CEO & Co-Founder @spectacles_gpt | Founder @decotiis_data | Opinions are my own and DO NOT constitute investment or legal advice | I keep the receipts 🧾

2 subscribers

How to get URL link on X (Twitter) App

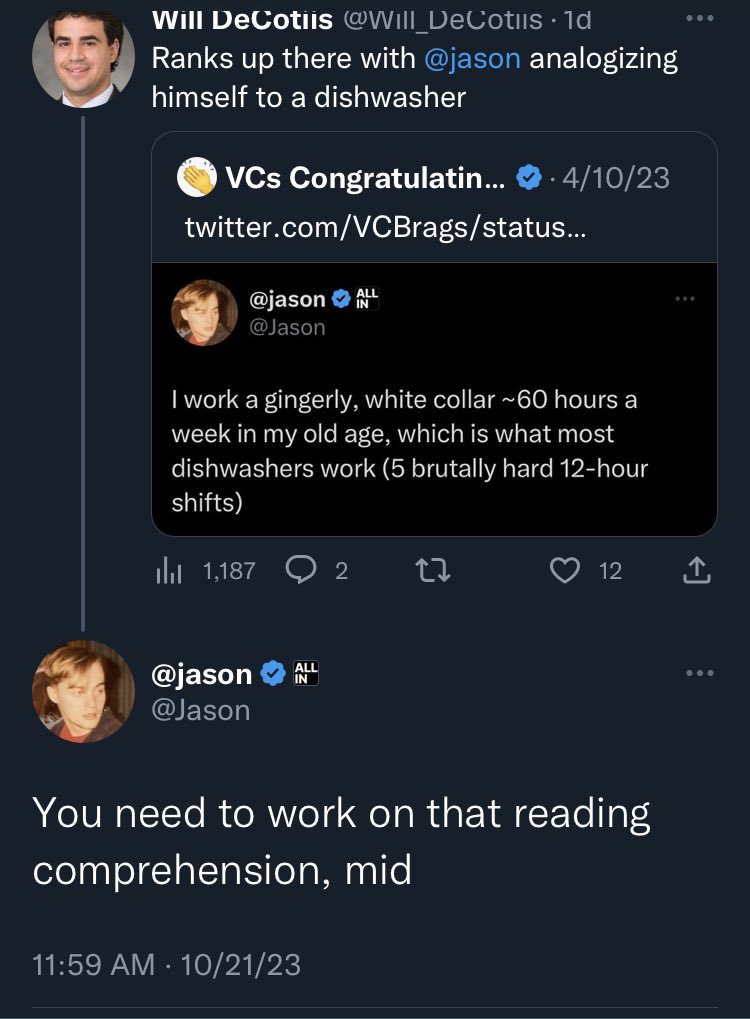

https://twitter.com/raydalio/status/1716216309124325771It’s more entertaining if you can garner a laugh tho 😉

https://twitter.com/will_decotiis/status/1715769216857509975

https://twitter.com/Will_DeCotiis/status/1645578859033640963effect…

https://twitter.com/SMB_Attorney/status/1644012211394732033

https://twitter.com/PriapusIQ/status/1635613625380470786

…

… https://twitter.com/Will_DeCotiis/status/1635363617452494853

https://twitter.com/meghankreynolds/status/1634622037103898624

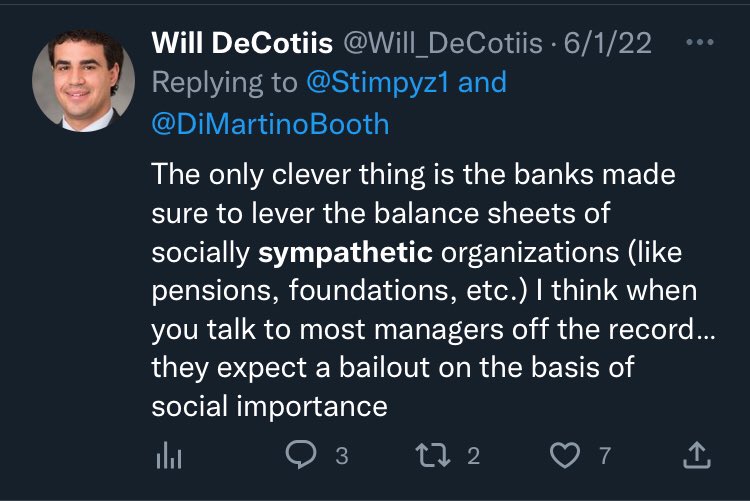

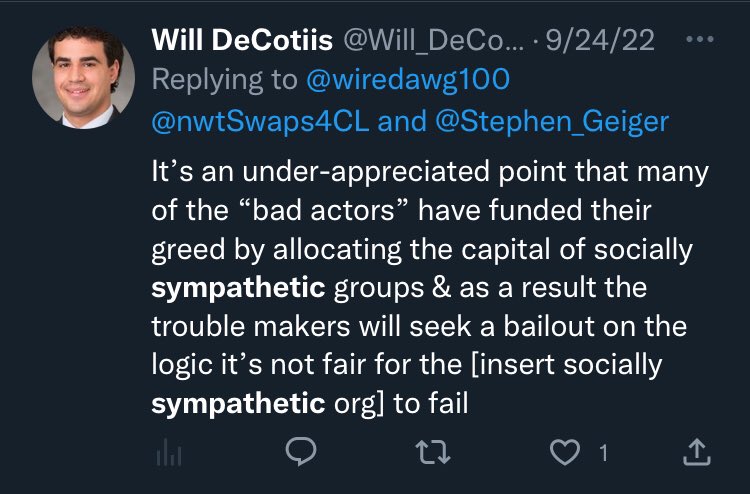

In case it wasn’t clear the folks who caused the crisis dgaf about your pension or university endowment…they were happy to lever the 💩 out of it when it was profitable to them to do so…now that it’s a crisis you have to save them “for your own sake”

In case it wasn’t clear the folks who caused the crisis dgaf about your pension or university endowment…they were happy to lever the 💩 out of it when it was profitable to them to do so…now that it’s a crisis you have to save them “for your own sake”

https://twitter.com/devahaz/status/1634293810967764997& leverage will be washing out of the VC ecosystem…which is actually healthy for the ecosystem