I don’t tweet often, but when I do, it’s a twitter thread about CPG strategy. Previously https://t.co/pk6YGsEjr6 (sold Oct 2020) & https://t.co/zCa7PF503j

4 subscribers

How to get URL link on X (Twitter) App

1/ First, note that >90% of food sales still happen in grocery stores. Yet incumbents still own most of the shelf space.

1/ First, note that >90% of food sales still happen in grocery stores. Yet incumbents still own most of the shelf space.

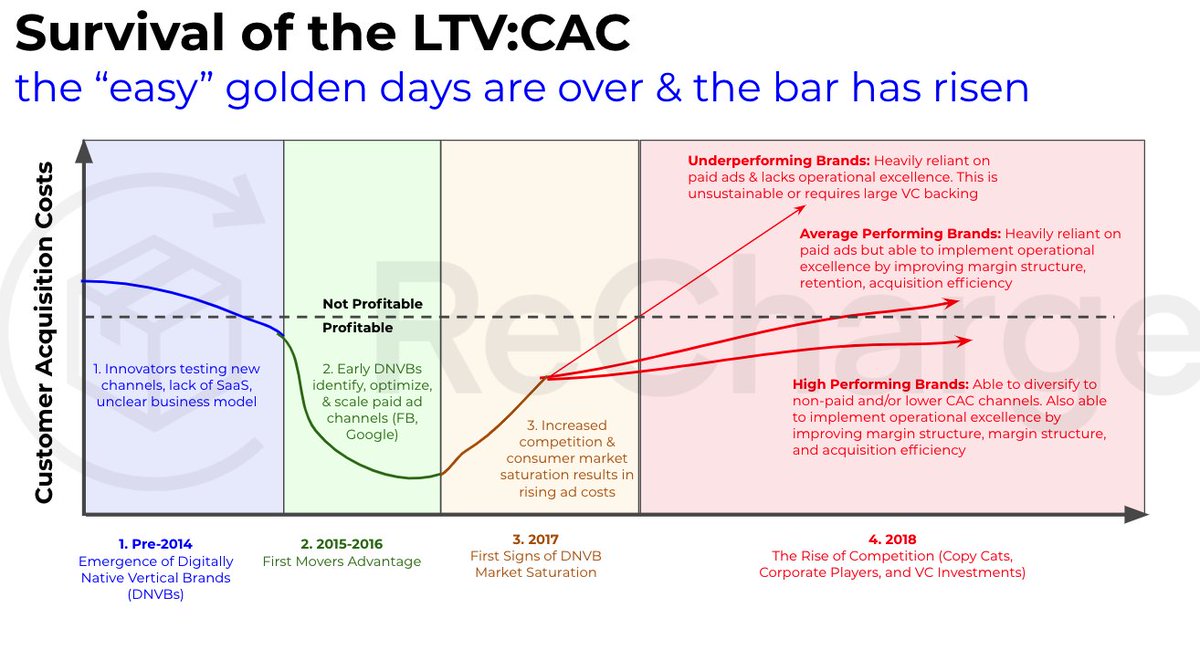

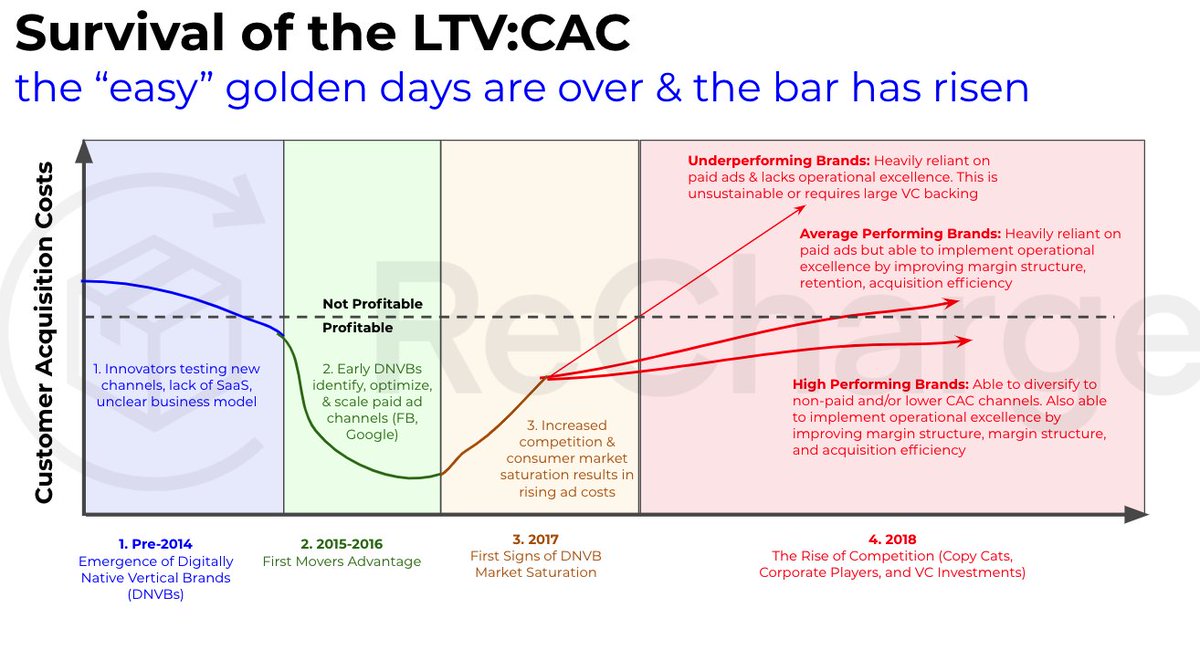

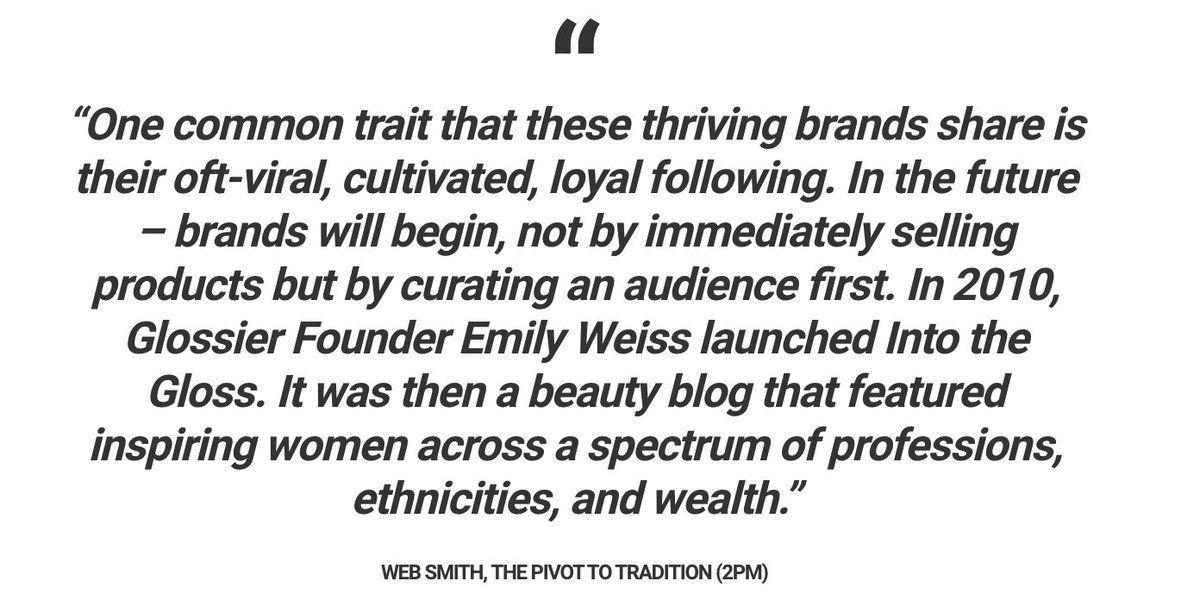

1.0 - Lower CACs by building your own inventory instead of bidding on it. "In the future – brands will begin, not by immediately selling products but by curating an audience first." - @web.

1.0 - Lower CACs by building your own inventory instead of bidding on it. "In the future – brands will begin, not by immediately selling products but by curating an audience first." - @web.

https://twitter.com/WilsonGHung/status/1080236415219322880.

2A/ Reason ONE: FB+Google have become so advanced that it has reduced the skill & tech barriers. Agencies w/ “in-house technologies” no longer have tech arbitrage advantages (bidding & analytical capabilities). Brands can “just let FB’s algo do it’s thing”.

2A/ Reason ONE: FB+Google have become so advanced that it has reduced the skill & tech barriers. Agencies w/ “in-house technologies” no longer have tech arbitrage advantages (bidding & analytical capabilities). Brands can “just let FB’s algo do it’s thing”.

2/ First, why are ad costs rising? First reason is the entry of the incumbent and giant CPG brands. Huge amounts of capital are entering the DNVB space as covered by @mrsharma in perell.com/blog/customer-…

2/ First, why are ad costs rising? First reason is the entry of the incumbent and giant CPG brands. Huge amounts of capital are entering the DNVB space as covered by @mrsharma in perell.com/blog/customer-…

2/ With a super team consisting of P&G’s logistical & manufacturing expertise, and Native’s premium brand, Native is now the #1 selling deodorant in Target AND at a premium price point.

2/ With a super team consisting of P&G’s logistical & manufacturing expertise, and Native’s premium brand, Native is now the #1 selling deodorant in Target AND at a premium price point.