The Largest Source of Financial Related Content and Shows on X | #1 Finance Marketing Agency

8 subscribers

How to get URL link on X (Twitter) App

A bond is a loan.

A bond is a loan.

Lots of people are bearish right now.

Lots of people are bearish right now.

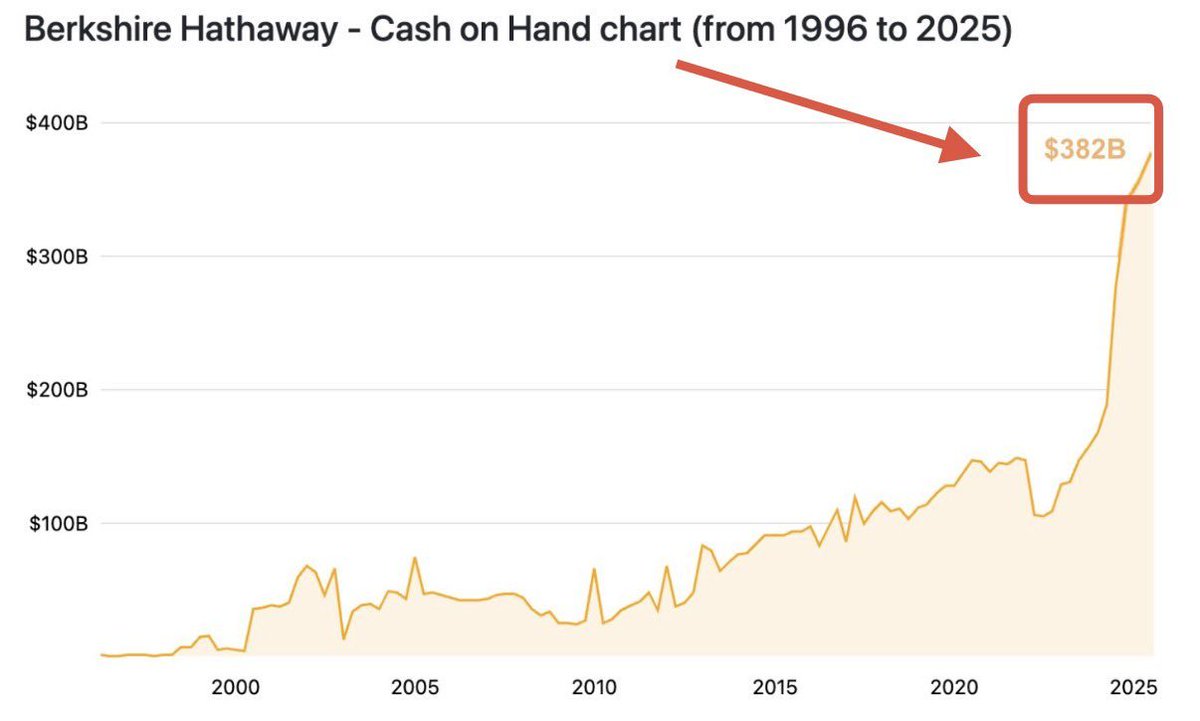

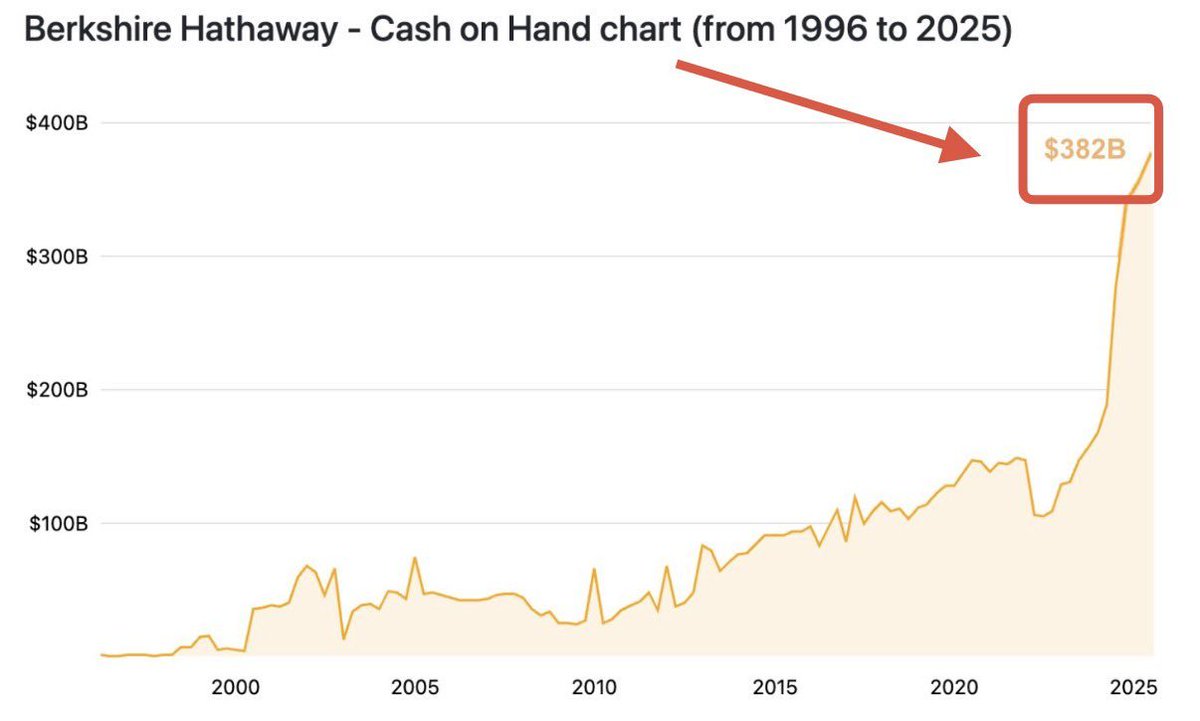

Let’s use Occam’s Razor to figure out why Buffett is holding so much cash.

Let’s use Occam’s Razor to figure out why Buffett is holding so much cash.

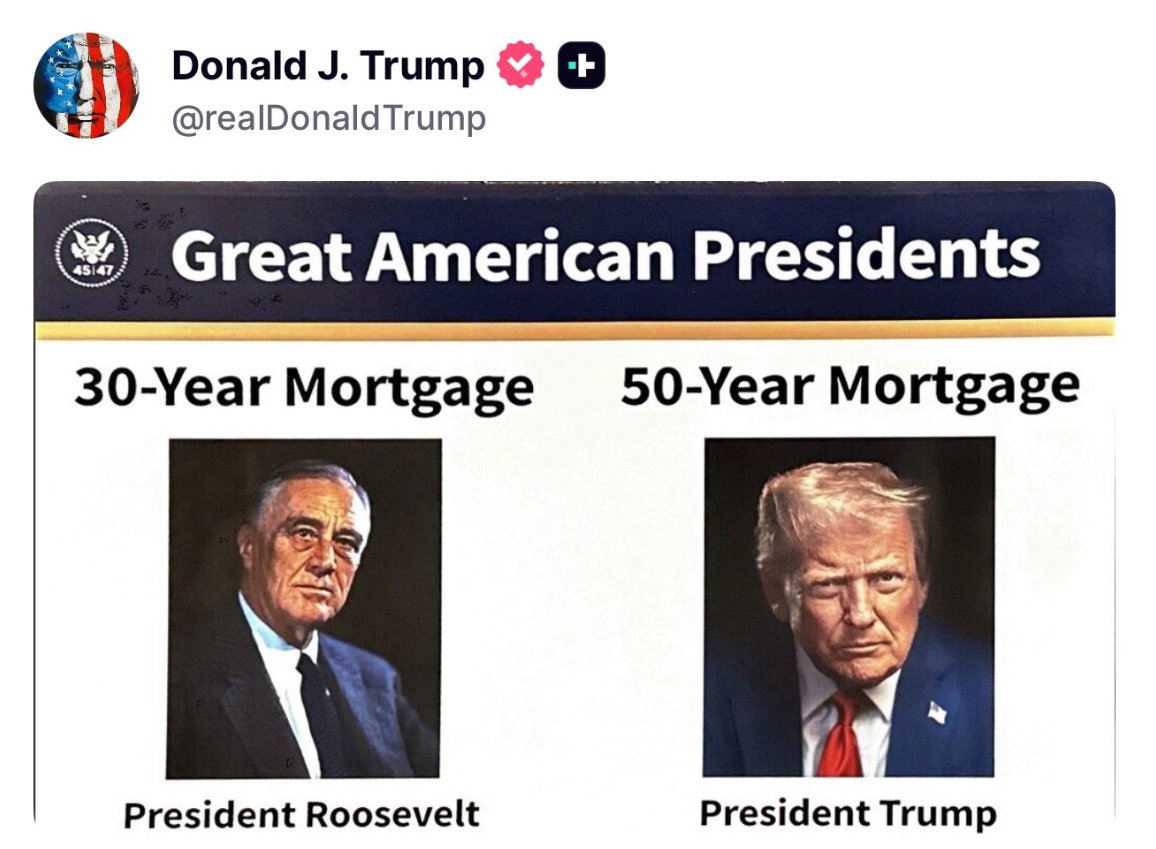

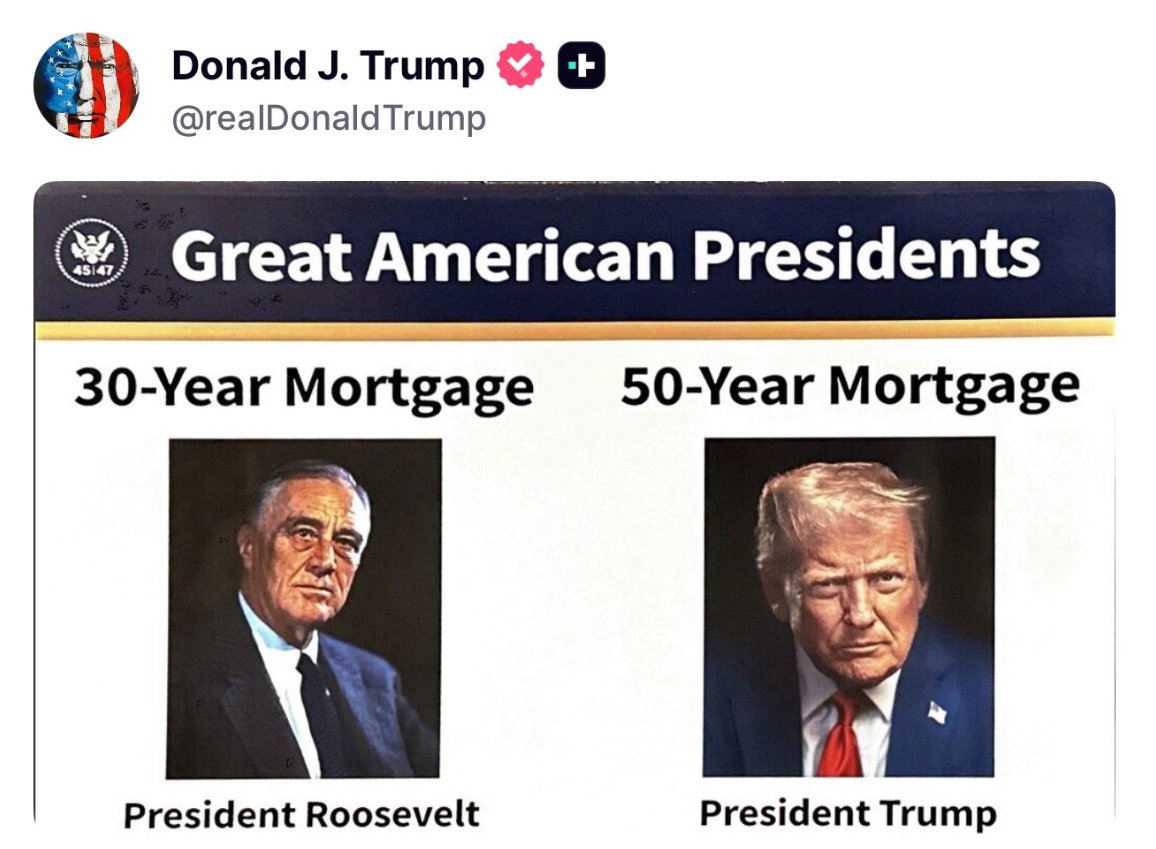

Trump is floating the idea of introducing a 50-year mortgage.

Trump is floating the idea of introducing a 50-year mortgage.

QT ENDING

QT ENDING

Anton Kobyakov, a direct advisor to Putin, says the quiet part out loud:

Anton Kobyakov, a direct advisor to Putin, says the quiet part out loud:

Nike never truly recovered from the 2022 bear market.

Nike never truly recovered from the 2022 bear market.

Are we in an “everything bubble”?

Are we in an “everything bubble”?

To hold reserve currency status, you need military supremacy.

To hold reserve currency status, you need military supremacy.

A few months ago, Bessent said something that many people overlooked:

A few months ago, Bessent said something that many people overlooked:

Valuesense is a financial analytics platform to help investors identify and capitalize on stock opportunities.

Valuesense is a financial analytics platform to help investors identify and capitalize on stock opportunities.