How to get URL link on X (Twitter) App

2/ In every big crisis, the Federal Reserve expands its mandate, interacting with various parts of the financial structure & altering the game along the way.

2/ In every big crisis, the Federal Reserve expands its mandate, interacting with various parts of the financial structure & altering the game along the way.

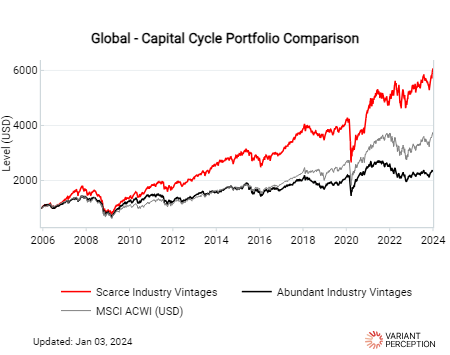

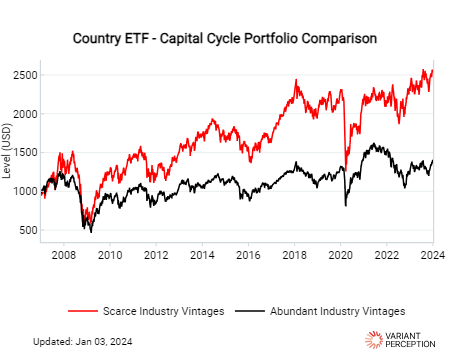

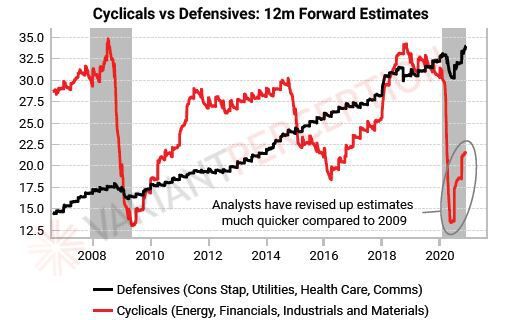

In the aftermath of covid, a peculiar scenario unfolded.

In the aftermath of covid, a peculiar scenario unfolded.

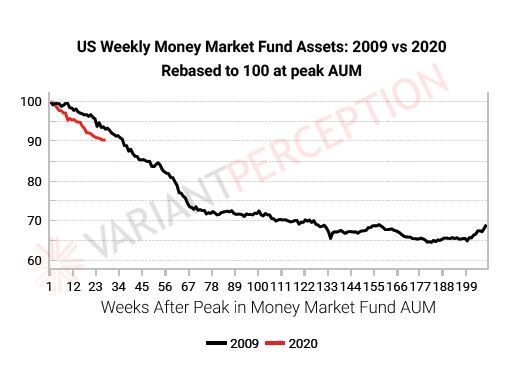

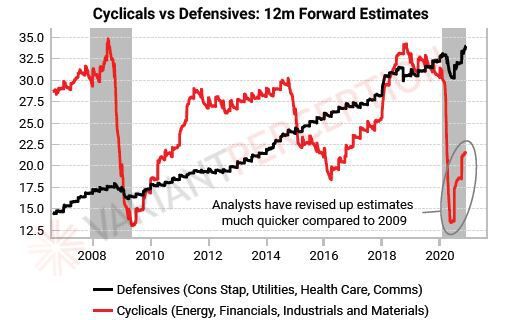

We still think there’s a lot more room until reflation trades become crowded. Money-market assets are very elevated and we see from 2009’s experience that it takes a while for money to be deployed into riskier assets.

We still think there’s a lot more room until reflation trades become crowded. Money-market assets are very elevated and we see from 2009’s experience that it takes a while for money to be deployed into riskier assets.