Macro/Abs Return PM

'We are what we repeatedly do. Excellence is not an act but a habit' - Socrates

'Control the tails, trading is a marathon, not a sprint'

How to get URL link on X (Twitter) App

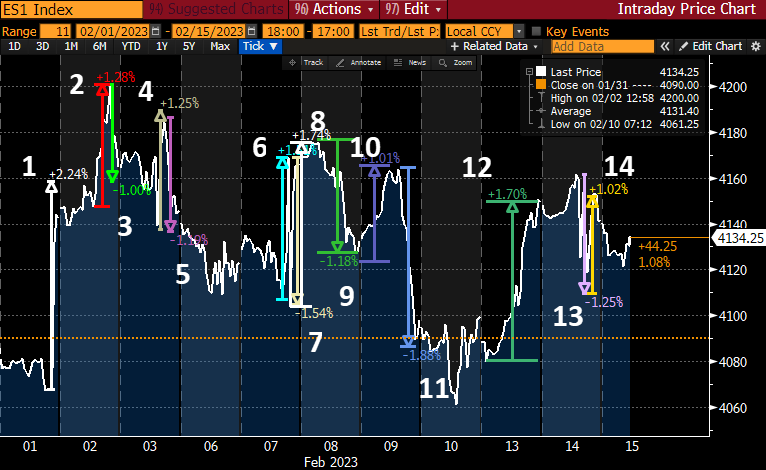

This is the market BUYING 0DTE and forcing dealers to chase the market up or down

This is the market BUYING 0DTE and forcing dealers to chase the market up or down