Understanding duration mismatches is the red pill. 17 yr HF PM, analyst, head trader; ex CS, Solly. All products. FLOW big data Energy quantitative fundamentals

2 subscribers

How to get URL link on X (Twitter) App

This thread is an outreach, contact us if you are already involved and are interested in talking about strategic options.

This thread is an outreach, contact us if you are already involved and are interested in talking about strategic options.

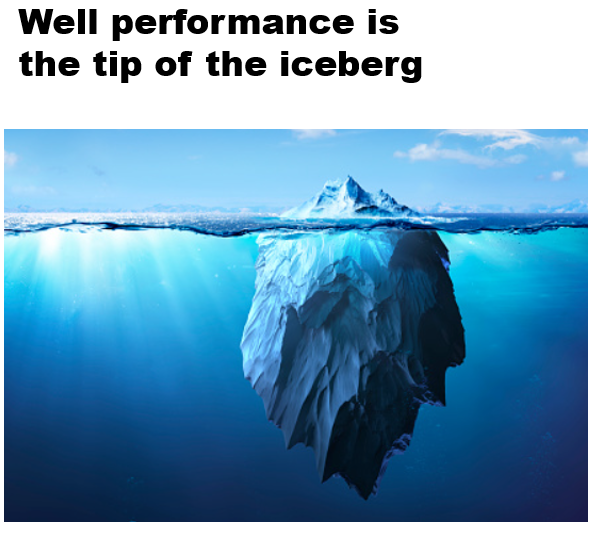

"How is XOM and PXD 1+1=3?" That's what appeared in my inbox.

"How is XOM and PXD 1+1=3?" That's what appeared in my inbox.

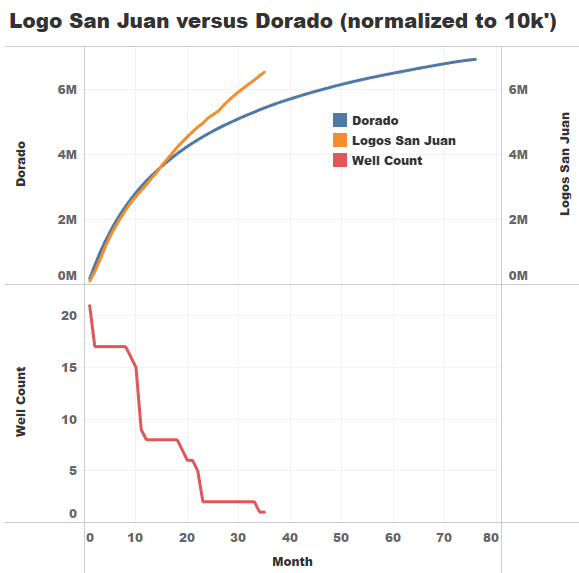

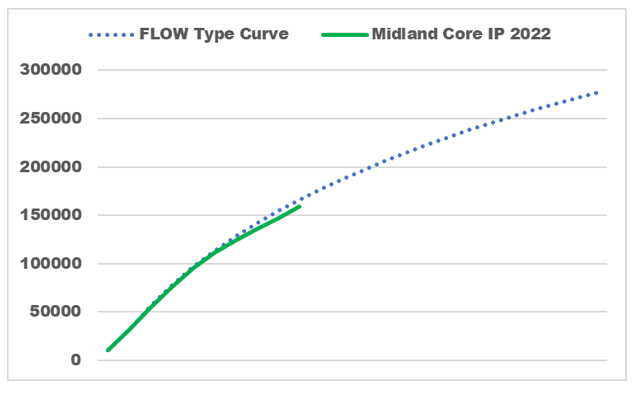

In our known resource plays, the variables are known.

In our known resource plays, the variables are known.

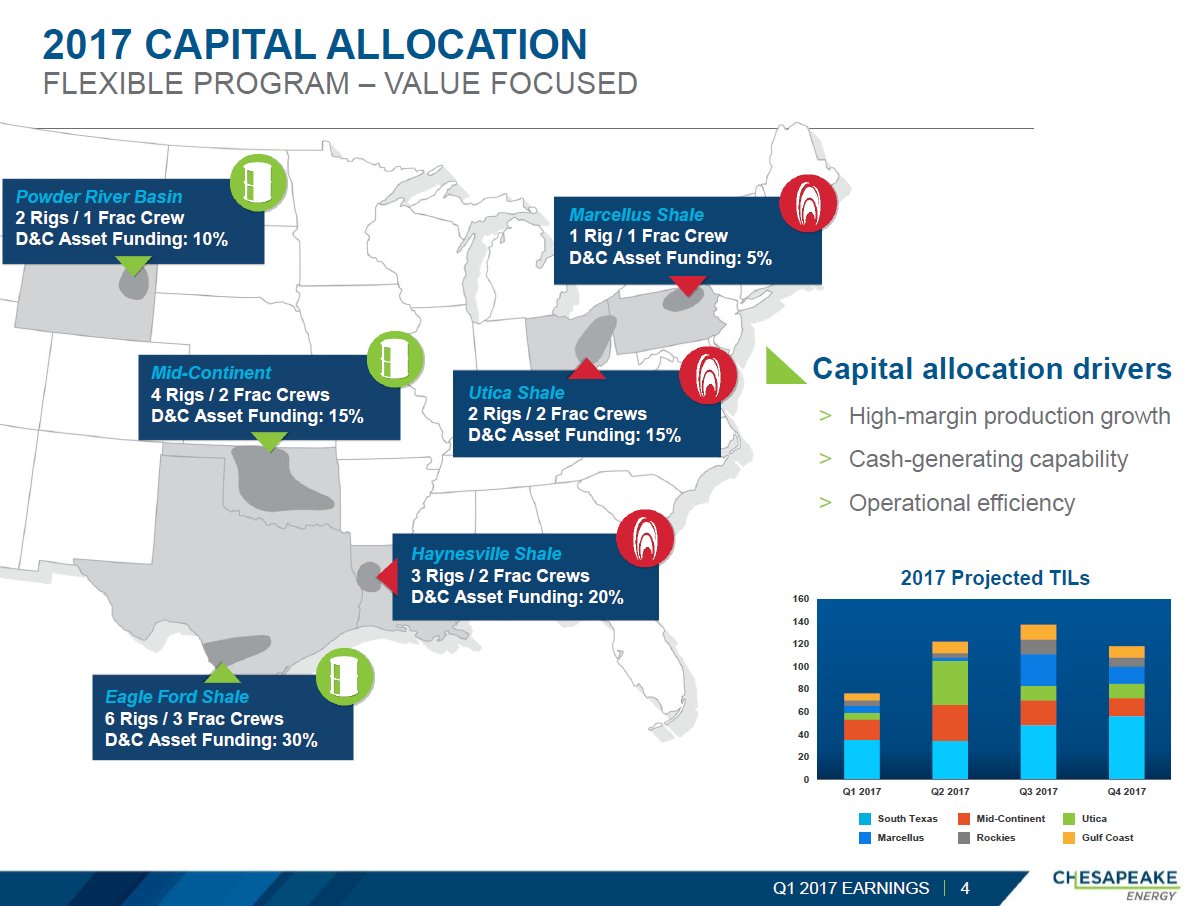

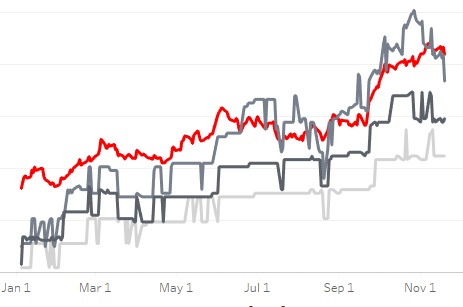

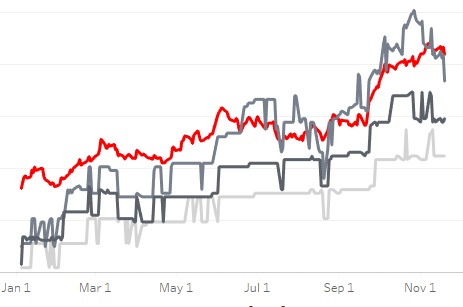

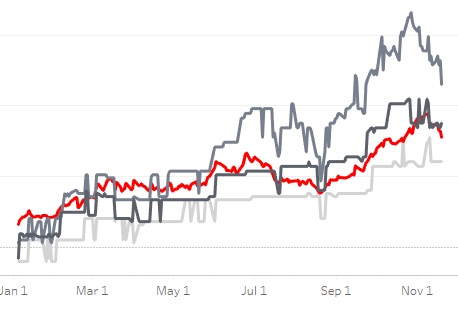

Here's a name that trades off the 12-mo contracts.

Here's a name that trades off the 12-mo contracts.

I used Ross from Friends to represent how we want to interact with data. Ross is wishy washy, but he wants you to like him. This is the wrong approach. Coach Taylor wants his team to have "Clear Eyes" - This is the whole point.

I used Ross from Friends to represent how we want to interact with data. Ross is wishy washy, but he wants you to like him. This is the wrong approach. Coach Taylor wants his team to have "Clear Eyes" - This is the whole point.