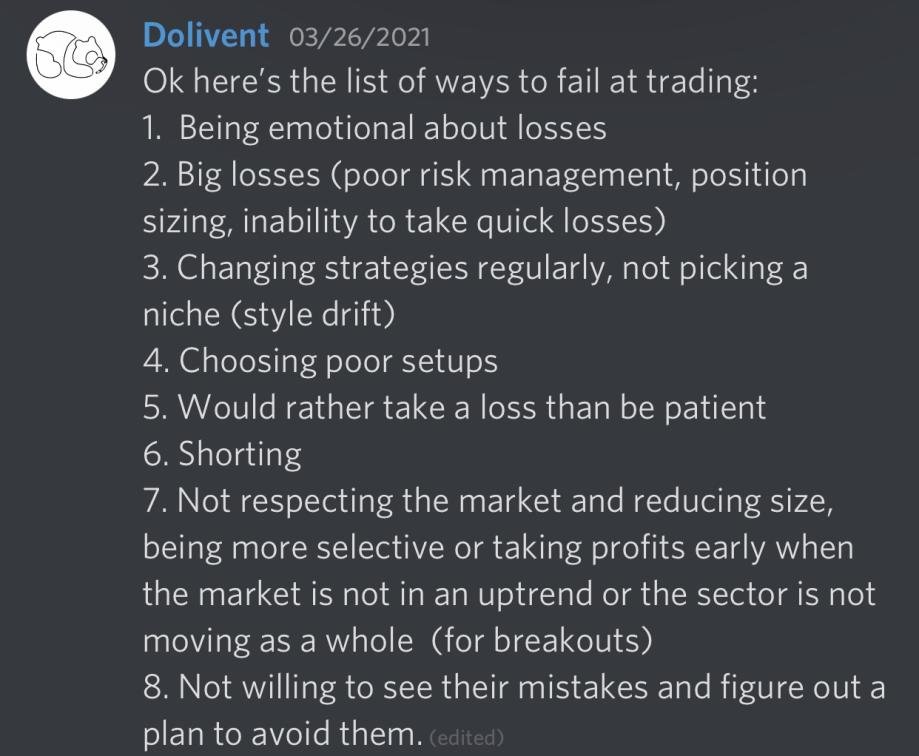

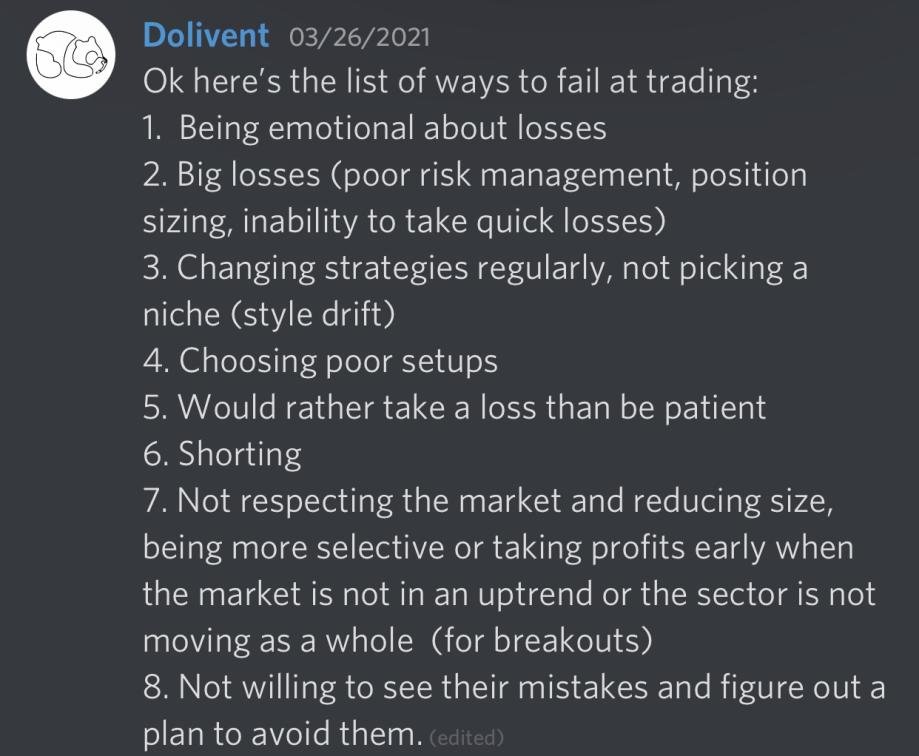

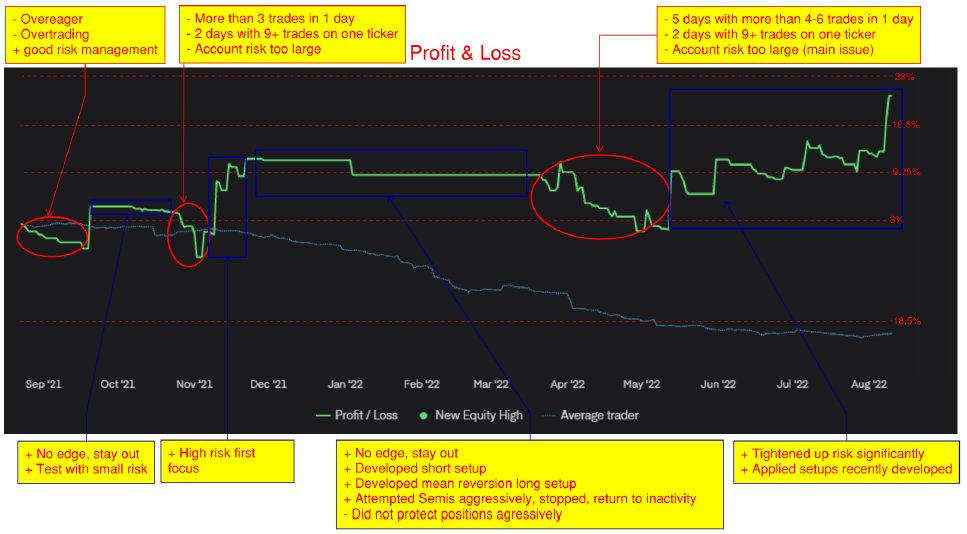

- If you experience each of these mistakes before learning the lesson, you may very well blow up 8 accounts (or give up before then)

- If you experience each of these mistakes before learning the lesson, you may very well blow up 8 accounts (or give up before then)

- Key focus: Overtrading

- Key focus: Overtrading

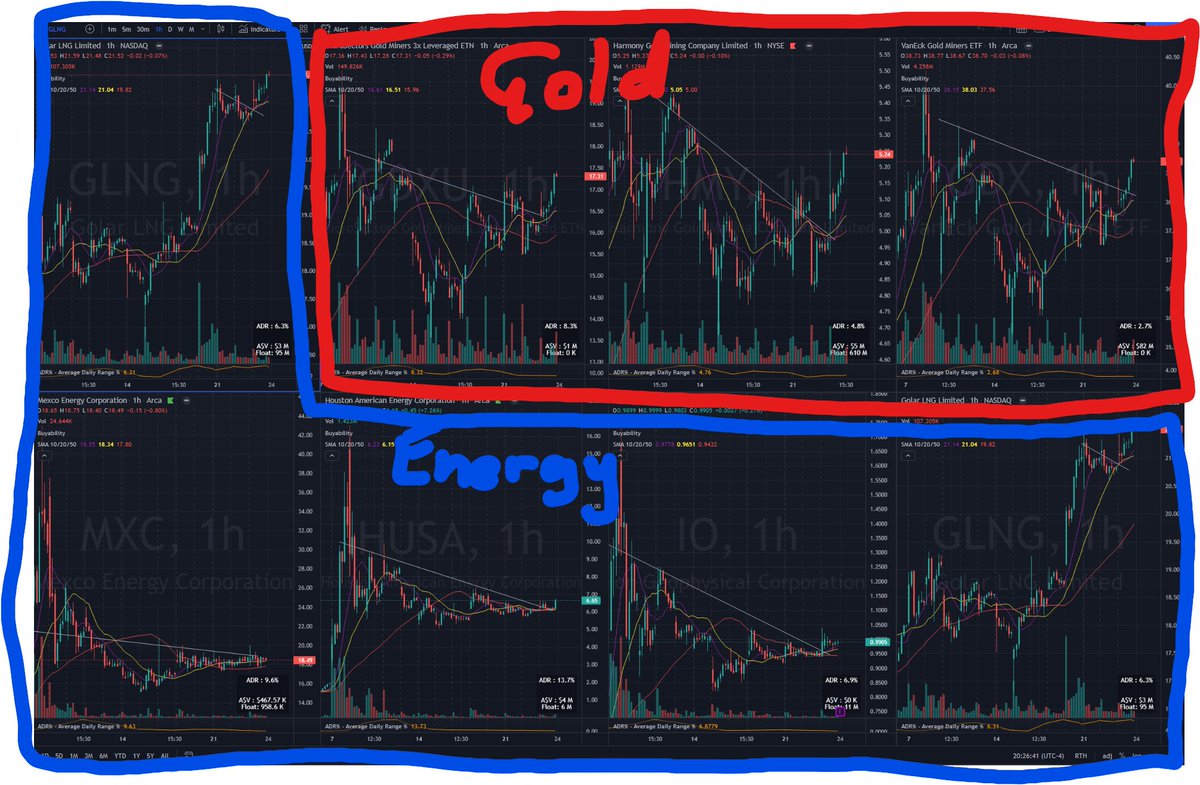

- This is the only setup to take but must have extreme RS

- This is the only setup to take but must have extreme RShttps://twitter.com/thebadtrader/status/1508612249660760066?s=20&t=2McDWVt-zFL3FOUzbZ6hMQ

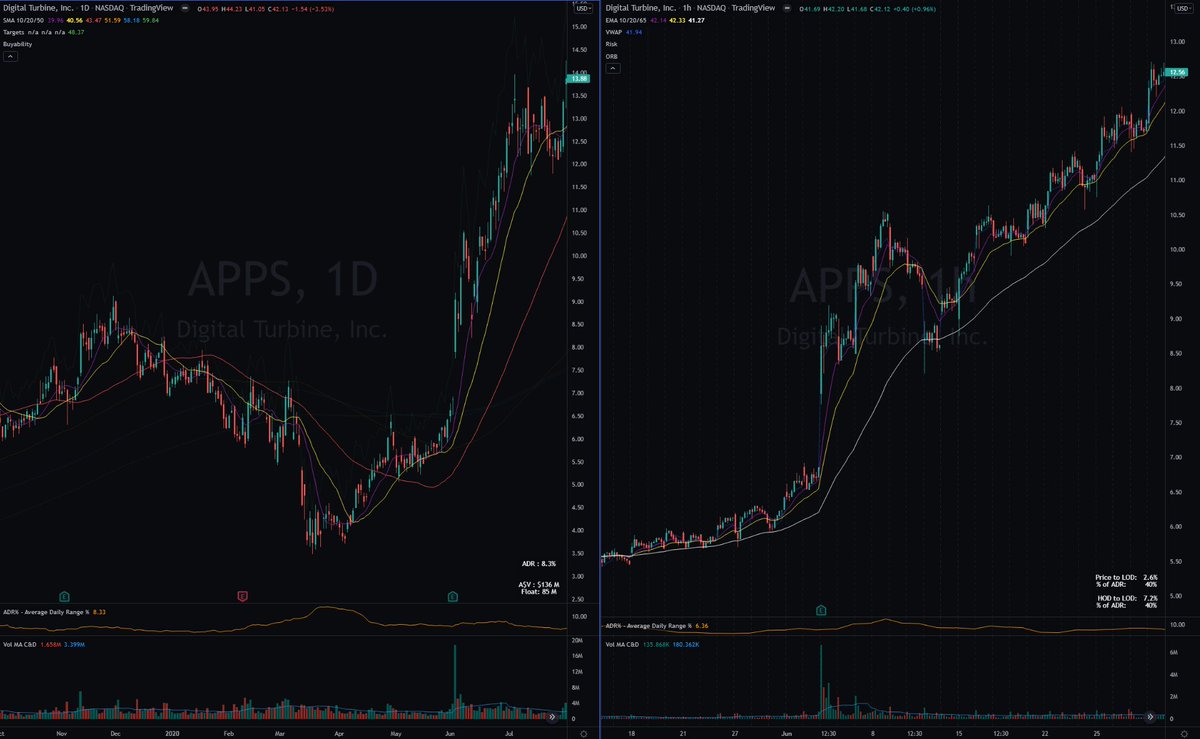

My first layout looked like this

My first layout looked like this

https://twitter.com/StatBear/status/1506784847070703626?s=20&t=Og18yfv8glbKgiZvcrnRUw