How to get URL link on X (Twitter) App

what your feed won’t tell you is that the attention economy in a bear market is easier to navigate because it’s not as diluted as it is in a bull

what your feed won’t tell you is that the attention economy in a bear market is easier to navigate because it’s not as diluted as it is in a bull

Most of you reading this likely spend a large portion of your time on the internet communicating with, or viewing other people's thoughts.

Most of you reading this likely spend a large portion of your time on the internet communicating with, or viewing other people's thoughts.

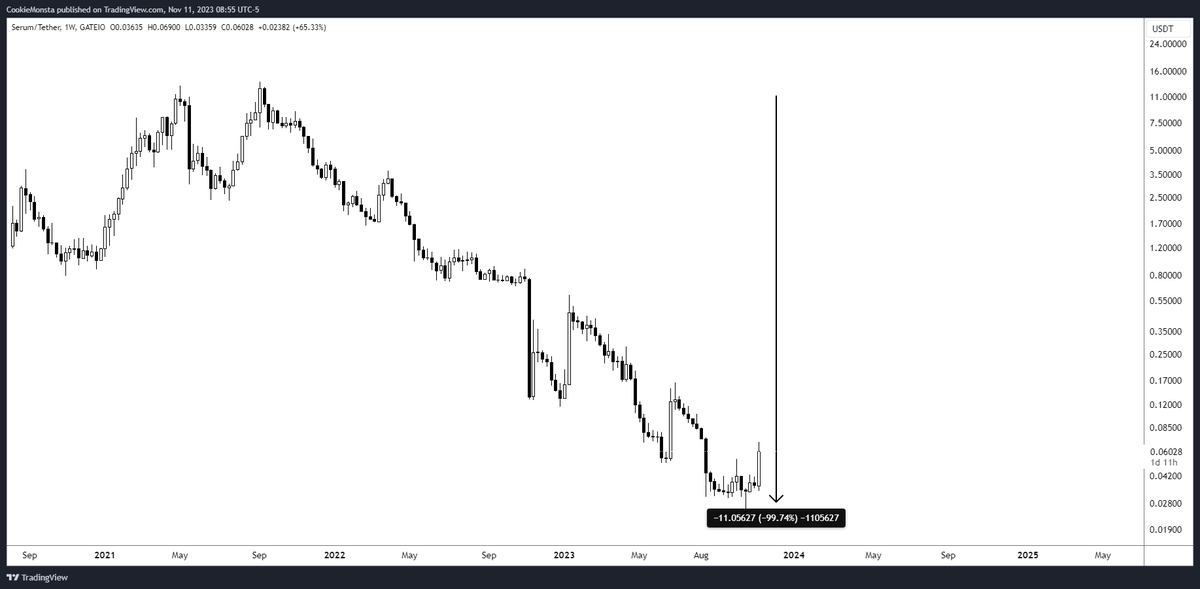

> "Don't buy coins from the previous cycle. Just buy the new coins. They're more likely to rip since there are no bagholders."

> "Don't buy coins from the previous cycle. Just buy the new coins. They're more likely to rip since there are no bagholders."

Before we get into it, let’s acknowledge that it’s easy to develop bad habits in trading to begin with.

Before we get into it, let’s acknowledge that it’s easy to develop bad habits in trading to begin with.

"Do what allows you to sleep best at night".

"Do what allows you to sleep best at night".

https://twitter.com/TraderMercury/status/1658494697998888963?s=20

For me as a trend trader; the same way I’m able to justify an expectation is the same way I’m able to invalidate that expectation.

For me as a trend trader; the same way I’m able to justify an expectation is the same way I’m able to invalidate that expectation.https://twitter.com/tradermercury/status/1616780125369933824?s=46&t=L5bTXKhorMZuVbnf_HPQCw

https://twitter.com/TraderMercury/status/1613203263448399873?s=20&t=LMr_wl_ojZZJ_LSxRqJGtw

https://twitter.com/TraderMercury/status/1524023074621992969

Exhibit A:

Exhibit A:https://twitter.com/TraderMercury/status/1522583503833075712?s=20&t=cdMJHNyN2o3NvspqMkFDww