🦾 On-chain researcher with a S̶o̶v̶i̶e̶t̶ Wakanda metal arm

Golden Degen’s bodyguard

7 subscribers

How to get URL link on X (Twitter) App

Market manipulation ALWAYS goes through the following phases:

Market manipulation ALWAYS goes through the following phases:

https://twitter.com/1032379192388857861/status/1704620324007071998

https://twitter.com/973261472/status/1362045016269590528

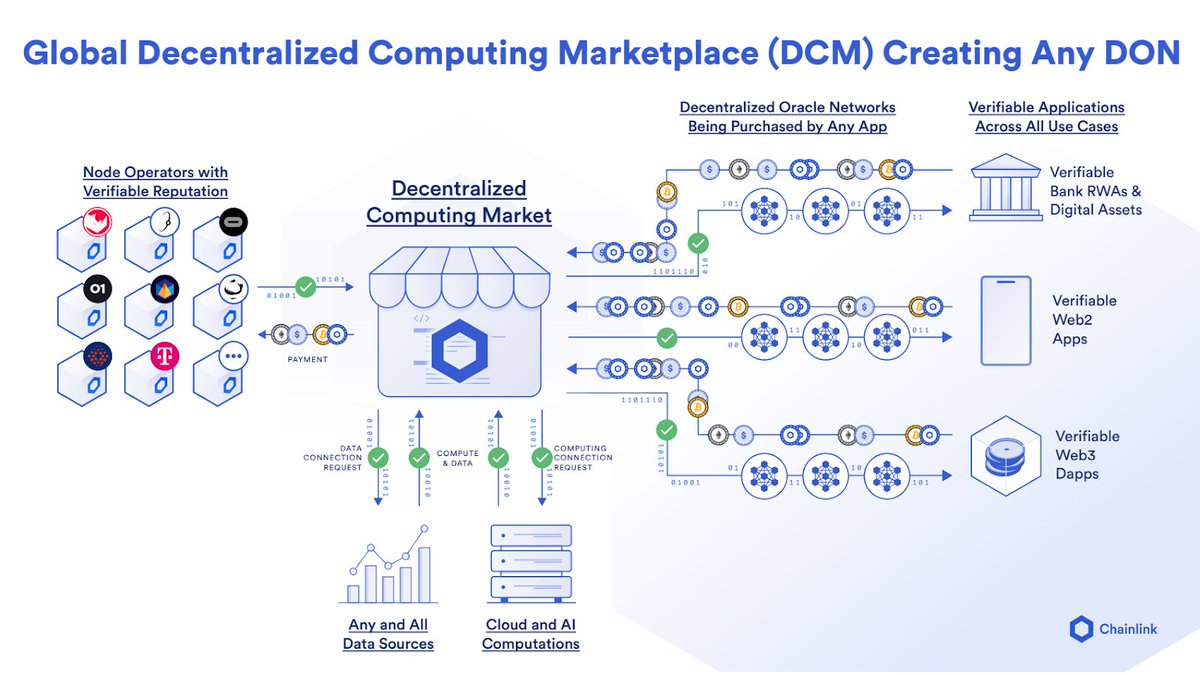

@chainlink Taggin some link marines for feedback

@chainlink Taggin some link marines for feedback

I soon learned black holes were much more than what I initially thought

I soon learned black holes were much more than what I initially thought

2/

2/

1/

1/

1/

1/https://twitter.com/WinterSoldierxz/status/1648329341712101376

1/

1/

1/

1/

1/

1/https://twitter.com/WinterSoldierxz/status/1651198204472598528

1/

1/

2/ Current bridges have adopted various design choices with tradeoffs surrounding native assets, liquidity and security.

2/ Current bridges have adopted various design choices with tradeoffs surrounding native assets, liquidity and security.

2/ In @Uniswap, tokens are mostly paired with $ETH.

2/ In @Uniswap, tokens are mostly paired with $ETH.

1/

1/

1/

1/

1️⃣ A thread by @ViNc2453 delving into #GLPLego strategies with @pendle_fi.

1️⃣ A thread by @ViNc2453 delving into #GLPLego strategies with @pendle_fi.https://twitter.com/ViNc2453/status/1633748452709638146

1/

1/

1/

1/