NVIDIA Daily | A fan of Jensen Huang & Elon Musk | My posts are not investment advice |

Join Patreon community for portfolio updates & more on AI Investing.

How to get URL link on X (Twitter) App

This is Jensen Huangs compensation package.

This is Jensen Huangs compensation package.

iot-analytics.com/leading-genera…

iot-analytics.com/leading-genera…

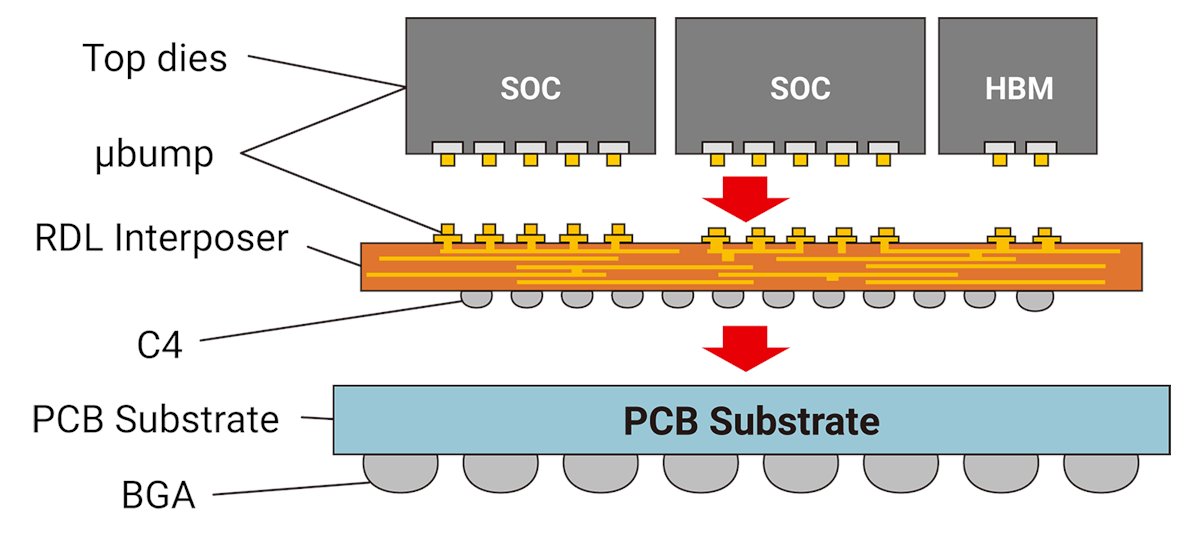

Why H100?

Why H100?

Apple iphone market share peaked in H1 2009 and then falling, the stock should fall too, right?

Apple iphone market share peaked in H1 2009 and then falling, the stock should fall too, right?

With S&P 500: 1.7 let's see how market expected $TSLA to grow EPS:

With S&P 500: 1.7 let's see how market expected $TSLA to grow EPS:

https://twitter.com/The_AI_Investor/status/1580092064272089088

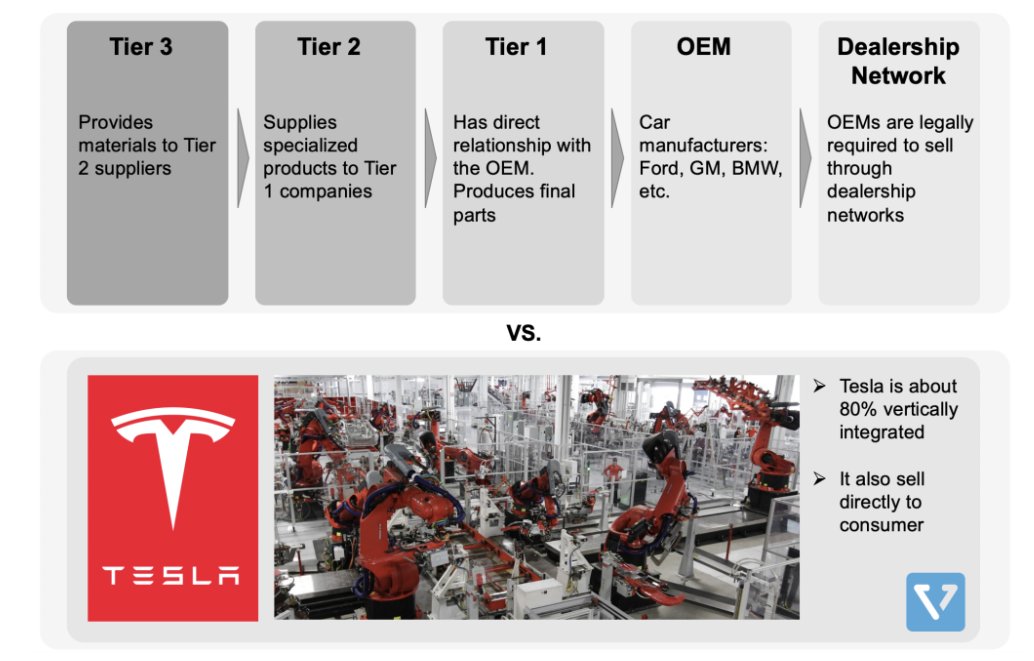

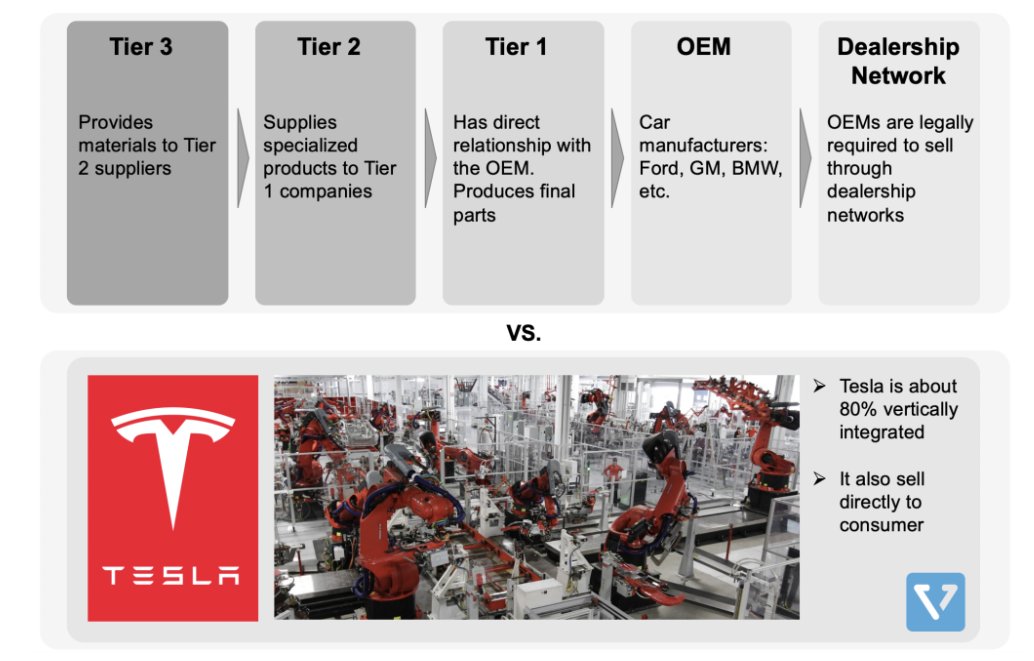

$TSLA moats:

$TSLA moats:

UiPath robots:

UiPath robots:

Athena AI

Athena AI