Former ECB Vice President. President of the Council of ISEG, University of Lisbon. Professor at Navarra University, Masters School, Madrid

7 subscribers

How to get URL link on X (Twitter) App

The DB index of the ECB’s Governing Council indicates an increase in divergence of views about the future, according to public statements of its members 2/

The DB index of the ECB’s Governing Council indicates an increase in divergence of views about the future, according to public statements of its members 2/

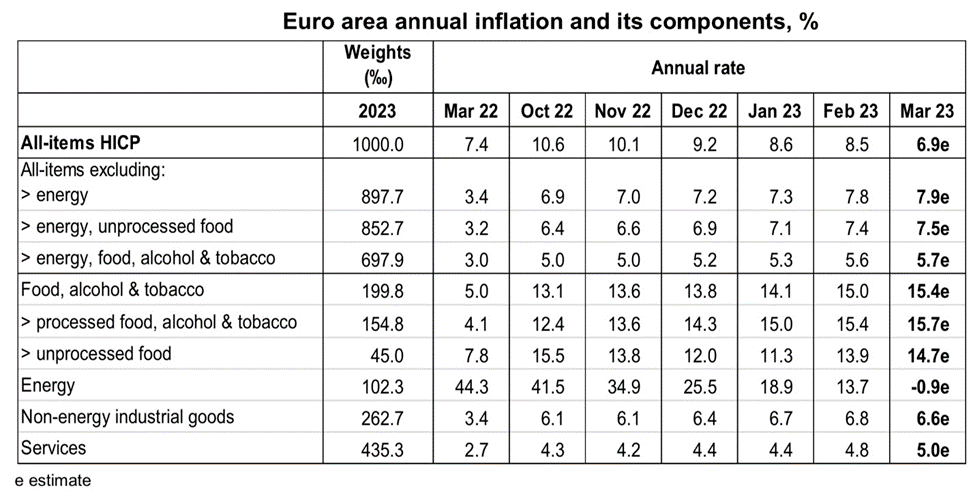

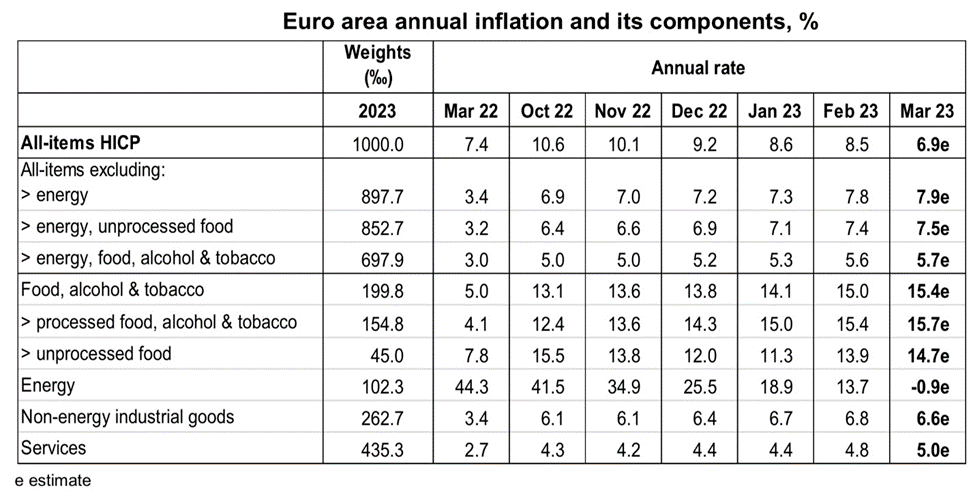

These results come from the drop in international prices and the delayed effect of monetary policy. Interest rate changes take time to produce their effect on the economy. Decisions now must be taken thinking about future inflation, i.e. the 3% in Dec and lower in 2024 2/

These results come from the drop in international prices and the delayed effect of monetary policy. Interest rate changes take time to produce their effect on the economy. Decisions now must be taken thinking about future inflation, i.e. the 3% in Dec and lower in 2024 2/

Various measures of core inflation have to be examined to identify the best indicator of what might be the persistent component of inflation. All of them, alas, are under the influence of indirect effects of energy inflation (variation of energy prices that will abate in 2023)2/

Various measures of core inflation have to be examined to identify the best indicator of what might be the persistent component of inflation. All of them, alas, are under the influence of indirect effects of energy inflation (variation of energy prices that will abate in 2023)2/