How to get URL link on X (Twitter) App

Presidential candidate RFK Jr. plans an executive order directing the US treasury to purchase 550 Bitcoin daily until the reserve holds 4 million BTC.

Presidential candidate RFK Jr. plans an executive order directing the US treasury to purchase 550 Bitcoin daily until the reserve holds 4 million BTC.

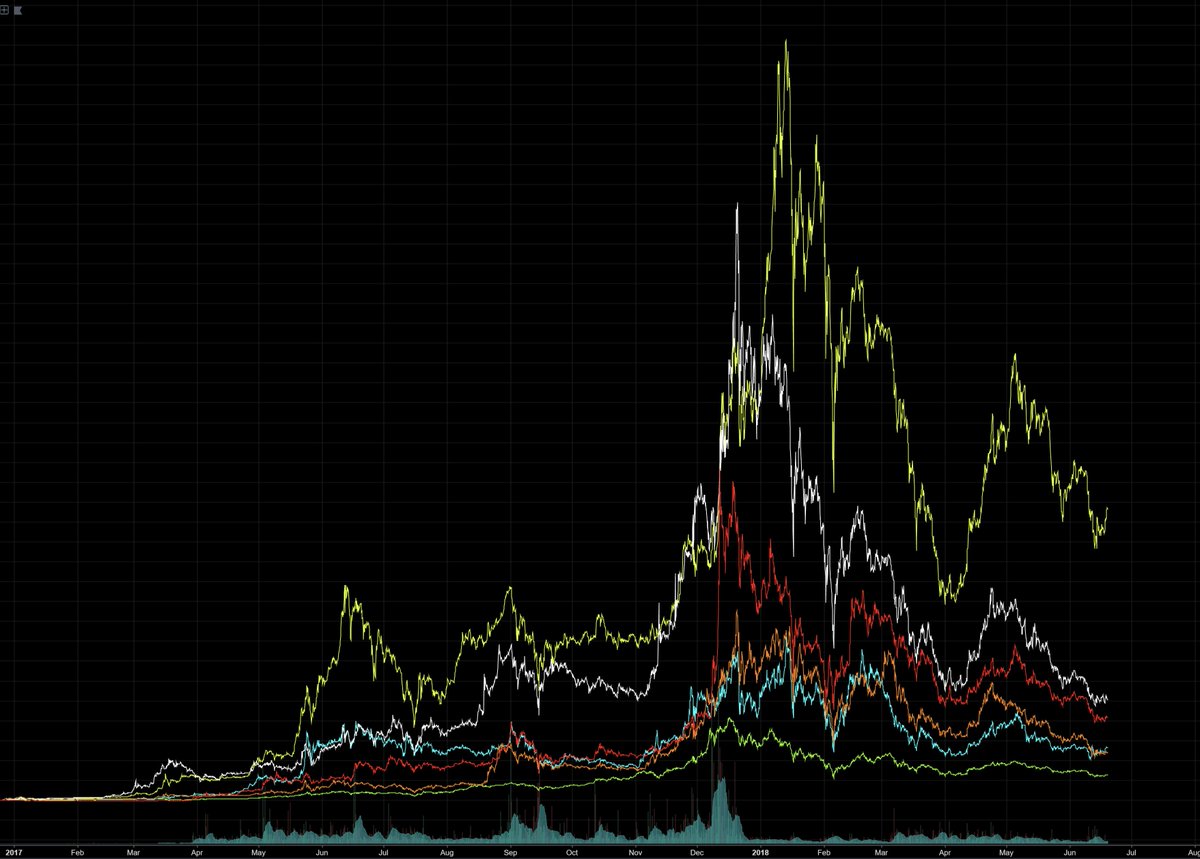

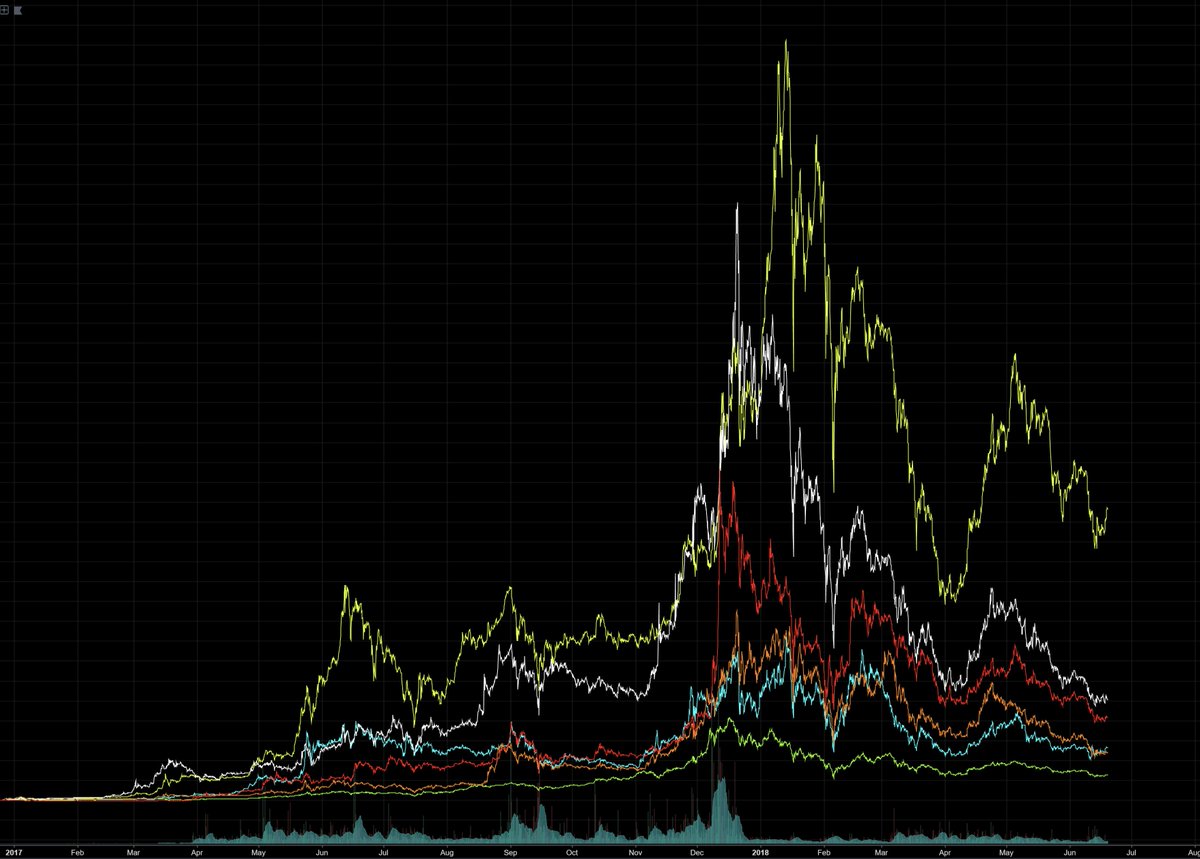

Steady lads, a little more summer chop then bull market continuation.

Steady lads, a little more summer chop then bull market continuation.

2/ Sam wasn't happy with the inefficiencies normal crypto derivs platforms have to deal with.

2/ Sam wasn't happy with the inefficiencies normal crypto derivs platforms have to deal with.

2/ For the past few years I've hosted some of the best traders, investors, funds, analysts, and founders on my podcast.

2/ For the past few years I've hosted some of the best traders, investors, funds, analysts, and founders on my podcast.

Two more examples of the pattern:

Two more examples of the pattern:

2/ Looking this morning at how this pattern is progressing just a few days later.

2/ Looking this morning at how this pattern is progressing just a few days later.

https://twitter.com/VentureCoinist/status/1051111336841805827$QKC take two illustrated.

https://twitter.com/VentureCoinist/status/10596002232684134402/ You have probably noticed that for the last 5 days large cap alts have been stealing most of the attention, volume and gains.

https://twitter.com/VentureCoinist/status/1059119551999287296

https://twitter.com/VentureCoinist/status/1052232547063779328

$QKC hit +50% mark, and still climbing.

$QKC hit +50% mark, and still climbing.

https://twitter.com/crypto_bobby/status/10421082374982492172/ Any exchange (or broker in traditional assets) that uses a dealing desk or makes the market, is inherently "trading against it's customers."

2/ Important note: have to consider trend/momentum as well....not JUST cheap or expensive.

2/ Important note: have to consider trend/momentum as well....not JUST cheap or expensive.

2/ $LTC is the red line. There were several replies to the post assuming it was yellow and that was a sign to buy $ETC ahead of the Coinbase add.

2/ $LTC is the red line. There were several replies to the post assuming it was yellow and that was a sign to buy $ETC ahead of the Coinbase add.

2/ Access - built relationship with $OMG "well before any thought of a token" and "first inst investor into $ENG with highest discount"

2/ Access - built relationship with $OMG "well before any thought of a token" and "first inst investor into $ENG with highest discount"

2/ His thread breaks down the current market environment very well, so I suggest reading it first to understand the 'now' -> cross-coin correlation high with low volatility.

External Tweet loading...

If nothing shows, it may have been deleted

by @cryptorae view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @VentureCoinist view original on Twitter

External Tweet loading...

If nothing shows, it may have been deleted

by @VentureCoinist view original on Twitter