How to get URL link on X (Twitter) App

1/ Jump Trading

1/ Jump Trading

4th/

4th/

Smart money wallets have been reducing their allocation balance since launch, but in the last 7 days there were several transactions going on the opposite direction of this trend

Smart money wallets have been reducing their allocation balance since launch, but in the last 7 days there were several transactions going on the opposite direction of this trend

https://twitter.com/UnlocksCalendar/status/1626599165399814144Wallet 0x48b30 received 1.34mln $BLUR at airdrop (valued $800k at current prices)

1/ What is BASE?

1/ What is BASE?

$CANTO is an $EVMOS competitor (originally a fork) providing Tendermint consensus and EVM execution layer via Cosmos

$CANTO is an $EVMOS competitor (originally a fork) providing Tendermint consensus and EVM execution layer via Cosmos

In 2021, among large cap coins, $SOL was surely one of the top performers

In 2021, among large cap coins, $SOL was surely one of the top performers

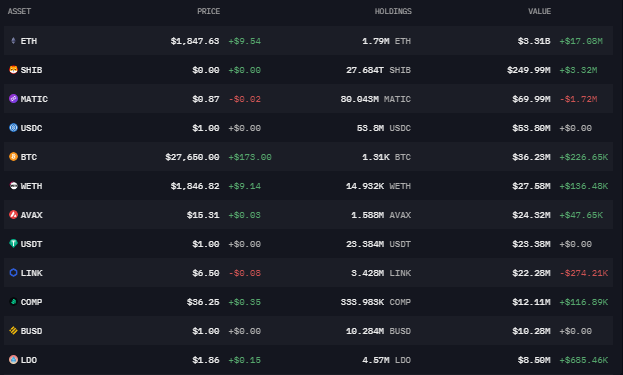

https://twitter.com/milesdeutscher/status/1537373757870047233[ Disclaimer: we avoided large caps such as $AVAX, $BTC, $ETH, $DOT, $SOL, $LUNA (Obviously), and $AAVE as the exercise does not make sense on them ]