How to get URL link on X (Twitter) App

I share crazy factoids like this every week in my newsletter

I share crazy factoids like this every week in my newsletter

Canva initially started as a simple, browser-based graphic design tool. It was built to be 10x easier than Adobe Photoshop. This meant it hit an entirely different, much larger customer base.

Canva initially started as a simple, browser-based graphic design tool. It was built to be 10x easier than Adobe Photoshop. This meant it hit an entirely different, much larger customer base.

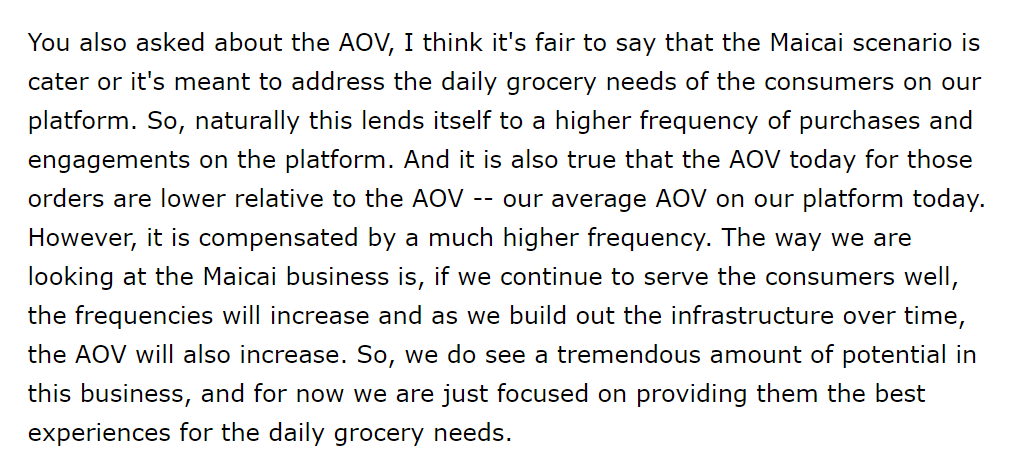

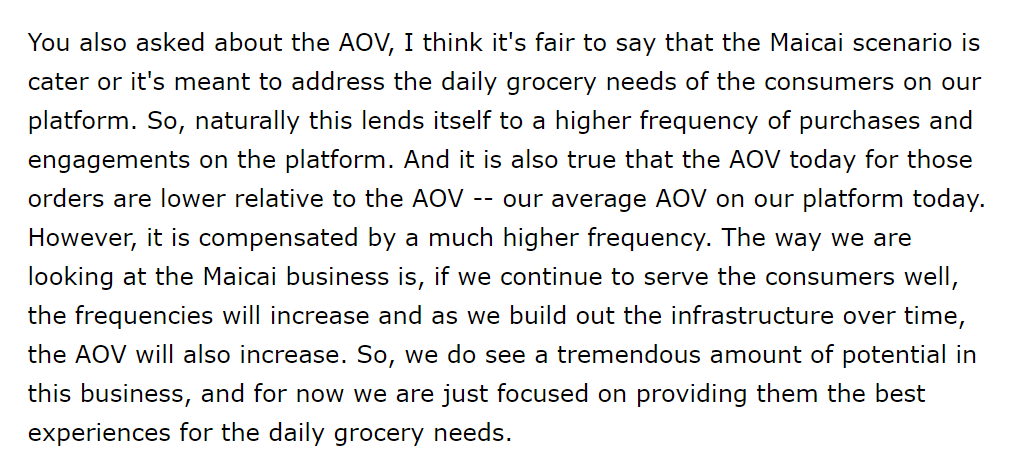

https://twitter.com/TurnerNovak/status/1297023704543698944The tl;dr is Stitch Fix has permission from 3.9m consumers to auto ship them products. It’s ecom’s “recommended bar” but IRL and converts at 10-20%. They know what will sell before its even produced. Can monetize this from suppliers, with private label, + their Direct Buy app.

https://twitter.com/TurnerNovak/status/1365374533419606016

https://twitter.com/turnernovak/status/1293564456371458053

https://twitter.com/TurnerNovak/status/1344774274960285696I also took 2x profits off the table on the FUBO puts, sold the rest at a loss a week later. This is why I very rarely short 😂