Central Banker. Dad. Husband. Pastoralist. 'From those to whom much has been given, much will be required'

Starehean. Opinions my own. Retweets not endorsements

7 subscribers

How to get URL link on X (Twitter) App

.........Encouraging people to save in dollars because you are paying up isn't a good idea. You'll have to keep generating dollars to pay the interest & it comes at the expense of boosting domestic assets /savings.

.........Encouraging people to save in dollars because you are paying up isn't a good idea. You'll have to keep generating dollars to pay the interest & it comes at the expense of boosting domestic assets /savings.

2. Will it target the same pool of buyers of local bonds ? Will this not scare the markets more? Tax revenues go to consolidated funds and the first charge is debt. So there is no extra comfort provided by the securitization?

2. Will it target the same pool of buyers of local bonds ? Will this not scare the markets more? Tax revenues go to consolidated funds and the first charge is debt. So there is no extra comfort provided by the securitization?

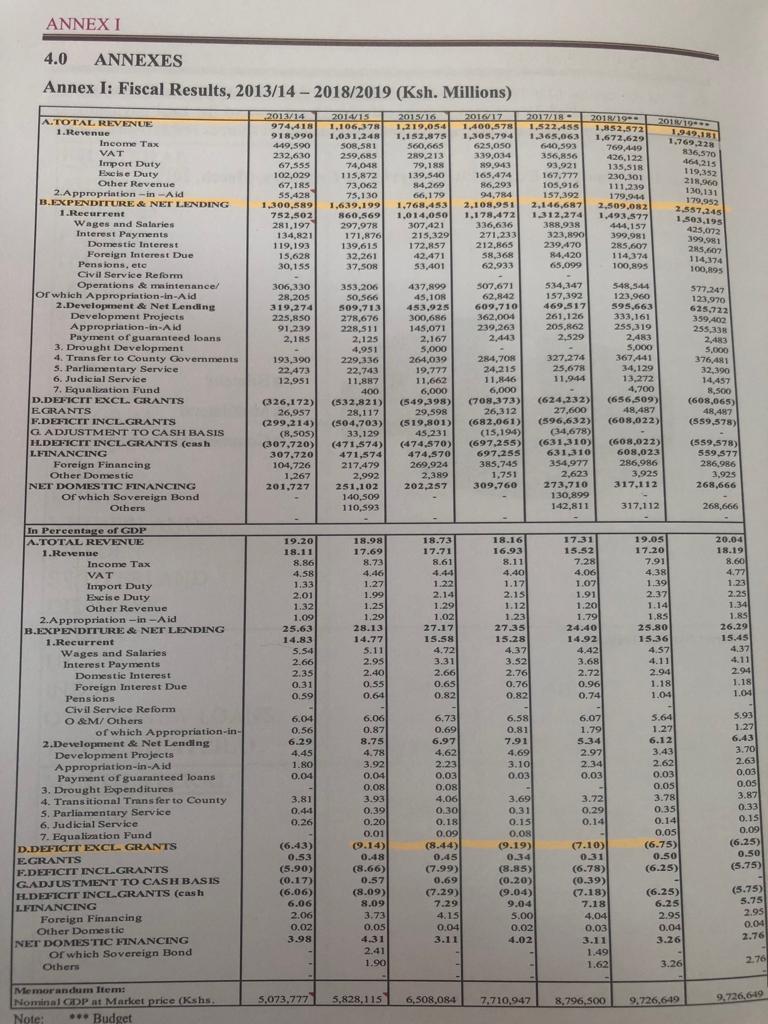

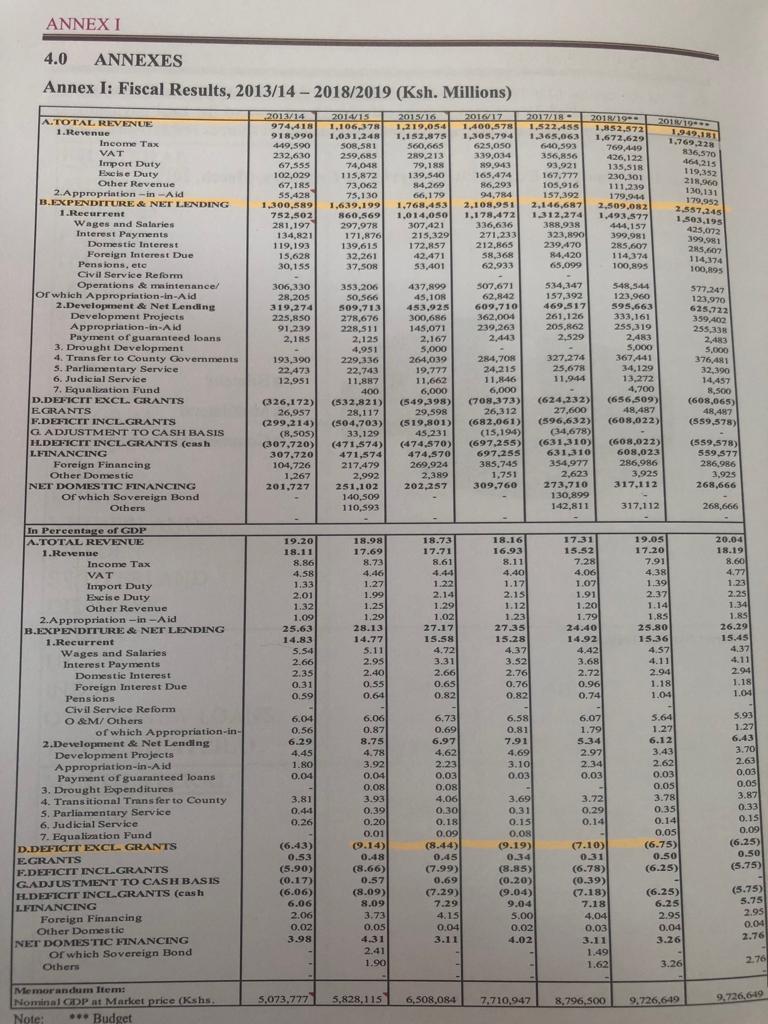

The deficit numbers are even worse than they look coz they do not include the PENDING BILLS. GoK budgets for a road, completes 25% of the road & the 75 % to complete that road is not budgeted for in the next FY. Why so many projects are incomplete. #BudgetKe2019

The deficit numbers are even worse than they look coz they do not include the PENDING BILLS. GoK budgets for a road, completes 25% of the road & the 75 % to complete that road is not budgeted for in the next FY. Why so many projects are incomplete. #BudgetKe2019